When the United States Ruled the World

Economics / US Economy Mar 24, 2009 - 08:25 AM GMTBy: James_Quinn

I used to rule the world

I used to rule the world

Seas would rise when I gave the word

Now in the morning I sleep alone

Sweep the streets I used to own

I used to roll the dice

Feel the fear in my enemy's eyes

Listen as the crowd would sing

"Now the old king is dead! Long live the king!"

One minute I held the key

Next the walls were closed on me

And I discovered that my castles stand

Upon pillars of salt and pillars of sand

Coldplay – Viva La Vida

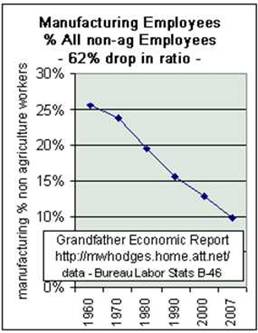

America has squandered the human sacrifice, blood, sweat and tears of two generations in less than seventy years. We have been an independent country for 226 years. From 1783 until 1946 was an unrelenting upward trajectory for the beacon of the free world. With the end of World War II , America was the last country standing. Germany and Japan were in shambles. Russia had lost millions of citizens, with Stalin about to murder millions more. Great Britain was a shell of its former self. The American Empire had been born. We were the manufacturer to the world. We rebuilt Europe and Japan . Our military was dominant. We made the best automobiles. We built 41,000 miles of national highway over two decades. In 1946, one in three U.S. workers was employed in the manufacturing industry. Today, less than one in ten workers makes something.

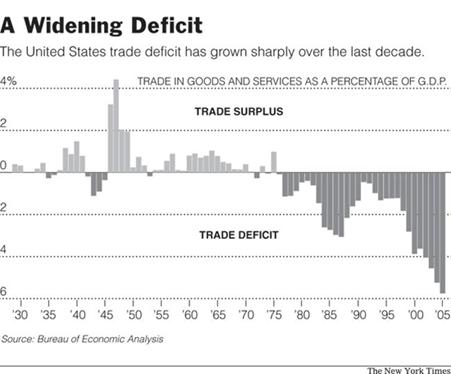

In the years following World War II, the United States ran trade surpluses of 2% to 4% of GDP. We regularly ran surpluses until the late 1970's. Since the late 1970's, the United States has run increasingly large trade deficits, reaching 6% of GDP in 2007. For the last three decades, Americans have tried to spend their way to prosperity. The government politicians and their moneyed backers have sold the idea that Americans could be the thinkers for the world, while other countries could do the menial work of producing stuff. After thirty years we are left with a hollowed out economy of paper pushers. It may be a reach to transition the Wall Street geniuses who created MBSs, CDSs, and CDO's into jobs building bridges. The manufacturing jobs are gone. Our workers are left to sweep the streets they used to own.

In the years following World War II, the United States ran trade surpluses of 2% to 4% of GDP. We regularly ran surpluses until the late 1970's. Since the late 1970's, the United States has run increasingly large trade deficits, reaching 6% of GDP in 2007. For the last three decades, Americans have tried to spend their way to prosperity. The government politicians and their moneyed backers have sold the idea that Americans could be the thinkers for the world, while other countries could do the menial work of producing stuff. After thirty years we are left with a hollowed out economy of paper pushers. It may be a reach to transition the Wall Street geniuses who created MBSs, CDSs, and CDO's into jobs building bridges. The manufacturing jobs are gone. Our workers are left to sweep the streets they used to own.

