Gold to Soar as the U.S. Dollar and then Treasury Bonds Collapse

Commodities / Gold & Silver 2009 Mar 19, 2009 - 12:41 PM GMTBy: Clive_Maund

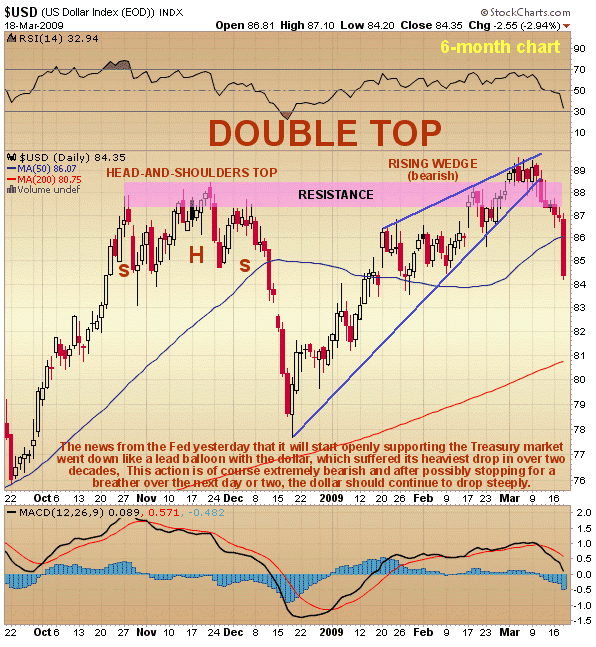

You may have heard the old saying that "the Market is the news", and it is true. You don't have to look for explanations regarding yesterday's response by the markets to the Fed's announcement that it will buy $300 billion of Treasuries, you only have to look at the reaction of the markets. The dollar index tanked by nearly 3% - it's biggest drop for over 2 decades. That alone tells you all that you need to know.

You may have heard the old saying that "the Market is the news", and it is true. You don't have to look for explanations regarding yesterday's response by the markets to the Fed's announcement that it will buy $300 billion of Treasuries, you only have to look at the reaction of the markets. The dollar index tanked by nearly 3% - it's biggest drop for over 2 decades. That alone tells you all that you need to know.

While the Fed is certainly very much to blame for the horrible dilemma in which it now finds itself, which has its roots in a litany of crassly irresponsible policies going back years, such as the slashing of interest rates to near zero in 2003 which ignited the housing boom and fuelled rampant leveraged speculation, one can understand why its present reactions to the financial crisis can be classed at best as clueless and at worst as desperate and reckless. Right now the hackneyed old saying "between a rock and a hard place" applies very well to the unenviable situation it finds itself in. Up until yesterday it had to make one of two choices, to support the Treasury market or not support it. Vast quantities of money have to be raised to finance the deficit, the government and to pay for the numerous bailouts, requiring the issue of a flood of new Treasuries.

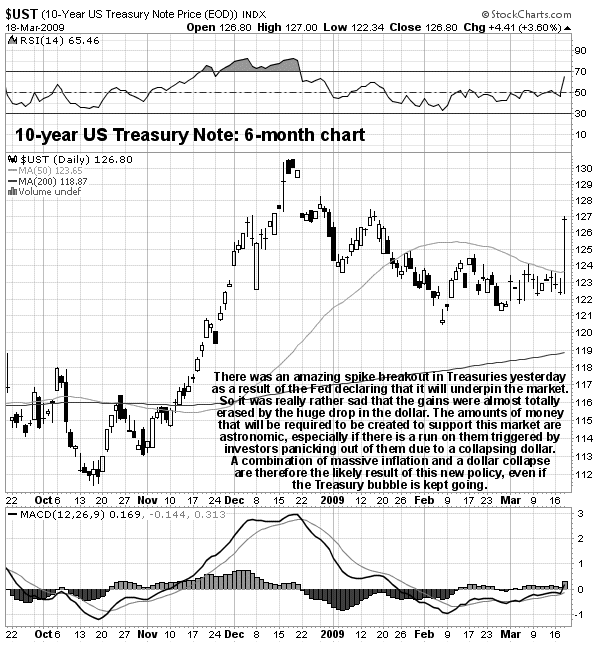

The problem is that overseas buyers are abandoning ship - they don't want them anymore because they have a miniscule yield, and besides they have plenty of problems at home that require urgent attention. This means that the US Treasury market is verging on collapse, and in the absence of intervention it will collapse. To prevent this and the resulting ruinous spike in interest rates, the Fed and the Treasury would have to monetise the new Treasuries, in other words, buy their own rubbish, and to do this this they will have to create vast quantities of new dollars. Yesterday was a momentous day because the Fed came down off the fence and announced that this is exactly what they they are going to do. Of course, major financial news networks tried to put a positive spin on it by proclaiming that this "would ensure adequate liquidity for the upcoming economic recovery", but the real news was the reaction of the dollar, which plummetted like a lead balloon.

