FusionIQ Trading System Signals

InvestorEducation / Trading Systems Jan 31, 2009 - 12:11 PM GMTBy: John_Mauldin

Trading With the Big Boys

Trading With the Big Boys - FusionIQ

- GM, AIG, and Alcoa -- Are They Still in Your Portfolio? >

- La Jolla, New York, and Las Vegas

This week we are going to do something a little different. I am in Bermuda taking a little weekend R&R after a speech, as well as working on my book. There is not the time for the usual letter this week, but I have asked Barry Ritholtz to write about his new trading program, FusionIQ, for reasons I will talk about below.

But first, and quickly, if you are planning on attending my Strategic Investment Conference this April 2-4 you need to act soon. You can get more details at the end of the letter. And the first of the "Conversations with John Mauldin" is up. We recorded it this week, with Ed Easterling and Dr. Lacy Hunt. I thought it went very well for an inaugural talk. The transcript is there already. For those who have subscribed, you should have received an email and be able to log in and listen or read the transcript. And I welcome feedback as we launch this new service. And I want to thank Tiffani, Ryan, and Anne in my office, who have worked long hours getting this ready. There is a lot of back-room work that has to be done to make something like this available, and I am happy to have their support.

Warning: This e-letter is about a new trading platform that I think is interesting. While not trying to be promotional, it will offer you a product at the end. As I write below, there is reason to think about what tools other are using when you are trading against them; but for those of you who are looking for economic analysis, skip this and wait till next week, when I am back in the office. For the rest of us, let's jump right in.

Trading With the Big Boys

Tough market!

That's something I hear in the office every day -- from professional traders, money managers, and hedge funds. These markets have been brutal, and the competition has been relentless.

For the individual investor, it is important to understand who your opponents are on the field of battle. Sports and war metaphors abound, because they are consistent with what you are going up against each day. In addition to always battling Mr. Market, as tough an opponent as there is, your rivals are also anyone else buying or selling stocks. They, too, are looking for ways to produce positive returns.

Consider what Charles Ellis, who helps oversee the $15-billion endowment fund at Yale University, said:

"Watch a pro football game, and it's obvious the guys on the field are far faster, stronger and more willing to bear and inflict pain than you are. Surely you would say, 'I don't want to play against those guys!'

Well, 90% of stock market volume is done by institutions, and half of that is done by the world's 50 largest investment firms, deeply committed, vastly well prepared -- the smartest sons of bitches in the world working their tails off all day long. You know what? I don't want to play against those guys either."

That's a brutal and very honest observation. The institutions Ellis refers to are mutual funds, hedge funds, and program traders -- and all of their professional staff, mathematicians, and researchers. The pros are deploying every possible tool to give them whatever edge they can get. And even they can have a hard time, as most of them will testify to the difficulty of trading in 2008.

Despite this daunting opposition, many individuals unhesitatingly step onto the playing field with the pros. To carry the sports metaphor further, they end up receiving season-ending injuries to their investment and retirement accounts.

My "day job" is finding money managers for clients. It is fair to say I have looked at many hundreds of managers and funds over the last 20 years. I have also talked with countless people who want to break into the investment management business. I must admit I am not always the most encouraging, as my experience says it is a tough world. But there are those who do indeed make it. Some very successful traders are small shops, while others grow into large management businesses.

But they do have one thing in common. They have an edge. Somewhere, somehow, they have developed an edge which gives them the ability to eke out profits, whether from trading stocks or commodities or currencies.

That's why it is so important to be prepared -- mentally, physically, and with the right equipment. It's not just guns and ammo, but intel and recon tools as well. The explosion of cheap PC power and web-based market data may have given everyone similar technology, but it did not grant them an equal ability to use them. Just as picking up a 5 iron doesn't make you Tiger Woods, sitting in front of a PC doesn't make you Jim Simons (Renaissance Technologies). There is a huge difference between accessing data and the knowledge of how to use it.

I have asked Barry Ritholtz (you may know him through his blog The Big Picture and appearances on CNBC) to write today about his new trading and statistical platform, FusionIQ. Barry is a successful, no-nonsense, take-no-prisoners type of trader. His rather blunt manner that you see on TV is what you get in real life. We have become good friends. I have watched him develop this software for the last few years, and I like it, as it marries fundamental and technical analysis. This is what Barron's had to say about the software:

"FUSIONIQ'S MODELS blend fundamental and technical metrics to determine the strength of some 8,000 publicly traded equities. They identify the most tradable issues and sectors with the lowest component of risk. FusionIQ also finds issues with unusual short-term strength or weakness, issuing Buy and Sell signals accordingly. In general, FusionIQ recommends subscribers hold a rolling portfolio of 15 to 20 issues for the intermediate term.

