The Perfect Storm: Financial Crisis of Epic Proportions

Economics / Financial Crash Feb 19, 2009 - 03:14 PM GMTBy: James_Quinn

The Perfect Storm: Financial Crisis of Epic Proportions

THE BURNING PLATFORM - "The US government is on a “burning platform” of unsustainable policies and

practices with fiscal deficits, chronic healthcare underfunding, immigration and

overseas military commitments threatening a crisis if action is not taken soon." David M. Walker

THE BURNING PLATFORM - "The US government is on a “burning platform” of unsustainable policies and

practices with fiscal deficits, chronic healthcare underfunding, immigration and

overseas military commitments threatening a crisis if action is not taken soon." David M. Walker

David Walker served as Comptroller General of the United States from 1998 through 2008. He is now the CEO of the Peter G. Peterson Foundation and leader of the Fiscal Wake Up Tour. He has been a lone voice in the wilderness for the last decade regarding our looming fiscal disaster.

As head of the General Accounting Office he would go before Congress and explain that the country need to change course before we flounder in a Perfect Storm of debt. They listened to him respectfully and proceeded to add $5 trillion to the National Debt in the next eight years. The borrowing binge is now entering a hyper-speed phase. President Obama has been only concerned with speed rather than long term corrective actions.

“ I don't believe it's too late to change course, but it will be if we don't take dramatic action as soon as possible. If nothing is done, this recession could linger for years. That is why we need to act boldly and act now to reverse these cycles.”

“ I don't believe it's too late to change course, but it will be if we don't take dramatic action as soon as possible. If nothing is done, this recession could linger for years. That is why we need to act boldly and act now to reverse these cycles.”

I prefer the wisdom of Thomas Jefferson and Abraham Lincoln .

”Delay is preferable to error.” – Jefferson

“Give me six hours to chop down a tree and I will spend the first four sharpening the axe.” – Lincoln

The $787 billion 1,074 page stimulus bill has been passed. President Obama has signed it. The market immediately dropped 500 points. It will have no impact on the economy in 2009. The bill will stimulate nothing but the National Debt. Within months, plans for another stimulus plan will be demanded by the Democratic led Congress because speed and the appearance of action are how politicians get reelected. When I see Senator Charles Schumer of New York make a speech on the floor of the Senate saying, "And let me say this to all of the chattering class that so much focuses on those little, tiny, yes, porky amendments, the American people really don't care", I want to throttle him.Only a U.S. Senator would consider $100 billion a little tiny pork. His words prove that our leaders are so corrupted and disconnected from real Americans that they are running this country for their own self interest and the interests of their corporate money backers. Abraham Lincoln, an honest and wise man by most accounts, knew that calling pork spending stimulus doesn't make it stimulus.

“ If you call a tail a leg, how many legs has a dog? Five? No, calling a tail a leg don't make it a leg.”

When I see annual deficits of $2 trillion to $3 trillion that Congress has committed the country to in the coming years, I can't help but associate our country's situation with the last voyage of the Andrea Gail. Anyone who has seen the movie A Perfect Storm or read the book knows the story of the sword-fishing crew that got caught in the Halloween Nor'easter of 1991, known as the perfect storm. The story is a precise analogy to what will happen if our country doesn't change course now.

The Andrea Gail (United States) is captained by Billy Tyne (Barack Obama) with his young first mate Bobby Shatford (Timothy Geithner). Their fishing boat was fighting the rough waves of the North Atlantic (Financial Crisis) as they sought their prize of swordfish (Economic Recovery). While they were concentrating on the task at hand, the remnants of Hurricane Grace (Unfunded Liabilities of $53 trillion) was moving up the Atlantic coast. A low pressure system ($787 billion stimulus bill) moved off the East Coast and a strong disturbance (Bank Bailout) along a cold front coming from Canada combined to create a strong Nor'easter. The intensifying storm was already dangerous (Causing Unemployment and Bankruptcies), but when the subtropical power of Hurricane Grace was sucked into the maelstrom, it became a Perfect Storm (Financial Crisis of Epic Proportions). With 75 mph winds (Deficits) and 60 foot waves (Unsustainable Spending on Social Programs & Military Spending), the storm had become enormously treacherous.

Source: Wikipedia

Captain Tyne (Barack Obama) received frantic warning calls from Captain Linda Greenlaw (David Walker) that the storm had grown into a killer and must be avoided. Cocky Captain Tyne (Barack Obama) thought he knew better and could make it through the storm and safely back to port in Gloucester to reap the riches of his catch. Instead of maneuvering (Reigning in spending and allowing banks to fail) to avoid the storm, Captain Tyne (Barack Obama) decides to double down and plough full speed ahead into the heart of the Perfect Storm. The Adrea Gail (United States) gets caught in the vortex of the storm. Ultimately, Captain Tyne (Barack Obama) and Bobby (Timothy Geithner) realize they will never get out alive. They make one last effort to climb a 60 foot wave and the Andrea Gail (United States) capsizes (Collapse of American Financial System), and all men are lost at sea.