Source: www.globalpolicy.org

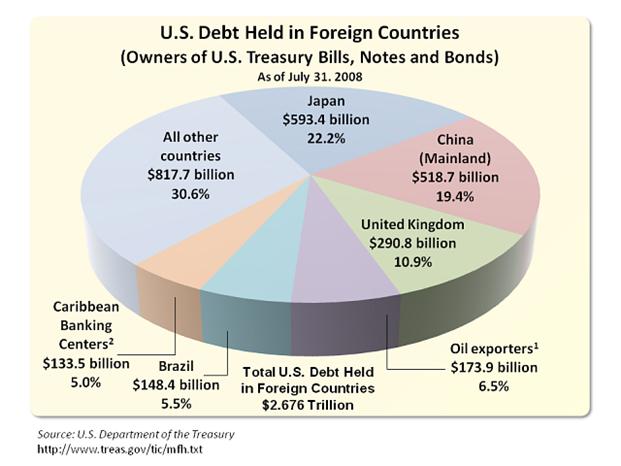

After three decades of burning our furniture to keep warm, we are left owing the rest of the world $2.7 trillion. Many of these countries don't like us. Ben Bernanke is actively trying to drive the value of the U.S. dollar down, while decreasing interest rates paid on this government debt. As Ben prints trillions of new dollars, the value of China 's, Japan 's and the oil exporting countries' holdings goes down. The U.S. will run a $2 trillion deficit in the next year. We need these foreign countries to buy at least $1 trillion of our new debt. We are sure they will do so. Our reasoning is, what else can they do. From a purely financial standpoint, it is insanity for a country to make an investment in an asset paying 2.5% interest, when in one day last week the Federal Reserve purposely knocked the value of the dollar down 5% in one day, wiping out two years of interest income.

The truth is that foreign countries are not stupid. They are already changing their strategy regarding American debt. The Treasury Department released their monthly analysis of international purchases and sales of U.S. assets for February, last week. Below is directly from that report.

Net foreign purchases of long-term securities were negative $43.0 billion.

- Net foreign purchases of long-term U.S. securities were negative $18.8 billion. Of this, net purchases by private foreign investors were negative $10.2 billion, and net purchases by foreign official institutions were negative $8.5 billion.

- U.S. residents purchased a net $24.2 billion of long-term foreign securities.

Net foreign acquisition of long-term securities, taking into account adjustments, is estimated to have been negative $60.9 billion.

The Chinese are not fools. They can clearly see that the U.S. will try to devalue our way out of our financial mess. They are going to put the $500 billion of USD holdings to work, before it becomes worthless. Recent examples reported by the Washington Post have been:

• On Feb. 12, China's state-owned metals giant Chinalco signed a $19.5 billion deal with Australia's Rio Tinto that will eventually double its stake in the world's second-largest mining company.

• On Feb. 17 and 18, China National Petroleum signed separate agreements with Russia and Venezuela under which China would provide $25 billion and $4 billion in loans, respectively, in exchange for long-term commitments to supply oil.

• On Feb. 19, the China Development Bank struck a similar deal with Petrobras, the Brazilian oil company, agreeing to a loan of $10 billion in exchange for oil.

• Iran announced that it had signed a $3.2 billion agreement with a Chinese consortium to develop an area beneath the Persian Gulf seabed that is believed to hold about 8 percent of the world's reserves of natural gas.

The Chinese have a long-term plan to rule the world. They are buying up natural resources throughout the world. The walls are closing in on the U.S. The U.S. solution is to print more dollars, borrow from future generations, and tax their citizens more. Ben Bernanke has rolled the dice, but the fear is in his eyes, not our enemies'. We will shortly realize that our castles were built upon pillars of salt and pillars of sand.

