Can North Korean Nukes Rattle Global Stock & Financial Markets?

Stock-Markets / North Korea May 27, 2009 - 02:44 PM GMTBy: Gary_Dorsch

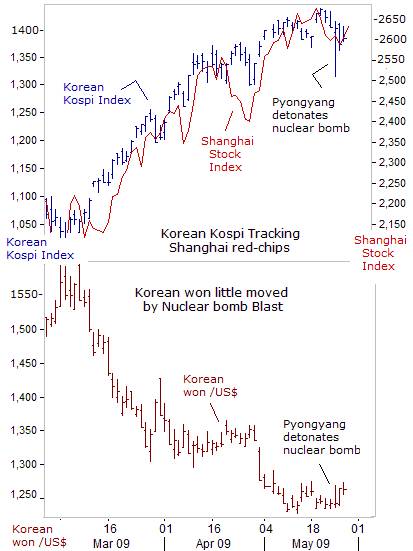

News that North Korea’s mercurial leader Kim Jong Il authorized the detonation of a nuclear bomb on May 25th, comparable to those that obliterated Hiroshima and Nagasaki, barely caused a ripple in the global financial markets. Japanese and South Korean stocks initially fell in a knee-jerk reaction, but soon recouped most of their losses, as traders shrugged off the nuclear fallout, - figuring it was just a harmless display of Kim Jong Il’s temper tantrums that erupts once every few years.

News that North Korea’s mercurial leader Kim Jong Il authorized the detonation of a nuclear bomb on May 25th, comparable to those that obliterated Hiroshima and Nagasaki, barely caused a ripple in the global financial markets. Japanese and South Korean stocks initially fell in a knee-jerk reaction, but soon recouped most of their losses, as traders shrugged off the nuclear fallout, - figuring it was just a harmless display of Kim Jong Il’s temper tantrums that erupts once every few years.

When foreign markets failed to take Pyongyang seriously, Kim Jong Il upped the ante by firing the Musudan-Ri missile, on which N-Korea could ultimately place a nuclear warhead, with a range of 2,500-miles. Pyongyang then fired three shorter-range missiles into the Sea of Japan. But global stock markets are so intoxicated with super-cheap money injected by the G-20 central banks each day, that even nuclear bomb blasts didn’t rattle the post March 10th “green-shoots” rally.

Pyongyang vowed on May 27th, to attack South Korea if its ships participate in a US-led effort to interdict vessels carrying missiles or weapons of mass destruction. Pyongyang also declared that the truce that ended the Korean War was no longer valid. “Those who provoke North Korea will not be able to escape its unimaginable and merciless punishment,” the North’s official news agency said. Calling South Korea’s government a “group of traitors,” “our revolutionary forces will consider the interdiction of ships as a declaration of war against us.”

North Korea threatened military action against American and South Korean warships in the waters near Korea’s' disputed maritime border, raising the specter of a naval clash just days after Pyongyang’s underground nuclear test. “Now that the South Korean puppets were so ridiculous as to join in the said racket and dare declare a war against compatriots, North Korea is compelled to take a decisive measure. Seoul’s decision comes at a time when the state of military confrontation is growing acute and there is constant danger of military conflict,” the statement warned.

North Korea threatened military action against American and South Korean warships in the waters near Korea’s' disputed maritime border, raising the specter of a naval clash just days after Pyongyang’s underground nuclear test. “Now that the South Korean puppets were so ridiculous as to join in the said racket and dare declare a war against compatriots, North Korea is compelled to take a decisive measure. Seoul’s decision comes at a time when the state of military confrontation is growing acute and there is constant danger of military conflict,” the statement warned.

Still, what global traders failed to recognize, is that North Korea and Iran are closely and secretly coordinating their nuclear weapons programs. Most of the missile guidance technology in Iran’s long-range Seijl-2 surface missile, tested by Tehran on May 20th, with its bull’s-eye accuracy, came from Pyongyang. Iran’s Seijl-2 missile test was carried out less than a month after North Korea’s internationally condemned missile test launch on April 5th, and the reopening of its plutonium reactors

Tehran might not be far behind in conducting its own nuclear test. Iranian scientists are regularly invited to attend Pyongyang’s missile and nuclear systems experiments and performance tests in recent years. Not surprisingly, therefore, Iran’s President Mahmoud Ahmadinejad ruled out negotiations with the West on its nuclear program on May 25th, and instead challenged President Barack Obama to a friendly debate at UN headquarters in New York, but added: “Iran’s nuclear issue is closed.”