"Beyond that, it identifies trading opportunities. FusionIQ models pinpoint highly ranked issues whose prices suddenly gap up 5% or more on high volume (and other conditions). They also issue alerts when analysts with good track records offer earnings forecasts outside peer estimates, and when short squeezes are in the offing -- that is, when a highly shorted issue exhibits enough relative strength to force short sellers to cover their positions and boost the price further."

There are three reasons I am bringing this to your attention today. First, there are tens of thousands of investment professionals out there who have lost their jobs in recent months. I was told last month that the number of people sitting for the CFA exams is the highest on record. The explosion of young people coming out of school looking for a job in the financial world is at an all-time high. I get calls and letters from them all the time asking for advice.

I feel somewhat uncomfortable with myself when asked what to do. I know the odds, as the financial world is down-sizing, and there are some really capable and experienced people on the street today. There are just going to be fewer jobs. That is the reality. But I also know that if you can make it, it can be a very rewarding and fascinating career, with some of the most exciting and switched-on people anywhere. I am literally having more fun than I ever have. And telling someone not to chase his dream? I don't want to do that, but I do want to be honest.

So, if you want to be a trader, listen up to what Barry is talking about, and know that you are dealing with people who AT A MINIMUM are armed with technology like this. I have been on some of the largest trading floors in the world. The tech at their disposal, the data they can call up, the research they can marshal, is impressive. Barry and his partners have spent literally millions. The big trading houses have spent tens of millions. It is not as easy as those commercials on TV make it sound. These pros spend hours learning their systems in front of a screen.

Second, Tiffani and I have been interviewing millionaires for our new book. I can't tell you how many have ridden this market down. The size of their portfolios does not make them better money managers. They or their managers had no discipline for selling. Seriously, buy and hold in a secular bear market like we are in is a losing strategy. On an inflation-adjusted basis, you are down if your holding period has been 30 years! Most of us would think that 30 years is the long run! On a nominal basis, you are about where you were ten years ago, if you are in a broad index.

Even if you are a value investor, you have gotten creamed in this market. (Some great value investors are down 60%. Their experience of buying and holding solid companies, which had worked so well for so long, needs to be married with some risk discipline.) You need a sell discipline. Barry's system, or others like it, can at least get you thinking about selling rather than riding a stock all the way to the bottom and hoping it comes back. Hope is not a viable investment strategy.

I don't know much personally about trading. My stomach won't allow me to trade, although I have watched and met with the best. But I do know this. The best traders and managers have risk controls and sell disciplines and they stick to them. Period. They don't fall in love with a stock or a commodity position.

If you are going to manage your own portfolio, and there is nothing wrong with that if you will spend the time to do it right, then you have to learn to manage your risk. And while simple systems are better than nothing, a little sophistication here will pay for itself.

Third, a small set of you in the professional world will find FusionIQ something that you should use. As a professional tool, it is relatively cheap.

Finally, for the regular investor, realize that you are trading against thousands of people and funds who have tools like this -- and many have far better tools. This is just one version. If you or your manager are not getting the results you need, maybe you need to figure out how you get your stock and fund "tips." Maybe you should find a manager who "get's it."

FusionIQ is one of several very good analysis programs, and my allowing Barry to write about it is not saying this is the best. But it appears to me to be one of the better platforms I have seen. Now, let's let Barry talk about how long it took and how much it cost to develop this platform.

Do you really want to put on your pads and get out on that field? If so, then make sure you are ready to play!

FusionIQ

By Barry Ritholtz

As professionals who have been trading these markets for a collective 50 years, we have long been interested in the ways we can apply technology to tilt the odds in our favor. All the big proprietary trading desks -- banks like Goldman Sachs, huge hedge funds like Pequot and SAC -- spend tens of millions of dollars to assist their decision making.

We decided some time ago that if we wanted to compete on this playing field, we needed something to even up the odds.

During the tech wreck and dot com collapse of 2000-03, my partner Kevin Lane came up with an idea. What if we could create a database to track various indicators for stocks and markets? The idea was to pull only the most important stock factors into one location. Not to merely screen the market, but to actually rank all of the most popular stocks from worst to best, based on both earnings and ownership metrics, as well as the charts. This way, we would have a timely method to measure important technical AND fundamental metrics.