Bubble, Bubble

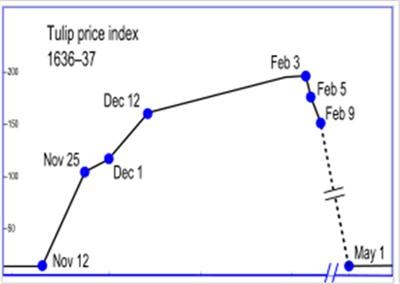

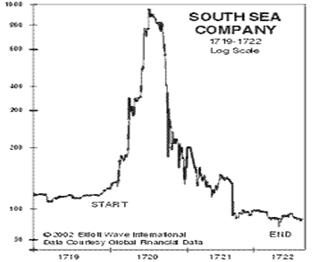

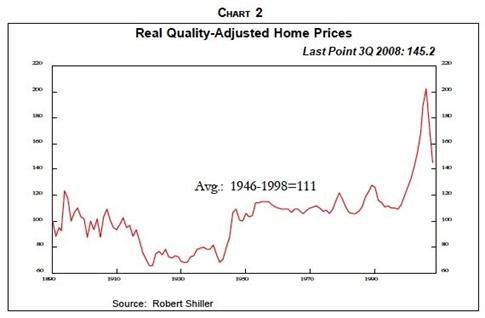

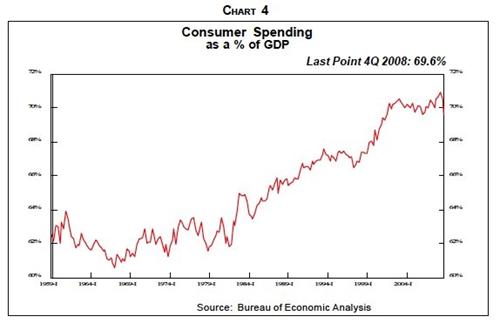

Never in the history of the world has a bubble burst halfway. Every bubble has collapsed to its starting point or below. The self serving pundits on CNBC and on Sunday talk shows continue to predict a stabilization of the housing market. They are wrong. The bubble is still deflating and will not end until home values are back to 2000 levels, if we're lucky. Examples of bubbles that fully deflated include the tulip bubble of 1637 - 1638, the South Sea bubble of 1719 - 1722, the Nikkei bubble from 1983 until today, and the NASDAQ bubble from 1999 – 2003. The United States has three bubbles that are deflating simultaneously, compliments of the Federal Reserve, George Bush, and a criminally incompetent Congress. Housing, consumer spending, and U.S. total debt are all at different phases of bubble deflation. No matter what politicians attempt, these bubbles cannot be re-inflated. They will deflate fully.

“It is a characteristic of wisdom not to do desperate things.” - Henry David Thoreau

Tulip mania struck Holland in 1637. The whole nation was consumed by tulip bulbs in the first recorded speculative bubble. Contract prices for tulip bulbs reached astronomical levels and then suddenly collapsed . At the peak of tulip mania in February 1637, tulip contracts sold for more than 10 times the annual income of a skilled craftsman. In a matter of seven months, fortunes were made and lost. The bubble popped completely.

Source: mysmp.com

The South Sea Company was the AIG of the 1700's. It was a British joint stock company, founded in 1711. The company was granted a monopoly to trade as part of a treaty during the War of Spanish Succession. The company assumed the national debt England had incurred during the war. In 1719 the company proposed a scheme by which it would buy more than half the national debt of Britain (£30,981,712), again with new shares, and a promise to the government that the debt would be converted to a lower interest rate, 5% until 1727 and 4% per year thereafter. The purpose of this conversion was similar to allow a conversion of high-interest but difficult-to-trade debt into low-interest, readily marketable debt and shares of the South Sea Company. These are the games that declining empires play when they have overreached in their empire building. The plan sounds a lot like Timmy Geithner's Good Bank Bad Bank scheme. Shuffling debt from one entity to another entity doesn't get rid of it. It is just a scam paid for by taxpayers.

“Any fool can make a rule, and any fool will mind it.” - Henry David Thoreau

The price of South Sea Company stock went up from £100 a share to almost £1,000 per share. Its success caused a country-wide investing frenzy by peasants, businessmen and lords. The price reached £1,000 in early August and the level of selling was such that the price started to fall, dropping back to £100 per share before the year was out, triggering bankruptcy among those who had bought on credit. The English Parliament reacted to the crisis exactly the way our current clueless bunch of moron Congressmen are reacting to the AIG debacle. The estates of the directors of the South Sea Company were confiscated and used to relieve the suffering of the victims, and the stock of the South Sea Company was divided between the Bank of England and East India Company. A resolution was proposed in parliament that bankers be tied up in sacks filled with snakes and tipped into the Thames River . I'm sure Barney Frank is preparing a similar resolution regarding AIG executives. No one can calculate the madness of men.