Unsustainable Policies & Practices

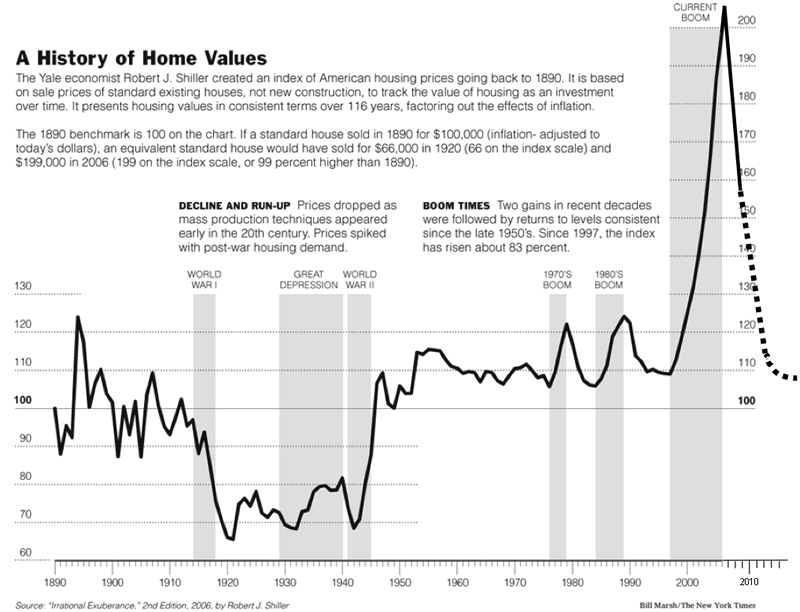

The definition of unsustainable is, not able to be maintained or supported in the future. To me, a picture is worth a thousand words.

Source: Robert Shiller

As Congressional moron after Congressional moron goes on the usual Sunday talk show circuit and says we must stop home prices from falling, I wonder whether these people took basic math in high school. Are they capable of looking at a chart and understanding a long-term average? The median value of a U.S. home in 2000 was $119,600. It peaked at $221,900 in 2006. Historically, home prices have risen annually in line with CPI. If they had followed the long-term trend, they would have increased by 17% to $140,000. Instead, they skyrocketed by 86% due to Alan Greenspan's irrational lowering of interest rates to 1%, the criminal pushing of loans by lowlife mortgage brokers, the greed and hubris of investment bankers and the foolishness and stupidity of home buyers. It is now 2009 and the median value should be $150,000 based on historical precedent. The median value at the end of 2008 was $180,100. Therefore, home prices are still 20% overvalued. Long-term averages are created by periods of overvaluation followed by periods of undervaluation. Prices need to fall 20% and could fall 30%. You will know we are at the bottom when the top shows on cable are Foreclose That House and Homeless Housewives of Orange County .

Instead of allowing the housing market to correct to its fair value, President Obama and Barney Frank will attempt to “mitigate” foreclosures. Mr. Frank has big plans for your tax dollars , "We may need more than $50 billion for foreclosure [mitigation]". What this means is that you will be making your monthly mortgage payment and in addition you will be making a $100 payment per month for a deadbeat who bought more house than they could afford, is still watching a 52 inch HDTV, still eating in their perfect kitchens with granite countertops and stainless steel appliances. Barney thinks he can reverse the law of supply and demand by throwing your money at the problem. He will succeed in wasting billions of tax dollars and home prices will still fall 20% to 30%. Unsustainably high home prices can not be sustained. I would normally say that even a 3rd grader could understand this concept. But, instead I'll say that even a U.S. Congressman should understand this.

