Investing in Junior Precious Metal Mining Stocks Using Warrants

Commodities / Gold & Silver Stocks Mar 19, 2009 - 10:27 AM GMTBy: Dudley_Baker

While warrants have been in the news recently many investors still do not have a clue as to what they are or why they should at least consider including some long-term warrants on companies that they like in their investment portfolio's. It has been over 2 years since we have visited this title and content of this article so we sense it to be very timely.

While warrants have been in the news recently many investors still do not have a clue as to what they are or why they should at least consider including some long-term warrants on companies that they like in their investment portfolio's. It has been over 2 years since we have visited this title and content of this article so we sense it to be very timely.

We realize each day that many investors, the investment community and many, if not all of the investment newsletters and analysis are not educated on the subject of warrants. Therefore, our mission, so to speak, has become one of educating the world on this exciting investment vehicle thought our articles.

More background on investing in the precious metals stocks and/or warrants for U.S. investors:

A substantial number of the precious metals stocks and warrants are Canadian based companies and therefore an investment therein by U.S. investors has the potential to yield gains on two fronts, as a “Currency Play” on the U.S. Dollar and also the capital gain potential on the rise in the price of the stocks or warrants. Remember, when you invest in the Canadian stocks or warrants, you are now making an investment out of the U.S. Dollar and into the Canadian Dollar. The Canadian Dollar has recently proven to be one of the strongest currencies in the world, perhaps due to the large natural resources in Canadian both in the commodity sector and in the energy sector.

Canadian Dollar – Looking for a Bottom

U.S. Dollar under serious long-term pressure)

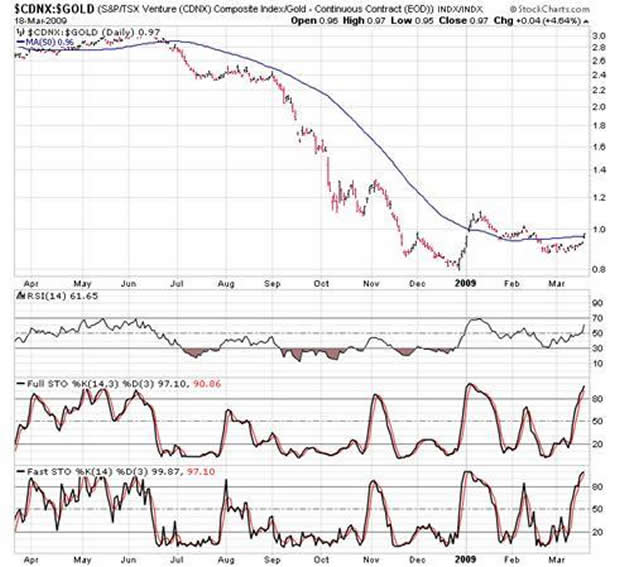

In this last chart we have the Canadian Venture Exchange to the price of gold which indicates the juniors mining shares could be heading substantially higher very soon.

We understand that many U.S. investors are not aware of the implications (as yet) as to the effects of the value of the U.S. Dollar on their investments. For those investors living outside of the United States , the “Currency Effect” is very simple. These investors deal with currency translations on a daily basis and seem to have a better grasp and understanding of the “Currency Effect” on their investment decisions. It is important for all investors to understand this concept

and the effects the currency in which you are invested will affect your investment outcome.

Now let us get back to our main subject, Why Warrants? – Why Now?

So exactly what is a warrant?

Most investors are familiar with options on stocks, calls and puts, right? I, like many of you, realize this is a very dangerous game for most investors. An option gives you the right, not the obligation, to acquire the underlying security/stock at a specific price and expiring at a specific date in the future. However, options are very short term, usually 30 – 90 days, so you have to be not only correct with respect to your timing but also with respect to the direction of the stock market. Perhaps you are a better market timer than I but it does not work out well for most investors.

A warrant is very similar to an option but with one major difference, TIME ! Warrants are usually issued with a minimum of 2 years to 5 years of life. Time is now your friend.

This means we as investors have the right to acquire the underlying stock at a specific price (determined by the company) and expiring at a specific date in the future. Warrants are usually issued by companies in connection with a financial arrangement and/or public offering and are a “kicker” to sweeten the deal. As investors in warrants our objective is to only trade the warrants with no intention of ever exercising them.

Warrants are all about Leverage . Leverage is why an investor should be interested in warrants. If your favorite mining stock has a warrant trading you should take a serious look to see if they fit your investment criteria which means “how long does the warrant have until expiration and does it provide good leverage?” It is not always easy to find all the facts on the warrants for some companies but you should always do your homework.

What does leverage mean? Leverage means getting the maximum return with the least amount of your investment capital at risk.

Our objective is to earn returns of over 2 to 1 over the gains on the common shares and there are many interesting opportunities today in the markets for accomplishing this potential.

This is not rocket science by any means; you just have to do the math.

With spot Gold currently at $948.00 as I write this article, some analysts believe we have broken out and are looking for substantially higher gold prices by years-end. There can be little doubt that eventually all mining shares will be in a rip roaring bull market. An investor should consider all the ways to participate in this bull market including adding warrants to their portfolio. All we ask is, “Why not attempt to maximize your investment returns?”

Of course, warrants do not come without some risk. If the underlying stock is trading below exercise price on the expiration date, the warrant will be worthless which is why we strongly recommend that investors focus on warrants that have a remaining life of at least 2 years, and preferably 3 or more years.

Each investor determines the content of their investment portfolio and if some of your favorite companies have long-term warrants trading it might be worth your time to investigate this option. Whether you decide to invest in the common shares or some of the long-term warrants your timing could not be better as we expect substantially higher prices in the coming weeks, months and years.

For those readers interested in learning more about warrants we encourage you to visit our website .

Dudley Pierce Baker

Guadalajara/Ajijic, México

Email: info@preciousmetalswarrants.com

Website: PreciousMetalsWarrants

Dudley Baker is the owner/editor of Precious Metals Warrants, a market data service which provides you with the details on all mining & energy companies with warrants trading on the U. S. and Canadian Exchanges. As new warrants are listed for trading we alert you via an e-mail blast. You are provided with links to the companies' websites, links to quotes and charts, tips for placing orders and much, much more. We do not make any specific recommendations in our service. We do the work for you and provide you with the knowledge, trading tips and the confidence in placing your orders.

Disclaimer/Disclosure Statement:PreciousMetalsWarrants.com is not an investment advisor and any reference to specific securities does not constitute a recommendation thereof. The opinions expressed herein are the express personal opinions of Dudley Baker. Neither the information, nor the opinions expressed should be construed as a solicitation to buy any securities mentioned in this Service. Examples given are only intended to make investors aware of the potential rewards of investing in Warrants. Investors are recommended to obtain the advice of a qualified investment advisor before entering into any transactions involving stocks or Warrants.

Dudley Pierce Baker Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.