Japan Inc. was going to dominate the world. From 1983 until its peak in 1989, the Nikkei rose from 7,500 to 38,900, a 500% increase in seven years. Following World War II Japan implemented tariffs that protected their industries from overseas competition. This resulted in large trade surpluses and an appreciating yen. With artificial protections, Japanese companies made mal-investments. Easy money and false confidence led to a frenzy in the stock market and real estate market. Japanese banks had financed this speculative bubble with high risk loans. The PE ratio of the Nikkei reached 78 in 1989. Twenty years after this peak, the Nikkei hit a low of 7,500 this year, the same level it started at in 1983. This has occurred despite spending billions on make work stimulus programs, reducing interest rates to zero, and artificially reducing the value of the yen. The ultimate outcome has been a national debt that is 150% of GDP with a rapidly ageing population and no way out. See any similarities?

Japan Inc. was going to dominate the world. From 1983 until its peak in 1989, the Nikkei rose from 7,500 to 38,900, a 500% increase in seven years. Following World War II Japan implemented tariffs that protected their industries from overseas competition. This resulted in large trade surpluses and an appreciating yen. With artificial protections, Japanese companies made mal-investments. Easy money and false confidence led to a frenzy in the stock market and real estate market. Japanese banks had financed this speculative bubble with high risk loans. The PE ratio of the Nikkei reached 78 in 1989. Twenty years after this peak, the Nikkei hit a low of 7,500 this year, the same level it started at in 1983. This has occurred despite spending billions on make work stimulus programs, reducing interest rates to zero, and artificially reducing the value of the yen. The ultimate outcome has been a national debt that is 150% of GDP with a rapidly ageing population and no way out. See any similarities?

![[$nikk-monthly.png]](../images/2009/Mar/James_Quinn_24_image012.jpg)

Source: Mike Shedlock

To prove that Japan didn't have a monopoly on foolishness and speculative frenzy, the U.S. had their bubble in 1999 and 2000. The NASDAQ market rose from 1,000 in 1996 to 5,132 in 2000. The introduction of the internet convinced millions that we had entered a new era. Wall Street did what it does best, and hyped the can't miss riches to be gained from investing in any company that added a dot.com to their name. When AOL acquired Time Warner in January, 2000, the top was marked. The over-hyped fear of the Y2K “disaster” that awaited our worldwide computer systems resulted in a surge of computer purchases. Alan Greenspan did what he did best and flooded the system with liquidity. These all combined to produce a blow-off top in March 2000. The PE ratio of the NASDAQ reached 264, as most of the hyped dot.com stocks had no earnings. Nine years later, the NASDAQ stands at 1,457, 72% below its peak at 1998 levels. The bubble burst fully.

NASDAQ Dot.Com Bubble

Source: Wikipedia

Toil & Trouble

I've scrutinized the four most well known bubbles in history. They all deflated completely. There are hundreds of other bubble examples throughout history and none of them deflated halfway. This brings us to the housing market today. The following chart from Gary Shilling's newsletter clearly shows that home prices went into a classic bubble frenzy after Alan Greenspan reduced interest rates to 1% and urged Americans to take out adjustable rate mortgages. Americans believed the hype from the National Association of Realtors and Wall Street shills that home prices would go up forever. You may notice that home prices will need to fall another 21% to reach pre-bubble levels. Jim “I haven't gotten one right yet” Cramer is calling for a June 2009 bottom in housing. It looks like he won't break his streak of great predictions. I'm sure Jon Stewart will remind him.

“Our houses are such unwieldy property that we are often imprisoned rather than housed by them.” - Henry David Thoreau

There are 75 million houses in America . Twenty four million don't have a mortgage. Of those 51 million homeowners with a mortgage, approximately 15 million are underwater. According to Mr. Shilling, with the further decline in prices a given, 25 million homeowners will be underwater to the tune of $1 trillion. Anyone predicting a recovery by the end of 2009 is delusional.

