Gold Manipulation and How Deflation Creates Hyperinflation

Commodities / Gold & Silver 2009 Feb 02, 2009 - 01:25 PM GMTBy: Rob_Kirby

We've All Been Had - As world leaders gathered over this past week for their annual wine-and-cheese ski-fest in Davos, Switzerland – perhaps we, the little people, should all take-stock [or a forensic account, perhaps?] of the cards we've been dealt.

We've All Been Had - As world leaders gathered over this past week for their annual wine-and-cheese ski-fest in Davos, Switzerland – perhaps we, the little people, should all take-stock [or a forensic account, perhaps?] of the cards we've been dealt.

Dim-Witted Deflationists

Kirbyanalytics subscribers are already schooled on the inflation / deflation debate from a discussion and analysis laid out in the subscriber only version of Questions Begging Answers ; but the following is a fuller discussion of the issue:

Kirbyanalytics subscribers are already schooled on the inflation / deflation debate from a discussion and analysis laid out in the subscriber only version of Questions Begging Answers ; but the following is a fuller discussion of the issue:

The reason most mainstream market pundits are misreading ‘where we are headed' is exactly because they have not acknowledged or accepted where we are and how we got here!

Where we are headed is perhaps best summed up by Eric deCarbonnel in a treatise titled, How Deflation Creates Hyperinflation , where deCarbonnel “almost nails it” when he summarizes our current predicament,

“Yes, there is debt deflation, and the overall money supply is shrinking as a result. However, those calling for "multi-year bull market" for the US dollar are insane. These individuals need to review basic monetary theory. The money supply is only one of three factors that determine whether prices rise or fall. The other two are the changes in the velocity of money and the real output of the economy. The danger of hyperinflation lies in a dramatic increase in the velocity of money due to a loss of confidence , not in changes in the money supply.”

Here is velocity defined by Wikipedia ;

The velocity of money is the average frequency with which a unit of money is spent in a specific period of time. Velocity affects the amount of economic activity associated with a given money supply. When the period is understood, the velocity may be present as a pure number; otherwise it should be given as a pure number over time. In the equation of exchange, velocity of money is one of the key variables determining inflation.

In the U.S. it is the Fed St. Louis who keeps ‘official records' as to what the velocity of money is. The measure of velocity is captured in a monthly publication called Monetary Trends. Arithmetically it is measured by the equation:

Velocity of Money = Nominal GDP / MZM [money supply of zero maturity]

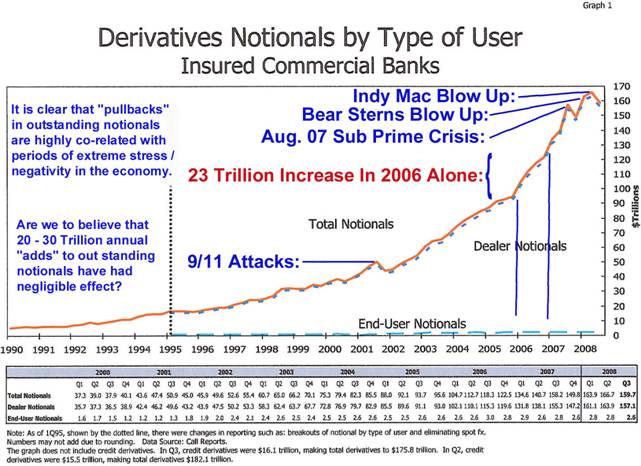

Nominal GDP measures the value of current production in the monetary unit of the country . In an increasingly financial-ized economy where the growth in outstanding off-balance sheet notional derivatives [ now measuring hundreds of trillions ] has absolutely mushroomed since 1995 – nominal GDP does not and never has adequately attempted to capture or measure this. The OBSCENE growth in these derivatives, with the Fed's ‘stooge surrogate institution' J.P. Morgan Chase leading the way, “ IS ” what predominantly has kept Wall Street fed for the past decade!!!! So how, in an increasingly financial-ized economy, can there be any valid reason for completely excluding them or their impact from nominal GDP?

The point I'm trying to make is this; if derivatives were being accounted for in a just manner - the Numerator in the equation above would be much, much larger and measurable Velocity would have been dramatically higher and flashing “red” signals long ago. Proper and just accounting / assimilation of derivatives into such measures as nominal GDP would have made a complete mockery of intentionally FALSIFIED [thank-you, John Williams ] inflation data. Of course, monetary authorities are all-too-well aware of this. This, above all else, is why and how Sir Alan Greenspan “fooled us all” - so frequently lobbying for there to be ZERO regulatory oversight of derivatives – it was all purposely designed to keep the focus and any intelligent discourse OFF derivatives!

