China's Economy Recovers as Stock Markets Turn Bullish

Economics / China Economy Mar 05, 2009 - 05:30 AM GMT

China's manufacturing Purchasing Managers' Index (PMI) strengthened for a third consecutive month in February, climbing to 49.0% from 45.3% the previous month. Li & Fung Research Centre reports that there were some encouraging signs: all sub-indices were higher than their respective levels in the previous month though many were still lower than the critical level of 50% (i.e. still contracting).

China's manufacturing Purchasing Managers' Index (PMI) strengthened for a third consecutive month in February, climbing to 49.0% from 45.3% the previous month. Li & Fung Research Centre reports that there were some encouraging signs: all sub-indices were higher than their respective levels in the previous month though many were still lower than the critical level of 50% (i.e. still contracting).

In particular, both the Output Index and the New Orders Index rebounded to the expansionary zone of higher than 50% for the first time since September last year. In addition, the New Export Orders Index grew strongly by 9.7 percentage points to 43.4% in February, compared to the previous month.

The improved PMI numbers, together with the government's additional stimulus package, probably mark a trough in the GDP growth cycle. Andrew Pyle of ScotiaMcLeod, as reported by CEP News said: “Estimates for the country's growth outlook in 2009 have also started to levitate from the alarming 5-6% suggestions earlier this year back to 8%. Not as lofty as what we have been used to, but firm enough to put a floor under commodity prices …”

Some of the recent headlines from China Economic Net give an indication of the Beijing's strong emphasis on boosting growth.

![]() NDRC: Further shut down backward production facilities [03-05-2009]

NDRC: Further shut down backward production facilities [03-05-2009]

![]() NDRC: China's outbound investment up 13.2% [03-05-2009]

NDRC: China's outbound investment up 13.2% [03-05-2009]

![]() China to further reform power pricing system [03-05-2009]

China to further reform power pricing system [03-05-2009]

![]() China to put more funds to support SMEs [03-05-2009]

China to put more funds to support SMEs [03-05-2009]

![]() China aims for 20% growth in fixed asset investment in 09 [03-05-2009]

China aims for 20% growth in fixed asset investment in 09 [03-05-2009]

![]() China to invest 716.1b yuan in agriculture [03-05-2009]

China to invest 716.1b yuan in agriculture [03-05-2009]

![]() China aims 1.58% of 2009 GDP in research and development [03-05-2009]

China aims 1.58% of 2009 GDP in research and development [03-05-2009]

![]() China stresses domestic demand in stimulating growth [03-05-2009]

China stresses domestic demand in stimulating growth [03-05-2009]

![]() China aims for 17% growth in money supply in 09 [03-05-2009]

China aims for 17% growth in money supply in 09 [03-05-2009]

![]() China pledges 42b yuan employment support [03-05-2009]

China pledges 42b yuan employment support [03-05-2009]

![]() China pledges hefty investment to boost agriculture [03-05-2009]

China pledges hefty investment to boost agriculture [03-05-2009]

![]() China budgets record-high fiscal deficit [03-05-2009]

China budgets record-high fiscal deficit [03-05-2009]

![]() Wen urges efforts to promote export [03-05-2009]

Wen urges efforts to promote export [03-05-2009]

![]() China to continue active fiscal policy for growth [03-05-2009]

China to continue active fiscal policy for growth [03-05-2009]

![]() New body planned to run underperforming SOEs [03-05-2009]

New body planned to run underperforming SOEs [03-05-2009]

![]() Official: Spend more to boost economy [03-05-2009]

Official: Spend more to boost economy [03-05-2009]

Let's focus on a few graphs in order to gain a better understanding of China's economic situation.

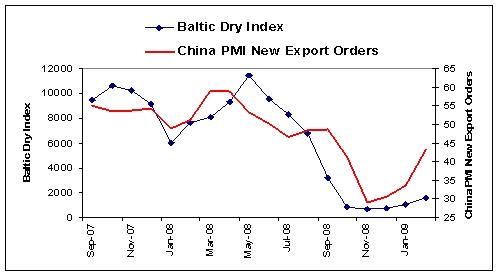

First up is the relationship between China's PMI for new orders and the Baltic Dry Index - measuring freight rates of iron ore and bulk goods - showing both indices turning up from last year's lows.

Source: Plexus Asset Management (based on data from I-Net Bridge)

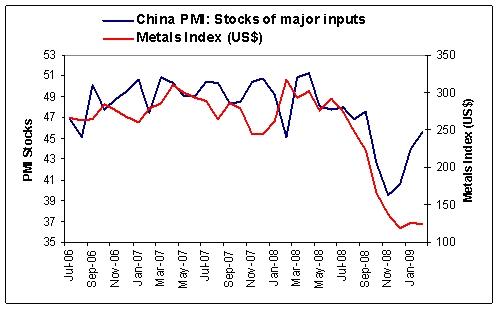

Next, China's PMI for stocks of major inputs shows the deterioration has probably bottomed and, based on the close relationship with the Metals Index, should put a floor under commodity prices.

Source: Plexus Asset Management (based on data from I-Net Bridge)

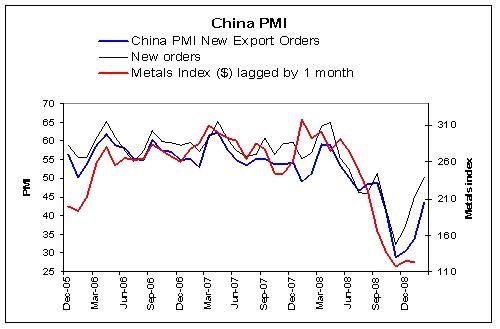

Source: Plexus Asset Management (based on data from I-Net Bridge)

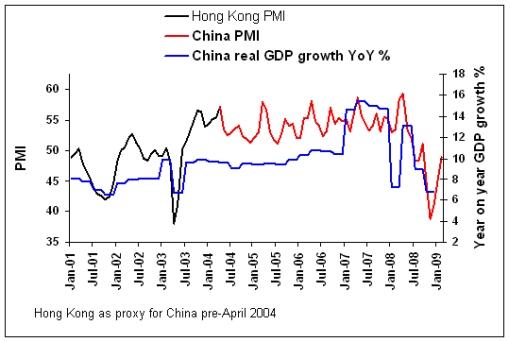

And finally, China's improving PMI seems to indicate that the country might have seen the worst of the GDP growth statistics. (The Hong Kong PMI is used as a proxy of the Chinese PMI prior to 2004.)

Source: Plexus Asset Management (based on data from I-Net Bridge)

The Chinese Shanghai Composite Index is still down 63.9% from its high of October 2007, but has recovered strongly since its November 4 low (+27.8%) and is also the top performer for the year to date (+20.7%). As mentioned before, the chart pattern of the Index shows arguably one of the most bullish formations of the major stock market indices (see graph below).

The chart (top section) shows a pattern of rising lows, supported by the four-month trend line and the 50-day moving average, with the 200-day moving average within sight. Also, Chinese stocks have outperformed the Dow Jones World Index by 87% over the past six months (see rising relative price-performance line in bottom section of chart) and the S&P 500 Index by a similar magnitude (not shown).

The Chinese believe good and bad follow each other closely. It is therefore also comforting to learn that the Year of the Ox is a sign of prosperity and has been very rewarding in the history of China. Will China's command economy come to the Western world's rescue? Time will tell, but there are rays of light, not least of which is a bullish-looking Chinese stock market.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.