Industrial Commodities Drive Broader Stock Market Trends

Commodities / Investing 2009 Feb 09, 2009 - 07:19 PM GMTBy: Richard_Shaw

As we think about possible economic recovery, it may be a good idea to watch the prices of certain materials inputs to industry. Perhaps they will perk up before other parts of the economy farther downstream from raw materials.

As we think about possible economic recovery, it may be a good idea to watch the prices of certain materials inputs to industry. Perhaps they will perk up before other parts of the economy farther downstream from raw materials.

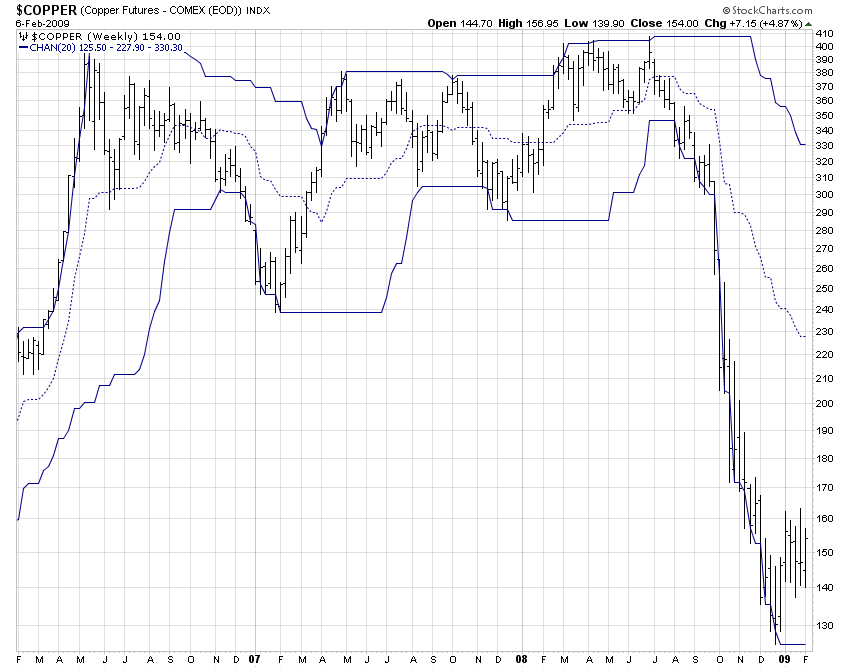

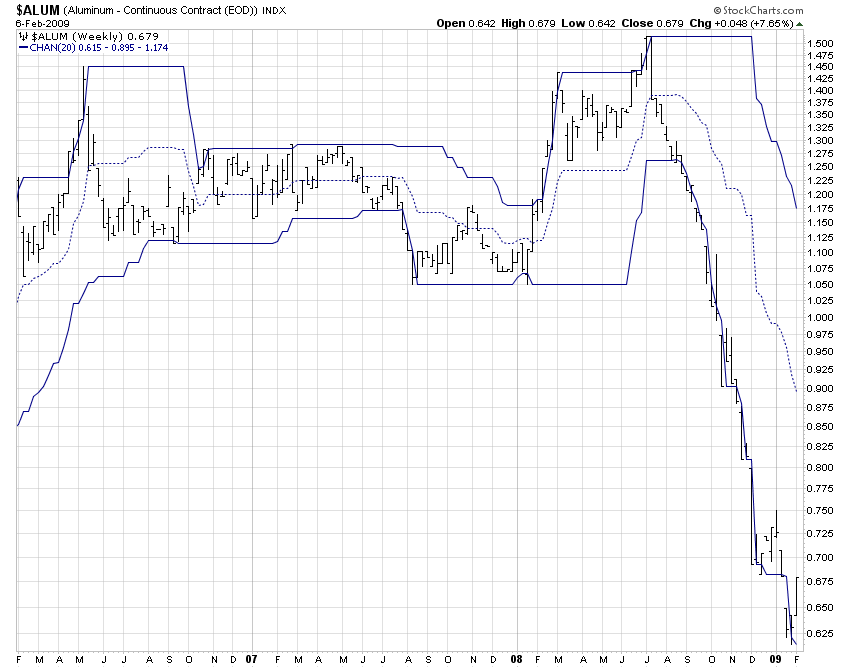

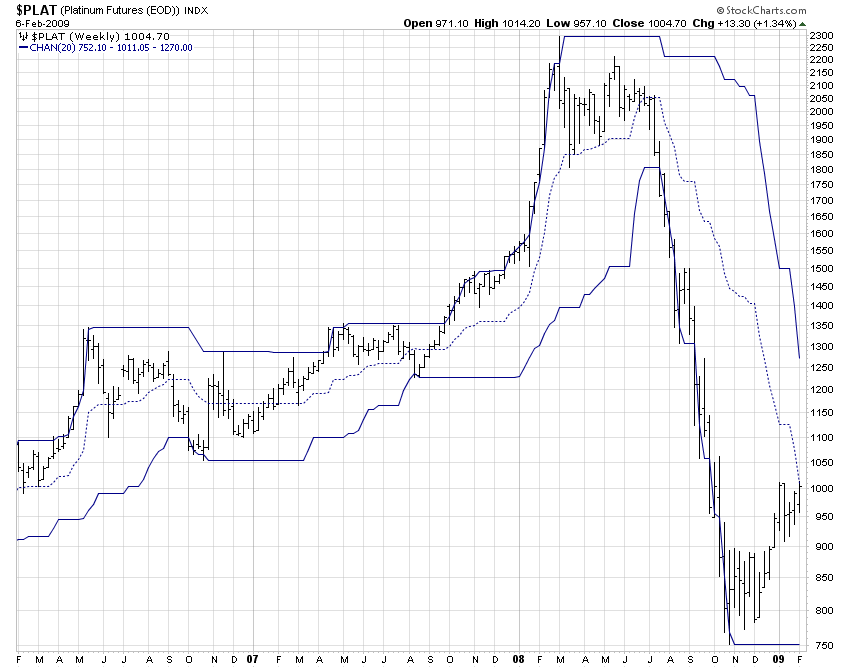

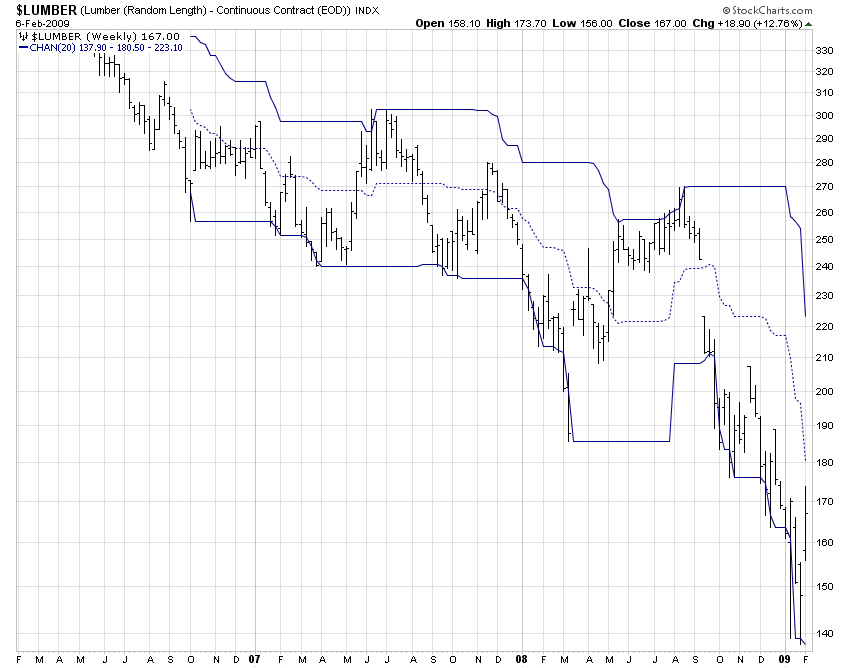

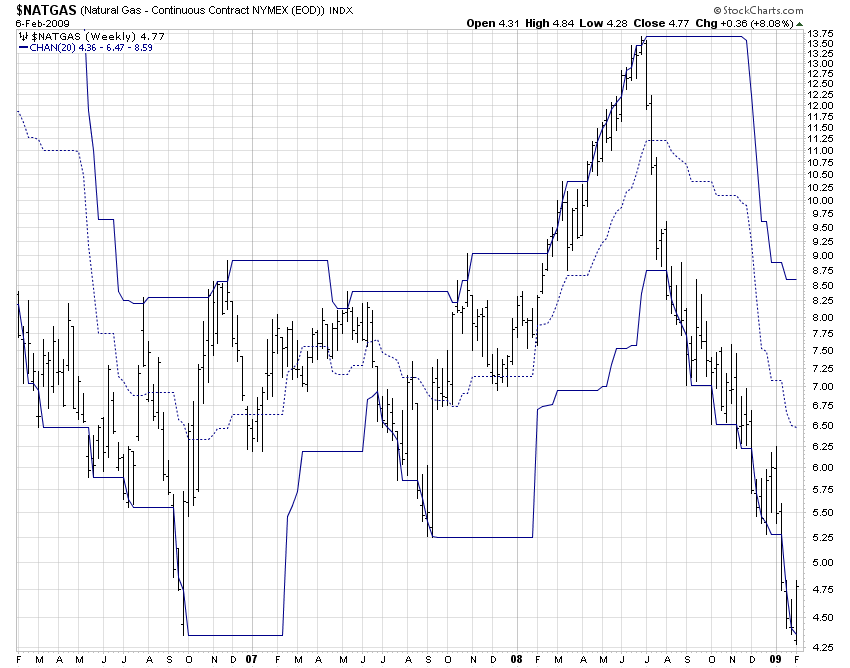

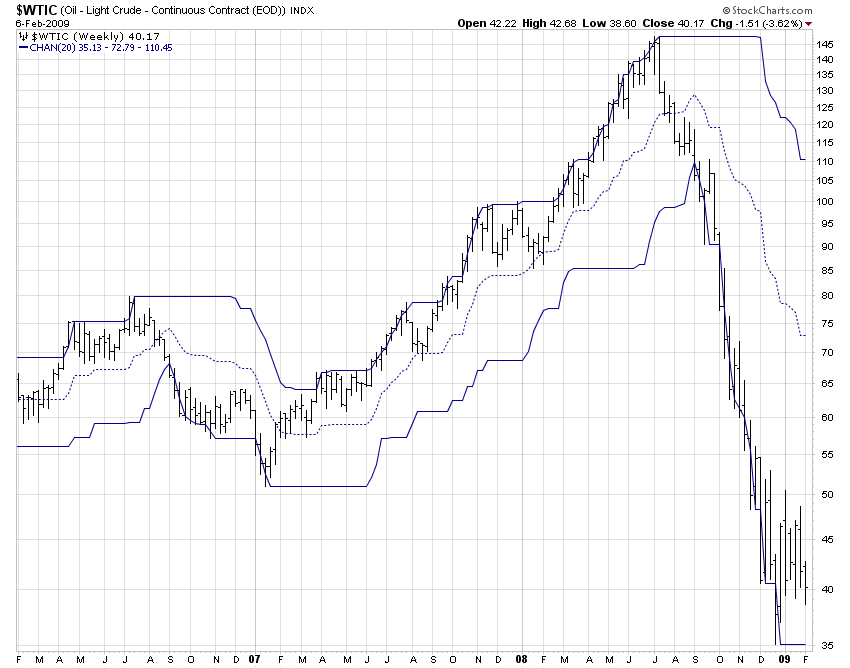

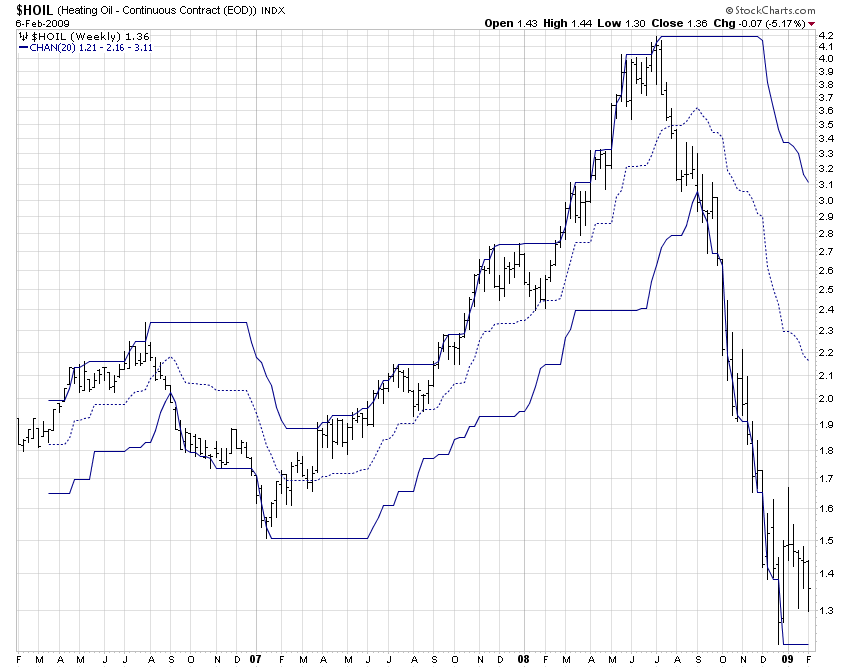

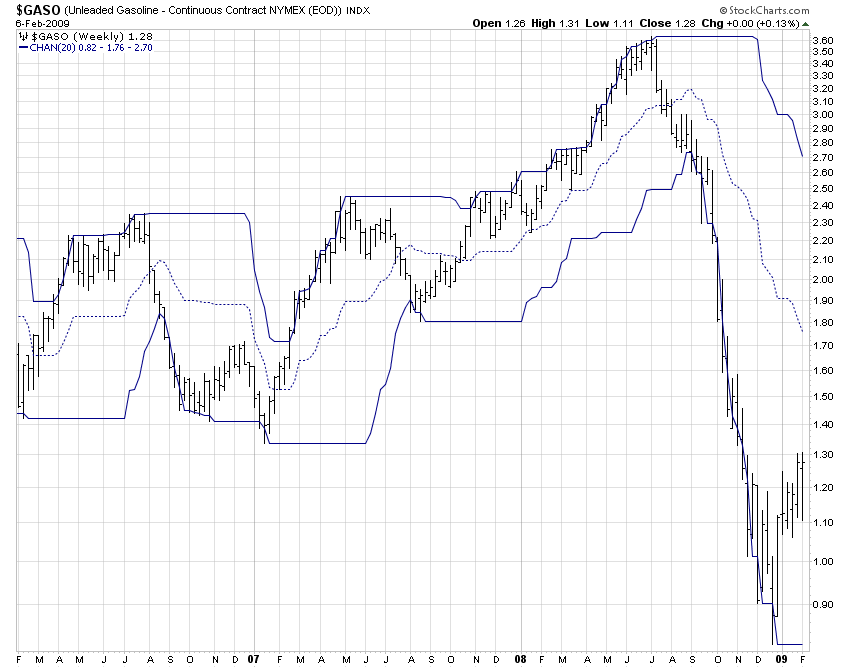

Here are weekly, 3-year charts for several basic inputs to industry used to make things and move materials and things around.

The charts present the continuous futures contract price, and also show a 20-period price channel (marking trailing 20-period highest high and lowest low).

