Economic Suicide and the ABC’s of DEPRESSION!, Stocks Bear Market Rally Underway

Economics / Great Depression II Aug 08, 2009 - 01:19 PM GMTBy: Ty_Andros

Many analysts are calling an end to the recession. No way, we are only in a countertrend bounce in economic activity before the next leg DOWN. One has to look no further than the incredible bounces of 50% or more in markets halfway to the lows from 1929 to 1933, or in post-bubble Japan since 1989 to see the parallels. The social welfare states of the G7 and their spawn known as FIAT currency and credit financial systems have just masked the unfolding death of their economies.

Many analysts are calling an end to the recession. No way, we are only in a countertrend bounce in economic activity before the next leg DOWN. One has to look no further than the incredible bounces of 50% or more in markets halfway to the lows from 1929 to 1933, or in post-bubble Japan since 1989 to see the parallels. The social welfare states of the G7 and their spawn known as FIAT currency and credit financial systems have just masked the unfolding death of their economies.

As public serpents, er…servants implement their plans for MISERY SPREAD WIDELY, also known as SOCIALISM, which forces more and more desperate voters into their grasp.

The Stock Market is in a thinly-supported rally, courtesy of the CNBS mainstream media PARADE of Patsies and the New York Fed (also known as the Plunge Protection Team), with its allies in corruption known as WALL STREET. This chart illustrates the thin underpinnings from a recent edition of The Gartman Letter (www.thegartmanletter.com ):

As Dennis commented: “The DOW industrials and volume on the Exchange: If volume is to follow the trend then there is something amiss here; since March, as the market has rallied, the volume has fallen steadily. This ain’t good.”

In a recent Barron’s, the noted David Rosenberg (former chief economist at Merrill Lynch) remarks:

“The trailing P/E on an operating earnings (adjusted to take out everything that is bad) is now at 24 times, while on trailing reported earnings, the multiple a mere 760-plus!”

“Something tells us”, Dave explains, “that the marginal buyer of equities today at that price may well be the same person who was loading up on REAL ESTATE during the summer of 06.”

And he is correct. This is a bounce in markets and economy engineered by Washington and Wall Street to FOOL you before the next leg down into depression unfolds. To get new FOOLS to BUY their TOXIC stock, loans and bond holdings before they decline to their REAL values, making the public and investors their PATSIES once again. If you or I attempted this, it would be called PUMP and DUMP, and we would be prosecuted for it; when WALL STREET and the Treasury do this it’s a wink and a smile… Dave goes on to say:

And he is correct. This is a bounce in markets and economy engineered by Washington and Wall Street to FOOL you before the next leg down into depression unfolds. To get new FOOLS to BUY their TOXIC stock, loans and bond holdings before they decline to their REAL values, making the public and investors their PATSIES once again. If you or I attempted this, it would be called PUMP and DUMP, and we would be prosecuted for it; when WALL STREET and the Treasury do this it’s a wink and a smile… Dave goes on to say:

"Consumer spending came in at -1.2% annualized, twice the decline expected by the consensus. This occurred in the face of gargantuan fiscal stimulus and leaves wondering how this critical 70% chunk of the economy is going to perform as the cash-flow boost from Uncle Sam's generosity recedes in the second half of the year. Imagine, government transfers to the household sector exploded at a 33% annual rate, while tax payments imploded at a 33% annual rate and the best we can do is a -1.2% annualized decline in consumer spending in real terms and flat in nominal terms? What do we do for an encore? In the absence of the fiscal largesse, it is quite conceivable that consumer spending would have shrunk at a 10% annual rate last quarter!"

Undoubtedly, Dave had to leave the banksters of Wall Street before he was FULLY allowed to utter these truths.

Take a look to the left at the Russell 2000 to get another picture of what ORWELLIAN stock valuations have become, courtesy of the www.wsj.com.

WOW, trailing earnings almost 50% HIGHER than any time in the last 30 YEARS; I think my nose is beginning to bleed at these heights. Buying the S&P 500 or Russell 2000 requires an investor wears a parachute… When you hear green shoots, consider the source. It is nothing more than the trillions of printed Quantitative-easing money going somewhere, aided by government manipulation of the markets and the MAIN STREAM media headlines. Risky assets of all types have risen with the stock markets (bonds, etc.), as desperate fiat currency holders seek returns and SHELTER from the hot fire hoses of money ROLLING off the presses. Maybe this is the beginning of the Zimbabwe Effect.

A Morphine high is the result of printing and injecting TRILLIONS of little pieces of paper known as G7 currencies and calling them capital, when in reality they are nothing more than accounting fictions. Their citizens, thinking they are receiving money, realize before it’s all over that they are holding nothing in their hands and nothing in their futures.

