Sunday, February 17, 2019

Fed Chairman Deceives; Precious Metals Mine Supply Threatened / Commodities / Gold & Silver 2019

By: MoneyMetals

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up Chris Martenson of PeakProsperity.com and famous author of The Crash Crouse and his latest book Prosper! joins me to dissect what’s behind the Yellow Vest movement in France and why the mainstream media and those in power simply don’t want you to know what’s really going on there. Chris also tells us which precious metal he most favors right now. Don’t miss another wonderful interview with the great Chris Martenson, coming up after this week’s market update.

In a recent speech, Federal Reserve chairman Jerome Powell told some real whoppers. We’ll address his misrepresentations head on, in just a bit.

But first, let’s review this week’s market action. Despite drama in Washington over averting a government shutdown and prompting President Donald Trump to declare a national emergency on the border, nothing too dramatic is happening in the gold market.

Prices are trading in a tight range, coming in essentially unchanged from last Friday’s close. Gold currently trades at $1,316 per ounce.

Read full article... Read full article...

Sunday, February 17, 2019

Here We Go – Get ready for the Stock Market Breakout Pattern Setup / Stock-Markets / Stock Markets 2019

By: Chris_Vermeulen

We are writing this post today with a few forward-looking expectations while attempting to warn traders that some extended rotation is likely to enter the markets over the next 30+ days. If you’ve been following our research, you’ll know that we’ve been calling these move months in advance of other researchers and analysts. Our September 17, 2018 research post highlighting our Adaptive Dynamic Learning predictive modeling system suggested the US stock markets were poised for a massive price rotation followed by a very unique price setup that we are experiencing now.

Read full article... Read full article...

Saturday, February 16, 2019

My Favorite Real Estate Strategies: Rent to Live, Buy to Rent / Housing-Market / US Housing

By: Harry_Dent

Did you read Andrea Riquier’s two articles on Market Watch last year about real estate strategies?

Did you read Andrea Riquier’s two articles on Market Watch last year about real estate strategies?Definitely worth it!

The first was “The new housing play: helping priced-out renters become long-distance landlords.”

It was a strategy aimed at people living in unaffordable areas like San Francisco, Los Angeles, Miami, or New York.

Rent in those areas to avoid the high purchase costs and a major bubble burst (when it inevitably comes). Then use your freed-up borrowing power to buy a house in an affordable area where renting for income is more lucrative, and far less risky. We’re talking places with high percentages of single-family rentals, like Detroit, Las Vegas, or Kansas City and a few more listed below.

Read full article... Read full article...

Saturday, February 16, 2019

After 8 Terrific Weeks for Stocks, What’s Next? / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

It’s been a terrific 8 weeks for the stock market. If anything, this proves that in the stock market, an objective investor/trader needs to have a long term bullish bias.

Read full article... Read full article...

Saturday, February 16, 2019

Schumer & Sanders Want One Thing: Your Money / Politics / US Politics

By: Rodney_Johnson

Senators Bernie Sanders and Chuck Schumer have proposed legislation that would stop public companies from paying dividends or buying back their shares unless they first meet certain conditions.

Senators Bernie Sanders and Chuck Schumer have proposed legislation that would stop public companies from paying dividends or buying back their shares unless they first meet certain conditions.The senators aren’t worried about viability (companies are financially stable before they send cash back to their shareholders). Instead, they want to verify that companies have done enough to support employees before they give anything back to investors.

That’s not so subtle code for, “Make sure you redistribute wealth before giving anything back.”

The senators make their case by pointing to last year’s tax reform and how much of the corporate windfall was spent on stock buybacks (almost $1 trillion), even as companies refused to invest, closed locations, and fired employees.

Read full article... Read full article...

Saturday, February 16, 2019

What Could Happen When the Stock Markets Correct Next / Stock-Markets / Stock Markets 2019

By: Harry_Dent

I hate to be so cynical, but the markets love to fool as many people as possible, bulls and bears alike. This is especially true at key turning points and even more so in extreme bubbles like the one we’ve been in since late 1994, with this final phase – and it’s unprecedented QE and tax cuts – since early 2009.