For Iran’s neighbors in the Middle East, the atomic fireworks display in North Korea proves the West cannot afford to wait much longer, until intelligence agencies confirms Iran’s nuclear capability, because Tehran can surprise the world with an underground atomic test of its own. When that day arrives, crude oil futures could soar above $100 per barrel, lifting grains and precious metals higher for the ride.

For Iran’s neighbors in the Middle East, the atomic fireworks display in North Korea proves the West cannot afford to wait much longer, until intelligence agencies confirms Iran’s nuclear capability, because Tehran can surprise the world with an underground atomic test of its own. When that day arrives, crude oil futures could soar above $100 per barrel, lifting grains and precious metals higher for the ride.

Saudi Arabia’s ruling family fears the growing regional power of non-Arab, Shi’ite Iran, which backs Hezbollah guerrillas in Lebanon and Palestinian Islamist factions such as Hamas in Gaza, and has considerable influence in southern Iraq. On May 11th, Israeli PM Benjamin Netanyahu met with Egyptian president Hosni Mubarak at Sharm el Sheikh, to discuss the formation of a united Egyptian-Saudi-Israeli military front, against Iran, blunting Obama’s détente with Tehran.

America’s top military official, Mike Mullen, thinks a nuclear-armed Iran “is one to three years away, depending on where they are right now. But they are moving closer,” he said on May 24th. “The consequences of Iran’s regime acquiring a nuclear weapon would be calamitous for the Middle East region and the entire world. Major Powers must act together to prevent it,” Mullen warned. “It then, in my view, generates neighbors who feel exposed, deficient and then develop or buy the capability themselves. The downside, potentially, is absolutely disastrous,” referring to the likelihood of a nuclear arms-race in the Middle East.

The South Korean Kospi Index is recovering from the global financial crisis, up +40% above its March 3rd lows, while the US-dollar has skidded -30% lower against the Korean-won. The South Korean economy managed to squeak-out a scant +0.1% increase in the January-March period, bucking a -4% plunge in Japan’s economy, and -3.8% plunge in Germany, (if one can trust Seoul’s statistics), after shrinking -5.1% in the previous three months. The Korean Kospi Index is piggybacking the Shanghai red-chip market, which in turn, is inflated by Beijing’s massive fiscal and monetary policies, equal to a combined 32% of China’s entire GDP.

The South Korean Kospi Index is recovering from the global financial crisis, up +40% above its March 3rd lows, while the US-dollar has skidded -30% lower against the Korean-won. The South Korean economy managed to squeak-out a scant +0.1% increase in the January-March period, bucking a -4% plunge in Japan’s economy, and -3.8% plunge in Germany, (if one can trust Seoul’s statistics), after shrinking -5.1% in the previous three months. The Korean Kospi Index is piggybacking the Shanghai red-chip market, which in turn, is inflated by Beijing’s massive fiscal and monetary policies, equal to a combined 32% of China’s entire GDP.

If the Korean Kospi rally should suddenly stumble, and its “green-shoots” begin to wither, it could be due to Pyongyang’s declaration of war. Or warnings by China’s central bank chief Zhou Xiaochuan on May 15th, could take some of the steam out the closely linked markets. “China may fine-tune monetary and fiscal policies as it seeks to minimize the risk of bad loans and fallout from asset bubbles,” Zhou said. On May 26th, China’s central bank drained 80-billion yuan ($11.7-billion) from the money market through repo operations, and a total of 160-billion yuan in central bank bills and repos are due to mature this week.