Source : Barrons

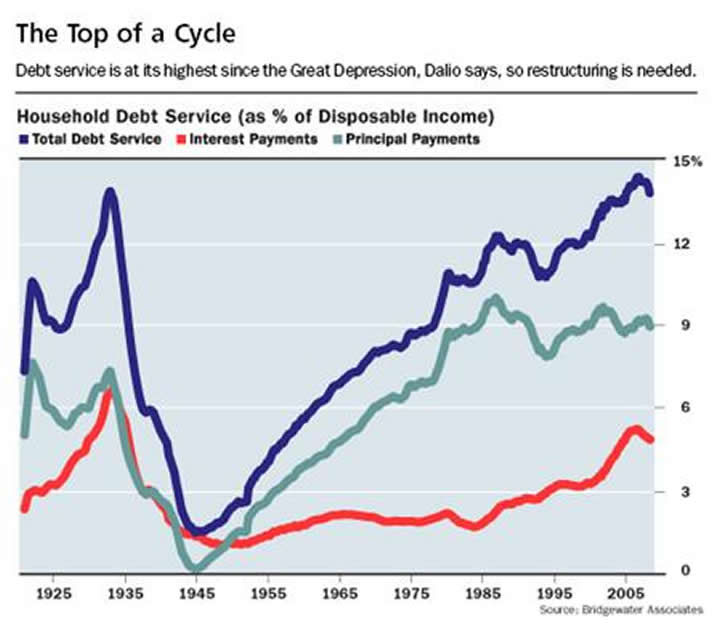

Ray Dalio, the Chief Investment Officer of Bridgewater Associates, in a recent interview in Barron's made an irrefutable argument that the United States consumers, companies and Government must accept the pain of debt restructuring to get our economy back to normal. His firm had been consistently right, years before the financial crisis hit.

“Basically what happens is that after a period of time, economies go through a long-term debt cycle -- a dynamic that is self-reinforcing, in which people finance their spending by borrowing and debts rise relative to incomes and, more accurately, debt-service payments rise relative to incomes. At cycle peaks, assets are bought on leverage at high-enough prices that the cash flows they produce aren't adequate to service the debt. The incomes aren't adequate to service the debt. Then begins the reversal process, and that becomes self-reinforcing, too. In the simplest sense, the country reaches the point when it needs a debt restructuring. We will go through a giant debt-restructuring, because we either have to bring debt-service payments down so they are low relative to incomes -- the cash flows that are being produced to service them -- or we are going to have to raise incomes by printing a lot of money.

It isn't complicated. It is the same as all bankruptcies, but when it happens pervasively to a country, and the country has a lot of foreign debt denominated in its own currency, it is preferable to print money and devalue. The biggest issue is that if you look at the borrowers, you don't want to lend to them. The basic problem is that the borrowers had too much debt when their incomes were higher and their asset values were higher. Now net worth's have gone down. The Federal Reserve is going to have to print money. The deficits will be greater than the savings. So you will see the Federal Reserve buy long-term Treasury bonds, as it did in the Great Depression. We are in a position where that will eventually create a problem for currencies and drive assets to gold.”

The debt service as a % of disposable income for consumers is above Great Depression levels as we enter the Next Great Depression. These levels are unsustainable. Consumers normally have a limited number of choices. They can pull a Trump and declare bankruptcy to wipe out the debt or reduce spending dramatically while paying down their debt. This is what is required to purge our capitalist system of its excesses. Instead, our Government “leaders” are coming to the rescue with your tax dollars. You have already given $7 billion to Capital One and American Express so they can hand out more credit cards with $20,000 limits to pizza delivery boys. When you see someone carting a 52 inch HDTV out the door of Best Buy, you may be making his credit card payment. Barney Frank, and his band of merry Congressmen, has also provided $9 billion of your hard earned tax dollars to GMAC Financial and Chrysler Financial. GMAC Financial used the name Di-Tech to lure millions of gullible poor people into negative amortization no doc mortgage loans at the peak of the housing bubble. When you see a BMW 525i parked in front of a boarded up house in West Philly, know that you are making the car payment for that deadbeat.

The stimulus plan will be a complete failure. Politicians have not taken into account the damaged psychology of the American public. We have been hit over the head with a baseball bat and will not be stepping up to the feeding trough of debt financed spending for a long time. If we do not let people and companies fail, we will encourage the same behavior that caused the problem. It will make sense for every upstanding American to stop paying their mortgage and to run their credit cards up to the limit. Pastor Adrian Rogers explained how many Americans feel today.

"You cannot legislate the poor into freedom by legislating the wealthy out of freedom. What one person receives without working for, another person must work for without receiving. The government cannot give to anybody anything that the government does not first take from somebody else. When half of the people get the idea that they do not have to work because the other half is going to take care of them, and when the other half gets the idea that it does no good to work because somebody else is going to get what they work for, that my dear friend, is about the end of any nation. You cannot multiply wealth by dividing it."