I hate to be so cynical, but the markets love to fool as many people as possible, bulls and bears alike. This is especially true at key turning points and even more so in extreme bubbles like the one we’ve been in since late 1994, with this final phase – and it’s unprecedented QE and tax cuts – since early 2009.This final rally (since 2009) is all “hot air.”

This recovery has been the weakest ever in real GDP, capital spending, employment growth, and productivity (I’ll talk about this in more detail in the upcoming February edition of The Leading Edge).

Read full article... Read full article...

Saturday, February 16, 2019

Bitcoin Your Best Opportunity Outside of Stocks / Currencies / Bitcoin

By: Harry_Dent

I just gave my second keynote for a major, top-secret crypto conference. It was SO secret, the organizer didn’t disclose the location on the website and only let us know where to travel to at the last minute.

I just gave my second keynote for a major, top-secret crypto conference. It was SO secret, the organizer didn’t disclose the location on the website and only let us know where to travel to at the last minute.These techno visionaries want a bottoms-up world like me, but with total transparency and total privacy! And that’s what Blockchain technologies are all about. In fact, I see that as the next revolution to follow the internet.

Read full article... Read full article...

Saturday, February 16, 2019

Olympus TG-5 Tough Camera Under SEA Water Test / Personal_Finance / Travel & Holidays

By: HGR

The ultimate test for the Olympus TG-5 waterproof camera is if it survives being take into the sea. So lets see if the TG-5 survives being plunged under sea water in our latest TG-5 series of videos as we test to see if the camera lives up to its primary sales pitch of being waterproof.

Read full article... Read full article...

Saturday, February 16, 2019

"Mi Amigo" Sheffield Bomber Crash Memorial Site Fly-past on 22nd February 2019 VR360 / Local / Sheffield

By: Anika_Walayat

2019 marks the 75th anniversary of the crash of a US B17 Flying Fortress bomber in Endcliffe Park, Sheffield on the 22nd of February 1944 costing the lives of the 10 member crew of the "Mi Amigo". In commemoration of which a fly past will take place on the 22nd of February 2019 at 8.45am at Endcliffe Park that will include an F15 fighter jet from RAF Lakenheath, other aircraft to include Ospreys, Typhoons and a Dakota.

Here's a unique view of the memorial site in VR 360.

Read full article... Read full article...

Friday, February 15, 2019

Plunging Inventories have Zinc Bulls Ready to Run / Commodities / Metals & Mining

By: Richard_Mills

On Tuesday zinc inventories in London Metal Exchange (LME) warehouses sunk into territory that one metal analyst believes could signal a major price kick for the base metal, used mostly for galvanizing steel to prevent corrosion.

On Tuesday zinc inventories in London Metal Exchange (LME) warehouses sunk into territory that one metal analyst believes could signal a major price kick for the base metal, used mostly for galvanizing steel to prevent corrosion.

The one-year chart below shows LME inventories falling steadily, touching the 108,425-tonne mark as of Feb. 11 - a 52-week low. It’s a long way from the annual high of 256,175 tonnes reached in August.

Cormark Securities mining analyst Stefan Ioannou said last fall that if zinc supply drops 2,000 to 3,000 tonnes a day it would be a very bullish price signal, especially if inventories go as low as 100,000 tonnes. The one-week chart shows zinc inventories dropping from 112,750 tonnes on Feb. 5 to 108,500t on Feb 11 - a fall of 4,250 tonnes, and within only 8,000 tonnes of Ioannou’s100,000t target zone.

Read full article... Read full article...

Friday, February 15, 2019

Gold Stocks Mega Mergers Are Bad for Shareholders / Commodities / Gold and Silver Stocks 2019

By: Zeal_LLC

The world’s two biggest gold miners both announced mega-mergers over the past 5 months or so. These huge deals briefly garnered some interest in the usually-forgotten gold-stock sector, and fleeting praise from Wall Street analysts. But gold-stock mega-mergers are bad news for gold-miner shareholders on all sides. They reveal the serious struggles of major gold miners, and really retard future upside in their stocks.