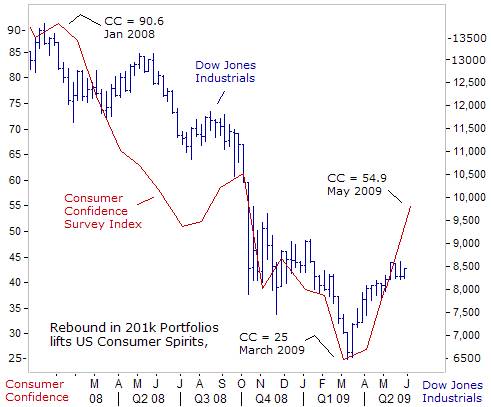

Nuclear bomb blasts in North Korea, an unrelenting slide in home prices, a record number of home foreclosures, rising gasoline prices, bankruptcy at General Motors, and the growing ranks of the unemployed, couldn’t dampen the bullish enthusiasm on Wall Street, where traders returned from their Memorial Day holiday in a mood to bid-up stocks. On May 26th, the Dow Jones Industrials jumped 196-points to finish at 8,473, keeping its “green-shoots” hopes alive awhile longer.

For a market that prides itself on anticipating the future, six-months ahead, traders were bidding-up stocks on a lagging indicator. A US-consumer confidence index, compiled from a survey of 5,000-households, surged to a reading of 54.9 in May, the biggest monthly jump since April 2003, from as low as 25.0 in March. However, the consumer confidence survey’s results are at odds with economic reality, and instead, are simply tracking the market values of household’s 201k’s. The consumer confidence survey is misleading, and might only lead to trading losses.

Home prices in the top-20 major metropolitan US-cities, (the most critical economic indicator), fell -2.2% on average in March, to stand -32% lower from their peak in August 2006, with no bottom in sight. In April, the inventory of existing homes for sale rose 8.8% to 3.97-million. The housing market could be swamped by a second massive wave of residential foreclosures, and the next big shoe to drop, - widespread defaults in commercial real-estate across the country. Meanwhile, the US-jobless rate is expected to climb to 9.2% of the workforce in May, up from 8.9%, as companies lay off more workers.

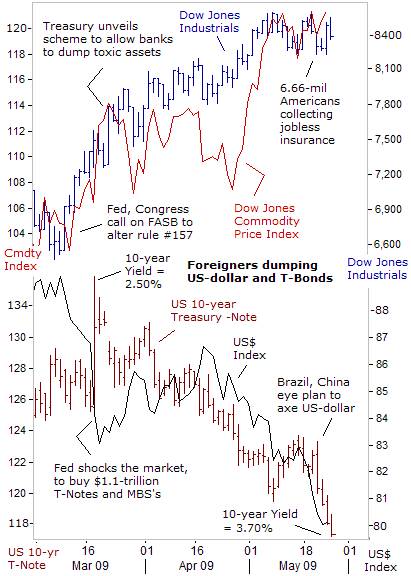

The post March 10th “green-shoots” rally on Wall Street has been largely fueled by accounting gimmickry, allowing banks to value their non-performing assets, at vastly inflated prices, and massive money printing by the Fed. The sharp slide in the value of the US-dollar can also boost multi-national income earned in foreign currencies. Furthermore, the sharp slide in US Treasury notes, lifting 10-year yields to as high as 3.52% today, has been downplayed as unwinding of safe-haven bets.

The post March 10th “green-shoots” rally on Wall Street has been largely fueled by accounting gimmickry, allowing banks to value their non-performing assets, at vastly inflated prices, and massive money printing by the Fed. The sharp slide in the value of the US-dollar can also boost multi-national income earned in foreign currencies. Furthermore, the sharp slide in US Treasury notes, lifting 10-year yields to as high as 3.52% today, has been downplayed as unwinding of safe-haven bets.

The US Treasury is flooding the market with $162-billion worth of bonds this week, and ultimately, about $2-trillion of fresh debt, or 14% of GDP, will be auctioned-off for the entire fiscal year. For fiscal 2010, the Obama team forecasts the deficit at $1.2-trillion. The Fed intends to monetize at least $300-billion of this year’s debt sales, and might bump that number upwards in the months ahead.