Copper

Aluminum

Platinum

Lumber

Natural Gas

West Texas Intermediate Crude Oil

Heating Oil

Gasoline

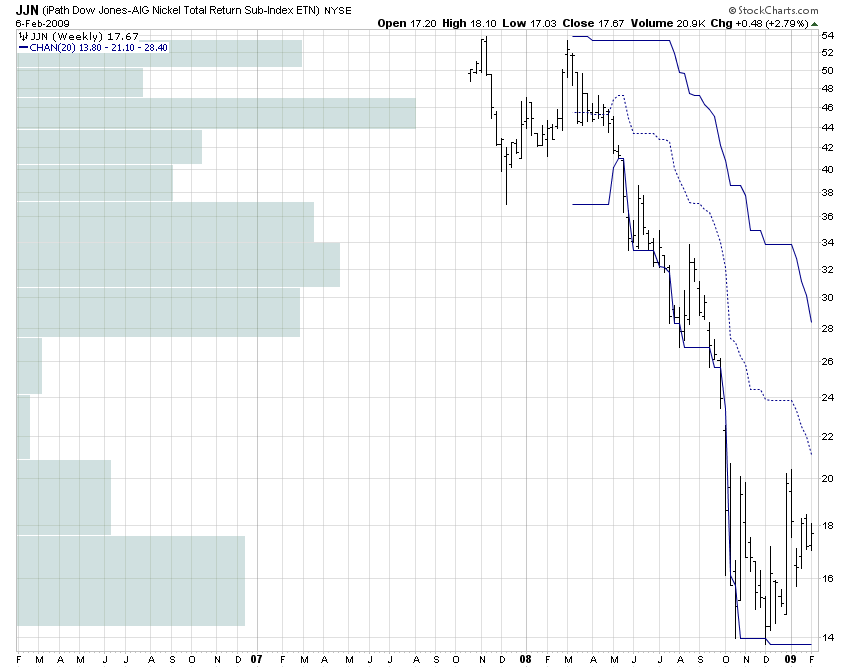

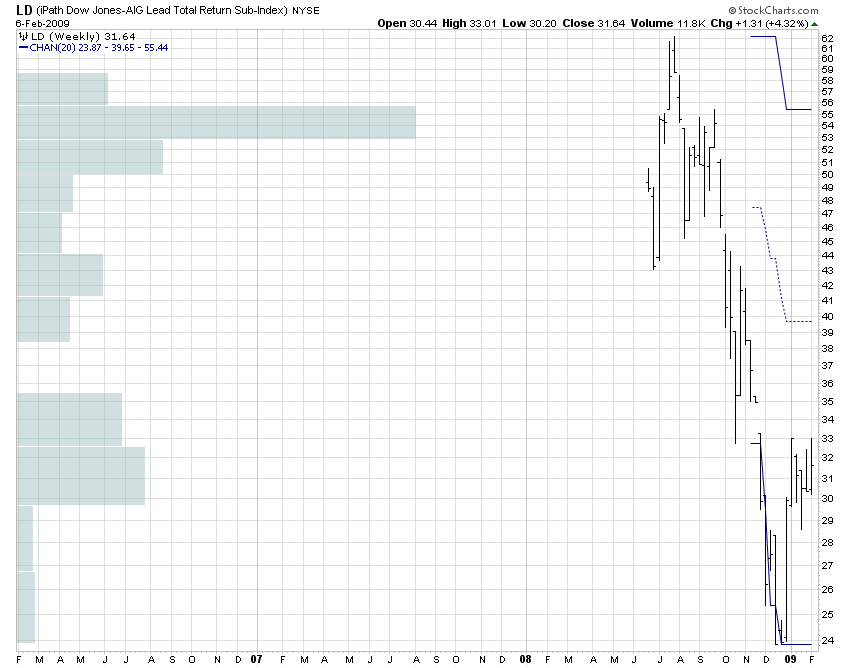

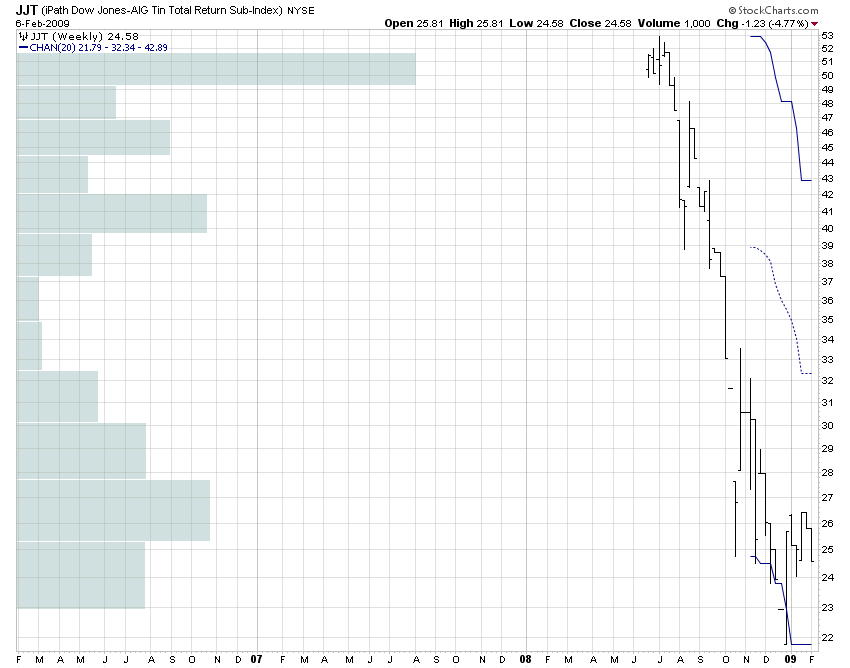

Here also are some shorter-term futures related prices for other industrial metals based on Barclay's iPathETN products (the green horizontal histograms are “volume at price”):

Nickel

Lead

Tin

Not everyone will find this data either interesting or useful, but it helps us get somewhat of a panoramic view of materials demand broken out more specifically than broad commodities indices.

Maybe the industrial materials will give early warning of possible stock market improvements.

Of course, until the stocks of various types actually move up in a decided way, we will keep our allocations on the sidelines. Because we have a market of stocks, industries and sectors — not a monolithic stock market — we will likely enter the market at different times for different parts.

Platinum (point & figure chart)

Platinum seems to be working on either a short-term double/triple top or a near-term breakout, probably related to speculation about the prospective auto industry bailout. Catalytic converters use platinum, which makes the metal sensitive to auto manufacturing volumes.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.