The world’s two biggest gold miners both announced mega-mergers over the past 5 months or so. These huge deals briefly garnered some interest in the usually-forgotten gold-stock sector, and fleeting praise from Wall Street analysts. But gold-stock mega-mergers are bad news for gold-miner shareholders on all sides. They reveal the serious struggles of major gold miners, and really retard future upside in their stocks.

For decades the largest gold miners in the world have been Newmont Mining (NEM) and Barrick Gold (ABX). These behemoths have long dwarfed all their peers in operational scope. While the gold miners are in the process of reporting Q4’18 results now, their latest complete set remains Q3’18’s. As after every quarterly earnings season, I analyzed them in depth for the major gold miners of GDX back in mid-November.

The GDX VanEck Vectors Gold Miners ETF is the world’s leading and dominant gold-stock investment vehicle. In Q3 alone NEM and ABX mined a staggering 1286k and 1149k ounces of gold! To put this in perspective, the average of the next 8 largest gold miners rounding out the top 10 was just 508k ounces. Newmont and Barrick have long been in a league of their own, with commensurate market capitalizations.

Read full article... Read full article...

Friday, February 15, 2019

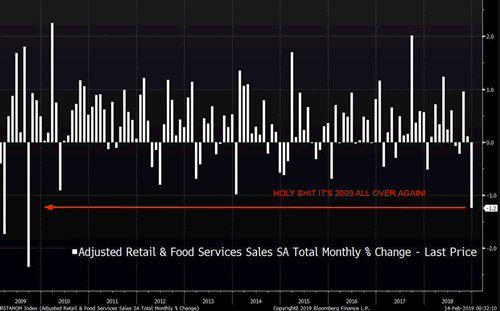

Retail Sales Crash! It’s 2008 All Over Again for Stock Market and Economy! / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

On a slow moving day for the U.S. stock market, today’s big news is that “Retail Sales crashed, just like in 2008/2009!!!”. Financial media jumped all over this – nothing sells like bad news.

On a slow moving day for the U.S. stock market, today’s big news is that “Retail Sales crashed, just like in 2008/2009!!!”. Financial media jumped all over this – nothing sells like bad news.

Friday, February 15, 2019

Chinese Lunar New Year Sales in line with Expectations / Economics / Retail Sector

By: Dan_Steinbock

According to some international observers, the Lunar New Year sales indicate a plunge in Chinese consumption. Economic realities tell a different story.Chinese Lunar New Year can be seen as a barometer for Chinese private consumption, due to gift-giving and family reunions. Consequently, both holiday data and its international coverage are of great interest.

Here’s the bottom line: During the Lunar New Year holiday in early February, Chinese retail and catering businesses generated a record over 1 trillion yuan ($148 billion). Sales by retail businesses rose 8.5% from a year earlier.

Read full article... Read full article...

Friday, February 15, 2019

Is Gold Market 2019 Like 2016? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

Have you even wanted to travel in time? You can, at least when reading about the gold market. Many analysts claim that this year is like 2016 for the gold market. We invite you to read our today’s article about the similarities and differences between the precious metals market then and today and find out what do they imply for the gold prices.

Have you even wanted to travel in time? You can, at least when reading about the gold market. Many analysts claim that this year is like 2016 for the gold market. We invite you to read our today’s article about the similarities and differences between the precious metals market then and today and find out what do they imply for the gold prices.

Finally, the scientists have invented the time machine! This is at least what we hear from many people: that we went back in time to 2016. Indeed, there are certain similarities between the precious metals market then and today. What are they – and what do they imply for the gold prices?

Let’s look at the chart below, which shows the price of the yellow metal since December 2015. As one can see, gold has rallied since December 2018, just like three years earlier.

Read full article... Read full article...

Friday, February 15, 2019

Virgin Media's Increasingly Unreliable Broadband Service / ConsumerWatch / ISP's

By: N_Walayat

The following map says it all of what to expect as a customer of Virgin Media. Where once livable outages of an hour or so are turning into near 24 hour losses of service.