After years of brainstorming, we selected and, more importantly, eliminated a variety of stock metrics. Lots of back-testing went into the final product. We performed variable testing -- something called fractal analysis -- that would make your brain explode if you saw the mathematics of it (I know mine did!).

We found ourselves using the tool more and more. Kevin had famously recommended shorting both Enron and Tyco during the dot com crash, and the tool had a lot to do with that. (See this Business Week article: "Analysts Who Get It" http://www.businessweek.com/..)

With the goal of making smarter, more informed trading decisions, we sought ways to create better returns with less risk. By combining good fundamentals and strong technical momentum characteristics, we found we could identify not only what to buy or sell, but when.

The results with the product were impressive enough that we decided to spin it out as a web-based software product for investors. We procured pricing data and fundamental feeds, hired a programming team and designers. It took almost six months to create all of the algorithms, and over the latter half of 2002 and into 2003 we did the programming, web front-end displays, database, and back-end architecture. Then came more testing and refinement. Our venture and equity partners spent over $1 million in development costs alone, hiring a development staff of programmers and market analysts to continually test and refine the software. From 2004 to 2005, the program underwent significant beta testing and renewed analysis of the variables that create the ranking system.

In 2006, we formed Fusion Analytics Investment Partners LLC. Since then, we have poured in close to another $1 million in refinements. We developed new algorithms, and beta tested everything throughout 2007. The software was launched at the current site in late 2007.

How Does FusionIQ Work? The software uses our unique combination of fundamental and technical indicators to rank over 8000 stocks, ETFs, and closed-end funds. The rankings range from 0 (worst) to 100 (best). These provide insight into stocks that are more likely to outperform, as well as identifying what stocks should be avoided. From there, we apply our proprietary algorithms, generating BUY, SELL, and NEUTRAL signals. For more aggressive traders, the system identifies breakouts and breakdowns, buy and sell signals, short squeezes, and other trading opportunities.

For long-term investors, we developed a way to help manage risk in your holdings by creating a Portfolio Watchlist. This allows you to enter all of your current holdings, which are automatically ranked and monitored. You can easily keep tabs on your portfolio holdings as their FusionIQ rankings change. Stocks ranked 70 and higher are candidates to keep, while lower-rated stocks should be reviewed for removal from a portfolio. For investors who do not like the buy & hold mantra, you can trim your portfolio using our BUY, SELL, and NEUTRAL signals. These signals are generated when specific conditions are met. It is both objective and neutral.

In 2008, the sell signals helped us avoid a lot of trouble. We recommended selling or shorting Bear Stearns when it was over $100. We very publicly said the same about AIG in early 2008 (http://www.bloomberg.com/apps/..). We told readers to sell Fannie Mae (over $40) and Lehman Brothers (over $30). While we caught some grief for these calls early on from fans of the companies, in the end our clients and investors thanked us. All of these calls were made via using the FusionIQ system.

Here are some recent signals and rankings from the FusionIQ software:

General Motors (GM)

Back in November, 2008, we looked again at General Motors, as it was under pressure, with liquidity concerns. The only hope seemed to be a big-time government bailout, or perhaps consolidation with another automobile/truck manufacturer.

We also noted that, once again, the large bulge-bracket research analysts were not exactly showing they were "value added" to investors or the investment community. Deutsche Bank's analyst cut GM from a hold to a sell with a price target of zero. We are not saying they were completely wrong, but where had they been? DB had a buy on GM until 2/25/08 at $31, then they had a hold on the stock all the way to $3.66, before they threw in the towel. (It is now marginally lower.)

We don't want to pick on only Deutsche Bank, as most of the analysts were using old earnings assumptions, and all seemed to come to the same conclusions ... and too late to do anything about it.

Using Fusion IQ screens, however, kept us ahead of the curve. As seen below on this yearly GM chart, our unbiased screening system has had GM ranked extremely low (an 18 Master, 10 Technical out of 100 as of that November date) with multiple sell

Triggers. These sell alerts would have woken an investor up that something was wrong with the underlying firm. That is something that will not show in the earnings or conference calls until it's too late.

GM CHART

November 10, 2008

Even more shocking than the GM chart is the AIG yearly chart. In addition to our ranking and timing indicators (see all the sells), Fusion Analytics published a sell on AIG for our institutional clients on 2/13/2008 at $46.14.

The first government bailout of AIG was not good enough, so they had to try, try again. In November, the US government announced that they would sweeten the pot in another attempt to save the firm. Hey, at least the taxpayers got an additional 2% stake in the firm!

AIG CHART

It's not only the sells -- we find many buys this way too.