Source: Gary Shilling

“Most of the luxuries and many of the so-called comforts of life are not only not indispensable, but positive hindrances to the elevation of mankind.” - Henry David Thoreau

The next bubble just peaked in 2008, so it has a long way to go on the downside. Consumer spending as a percent of GDP peaked at 71% in the 2 nd quarter of 2008. Americans allowed their savings rate to drop below 0% and counted on their home appreciation to fund their retirements. They believed the Wall Street hype about 10% long term stock returns. This overconfidence led millions of Americans to borrow and spend at excessive levels. In order to get back to pre-bubble levels of 62% of GDP will take years. With home prices down 25% and retirement funds down 50%, only an insane person would continue to spend at previous levels. Ben Bernanke and the Obama administration are praying that Americans will continue the insanity. They will not. Consumer spending will decline by $1.3 trillion annually for years to come. This bubble will not burst halfway.

Source: Gary Shilling

“Most men lead lives of quiet desperation and go to the grave with the song still in them. “ - Henry David Thoreau

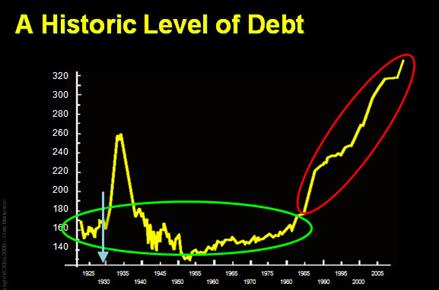

The last and most dramatic bubble is total U.S. debt. There is no doubt that it is unsustainable. It currently amounts to 340% of GDP. It would need to go back to 200% of GDP or below to retrace its bubble path. This would require $20 trillion of debt to be paid off or written off. The implications of this are staggering. The Federal Reserve and politicians running the country will fight the deflation of this bubble with all of their might. It won't work. Bubbles always burst. This bubble bursting will change America forever. The American standard of living will decline significantly. Not many people are prepared for this wrenching future. The mantle of ruling the world will be passed to some other lucky country. The government is trying to keep all three bubbles from popping. Their solutions are dangerous and could result in a collapse of our economic system.

Source: Chris Martenson

“If the machine of government is of such a nature that it requires you to be the agent of injustice to another, then, I say, break the law.” - Henry David Thoreau

Civil Disobedience

“There's nothing that I detest more than the stench of lies.” - Colonel Kilgore – Apocalypse Now

The National Debt of the United States from the creation of the country in 1783 until 1986 was $2 trillion. The National Debt of the United States has increased by $2 trillion in the last 18 months from $9 trillion to $11 trillion. It has increased by $1 trillion in the last six months. The independent Congressional Budget Office, which has been overly optimistic over time, projects that the Obama budget plan will add $9.3 trillion to the National Debt by 2019. This will drive the National Debt as a percentage of GDP to levels above the peak years reached during World War II. The difference is that in 2019 the unfunded liabilities totaling $56 trillion for Social Security, Medicare, and Medicaid will sweep over the country like a tsunami. If our government follows the path it has chosen, our country will be bankrupted.

Source: 911review.org

Many Americans who have lived by the rules are angry, frustrated, and appalled at what the government is doing. They feel helpless to change the course of the country. The housing, spending, and debt bubbles will burst completely, no matter what the government does. Following the current path will lead us into the Japanese model of a 25 year downturn, if we're lucky. When I read many of the responses to my last article about ways to reclaim your life, I was struck that We The People actually hold all the cards. The government is at our mercy. Americans can change the course of the country through passive resistance. American consumer spending makes up 70% of the U.S. economy. No matter how much liquidity the Federal Reserve creates out of thin air, we do not have to spend the money. American citizens pay $1.2 trillion in Federal Income taxes per year. If they decided not to pay these taxes, the empire would come to a grinding halt. American citizens have more control then they know.

I came across an essay by Henry David Thoreau called Civil Disobedience ( Resistance to Civil Government ), published in 1849. It argues that people should not permit governments to overrule or atrophy their consciences, and that people have a duty to avoid allowing such acquiescence to enable the government to make them the agents of injustice. The definition of civil disobedience is the active refusal to obey certain laws, demands and commands of a government, without resorting to physical violence.

“Resistance” also served as part of Thoreau's metaphor which compared the government to a machine, and said that when the machine was working injustice it was the duty of conscientious citizens to be “a counter friction” – that is, a resistance – “to stop the machine.”

