Crude Oil Traders Be Ready for Strong Breakout Higher

Commodities / Crude Oil Apr 12, 2009 - 05:56 PM GMTBy: Chris_Vermeulen

Energy traders have been watching this slow rounded bottom reversal forming for months in the energy sector and crude oil prices. I have pointed it out many times and even posted some buy signals for USO and Crude Oil a while back. Oil is now testing a key resistance level and a breakout here could really send oil prices gushing higher towards the $70 per barrel level.

Energy traders have been watching this slow rounded bottom reversal forming for months in the energy sector and crude oil prices. I have pointed it out many times and even posted some buy signals for USO and Crude Oil a while back. Oil is now testing a key resistance level and a breakout here could really send oil prices gushing higher towards the $70 per barrel level.

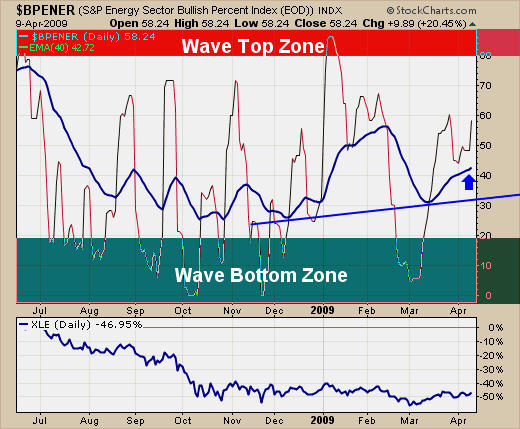

Energy Bullish Percent index

Energy stocks have been bottoming for about 5 months so most investors should be trading at about the breakeven point here if they have been holding their positions. The BP chart below is showing some bullish momentum as more energy stocks are on point and figure buy signals now. This is a very bullish looking chart.

Crude Oil Traders

Not many times a trader gets to see the amount of volatility we have seen in the recent months with crude oil. It really is an eye opening experience and can provides huge profit potential if one is to focus on trading this commodity.

This multi month cup and handle pattern is very exciting to see. Not only is this one of the most powerful bullish patterns but its in oil which I think is safe to say has almost every trader and investor watching around the world. If we get a breakout here I expect to see prices sky rocket higher toward the $70 level.

Oil Traders Be Ready

Trading oil does carry a lot more risk than a lot of other investment vehicles but the profit potential in oil looks great. We may see prices pause at this key resistance level as a lot of traders will be taking profits and or shorting oil here.

But if oil does breakout, then this could be the trade that sets you for the year. Those of you who went long on my buy signal at the end of February are sitting with a nice profit and praying for a big pop in oil prices.

Those of you who are not long energy yet will have to decide what your risk level is. Entering on a breakout will carry 10-20% downside risk. Or you could wait for a breakout and correction to buy in. As usual I will wait for another low risk setup and provide it to my members when the time is right.

Some funds to trade would be XLE – Energy Stocks Fund, USO – Texas Oil Fund, XEG.TO – Canadian Energy Stocks Fund

If you would like more information on my trading model or to receive my Free Weekly Trading Reports - Click Here

I have put together a Recession Special package for yearly subscribers which is if you join for a year ($299) I will send you $300 FREE in gas, merchandise or grocery vouchers FREE which work with all gas stations, all grocery stores and over 100 different retail outlets in USA & Canada.

If you interested please act fast before they are gone for good.

If you would like to receive my free weekly market updates please visit my website: www.TheGoldAndOilGuy.com

I look forward to hearing from you soon!

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.