Fiscal Deficits

“A wise and frugal government, which shall leave men free to regulate their own pursuits of industry and improvement, and shall not take from the mouth of labor the bread it has earned - this is the sum of good government.” Thomas Jefferson

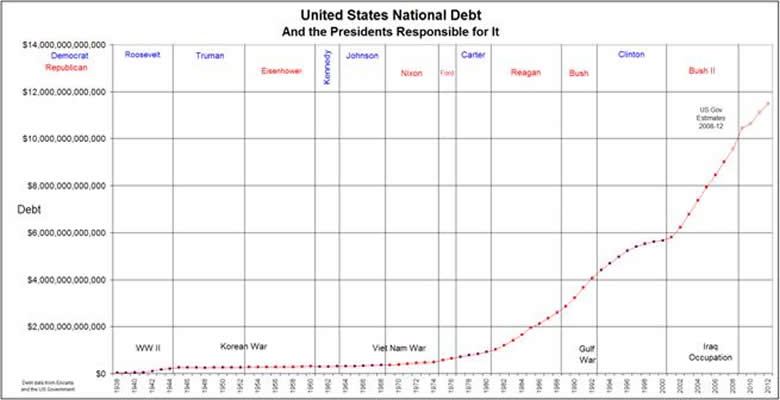

The chart below, which shows our National Debt from 1938 onward, is totally outdated. The projections through 2012 were made before the current Congress unleashed its hell fury. The chart is now vertically challenged, topping out at a mere $14 trillion. The little red line that was so sedate until Richard Nixon took the United States off the gold standard in 1971, is about to take off like the Space Shuttle. The current “stimulus” package of $787 billion is more than the entire National Debt in 1978 ($771 billion). By 2012, the National Debt will easily exceed $15 trillion. If economists like Paul Krugman have their way, the debt will surpass $16 trillion. The bill has just been signed and the ultra-liberal Krugman is already saying it isn't nearly enough spending. Keynes is his god. The man is so disconnected from the real world, it is sad. He is only comfortable in his secluded academic world at Princeton with his models and theories. He needs to shuttle kids to hockey games on the weekend so he can stop thinking of ways to spend our money. He has probably never set foot in a Wal-Mart or a Jiffy Lube. I truly believe that his goal in life is that 80 years from now, people will say “We're all Krugmans now”.

Source: Cedarcomm.com

I guess I'm thinking of the examples of people and businesses with solid credit records who can't get banks to lend to them.

Where is the U.S. and the rest of the world going to keep getting money to pay for these stimulus packages?

Are you a fan of gold?

Have you always been?

You mentioned, too, that inflation is not as big a worry for you as it is for some. Could you elaborate?

Given this outlook, what is your view on stocks?

Thanks, Ray.

The chart looks eerily similar to the previous housing chart. How far up can it go before the fat lady sings? It looks like we are going to find out if Dick Cheney was right. “Deficits don't matter”. We all know Mr. Cheney has never been wrong before. The annual deficit for 2009 is now estimated at between $2 trillion and $3 trillion give or take a few hundred billion. These figures seem incomprehensible to the average person on the street. Some perspective is in order. If we use $2.5 trillion as the estimated deficit that means:

- We're adding $6.85 billion per day to the National Debt

- We're adding $285 million per hour to the National Debt

- We're adding $475,000 per minute to the National Debt

In the time it takes to say Audacity of Hope, we've added $25,000 to the National Debt. There are many pundits who say the National Debt doesn't matter. We are only paying 3.4% on our 30 Year Treasuries and there is always enough demand. The dollar continues to be steady versus the Euro. Government debt as a percentage of GDP was 122% during World War II, versus only 78% today. All of these statements are true, today. On March 1, 2008 I could have said that the American banking system was sound. I would have appeared to be right. Two weeks later Bear Stearns collapsed and the downward spiral of our worldwide financial system accelerated out of control. Are these reasonable questions to ask?

- How long will foreign countries fund our rapidly accelerating deficits for a 3.4% return which will be wiped out by a slight decline in the USD?

- Will foreign countries with their own economies contracting and pouring billions into domestic stimulus even have the funds to invest in U.S. Treasuries?

- Is there a tipping point when Bernanke has printed one too many dollars? If there is, you can be sure he won't see it coming.

- When government debt reaches 110% of GDP next year, will we be in better or worse position as a nation than we were in 1945 as the only remaining power in the world?

- How do you solve a $53 trillion unfunded liability problem while tripling your National Debt in the space of 10 years?

The answers to these questions will determine when the Great American Economic Ponzi Scheme Collapses. It is only a question of timing if we continue on the current fiscal path. As we lay in our beds watching American Idol and pondering whether Britney Spears is a good mom, our beds are burning.