To fight the economic collapse, most government programs are nothing less than the implementation of political goals of government expansion, as well as government control over everything (also known as fascist socialism), and calling it the solution to practical problems we face today. The only solution is income growth in the PRIVATE SECTOR, not the demise of it.

To rescue the financial sector, the Inspector General of the TARP program reported that the total outlays and commitments have now EXCEEDED $23 trillion (that is 23 million, million). He was immediately called into the White house and viciously attacked for saying the truth. The next day the Treasury and White House VIGOROUSLY DENIED the reports. And we have heard not a peep from the supposedly independent auditor. Chicago politics at work….

The STIMULUS Bill and 2009 budget are perfect examples, 11 to 15% actual stimulus and the rest just expands government by 90% IN ONE YEAR. Only the locusts have not arrived yet, as the government cannot spend and implement their new schemes as fast as they fund them, with dollars printed out of thin air and NEW BORROWING…

Abraham Lincoln once said:

- You cannot help the poor by destroying the rich.

- You cannot strengthen the weak by weakening the strong.

- You cannot bring about prosperity by discouraging thrift.

- You cannot lift the wage earner up by pulling the wage payer down.

- You cannot further the brotherhood of man by inciting class hatred.

- You cannot build character and courage by taking away men's initiative and independence.

- You cannot help men permanently by doing for them, what they could and should do for themselves.

This is PRECISELY the public policy being implemented today. It is exactly what he warned us not to do, specifically designed to engineer the collapse of income and economies which our PROGRESSIVE, aka Socialist, public servants will use as their excuse to seize power and private-sector money, all to SAVE you. These are the teachings of SAUL ALINSKY in action. Every policy they implement destroys income in the private sectors, which equates to personal freedom, and INCREASINGLY puts the government in charge of who gets what. As Alexander Tytler observed in 1775 during the Revolutionary War:

"A democracy cannot exist as a permanent form of government. It can only exist until the voters discover they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising them the most benefits from the public treasury, with the result that a democracy always collapses over a loss of fiscal responsibility, always followed by a dictatorship. The average of the world's great civilizations before they decline has been 200 years. These nations have progressed in this sequence: From bondage to spiritual faith; from spiritual faith to great courage; from courage to liberty; from liberty to abundance; from abundance to selfishness; from selfishness to complacency; from complacency to apathy; from apathy to dependency; from dependency back again to bondage."

The G7 is firmly in the latter two stages of this observation; private property and the private sectors are SUBSUMED to feed the dependency of the captive victims known as CITIZENS. Now we know what the progressive Democratic Party and its standard bearer, aka the President, meant when they said they would be the agents of change:

In other words, change means increasingly becoming SLAVES of the GOVERNMENT and FREE MEN NO MORE!

In other words, change means increasingly becoming SLAVES of the GOVERNMENT and FREE MEN NO MORE!

The naked corruption emanating from the capitals of the G7 and their crony capitalist handmaidens is breathtaking in its depth and breadth. Climate change and health care bills written in a back room, read by NOBODY in the legislature and passed by “paid for” public serpents, er… servants. They are Benedict Arnolds to their oaths to uphold the constitution and partners in the corruption.

One of the primary missing ingredients is the acknowledgment that wealth is not generated from the GOVERNMENT and PUBLIC sectors; in fact, they are the destroyers of it.

“Government spending cannot create additional jobs. If the government provides the funds required by taxing citizens or by borrowing from the public, it abolishes on one hand as many jobs as it creates on the other”…

-Ludwig Von Mises

Unfortunately one other CRITICAL difference is also left unsaid, so I will say it: most of the jobs in the private sector “produce more than they consume” and create wealth (otherwise the business goes bankrupt), and ALL of the jobs created by government “consume more than they produce” and represent a never-ending DESTRUCTION of wealth and capital. They must continuously be supported by more taxes and borrowing from the producing sectors of the various countries. One needs look no further than the ETHANOL industry to see this in action.

Such as, reducing the seed corn CAPITAL from the private sector - entrepreneurs require this to create new and innovative businesses which provide “MORE FOR LESS” as rising new competitors put crony capitalists OUT OF BUSINESS. In the G7, this cannot be countenanced. What would: GM, Chrysler, Wall Street and the biggest banks, AIG, Fannie Mae and Freddie Mac, Airbus, GE and soon the public health insurance option do if they were not protected by LEGISLATORS? Since 1998, Wall Street and the big banks have contributed OVER $1.8 billion to REELECTION campaigns. What did they get? PROTECTION from their own mistakes (privatizing profits and socializing the losses) and new competitors… They get the profits and their mistakes are paid for by You, Me and our children, better known as the public.

