The Case for Economic Depression, Demographics

Economics / Great Depression II Jul 22, 2009 - 12:57 AM GMTBy: Moses_Kim

If I were a forecaster of economic trends and had access to only one piece of data, it would probably be demographics. The forecasting power of demographic trends is underappreciated even though cycles of booms and busts have historically mirrored the age characteristics of the population.

If I were a forecaster of economic trends and had access to only one piece of data, it would probably be demographics. The forecasting power of demographic trends is underappreciated even though cycles of booms and busts have historically mirrored the age characteristics of the population.

It's no secret that different age groups have different spending patterns. Younger people are a drag on economic growth since they consume a great deal but don't produce. In other words, they exacerbate inflation since they increase demand and reduce supply for goods. On the other hand, middle aged people are high earners, producers, and spenders. They tend to moderate inflation and prop up asset prices. Peak spending occurs on average at age 48. Spending patterns resemble a bell curve, so beyond this age, spending tapers as people save for retirement.

Now, let's extrapolate these spending characteristics on to the most important generation in America: the Baby Boomers (1946-1960). The stagflationary period of the 1970's, characterized by low productivity and high inflation, coincided with the youth of baby boomers, which makes sense considering the producing and spending characteristics of the young. The Baby Boomers entered their mid 40's of peak spending in the early 90's up until 2007. It's no surprise then that a boom in America occurred in this time frame.

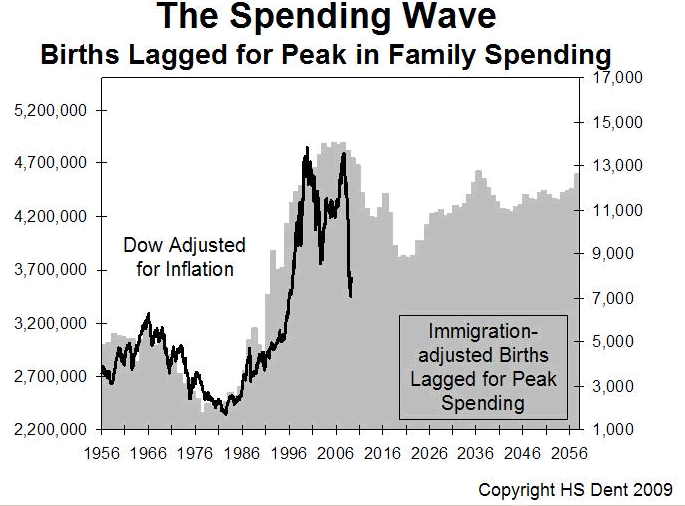

The following chart courtesy of Harry Dent demonstrates the powerful relationship between population and the stock market. As noted earlier, the 48-year-old demographic earns and consumes the most, and therefore drives economic growth. Notice how for this reason the early 90's spike in the Dow (in black) closely tracks births from 48 years prior - when the baby boomers were first born.

Demographic trends in the U.S. moving forward portend a decade-long depression. In a country highly dependent on consumption, there just aren't enough high-earning consumers to drive growth. This is because the 15 years following the baby boom generation saw births decrease by about 25%. These are the people who are now entering their peak earnings and spending years who must replace the productivity of boomers now entering retirement.

All is not lost as there are a couple of potential factors that could mitigate these trends. One is increased immigration to our country. However, early indications suggest that there will be growing protectionism in this area, much like the Great Depression when immigration came to a halt. For example, banks that received TARP funds are contrained by law in terms of the foreigners they can hire. These are often highly educated and productive foreign workers who pay more in taxes than they receive in benefits.

The other potential mitigating factor is technological progress. Unfortunately, technological advances are cyclical and largley driven by demographics as well. Generally young people drive technological innovation. The same baby boomers who discovered nascent technologies in the 70's and 80's are now more focused on retirement. Most of the cutting-edge technologies they created, such as the internet, have already achieved maturity- meaning they have reached over 90% of households. Therefore, technology will likely not provide the productivity boost it did in the 80's and 90's.

The government extended promises when demographics were favorable, such as Medicare and Social Security, that they will not be able to keep. Higher taxes, whether explicit or implicit (through inflation), that result from the demographic storm will further dampen economic growth. According to former Treasury Department economist Bruce Bartlett, tax rates will have to increase 81% right now to compensate for our shortfall in promised benefits. Because of quickly collapsing tax receipts and massive unfunded liabilities, taxes are about to increase significantly.

We have been able to delay the day of reckoning because demographic trends were strong for so long. However, the tide has already started to reverse, and our country is bound to experience significant economic strife in the future. The very nature of spending and productivity patterns with age suggests a significant retrenchment in output is coming, which is the very definition of a Depression. While demographics are significant in catching long-term trends, an economy can operate only with a functioning currency. Part 4 of my series will explore the destruction of the dollar and its potential effects on economic growth.

By Moses Kim

http://expectedreturns.blogspot.com/

Graduate of Columbia University with a B.A. in History. Student of the markets focused on long-term economic trends. I believe the markets are inefficient, and that these inefficiencies can be exploited to attain profitable returns.

© 2009 Copyright Moses Kim - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.