Read full article... Read full article...

Friday, February 15, 2019

2019 Starting to Shine But is it a Long Con for Stock Investors? / Stock-Markets / Stock Markets 2019

By: Chris_Vermeulen

An odd thing happened at the beginning of 2019 for the markets – price levels across almost all sectors were deeply depressed as a result of the October through December 2018 price correction. We’re noticing that almost all sectors of the SP500 were relatively deeply depressed just before Christmas 2018 and the recent price rally has set up an interesting psychological phenomenon – a self-propelling bullish mantra for US Stocks.

An odd thing happened at the beginning of 2019 for the markets – price levels across almost all sectors were deeply depressed as a result of the October through December 2018 price correction. We’re noticing that almost all sectors of the SP500 were relatively deeply depressed just before Christmas 2018 and the recent price rally has set up an interesting psychological phenomenon – a self-propelling bullish mantra for US Stocks.

Yes, 2018 ended with a drop – almost a CRASH. Yet, 2019 is starting off on a terror rally that is beginning to lay the grounds for a very dramatic Q1 and possibly Q2 recovery for many in the managed and passive funds. Remember the news in early January 2019? Hedge funds losing 12~22% or more for the 2018 end of year returns? Remember the feeling that these firms just couldn’t find any means of success when almost the entire 2018 year was mired in deep price rotations and sideways trading?

Read full article... Read full article...

Friday, February 15, 2019

Gold is on the Verge of a Bull-run and Here's Why / Commodities / Gold & Silver 2019

By: Umer_Mahmood

The majority of gold traders are very bearish on the gold market currently. The sentiment could signal a start of a possible jump in price for the precious metal.If you are also expecting such a price shift, you might want to consider buying the SPDR Gold Shares ( a fund holding bullion bars).

Read full article... Read full article...

Thursday, February 14, 2019

Capitalism Isn’t Bad, It’s Just Broken / Economics / Economic Theory

By: John_Mauldin

The Soviet Union’s collapse ended the socialism vs. capitalism argument.

The Soviet Union’s collapse ended the socialism vs. capitalism argument.

Semi-free markets spread through Eastern Europe. Collectivist economies everywhere began turning free. Capitalism seemingly won.

Even communist China adopted a form of free market capitalism. Although, as they say, it has “Chinese characteristics.”

With all its faults and problems, capitalism generated the greatest accumulation of wealth in human history. It has freed millions of people from abject poverty.

Thursday, February 14, 2019

Will Stock Market 2019 be like 1999? / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

As the stock market pushes higher, the year “1998” keeps popping up in our market studies recently. 1998 saw a rapid stock market crash, a retest (something we have yet to see today), followed by a massive nonstop rally. Everyone at the time thought that the 1998 crash was the start of a much bigger crash. To their surprise, the bull market (already late-cycle) surged for another 1.5 years before topping.

As the stock market pushes higher, the year “1998” keeps popping up in our market studies recently. 1998 saw a rapid stock market crash, a retest (something we have yet to see today), followed by a massive nonstop rally. Everyone at the time thought that the 1998 crash was the start of a much bigger crash. To their surprise, the bull market (already late-cycle) surged for another 1.5 years before topping.

There is indeed the possibility that today is similar to 1998. There are fundamental and technical parallels.

Read full article... Read full article...

Thursday, February 14, 2019

KitKat "Make a Break for It" Proving Impossible to Win 100 Travel Holiday Goodies Per Day Promo / Personal_Finance / Freebies and Comps

By: Anika_Walayat

KitKat's new promotion for 2019 that went live on the 1st of Feb, which apart from the top prizes of 10 holidays worth £8,000 each, supposedly has 100 holiday getaway goodies to be won EVERY DAY by just entering the codes found on the inside of kitkat wrappers. Thus this 'should' be a relatively easy to win promotion. Unfortunate, that is not our experience after having entered 20 codes to date and not having won a single prize! Which makes us skeptical of the deployment of this promotion.

Read full article... Read full article...