Gold Bull Market, More Strength on the Way

Commodities / Gold & Silver 2009 Feb 23, 2009 - 05:53 PM GMTBy: Aden_Forecast

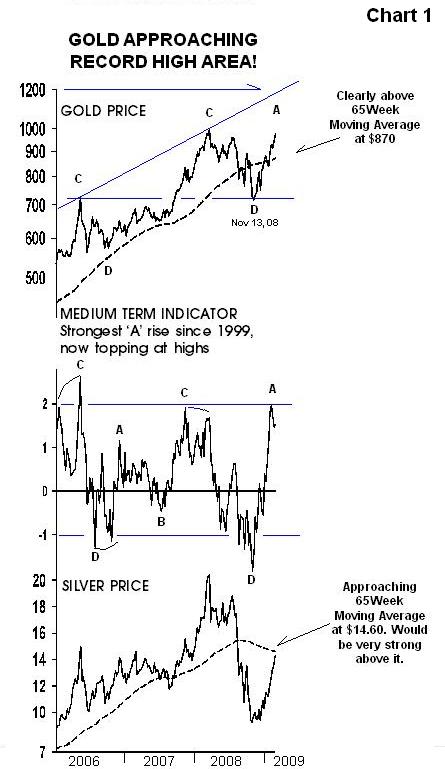

Gold shot up, reaching a nearly one year high today, and rapidly approaching its record high area.

Gold shot up, reaching a nearly one year high today, and rapidly approaching its record high area.

The ongoing current A rise that started last November is the strongest in this bull market and the strongest since 1999. Since this is an abnormally strong 'A' rise in an abnormal world recession, if gold reaches a new record high above $1004, gold will most likely be embarking on the start of a great bull market rise.

Gold could then jump to the $1200 level as its next target. Keep an eye on $910 as gold's 'A' rise is very strong above it (see Chart 1).

Gold could then jump to the $1200 level as its next target. Keep an eye on $910 as gold's 'A' rise is very strong above it (see Chart 1).

GOLD: An eight year phenomenon

Further backing this up is gold's ongoing bull market, which turns eight years old this month. The eight year mark has been a consistent low time for gold going back to the late 1960s when gold began trading in the free market.

Chart 2 shows this best. Note the pattern. It has repeated four times since 1969 and the fifth one is possibly happening now. Important lows vary from 7 years to 8 ½ years following the previous low, with the average being eight years. This recurring pattern tells us that the low could've been last November's low, three months shy of eight years, or it could still be upcoming. The long side would be a low this Summer.

The point is that gold's near or at an important low time. This means we want to buy more gold during weakness this year because gold is set to reach a record high, and the $2000 level would eventually be a likely target, near the top of the mega upchannel (see Chart 2 ).

In other words, whether it was last November's low or a low upcoming this year, the gold price is getting closer to the start of an even greater bull market rise. We should, therefore, have all of our gold positions completely bought well before year end.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.