However, a coordinated slide of the US-dollar and slumping US-Treasury notes is now apparent, indicating that a significant exodus of foreign money from the US-debt markets is underway, (contrary to Fed and Treasury propaganda). Earlier today, the Fed bought $6-billion of T-Notes to stabilize the sliding bond market, but at the same time, it’s weakening the US-dollar, and preparing the groundwork for the next big wave of inflation. Within an hour of the Fed’s $6-billion money printing operation, the US Treasury bond market resumed its downward spiral, plunging in a free-fall.

In reaction to the Fed’s QE scheme, Brazil and China are working towards bypassing the US-dollar in bi-lateral trade transactions, challenging the status of the greenback as the world’s leading international currency. “We don’t need dollars,” said Brazilian President Luiz Inacio Lula da Silva. “It’s crazy that the dollar is the reference, and that you give a single country the power to print that currency.”

(An analysis of the longer-term impact on the Dow Jones Industrials and other global stock markets, from a sliding US-dollar and higher Treasury bond yields was presented in the latest edition of Global Money Trends).

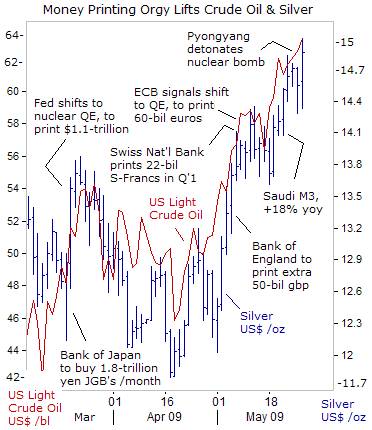

While Chinese leaders are disturbed by the Fed’s monetization of the US-Treasury’s debt, Beijing is also playing the same mischievous game, - inflating the Chinese M2 money supply at a 26% annualized rate. All central banks are participating in the money printing orgy, in order to prevent their currencies from rapidly increasing in value against the US-dollar. Saudi Arabia’s M3 money supply is +18.3% higher than a year ago, after the central bank slashed an interest rate to a half-percent.

While Chinese leaders are disturbed by the Fed’s monetization of the US-Treasury’s debt, Beijing is also playing the same mischievous game, - inflating the Chinese M2 money supply at a 26% annualized rate. All central banks are participating in the money printing orgy, in order to prevent their currencies from rapidly increasing in value against the US-dollar. Saudi Arabia’s M3 money supply is +18.3% higher than a year ago, after the central bank slashed an interest rate to a half-percent.

The Saudi kingdom is now signaling a willingness to see crude oil prices at $80 per barrel, in order to compensate the oil producing kingdoms, for the US-dollar’s loss of purchasing power in Asia and Europe. Oil has already climbed from a low of $32.40 last December to a six-month high above $63 /barrel today. “The price rise is a function of optimism that better things are coming in the future. We see offshoots of recovery,” said Saudi oil chief Ali-al Naimi on May 27th. “There are a lot of positives in what I say, because I am seeing a recovery. Demand is picking up, especially in Asia, Latin America and the Middle East,” he added.

The G-20 central banks are sowing the seeds of double-digit inflation in the years to come, and long-term minded investors are buying precious metals, including gold and silver as a hedge, and other commodities that can’t be printed by central banks. There is no exit strategy from the hallucinogenic drug of QE that can overcome the opposition of the ruling political elite, which are hooked on super-easy money.

However, what would happen if the QE addiction leads to a collapse in G-7 bond prices? “The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.” Ernest Hemingway, “Notes on the Next War: A Serious Topical Letter”, 1935.

Moody's Investors Service affirmed its top AAA credit rating for the United States on May 27th, despite mounting debts and the eventual loss of the US-dollar’s reserve status. “The way rating agencies worked, is that they were paid by the people they rated. I saw that from the inside,” said Dallas Fed chief Richard Fischer on May 25th. “I never paid attention to the rating agencies. If you relied on them you got the gory details. Do your own analysis. What is clear is that rating agencies always change something after it is obvious to everyone else,” Fischer concluded.

This article is just the Tip-of-the-Iceberg of what's available in the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2009 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.