U.S. Dollar Continues to Drift Lower Amidst Two Way Action

Currencies / Forex Trading Jan 27, 2009 - 05:56 AM GMTBy: ForexPros

The USD gave back overnight gains as the Greenback failed to follow through during New York trade; at the close the majors are all better on the day but off their highs suggesting lots of two-way action and a potential short-squeeze underway. US data was better-than-expected this morning as existing home sales showed a gain suggesting that the housing crisis might be ending but savvy traders note that it will take more than one month of gains to suggest the housing problem is mitigating.

The USD gave back overnight gains as the Greenback failed to follow through during New York trade; at the close the majors are all better on the day but off their highs suggesting lots of two-way action and a potential short-squeeze underway. US data was better-than-expected this morning as existing home sales showed a gain suggesting that the housing crisis might be ending but savvy traders note that it will take more than one month of gains to suggest the housing problem is mitigating.

Most analysts see the gain in sales as positive but would like to see two or three months in a row of gains before calling a bottom in home sales and prices. Economic data remains light ahead of the FOMC meeting and rate announcement due Wednesday but analysts note there isn’t any cuts in interest rates coming suggesting that the rhetoric of the statement will be the main driver of near-term USD sentiment assuming that economic news due later in the week remain flat to lower.

GBP rallied off low prints in Asia at 1.3547 to trade to a high print at 1.3997 with traders expressing a rally past 1.4000 can’t be ruled out as large stops are layered above the market; late shorts were left holding the bag today as the market went one way to the highs and despite a mid-session fall back to 1.3850 area the rate regained the 1.3900 handle into the close. Traders now expect a solid close over the 1.3980 area for the month to possibly signal a bid-tone off the new 23-year lows seen last week. Traders note that comments today by BOE MPC member Blanchflower as GBP-negative but the ability for Cable to continue higher suggests more gains are likely near-term.

EURO rallied to a high print at 1.3208 before dropping back under the 1.3100 handle briefly before regaining the 1.3100 handle; closing rates around the 1.3150 area suggest more upside is coming. In both EURO and GBP a short-squeeze is likely in play.

USD/CHF was under pressure all day never seeing much higher action; the rate dropping to a new low in late New York at 1.1386 and ending below the 100 day MA. Traders note conditions were thin except into the lows suggesting that late longs threw in the towel into the end of day.

USD/CAD made a low print under near-term support at 1.2139 before rallying more than a full handle to trade 1.2274; the rate falling off into the close as well looking like a close under the 1.2220 area will turn the charts negative for the middle of the week. The slow mover today was

USD/JPY; failing to extend gains or losses beyond existing S/R with high prints in New York at 89.70 and overnight lows at 88.25. The rate is mid-range into the close for a neutral reading into Asia tonight. Look for a quiet open in Asia as China remains closed for the Lunar New Year holiday. Follow-on selling of USD is likely but also expect two-way action.

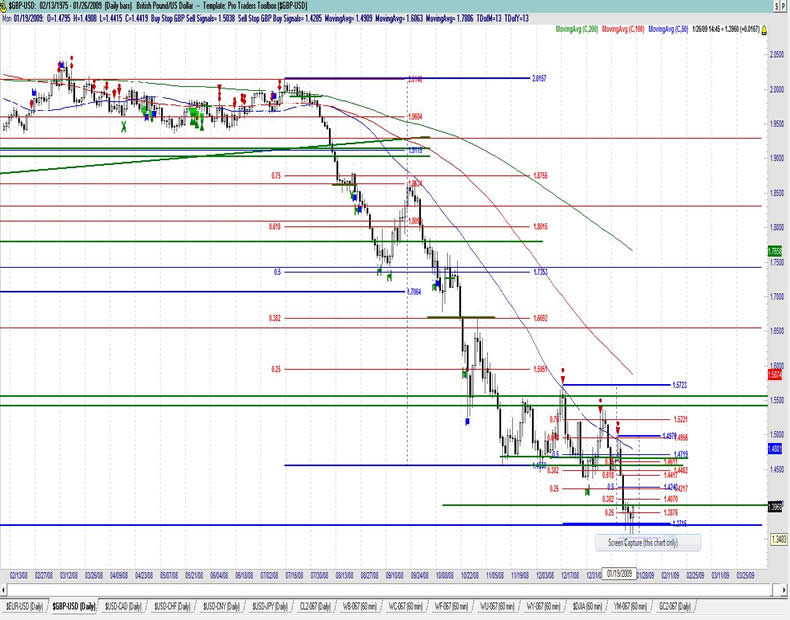

GBP USD Daily

Resistance 3: 1.4010/20, Resistance 2: 1.3950, Resistance 1: 1.3880

Latest New York: 1.3962, Support 1: 1.3550, Support 2: 1.3500/10, Support 3: ?

Comments

Rate falls back to open Asia but rallies to trade better on the day after MPC Blanchflower comments fail to depress the rate; light stops seen on the move over the 1.3700 area as late shorts get squeezed. Aggressive bids seen and the rate recovers as New York puts on weight. Two-way action continues suggesting that shorts are aggressively adding and longs are trying to find a bottom with shorts losing this morning. Stops and aggressive selling drive the rate to a 23.0 year low last week. Short-squeeze likely in progress after first attempt to rally was sold back but recovers. Overnight economic news seen as neutral to bearish; rate trading on technical’s now. Signs of the bottom may be showing up as “smart” buyers reported in GBP Wednesday and Thursday night last week. Spillover from EURO likely but modest. Look for two-way action into this bottom. A short-covering rally is increasingly likely now. Late sellers likely in or hurting.

Data due Tuesday: All times EASTERN (-5 GMT)

6:00am GBP CBI Realized Sales

EUR USD Daily

Resistance 3: 1.3320, Resistance 2: 1.3280, Resistance 1: 1.3200/10

Latest New York: 1.3172, Support 1: 1.2850/60, Support 2: 1.2800/10, Support 3: 1.2750/60

Comments

Rate follows GBP higher; scores highs during New York at 1.3208; rally less volatile and the rate holds tech support at 1.2850/60 area overnight and 1.3180 to end the day. Rally all day today suggests a short-squeeze is in the works. Stops baked on the dip under 1.2880 again overnight; stops around 1.3030 area and layered above cleared but more likely around 1.3280. Bulls are attempting to find a bottom. 50 bar MA failed now likely to offer resistance and a close above suggests the bottom will be in. Close over 1.3000 to end the day today will be seen as positive for a rally. Semi-official and sovereign bids and offers seen last week. Technical levels around the 1.3300 area now likely to offer resistance so expect two-way action and consolidation. Aggressive traders can look to buy the next dip.

Data due Tuesday: All times EASTERN (-5 GMT)

2:00am EUR German Import Prices m/m

4:00am EUR German Ifo Business Climate

4:00am EUR Current Account

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.