The time has come

To say fairs fair

To pay the rent

To pay our share

The time has come

A facts a fact

It belongs to them

Lets give it back

How can we dance when our earth is turning

How do we sleep when our beds are burning

Beds are Burning – Midnight Oil

Healthcare Underfunding

“I am a firm believer in the people. If given the truth, they can be depended upon to meet any national crisis. The great point is to bring them the real facts.” Abraham Lincoln

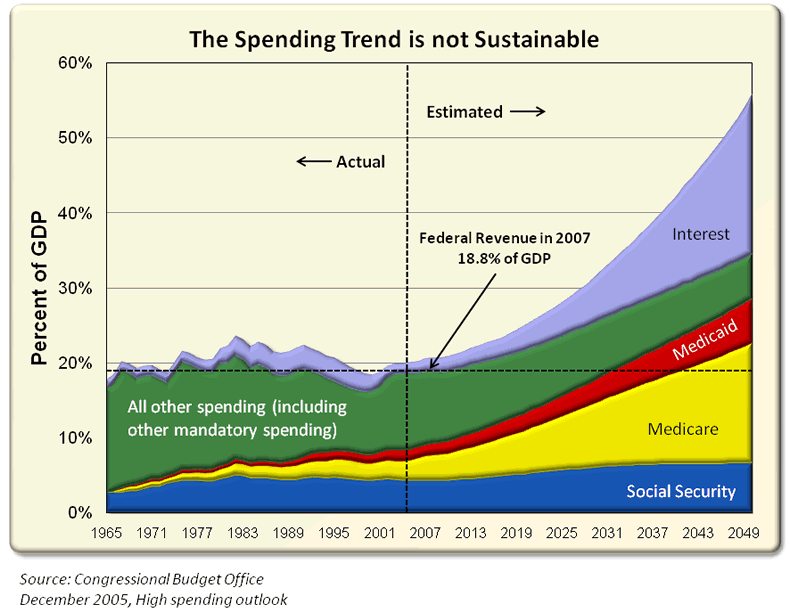

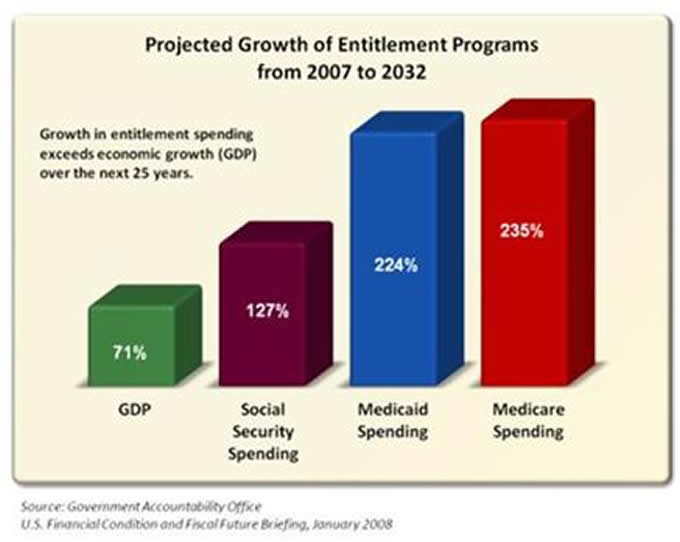

The American people have not been given the truth by our politician leaders since the Eisenhower administration. By hiding the truth and not addressing the unsustainable trend of our social programs, our leaders have insured a painful outcome of this trend. In 1965, 27% of Federal spending was mandatory. on Today, 53% of Federal spending is on auto-pilot. The entire Social Security, Medicare, and Medicaid system will need to be overhauled or scrapped. Benefits will have to be reduced and taxes will have to be raised. There are no other choices. Medicare costs will explode over the next 40 years. The increasing debt will result in interest payments on the debt becoming the largest expenditure in the federal budget. The longer we wait to address this unavoidable train wreck, the more likely it will result in generational warfare between baby boomers and younger generations.

Source: Perotcharts.com

As entitlements and net interest grow, discretionary spending gets squeezed. Non-defense programs, which include, activities related to children, transportation infrastructure, education, training and research that should promote future economic growth and prosperity, come under increasing funding pressure. We are forced to ignore investments in the future to pay for commitments made decades ago. The short term focus of our Washington politicians has ruined our fiscal future. Children don't vote, and younger people are less involved in the political process. As a result, the political gain from immediate increases in spending or reductions in taxes outweighs the eventual economic benefits of more politically costly but fiscally responsible choices. This is a criminal and immoral act upon our future generations. It is time to hold these politicians accountable for their actions. Again, Abraham Lincoln's wisdom from 150 years ago applies today.

“You cannot escape the responsibility of tomorrow by evading it today.”