Disobedience is the true foundation of liberty. The obedient must be slaves. - Henry David Thoreau

Thoreau's most famous quote from the essay was: “That government is best which governs least”

Thoreau's most famous quote from the essay was: “That government is best which governs least”

Mr. Thoreau was a man of principle. He believed that citizens should follow their moral conscience above the laws of the state. He believed that slavery was immoral and that the invasion of Mexico to acquire land was not right. He refused to pay his taxes in protest and was jailed for this action. Thoreau's argument was as follows:

“How does it become a man to behave toward this American government to day? I answer that he cannot without disgrace be associated with it. I cannot for an instant recognize that political organization as my government which is the slave's government also.”

Thoreau's essay was the inspiration for both Mohandas Gandhi's Indian independence movement and Martin Luther King's civil rights movement. Both men admired him for his bravery and morality.

“Thoreau was a great writer, philosopher, poet, and withal a most practical man, that is, he taught nothing he was not prepared to practice in himself. He was one of the greatest and most moral men America has produced. He went to jail for the sake of his principles and suffering humanity. His essay has, therefore, been sanctified by suffering. Moreover, it is written for all time. Its incisive logic is unanswerable.” - Mohandas Gandhi

“I became convinced that noncooperation with evil is as much a moral obligation as is cooperation with good. The teachings of Thoreau came alive in our civil rights movement; indeed, they are more alive than ever before. Whether expressed in a sit in at lunch counters, a freedom ride into Mississippi, a peaceful protest in Albany, Georgia, a bus boycott in Montgomery, Alabama these are outgrowths of Thoreau's insistence that evil must be resisted and that no moral man can patiently adjust to injustice.” - Martin Luther King

Americans have a duty to not sit idly by and enable the government to be an agent of injustice. The reckless actions taken by politicians and the Federal Reserve in the last eighteen months and their inaction regarding our $56 trillion of unfunded future liabilities are immoral, cowardly, and evil. David Galland, from Casey Research, reflects my anger in his recent column:

“But it is our generation that should take the hit. It is us who should feel the pain of the collapse. We did it to ourselves by standing idly by while the government and its many friends in the banking sector got us into this mess. And don't forget the orgy of spending and personal debt that the population engaged in, encouraged every step of the way by the government's easy-money policies. This all happened on our watch, but instead of taking our medicine, we the people are now encouraging the government in its many efforts to re-inflate the bubble, fully aware all we are really doing is trying to shift the mess onto the backs of our children, and their children, and probably their children's children. What a bunch of cowards we are.”

The bailout of corrupt bankers by corrupt politicians with money printed and borrowed from future generations is a criminal act and must be overturned by civil disobedience on the part of Americans with a moral conscience. The government has stepped over the line and we must act before it is too late. The brilliant John Hussman describes what Geithner, Bernanke and Congress have done in the last two weeks:

“Ultimately, funding the bailout of lousy assets comes at the cost of debasing our currency and selling our good assets to foreigners. Make no mistake - we are selling off our future and the future of our children to prevent the bondholders of U.S. financial corporations from taking losses. We are using public funds to protect the bondholders of some of the most mismanaged companies in the history of capitalism, instead of allowing them to take losses that should have been their own. All our policy makers have done to date has been to squander public funds to protect the full interests of corporate bondholders.”

Americans formed this country by revolution. We are not a country of laws. We are a country of citizens with consciences. If government becomes so corrupt and out of control that they threaten our very existence as a country, they must be cast aside. Americans have an obligation to do what is right. Thoreau voiced the right of people with a conscience 160 years ago:

“All men recognize the right of revolution; that is, the right to refuse allegiance to and to resist the government, when its tyranny or its inefficiency are great and unendurable.”