So, perhaps the velocity of money is now falling or contracting in absolute terms; but from what level? [If my blood pressure “falls” from 250 over 175 to 200 over 125 – I would have falling blood pressure but would anyone claim that I have “low” blood pressure?]

Scope of Derivatives

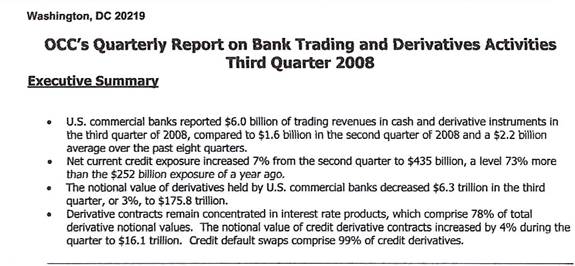

The U.S. economy is financial-ized to the point where 5 institutions alone have created 175 Trillion worth of derivatives – quite a trick in a 13 Trillion economy, ehhh?

![]()

Source: Comptroller of the Currency

So, is it a stretch to say that the current production of the financial-ized U.S. economy “is” derivatives? So what share of this notional should we be adding to U.S. reported GDP [approx 13 Trillion] to adequately account for Derivatives?

As it stands now, only revenue [8 – 12 billion per annum in fees] generated from trading these “off balance sheet” instruments is attributed - counted in bank revenues. But as we have learned in recent times; when things go awry with these instruments – many TRILLIONS of losses quickly materialize and migrate to these banks' income statements, negatively affecting GDP. Amazingly, folks who trade these instruments are widely referred to as “smart money”, but the empirical evidence “screams” that these derivatives instruments are bought and sold [conjured] into existence by individuals who do not fundamentally know what they are worth.

The dichotomy arises due to the manner in which mark-to-market accounting rules are applied – losses being crystallized and ‘counted' on the income statement [negatively affecting nominal GDP] while gains are left to accrue off-balance-sheet where they are NOT MEASURED [no affect on measurable GDP], because doing so would be construed as a taxable event. This is and has been the root of a major dilemma in the accounting treatment of derivatives for YEARS. The fact that derivatives are treated in this fashion is not sound from a purely economic perspective but rather traditional from an accounting perspective.

The observable implications are that these instruments always have had MUCH greater impact on nominal GDP than the current “practice” of recording trading fees as revenue only. It's all about gearing and the point from which you measure your base. Remember, for the past 15 years – right up until Q2/08 - these outstanding notionals have done nothing but mushroom – and in the past few years, leap by as much as 20 to 30 TRILLION in notional in a given year:

So then, what percentage of the growth of these outstanding notionals should be prudently attributed to GDP? Let's just say a small percentage of the growth in these notionals could amount to TRILLIONS in addition to annual nominal GDP. If measured, this would have had a material impact on reported numbers and quite possibly “red flagged” the inflationary spiral we are about to experience. You see folks; velocity of money, as it is currently measured, is no more honest-a-measure / accurate-determinant of inflation as Bernard Madoff was an honest stock jockey.

What too many ignorant, compromised, or would-be-economists refuse to grapple with is the notion that ALL fiat money systems – like table cream - have “shelf lives”. As Chris Martenson so eloquently sums it up,

“… there are over 3,800 past examples of paper currencies that no longer exist . There are numerous examples from the United States, which may have some collector value but no longer possess any monetary value. Of course, I could just as easily display beautiful but no longer functional examples from Argentina, Bolivia, and Columbia, and a hundred other places.”

Our current system has, arguably, already passed its expiration date. Derivatives have been used to obscure-the-curdles [rig markets]; but they cannot hide the rancid odor emanating from the rotting carcass of the fiat corpse of the Federal Reserve.

Hence, “Velocity” as it is measured today – like CPI, is too low – and but another neutered and “unreliable” gauge in accurately determining anything – let alone inflation.

I mentioned earlier that deCarbonnel almost nailed it; that's because he recognized the importance of a loss in confidence and its implications to velocity going forward.

You see folks, the countless anecdotal reports from around the world reporting a global rush to physical gold bullion is empirical proof that confidence in “fiat money” is in the process of rotting-off-the-bone before our eyes. Here's what deCarbonnel says about the natural conclusion to this process,

“When confidence in an issuing authority crumbles, money starts flowing through the economy at a feverish pace. For example, in normal, non-inflationary times the money supply might be equivalent to three months of output, but in a period of hyperinflation it might drop to two weeks worth of output. Since increases in the velocity of money have the same impact on prices as increases in the money supply, a 1000% increase in the velocity of money (typical in any period of hyperinflation) is equivalent to a 1000% increase in the money supply. Due to its effects on the velocity of money, the ebb and flow of confidence have a much greater impact on the short-term trend of prices then changes in the money supply.”