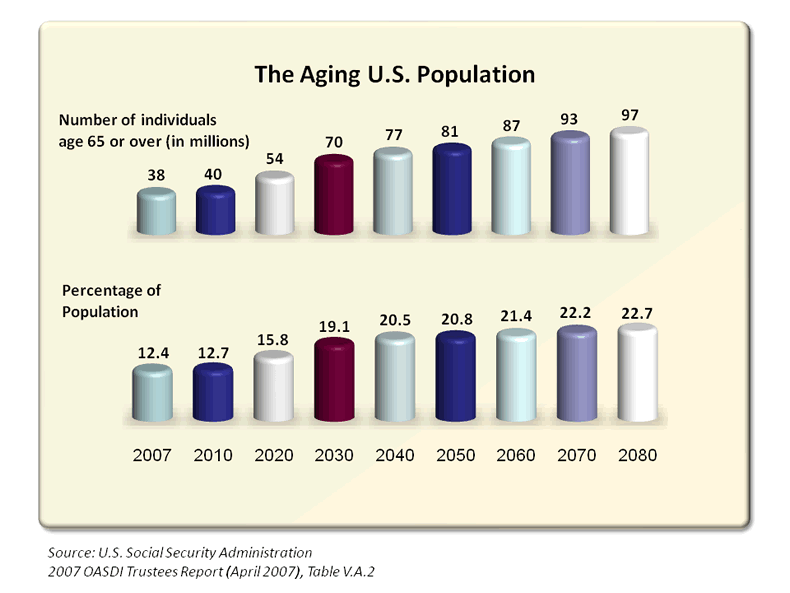

Source: Perotcharts.com

The above chart proves we cannot possibly grow our way out of this problem. On average, more than 10,000 baby boomers will become eligible for Social Security benefits each day for the next two decades. As they do, there will be fewer workers supporting a growing number of retirees. This eventually will place an unfair burden on younger workers, who will end up bearing the brunt of future taxes. A politically unpopular decision deferred today is a tax increase on future generations. The United States spends 16.5% of GDP on healthcare every year. This is far more than any country on earth. This amounts to $2.3 trillion per year. Even with this immense spending, there are 47 million Americans without health coverage. Canada, Australia, and Sweden only spend 9% of GDP and cover all of their citizens. The waste, fraud and bureaucracy of our system are out of control. Nationalization would be a disaster. Totally free markets favor only the rich. There is no easy answer. It will take compromise, sacrifice, and intelligence to solve this problem.

Immigration

As our country sinks deeper into this recession and more people lose their jobs, anger at illegal immigrants will continue to grow. This is not an unexpected reaction, as anger has to be directed somewhere. According to a Pew Institute report, there are 11 million illegal immigrants in the United States, with almost 50% of the total in California, Texas and Florida. Approximately 57% of the illegal immigrants are from Mexico and another 24% from other Latin American countries. The cost to the American taxpayer is huge. Estimates of the annual cost are in the range of $300 billion per year. Some disturbing statistics include:

- $11 Billion to $22 billion is spent on welfare to illegal aliens each year by state governments.

- $2.2 Billion dollars a year is spent on food assistance programs such as food stamps, WIC, and free school lunches for illegal aliens.

- $2.5 Billion dollars a year is spent on Medicaid for illegal aliens.

- $12 Billion dollars a year is spent on primary and secondary school education for children here illegally.

- $17 Billion dollars a year is spent for education for the American-born children of illegal aliens, known as anchor babies.

- $3 Million Dollars a day is spent to incarcerate illegal aliens.

- 30% percent of all Federal Prison inmates are illegal aliens.

- $90 Billion Dollars a year is spent on illegal aliens for welfare social services by the American taxpayers.

Why are there 11 million illegal immigrants in the country? So the rich can have housekeepers and landscapers. So homebuilders have cheap labor to put roofs on their houses. So farming conglomerates can have someone to pick their crops. All of these people benefit from cheap illegal labor. The American taxpayer foots the bill for the social costs.

Now the really bad news. We need a large increase in immigration in order to have any chance at maintaining a decent standard of living in the future. The number of Americans over 65 years old will increase by 75% between 2010 and 2030. These 70 million people will all be collecting Social Security and sucking our system dry. There aren't enough young people to replace them in the work force. With only 28% of Americans achieving a college degree, we need to undertake a concerted effort to bring in as many smart immigrants as possible and convince them to stay here after graduation. Our educational system is graduating too many Bluto Blutarskys and not enough Einsteins.

Dean Vernon Wormer: Zero point two... Fat, drunk and stupid is no way to go through life, son.

Bluto: Over? Did you say "over"? Nothing is over until we decide it is! Was it over when the Germans bombed Pearl Harbor? Hell no!

Bluto: Christ. Seven years of college down the drain.

Our only realistic chance to solve many of our fiscal problems is through discoveries in science and medicine that can only happen with highly educated people whether they are born in the U.S. or elsewhere.