People's first obligation is to do what they believe is right and not to follow the law dictated by the majority. When a government is unjust, people should refuse to follow the law and distance themselves from the government in general. A person is not obligated to devote his life to eliminating evils from the world, but he is obligated not to participate in such evils. If we do not fight the injustice that is being inflicted on future generations by the actions of government today we are also guilty. Thoreau argued that the majority that rules through strength rather than legitimacy is worthless:

“But a government in which the majority rules in all cases cannot be based on justice, even as far as men understand it. Can there not be a government in which majorities do not virtually decide right and wrong, but conscience? — in which majorities decide only those questions to which the rule of expediency is applicable? Must the citizen ever for a moment, or in the least degree, resign his conscience to the legislator? Why has every man a conscience, then? I think that we should be men first, and subjects afterward. It is not desirable to cultivate a respect for the law, so much as for the right. The only obligation which I have a right to assume is to do at any time what I think right. It is truly enough said that a corporation has no conscience; but a corporation of conscientious men is a corporation with a conscience. Law never made men a whit more just; and, by means of their respect for it, even the well- disposed are daily made the agents of injustice .”

Fiscal Sanity Movement

It is now time for all Americans to force fiscal sanity upon our government through the use of civil disobedience. Our current fiscal path is unsustainable. The government's solutions will extend the pain for decades in the best case or result in an abrupt collapse in the worst case. If Americans force a fiscal restructuring upon the world it will be extremely painful, but would result in a more balanced sustainable society going forward. In both cases, Americans will need to accept a reduction in their standard of living. This is the price that must be paid for thirty years of living above our means. Some passive resistance ideas regarding the fiscal sanity movement could be:

- Imagine that Americans refused to spend any money on discretionary items like electronic gadgets, furniture, and jewelry. With 70% of GDP dependent on consumer spending, this would result in the closing of thousands of unnecessary retail stores. We know that a sustainable level of spending is 62% of GDP, so let's get there in two years rather than dragging it out over a decade.

- Imagine that Americans decided to withdraw every dime of their money from all the banks that have accepted TARP funds. There are 8,500 banks in the United States . Seventy banks have accepted TARP funds. Pull your money out of these banks and put it in your local banks or credit unions that didn't bring down the financial system. This would ruin the Treasury's latest $1 trillion scheme of hiding toxic assets.

- Imagine that Americans stopped using credit cards. The major purveyors of credit cards, Bank of America, Citicorp, American Express and Capital One would collapse under the weight of bad debt. Credit cards are a ponzi scheme dependent upon new credit issuance. Without charging 21% interest and collecting $25 late fees for being one day late, their businesses will implode.

- Imagine that every working American walked into work tomorrow and changed their W-4 to 20 exemptions. This would immediately remove $1.2 trillion of taxes from the grasp of politicians in Washington . You could bet that would get the attention of the political hacks in Washington .

- Imagine that no more young men and women volunteered for the military or re-enlisted. With an all volunteer military, the lack of cannon fodder would force a downscaling of the American military empire. The government doesn't have the guts to reinstitute a draft.

- Imagine that Americans refused to buy new cars and choose to get by with the 240 million existing automobiles already in use. This would force the necessary bankruptcies of General Motors and Chrysler.

- Imagine that Americans refused to purchase any more 6,000 square foot McMansions. Maybe families of four could make do with a 2,000 square foot home. This would force down prices further and leave people with more discretionary income to save for their retirement.

- Imagine that no one voted in the next national elections in 2010. A voter strike would send the ultimate message to the two corrupt parties. Ron Paul describes why the two parties are worthless. “ Pretending that a true difference exists between the two major candidates is a charade of great proportion. Influential forces, the media, the government, the privileged corporations and moneyed interests see to it that both party's candidates are acceptable, regardless of the outcome, since they will still be in charge. The two parties and their candidates have no real disagreements on foreign policy, monetary policy, privacy issues, or the welfare state. They both are willing to abuse the Rule of Law and ignore constitutional restraint on Executive Powers.”

- Imagine a one day national strike coinciding with the largest March on Washington in the history of the Republic. This would surely change the dialogue in the country. The lightweight politicians in Washington DC would cave immediately.

It is not inconceivable that these civil disobedience measures would be met with violent countermeasures by those in power. They will do anything to retain their wealth, influence and power. Americans with a conscience will be willing to sacrifice whatever is necessary.

Under a government which imprisons any unjustly, the true place for a just man is also a prison. - Henry David Thoreau

To discuss ways to take back our country from corrupt politicians and criminal bankers join me at TheBurningPlatform.com .

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2009 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.