U.S. Dollar Rally Due to Weak Equities Falters

Currencies / Forex Trading Mar 31, 2009 - 03:17 AM GMTBy: ForexPros

The USD is holding gains in late New York as traders continue to digest weekend developments; focus is on the upcoming G-20 meeting which is expected to produce solid plans for addressing the developing global economic crisis but smart money is not anticipating anything concrete at this point. More interest is on how the ECB may move interest rates with a strong expectations of at least a 25 BP rate cut heavily factored in. In my view, any hint that the ECB will stand pat or make less than a 25 BP cut will likely fuel a short-covering rally although a case can be made for a “buy the rumor/sell the fact” rally anyway.

The USD is holding gains in late New York as traders continue to digest weekend developments; focus is on the upcoming G-20 meeting which is expected to produce solid plans for addressing the developing global economic crisis but smart money is not anticipating anything concrete at this point. More interest is on how the ECB may move interest rates with a strong expectations of at least a 25 BP rate cut heavily factored in. In my view, any hint that the ECB will stand pat or make less than a 25 BP cut will likely fuel a short-covering rally although a case can be made for a “buy the rumor/sell the fact” rally anyway.

EURO is holding the 1.3150 area in light trade after a dip into stops around the 1.3150 resulted in a low print at 1.3113 before recovering quickly. Traders note that stops were in good size suggesting that longs were early on the dip Friday and semi-official names were seen on the bid under the 1.3150 area. Also, some profit-taking bids from momentum and short-term shorts were noted suggesting that the selling pressure was not going to last. EURO is also holding the 100 day MA on the dip making for a technical buy; a close above the 1.3200 handle near-term would but the bears on the defense I think.

GBP fell into low prints overnight at 1.4109 and failed to follow EURO lower today suggesting that the dip was supported by quality bids. The rate has retraced about 61.8% of the monthly range and will likely end the month in a “doji” formation suggesting the GBP is at a point of indecision; aggressive traders can buy any further weakness into the low 1.4100 area or slightly below with key support about the 1.4050/80 area.

USD/JPY continued to bounce off support around the 96.00 handle failing to extend the day’s range from overnight lows at 95.94; the rate regains the 97.00 handle into the close leaving a healthy bid-wick suggesting another whipsaw back to the breakdown area around the 98.30 area. Overhead resistance is expected to be heavy on any test of the 98.50/80 area and aggressive traders can look to short the rate on a rally back to that area.

USD/CHF is holding sharp gains against a backdrop of SNB intervention; high prints in New York extended the days ranges to 1.1552 before falling back under the 1.1500 handle. Sellers are likely on any strength and traders can look to sell into the 1.1580 area if we get it on further volatility.

USD/CAD continued to advance as well finding upside stops over the 1.2580 area for a high print at 1.2650 and is holding gains into late New York trade; traders note that resistance is next at 1.2680 area and likely will attract selling from short-term longs but the rate is above the 50 day MA once again possibly encouraging buyers on a firm close. Fib resistance is around 1.2630 and likely some consolidation will be the result the next 24 hours or so.

In my view, the USD rally was largely due to weak equities as the entire day centered around the possible bankruptcy of GM and/or Chrysler; traders note that without the news it is hard to argue for a flight-to-quality rally in the greenback and the higher pricing may be a head-fake. Look for two-way action overnight with a pullback in the USD ahead of tomorrow’s US data.

GBP/USD Daily

Resistance 3: 1.4440/50, Resistance 2: 1.4380, Resistance 1: 1.4300

Latest New York: 1.4248, Support 1: 1.4100/10, Support 2: 1.4050, Support 3: 1.4020

Comments

Rate falls through stops into support around the 1.4100 handle overnight; traders report more stops waiting under 1.4100 with bids around 1.4050 for the day. Rate recovers back to the 1.4200 handle late as late shorts fail to get a foothold. A close back under the 1.4250 area argues for more losses but support is solid around 1.4100 so aggressive traders can buy dips. Traders report large names on the dips last week but they may have been whipsawed out to start this week. Overhead resistance now drops to 1.4380 to 1.4440 area; overhead target of the 1.5000 area likely to be on hold with a test of the lows first possibly creating a range. Traders feel the 23-year lows will likely remain secure. The shorts have taken control of the market above the 1.4440 area for now and if a range is forming a test under the 1.3900 handle is likely; traders report stops in-range adding for two-way action.

Data due Tuesday: All times EASTERN (-5 GMT)

4:30am GBP Index of Services 3m/3m

9:00am GBP MPC Member Tucker Speaks

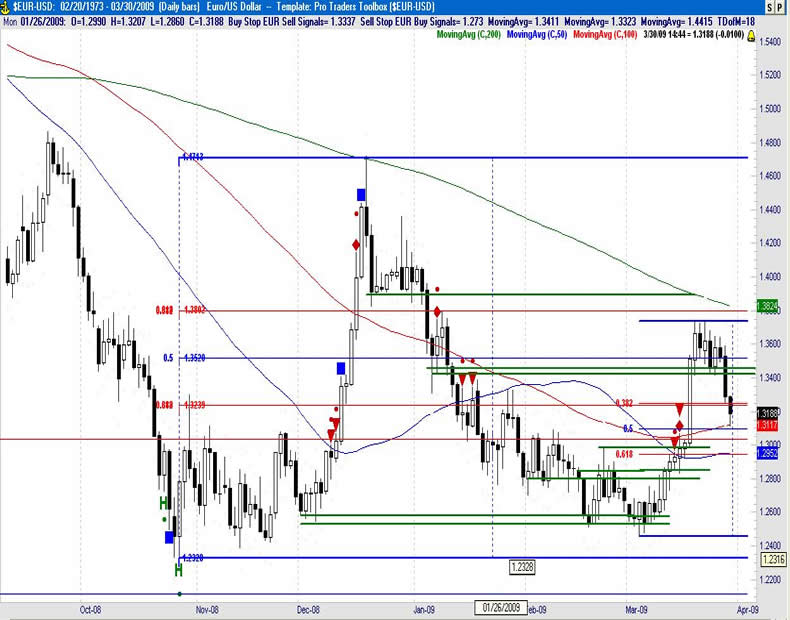

EUR/USD Daily

Resistance 3: 1.3380, Resistance 2: 1.3330, Resistance 1: 1.3280

Latest New York: 1.3187, Support 1: 1.3150, Support 2: 1.3100, Support 3: 1.3080

Comments

Rate fails at support and clears large stops under 1.3200; rate likely has stops building in both directions but shorts have taken control of the market as the rate gives back gains over the 1.3400 area last week late. Action remains two-way; stops under 1.3150 area said to be building in size but the rate recovers from low prints off the 100 day MA suggesting the move lower is likely supported on dips. Overhead resistance of 1.3350 area now back in play; expect sellers in that area on a rally. Asian sovereigns seen selling rallies last week and a US bank seen leaning on the rate at the open; no doubt momentum traders from Friday’s close. Long-term bulls are likely still in control of the market and this significant pullback is a buying opportunity in my view but the timing needs another day or two to work through. Expect two-way action.

Data due Tuesday: All times EASTERN (-5 GMT)

3:55am EUR German Unemployment Change

4:00am EUR Italian Retail Sales m/m

5:00am EUR CPI Flash Estimate y/y

5:00am EUR Italian Prelim CPI m/m

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.