Further adding,

“It is no accident that many of the worst periods of hyperinflation are preceded by deflation. In fiat currencies with high levels of government debt, severe cases of deflation cause a loss of confidence in the nation's currency by shrinking the economy and making the government's debt appear increasingly unsustainable. The loss of confidence then causes the flow of money to speed up as individuals become desperate to exchange cash for real goods as fast as possible, producing hyperinflation.”

Everyone should realize that fiat money – by its very design – has a PERFECT historical track record, where longevity is concerned, in that it has always failed – there are no exceptions. History dictates that pure fiat money systems generally have life-spans of 30 – 40 years. Folks would do well to remember that President Nixon closed the gold window in August, 1971 – meaning that our current U.S. Dollar-centric fiat money regime celebrated its 37 th birthday back in August, 2008. One might hazard to guess that it would take some “real magic” for the current U.S. Dollar-centric fiat money regime to outlive its natural life-span.

A Rabbit In Every Hat

I'd like everyone to take note of this revelation published in the UK's Daily Mail one week ago:

Revealed: Day the banks were just three hours from collapse

By Glen Owen

Last updated at 11:21 PM on 24th January 2009

Britain was just three hours away from going bust last year after a secret run on the banks, one of Gordon Brown's Ministers has revealed.

City Minister Paul Myners disclosed that on Friday, October 10, the country was 'very close' to a complete banking collapse after 'major depositors' attempted to withdraw their money en masse.

The Mail on Sunday has been told that the Treasury was preparing for the banks to shut their doors to all customers, terminate electronic transfers and even block hole-in-the-wall cash withdrawals.

Only frantic behind-the-scenes efforts averted financial meltdown.

If the moves had failed, Mr Brown would have been forced to announce that the Government was nationalising the entire financial system and guaranteeing all deposits.

But 60-year-old Lord Myners was accused last night of being 'completely irresponsible' for admitting the scale of the crisis while the recession was still deepening and major institutions such as Barclays remain under intense pressure.

The build-up to 'Black Friday' started on Monday, October 6, when the FTSE 100 dropped by nearly eight per cent as bad news on the economy started to multiply.

The following day, Chancellor Alistair Darling began all-night talks ahead of an announcement on the Wednesday that billions of pounds of taxpayers' money would be used to pour liquidity into the system.

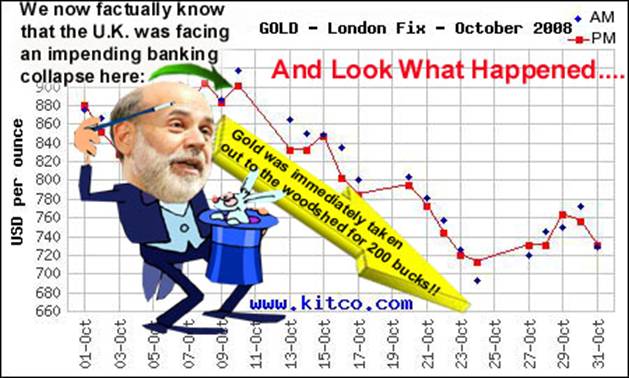

So, with that kind of impending financial calamity – back on Oct. 10, 2008, one might logically expect a rush to a safe haven play like gold bullion – and for the price to “really take off” in response – ehhh? Well, here's what happened to gold over those few crucial days:

Now I'm not sure sure how many more rabbits Sir Benedict of Benjamin Bernake really has left in his sourcer's hat – but the wretched odor emanating from its bowels bears an unmistabable and striking resemblence to vile, rancid, hubris.

So, while everyone rejoices in the notion that “change has come to America” – I hope everyone takes time to remember the sobering thought; that while faces do change, the book remains the same!

Chart compliments of Kitco.com

Subscribers to Kirbyanalytics.com are educating themselves; not only about the merits of ownership of gold and precious metals – but valuable know-how on the merits of different forms of ownership as well as tips and guidance on the acquisition of physical precious metal. The remainder of this article for subscribers only contains larger picture issues in a section titled, Where This Is All Leading as well as new analysis of the recent oil price collapse.

If you haven't got gold, you really have been had!

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research. Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.