Look no further than the new financial regulation bill, no doubt written in the executive offices of the Big Banks and Brokerages, creating a new class of too-big-to-fail firms, which are NEVER going to be reduced to a size which is not threatening to the public. This allows them to take even bigger risks, firm in the knowledge that government has ENSHRINED into law that they CANNOT FAIL. Those financial institutions outside this SAFETY net then become the PREY of the government-supported entities, such as JP Morgan, Goldman Sachs\ and Morgan Stanley. All the while, letting lose a plague of locusts on their smaller competitors (government regulators) so they can no longer be challenged in the MARKETPLACE, as their competitors fall under the brass knuckles of UNCLE SAM. Bought and paid for on a regular basis…

CORRUPTION

“All political thinking for years past has been vitiated in the same way. People can foresee the future only when it coincides with their own wishes, and the most grossly obvious facts can be ignored when they are unwelcome. Political language... is designed to make lies sound truthful and murder respectable, and to give an appearance of solidity to pure wind.” - George Orwell

Ditto the INVESTIGATION in OIL speculation, lead by a former Government, er… Goldman Sachs partner; a farce, as they guide the coming boom in the commodity sector into the hands of the CORRUPT big banks and brokers on Wall Street (JP Morgan, Morgan Stanley, r Goldman Sachs) who form a chorus of support. Isn’t it interesting that not once during this hearing did the fact come up that the dollar has lost half its purchasing power in less than 10 YEARS?

When some of the biggest commodities banks and brokers in the world support this, you KNOW the fix is in! They are fixing it so their emerging competitors cannot do what they will be allowed to do. To see how HORRIBLY corrupt and compromised the current residents of Washington D.C. are, take a look at this recent report by Glen Beck: http://www.youtube.com/watch?v=khGZ3a4zTNU. A press leak occurred during the hearings and they are REWRITING a report from last year by the regulators with ALL NEW POLITICALLY CORRECT conclusions, rather than those presented last year by the Government. With respect to MONETARY DEBASEMENT, this is nothing less than trying to KILL THE CANARY IN THE COALMINE, just as they have done to GOLD for years…..

Their policies destroy EVERYTHING required to create expanding incomes, new businesses and economies and redirect it to their FRIENDS and SUPPORTERS under the guise of SAVING you. The fact that the majority of people in the United States and the G7 do not understand this is testimony to the abject failures that the public school monopolies have become. They teach nothing but ignorance, misinformation and socialism. Although for our socialist masters in G7 governments, this marks the pinnacle of success. It allows them to operate in the open since their ideas are embraced as COMMON SENSE, rather than based on the absurdity of the ideas they implement and have taught to the ignorant masses and their children.

As billions of G7 and emerging-market currencies are created daily out of THIN air to prop up the dying social-welfare economic systems of the G7. Nominal market prices skyrocket or plummet to reflect this fiat capital seeking shelter from the next Dollar, Pound or Euro to roll off the presses right behind them, and pushing markets up and down to price in the new realities or rapid monetary debasement practiced on a GLOBAL scale in a vain attempt to preserve what has gone before. Take a look at global Bond and Interest Rate Markets to see return on risky investments SHRINK, just as it had before the economic crash started in mid 2007, caused by the same phenomenon: RAMPANT money printing forcing people to seek shelter or escape from debasing G7 currencies. These are HUGE OPPORTUNITIES, learn how to capture them.

This volatility will only increase until these G7 currencies and financial systems meet their final demise in the next 5 to 10 years. This is a FIAT currency extinction event. This volatility is opportunity to the prepared investor. “Buy and Hold” is dead until after the final collapse occurs, which will force the social welfare states and corrupt public serpents, er… servants to implement the policies of growth, or face their demise at the hands of their constituents. Once these constituents lose everything, the stage will be set for the demise of the welfare state.

To see its demise on a small scale, look at the State of California. It is but the first of dozens of such episodes throughout the G7 in the not-too-distant future. The bigger the entity that fails, the more public servants will use these failures of their own policies to justify taking more from the private sectors.

What are the policies of growth? They are the policies which encourage producing more than you consume, small business creation, SOUND money practices and private property rights being restored. They encourage families being able to accumulate savings without the INVISIBLE saving tax of currency debasement (for example, someone who saved $100 in 1980 can now only buy what $17 did at that time; at no time did the interest they were paid outperform the compounding of MISTATED inflation),. These things have been FORGOTTEN in the G7 today, only to return when the final collapse forces these REALITIES back onto the future agendas, as nothing else will restore growth and the ability to save.