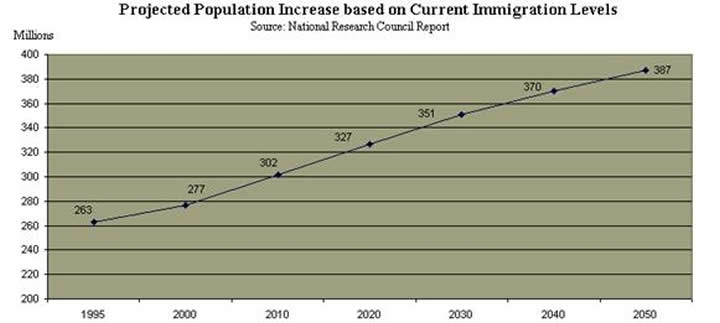

If we could increase the expected 2030 population from 351 million to 380 million, those added taxpayers would greatly help the national fiscal situation. Regarding the 11 million illegal aliens already in the country, it is not feasible to round them up and send them back. Mexico is already on the brink of implosion, with drug lords controlling much of the country. A realistic approach is needed.

Overseas Military Commitments

"Every gun that is made, every warship launched, every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed, those who are cold and not clothed. This world in arms is not spending money alone. It is spending the sweat of its laborers, the genius of its scientists, the hope of its children." Dwight D. Eisenhower – Farewell Speech

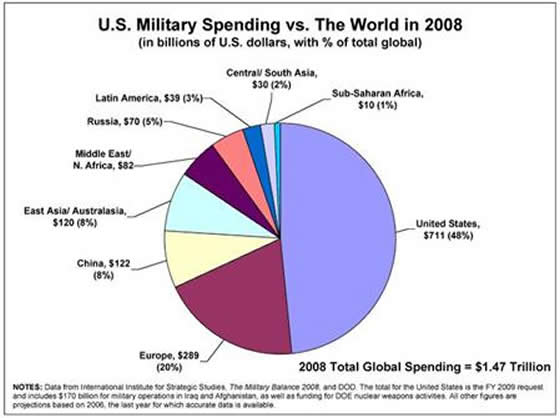

The man who led the Allies to victory in WW II warned the country that the Military Industrial Complex was too powerful. We did not heed his warning. The United States, the only superpower remaining on earth, currently spends more on military than the next 45 highest spending countries in the world combined. The U.S. accounts for 48% of the world's total military spending. The Cold War has been over for 20 years, but we are spending like World War III is on the near term horizon. There is no country on earth that can challenge the U.S. militarily. So, why are we spending like we are preparing for a major conflict? The impression on the rest of the world is that we have aggressive intentions. Defense spending had peaked at just under $500 billion in 1988. The fall of communist Russia did result in a decline to the $350 billion range from 1995 through 2000, and an economic boom ensued. Since 9/11 we have doubled our spending on defense.

George Bush's pre-emptive war has cost the American taxpayer $800 billion so far. The human cost of this war is worse than the dollar cost. Almost 5,000 Americans have died for the lies of Dick Cheney and Donald Rumsfeld. Thousands of mothers, fathers, sisters, brothers, wives, husbands, and children have lost their loved ones for a false cause. Our National Guard troops have been stretched beyond the breaking point. Military families have been devastated by multiple deployments. Soldiers are committing suicide in record numbers. Returning soldiers are not being treated for psychological illnesses. The anger of the Guns N Roses song Civil War captures how I feel.

Look at your young men fighting

Look at your women crying

Look at your young men dying

The way they've always done before

Look at the hate we're breeding

Look at the fear we're feeding

Look at the lives we're leading

The way we've always done before

I don't need your civil war

It feeds the rich while it buries the poor

You're power hungry sellin' soldiers

In a human grocery store

Ain't that fresh

I don't need your civil war

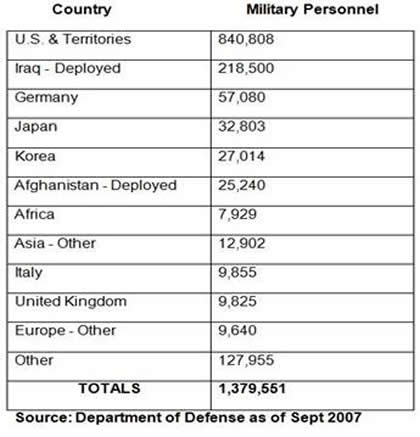

If as a country we continue to allow our politicians and their military industrial complex corporate sponsors to spend $800+ billion per year on weapons, to the detriment of higher education, alternative energy projects, and national infrastructure needs, we will be paying an extremely high price. According to the Defense Department's latest "Personnel Strengths" report, the United States now has troops stationed in 147 countries and 10 territories. Why are we policing the world? What is the point of having 57,000 troops in Germany and 33,000 troops in Japan? Germany and Japan each spend $40 billion per year on their military. Can't they defend themselves at this point?

We have some of the brightest engineers in the country developing weapons to kill human beings more efficiently. There is an enormous opportunity cost that is being paid. These engineers could be concentrating their brilliance on developing alternative energy solutions which could free us from our Middle East oil dependence. Which effort would benefit our country more, weapons development or energy independence? War and non-stop conflict benefit the military industrial complex. It is in their best interest to support candidates that favor an aggressive foreign policy. This has led to Defense companies using their influence to provoke conflict throughout the world. President Eisenhower's final words in his farewell address are the most chilling.

