Increased Investor Risk Appetite Boosts Australian Dollar (AUD)

Currencies / Austrailia Feb 03, 2009 - 04:17 PM GMTBy: Ashraf_Laidi

Aussie is the days best performing currency out of a group of 9 currencies due to market optimism resulting from the latest government stimulus package of A$42 billion and ahead of tonights (3:30 am GMT) widely expected 100-bp rate from the RBA. With a 100-bps cut fully priced in, the risks are in favour of further Aussie upside in the event of only a 75-bp cut.

Aussie is the days best performing currency out of a group of 9 currencies due to market optimism resulting from the latest government stimulus package of A$42 billion and ahead of tonights (3:30 am GMT) widely expected 100-bp rate from the RBA. With a 100-bps cut fully priced in, the risks are in favour of further Aussie upside in the event of only a 75-bp cut.

AUDJPY is seen particularly bullish in the event of a positive close in US equities and Asia, which would trigger fresh risk buying and an additional boost for the pair. Last week's 150-bp rate cut from the RBNZ to 3.50% took rates below those of Australia for the first time in 10 years. The RBA will have to cut by 100-bps to keep its rates below the RBNZ's. Considering emerging Aussie optimism from monetary and fiscal stimuli, a 100-bp cut would be deemed neutral too positive, while anything less is expected to boost the currency towards the 65-cent figure. AUDNZD is likely to extend gains towards 1.28 in the event of a 75-bp rate cut to 3.50%.

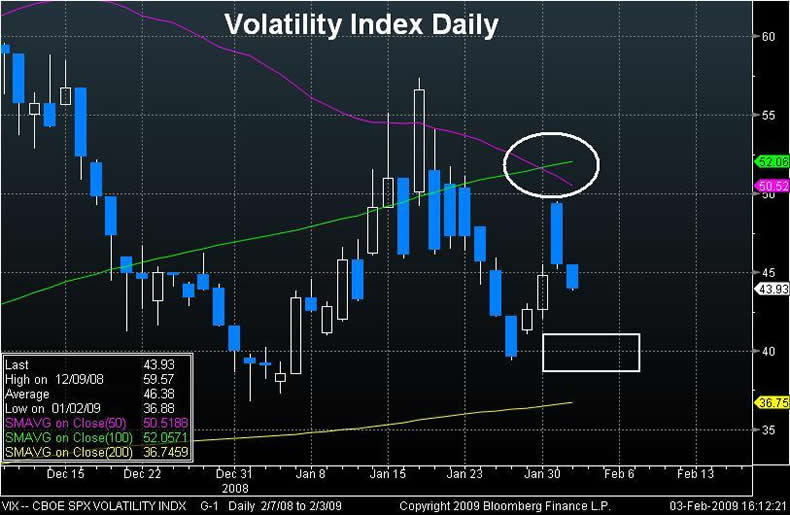

The VIX chart is set for further declines in the short-term, heading towards the 40 level (from todays 43.90), with market bulls likely to eye the 200-day moving average (currently at 36.75). Rather than the end of the bear market, the incoming retreat in volatility is seen as another temporary opportunity for the next relief rally in the VIX (and renewed pullback in stocks).

Risk appetite is also boosted by the Bank of Japans decision to buy risk assets via its purchase of shares in major Japanese banks. Seven years after the BoJ purchased shares in ailing banks to stabilize the tumbling equity market, the central bank returns overnight with a purchase of 1 trillion yen worth of shares aimed at boosting top banks capital. The purchases, which will go into effect until April 2010, is a reflection of the escalating risks emerging from falling bank lending, a soaring yen, and deteriorating capital partly dragged by struggling equities.

Cognizant of the incoming event risks from data releases that are likely to trigger fresh yen strength, the BoJs purchases may also be aimed at staving off the exceedingly positive bias in the currency. Recall that the BoJ purchases of Japanese shares in 2002 coincided with yen-selling intervention--which at the time had more fundamental validity as Japan was isolated in a deflationary spiral. Today, however, any overt intervention to sell the yen has little fundamental support due to the persistently downward path in G10 interest rates and negative risk environment.

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.