Receipts are PLUMMETING and outlays SKYROCKETING at every level of society: public, municipal, state and federal:

This chart can be seen on ALL LEVELS of government and it shows living BEYOND their means and REFUSING to adjust their budgets. In the meantime, while government as a percentage of GDP is skyrocketing, TAX RECEIPTS are having the biggest drop since 1932; so far, off at an 18% annual rate: Individuals down 22%, corporate down 57%, and social security receipts could drop for only the second time since 1940, not to mention plummeting sales and real estate taxes. Most SANE people and businesses would adjust their spending to reflect income and bring the difference to zero. In the G7, public servants ACCELERATE the outlays, and BORROW and print the money. This is the definition of INSANITY!!!!

This chart can be seen on ALL LEVELS of government and it shows living BEYOND their means and REFUSING to adjust their budgets. In the meantime, while government as a percentage of GDP is skyrocketing, TAX RECEIPTS are having the biggest drop since 1932; so far, off at an 18% annual rate: Individuals down 22%, corporate down 57%, and social security receipts could drop for only the second time since 1940, not to mention plummeting sales and real estate taxes. Most SANE people and businesses would adjust their spending to reflect income and bring the difference to zero. In the G7, public servants ACCELERATE the outlays, and BORROW and print the money. This is the definition of INSANITY!!!!

This is called the Policies of Insolvency. The Jack boot of government will RAISE taxes so they can fund their social welfare states, and their remaining PRODUCTIVE citizens are ROBBED of the ability to pay their own bills at the point of force, also known as the TAXMAN. Recent Wall Street Journal reports outline how the public sector pension plans are UNDERFUNDED to the tune of almost $1.7 trillion; just another indicator of the complete malfeasance by elected officials, crony capitalist asset management firms and the public-sector labor unions in respect to the public they claim to serve. You can expect a knock on the door SOON asking you to FILL THEM UP for them to cover their INVESTING MISTAKES.

A government big enough to give you all you want is strong enough to take everything you have….

-- Thomas Jefferson

They have passed the spending sides of many of their hopes and dreams; now they need the money. It used to be that the progressives were TAX and Spend. It has not changed, only its order has; now it’s spend and TAX, and it is the same thing….

Some of the most extensive research on the effects of taxation and multipliers is found in a paper written at UC Berkeley by Christina D. and David H. Romer (Christina Romer chairs the Council of Economic Advisors of the Ob@ma administration) entitled “The Macroeconomic Effects of Tax Changes,” , which finds that the multiplier is 3, meaning that each dollar of higher taxes will reduce private sector spending by 3 dollars. These findings are COMPLETELY ignored by the masters of the universe in G7 capitals. The Gang of 535 is set to raise them over a trillion dollars over the next two years. YOU DO THE MATH…. Can you say “collapsing spending?” But as all good progressives (liberal Democrats and big-government Republicans) KNOW incentives don’t matter, and they legislate as if they do.

So the reckless Congress and Administration are in the process of raising them to draconian levels for the most productive small businesses and individuals, emulating the egalitarian economic powerhouse of FRANCE:

Tax rates are now higher than the worst welfare states in EUROPE where growth is only a mirage, courtesy of lying statistical agencies and misstated inflation. Private property and the ability to save are dead. They will get you one of two ways: at the point of a gun or by confiscation of purchasing power through debasement. Recent developments push this tax number now closer to 58 to 62%, depending upon the state in which you live. And this is before the new levies, which are being concocted for health care NATIONALIZATION and the CAP and TAX hoax of climate change which enables the theft of the energy industry profits and the transfer of its revenues to the GOVERNMENT or their crony capitalists in the GREEN jobs sectors. Can you say “CONSUME more than you PRODUCE?”

Now in the US, almost 60% of the public NO LONGER PAY taxes, and the top forty percent of taxpayers pay 60%, indentured serfs to those citizens who PAY NOTHING. Furthermore, this is set to ACCELERATE as the pay-nothings will vote for anything to alleviate the suffering they have endured at the hands of continually debased wages -- courtesy of the people leading the charge against the PRIVATE SECTOR’S last vestiges of SMALL BUSINESSMEN. Look carefully at the list of states and countries; not a lot of economic winners can be seen, most are abject economic LOSERS.

This DOES NOT outline the CORPORATE tax rates, which are almost at 40 %, and the second highest in the world after Japan, an economy that has not grown for almost two decades now. Citizens and employees are ignorant to the fact that corporations DO NOT PAY taxes; their customers do, through HIGHER prices, and their employees do, through LOWER wages (the government and unions blame the employer when in actuality it is the TAXMAN who keeps their wages down). And if the price is too high, those jobs and businesses move to areas in the world where they are treated better. This is nothing less than COMMON sense and self-preservation, of which most G7 citizens and their government masters have very LITTLE.