“In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military industrial complex. The potential for the disastrous rise of misplaced power exists and will persist.”

If the words of a noble 20th century President aren't enough to convince you of a dangerous too powerful military, maybe the words of our Founding Father will.

“Over grown military establishments are under any form of government inauspicious to liberty, and are to be regarded as particularly hostile to republican liberty." George Washington

Are You Part of the Cure or Part of the Disease?

Come out upon my seas, curse missed opportunities (am I)

A part of the cure, or am I part of the disease Clocks - Coldplay

I think I've made a valid case that our government is on a burning platform of unsustainable policies. The important point now is how do we put the fire out and save the country from imploding under a mountain of debt? This is where ideology needs to be put aside. The best ideas from anyone should be considered. I believe that Samuel Adams was correct.

"It does not take the majority to prevail, but rather an irate, tireless minority, keen on setting brush fire freedom in the minds of men."

Some ideas for consideration follow:

- We know that Congress is corrupt and in the pocket of lobbyists. They show no courage to make necessary unpopular decisions because they won't be re-elected. The founding fathers envisioned representatives who did their civic duty for a short time and then went back to their real profession. Almost 200 out of 535 members of Congress are lawyers and lifetime politicians. This explains much about our predicament. Term limits would inject our leaders with a dose of courage. Maybe they would do what was best for the country if they knew that they would only be in Washington for six years.

- Outlawing lobbyists and PACs would remove the buying and selling of votes in Congress. We must remove the corruption from Washington DC.

- The PAYGO rules that were allowed to expire in 2002 must be reinstituted. These rules would not allow new spending initiatives without an equal cut in other spending. These rules allow Congressmen to pretend to have a backbone and say no to constituent demands.

- The banks that are insolvent will need to be nationalized, investors wiped out, and good assets sold off to good banks. Nouriel Roubini lays out a logical scenario . The sooner we purge the system of its bad debt, the sooner we can get this economy on a positive track.

- Dr. John Hussman has a solution for the foreclosure disaster that would not stick the U.S. taxpayer with the bill. Banks could write down the mortgage balance but receive a PAR (property appreciation right) back from the homeowner. The idea is discussed in more detail here .

- The U.S. carmakers need to be restructured within a pre-packaged bankruptcy. They want another $39 billion of your tax dollars. No more taxpayer funds can be wasted on these bloated pigs.

- A truly non-partisan commission appointed by the President with the power to put forth a comprehensive plan to restructure Medicare, Medicaid, and Social Security for an up or down vote by Congress is the only way to create a viable future. Congress must be forced to confront this issue.

- John McCain's moderate approach of allowing a path to citizenship seems like the best immigration plan. Most came here to try and live a better life. If they have committed crimes or don't follow the prescribed path to citizenship, then they need to be expelled from our country. We need to encourage foreign professionals to immigrate to America with incentives, if necessary.

- If 50% of the $1.4 trillion annual military related budget was redirected to debt reduction, energy independence, and infrastructure rebuilding, we would actually get a positive return on our tax contribution. Our military is supposed to defend our country, not invade sovereign nations.

- A “Manhattan Project” to develop new energy sources which would eliminate the $400 billion per year that we send overseas for foreign oil. The number of high paying jobs that could be created by building nuclear power plants, wind farms, and converting vehicles to natural gas would be in the hundreds of thousands.

- A tax system that eliminated all the preferences and loopholes for corporations and individuals while lowering rates would be fairer. Maybe even our Treasury Secretary could do his taxes correctly. Congress and lobbyists use the tax system to push their agendas. A flat tax or replacing the income tax with a national sales tax are other possible options.

- The Federal Reserve needs to be abolished. A currency backed by gold or a basket of precious metals would restrict what Congress could spend. This would save us from ourselves. The dollar has lost 93% of its purchasing power since Nixon closed the gold window in 1971 and the National Debt has gone from $389 billion to $10.8 trillion, a 2,800% increase in 38 years. Politicians will spend your money if they are given the chance. Let's not give them the chance.

“All tyranny needs to gain a foothold is for people of good conscience to remain silent.” Thomas Jefferson

When I was a kid and I'd read something fascinating in a book, I'd breathlessly tell my Dad what I'd learned. He'd look up from his newspaper and say, “Don't believe everything you read”. I'd be so mad, but his advice produced a world class skeptic. Don't believe anything or anyone until you've verified their facts and figured out their motives. If you are tired of remaining silent and have ideas you want to discuss, join me at TheBurningPlatform.com to have a forum for ideas that can put our country back on track.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2009 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.