My partners and I are all chart watchers. We are always perusing FusionIQ for stocks in the trading screens section of the site. I look at all the breakouts/breakdowns and stocks that have had a recent short squeeze, looking for just the right technical setup before I try to ferret out a fundamental catalyst.

I also have charts that for some reason or another have caught my eye. When this occurs I place them in my FusionIQ watch list. This way, if the ranking improves, or a buy signal gets generated, I can see it right away. If I really like a chart, I will set a FusionIQ email alert to notify me when my trade conditions are met.

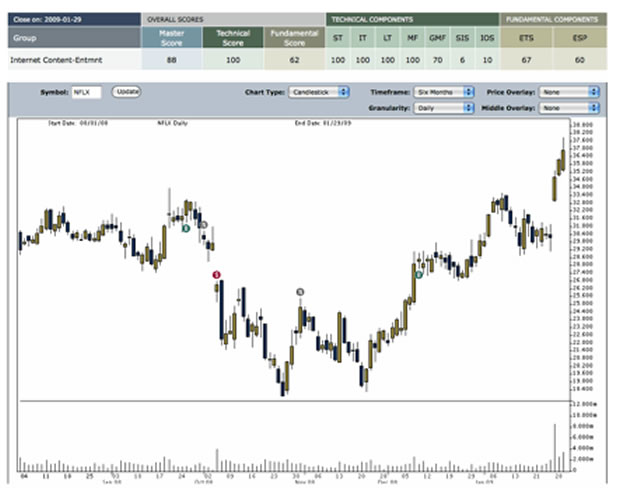

Recently Netflix Corp. (NFLX) caught our eye. As the chart below shows, NFLX had a new FusionIQ timing BUY signal in mid-December. Since then, despite the market's overall softness, there was technical strength in the stock. As seen below, NFLX shot up almost 30% since that buy signal.

NFLX CHART

More-active traders can use Fusion IQ's short-term trading signals. These are mostly technically based, as opposed to the Fusion of technical and fundamental data used to arrive at our scoring system. However, institutional clients geared towards fundamental research have found these to be a strong supplement to their basic research.

These trading signals can be used as a wakeup call that something may be changing and your analysts need to dig deeper. Also, many clients use these signals as a way to trade around their core holdings (adding alpha).

These charts that follow ... if you were long these names in your portfolio, do you think these heads-up might have helped?

These names have all come off long Sells, too. Perhaps it's time to relook at them!

ALCOA CHART

SEPRACOR CHART

MOSIAC CHART

If you would like to know more or get a subscription, the price to John's readers is $39.95 a month, and you will get the full professional system as part of this introductory offer.

La Jolla, New York, and Las Vegas

As I mentioned at the beginning of this letter, along with my partners Altegris Investments I will be co-hosting our 6th annual Strategic Investment Conference in La Jolla, California, April 2-4. I have invited some of the top economic minds in the country to come and address us, giving us their views on what seems to be a continuing crisis. It will be a mix of economic theory and practical investment advice.

Already committed to speak are Martin Barnes, Woody Brock, Dennis Gartman, Louis Gave, George Friedman (of Stratfor), and Paul McCulley. I anticipate adding another stellar name or two. This is as strong a lineup as we have ever had, and on par with any conference I know of anywhere. And as a special bonus, we have invited Fredrik Haren from Sweden. I heard him speak at a conference in Stockholm last year and was blown away. You can click on the link below to learn more about the speakers.

Due to securities regulations, attendance is limited to qualified high-net-worth investors and/or institutional investors, because we will be showcasing a select number of commodity fund managers and other alternative strategies. Early registrants will get a discount. Last year we had to close registration, and I anticipate we will run out of room again, so I would not procrastinate. Click this link to find out more and register: https://hedge-fund-conference.com/register.aspx. And if you cut and paste this link, make sure you copy the "https:" so you go to the secure site.

I am going to be in New York in the middle of March and then fly to Las Vegas to be with good friends Doug Casey, David Galland, and the crew for a weekend where I get to be the resident "bull" for a change. I will get you information on his conference next week, and hope to see you there.

It has been a few years since I have been to Bermuda, and it is as beautiful as I remember it. It really is, as Mark Twain said, a little bit of heaven on earth. And I want to thank Bill and Bini Yit for hosting us Tucker's Point. It is one of the more beautiful golf courses in the world, and they were so gracious.

It is time to hit the send button, as the restaurants will not stay open on my schedule. Have a great weekend.

Your didn't lose a ball today (we celebrate small triumphs) analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2009 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.