This news telegraphs that the course has been set towards collapse of the dollar and hyperinflation because yesterday's announcement has opened the floodgates - they can't stop with buying $300 billion of this stuff, just like the bailouts they will find themselves obliged to buy more and more until they crumple up completely like an exhausted junkie. If the Fed thinks it can prop up the Treasury market by creating money to backstop it, it is in for a rude awakening - the huge near 3% drop in the dollar index yesterday will have scared the **** out of foreign investors in US government paper. So Treasuries spiked yesterday, but the gains were almost entirely erased by the drop in the dollar, and then you have to factor in the drop in the yield for potential new buyers. So in an environment where the Fed and Treasury are going to have to create dollars, i.e. dilute the currency, to prop up financial instruments which have almost zero yield, due to a serious shortfall of demand, meaning that their real worth will decline because of the steeply depreciating currency, who but a complete imbecile is going to buy them? Less and less investors is the answer, and that being the case the Treasury market will collapse in due course anyway despite, and perhaps even because of the Fed's desperate and reckless attempts to backstop it.

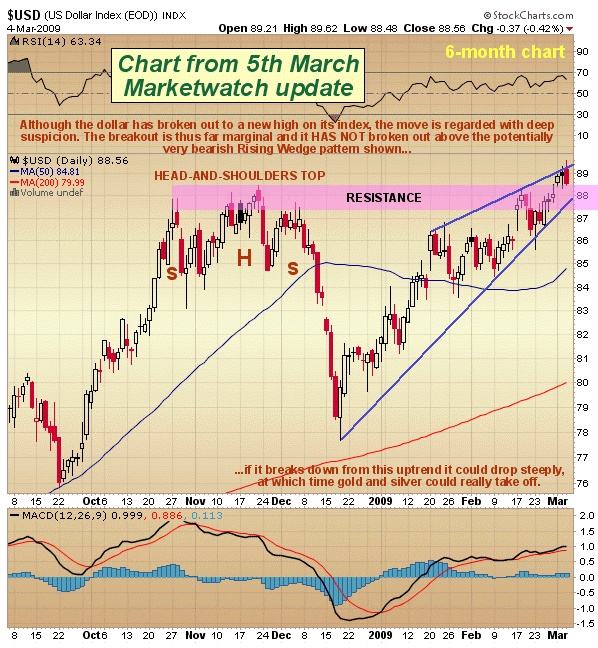

Below is the dollar chart interpretation from the Marketwatch update of 5th March.

Over the past 6 months or so safe haven money has flooded into US dollars to buy Treasuries, and into gold, which has risen to new highs against most currencies, but, especially after yesterday's developments, it is clear that quite soon, only one of these investment categories will be left standing as a viable safe haven destination for funds fleeing the vortex of deleveraging that continues to take down most asset classes. Since the Treasury market is infinitely larger than the gold market, and since the currency in which gold is priced on world markets will happen to be depreciating at a very rapid rate, it should that clear that gold can be expected to be subject to a positive double whammy of buying pressure. For these reasons yesterday's dramatic reversal by gold is believed to mark the start of a major uptrend that should break it out the trading range situation it has been stuck in for a year now and even if it settles into it's usual Summer reaction, which this year cannot be relied upon because of the extraordinary conditions prevailing, it should then advance strongly again going into the Fall. Silver should perform well too.

In recent months we have engaged in trading Precious Metals stocks, but now we are believed to be moving into a "buy and hold" environment as the kind of advance we are likely to see could be truly massive. This has been long been anticipated by the likes of Bob Chapman, Jim Sinclair and Jim Willie to name but three, dismissed by many as fringe-wing alarmists and lunatics, yet their predictions are looking more and more reasonable with passing time. We will therefore be generally looking to go long and stay long, and while we will from time to time take profits and trim positions when stocks become overbought, generally we will be aiming to build and adjust a strong and comprehensive portfolio in the sector. Compared to what is coming we certainly haven't left it too late and it is worth pointing out that many quality juniors are still trading at absurdly low prices after last year's devastating rout and thus have massive upside potential.

A list of the better gold and silver stocks ranging from junior and exploration stocks through to the stocks of the largest companies follows for subscribers.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2009 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.