![]()

Ponzi Finance FAILURE

Before the top in 2007, it took 6 dollars of new lending to create 1 dollar of GDP. Now there is no expansion in lending, so the Ponzi “asset-backed” economies are imploding. As long as the government fabricates growth through money creation, also known as quantitative easing, which at this point can NEVER be withdrawn, you will have, as Clyde Harrison points out: “Deflation in everything you own and inflation in everything you use.”

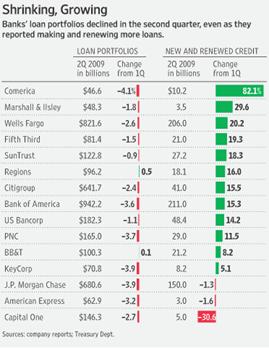

Lending is shrinking, that is one of the reasons quantitative easing (QE) CANNOT be withdrawn. QE must SUBSTITUTE for credit growth to lift PAPER assets in the absence of new lending. Take a look at these ugly numbers:

This is the face of DELEVERAGING, and it has only begun. As these different categories of lending decline, so will the asset values they underpin. The QE RELEASES the funds from other investment categories needed to buy these paper assets. This is the face of DEFLATION in bank lending; as it unfolds, lower prices on the different categories of assets can be expected.

Today, reports are detailing that CLO’s, also known as private equity loans, are back trading at almost 90 cents on the dollar. Woe to the fools that are buying them as they are priced to perfection, and at these prices, the underlying assets DO NOT produce enough to PAY them back. These are mispriced assets and misallocated capital which have not yet BITTEN the DUST. Rest assured it will, as will the CMBS, credit card and the unfolding debacle in the housing markets. The housing problem is far from over; one up month does not signal the end of that trend and any analyst who says so is dreaming. How are the BIG banks and brokers avoiding the write-offs?

![]()

DANGER! Special Alert by Garrett Jones

Here is a special report – a technical and fundamental analysis of stocks and economic cycles and a possible stock market peak before the next downleg in the economy and the Stock Market. Click Here.

![]()

Emerging Trends Report, part 1 of 6: Credit and Credibility

This is one of the finest general overviews of the global economy today. It embodies the majority of what I believe and is heavy reading, but if you really want a big picture and what to think about it then it is a must read. I want to thank Richard Karn at the Emerging Trends Report for allowing me to share this very special work with you – I highly urge everyone to subscribe to EmergingTrendsReport.com.

A six-chapter work, we will be releasing one chapter at a time over the next six issues of Tedbits. Here is Chapter One: Click here.

![]()

Health Care REFORM

Nothing epitomizes the brazen deception and corruption rampant in Washington than the recent debate over health care, its details so onerous that all records of the legislation have been removed from public review. This video outlines some of the lies and deceptions being spoken today, compared to their recent words: http://www.breitbart.tv/uncovered-video-obama-explains-how-his-health-care-plan-will-eliminate-private-insurance/.

An outstanding piece on health care entitled “Utopia vs. Freedom” outlines that health care reform is actually a choice between freedom and slavery; many of the thoughts which should be part of the debate are presented:

http://article.nationalreview.com/?q=NmVlODY0YzFiMzcxNzYwNGE2Nzg2ZTBhZTA2YTU0NjM=

In some excellent work done BEFORE it was taken from public view, here are some of the NASTY details from a doctor in Florida:

Page 16: A provision making INDIVIDUAL private Medical insurance illegal

Page 22: Mandates audits of all employers that self-insure!

Page 29: Admission: your health care will be rationed!

Page 30: A government committee will decide what treatments and benefits you get (and, unlike an insurer, there will be no appeals process)

Page 42: The "Health Choices Commissioner" will decide health benefits for you. You will have no choice. None.

Page 50: All non-US citizens, illegal or not, will be provided with free healthcare services.

Page 58: Every person will be issued a National ID Health Card.

Page 59: The federal government will have direct, real-time access to all individual bank accounts for electronic funds transfer.

We have truncated the list here to keep the length of this issue as reasonable as possible.

I urge you to please click here to read the remaining items in this list.

Those of us who love freedom cannot tolerate this brazen intrusion into our lives by a President and a party drunk with power.

This puts to bed the OUTRIGHT LIES coming from the supporters of this bill, ignored and unreported by the MAINSTREAM media. There are over 800 pages to this bill that were not reviewed by the doctor, and I promise you the devil is in every one of the details. Well done and well said, Doctor. The bottom line of government healthcare is that if you participate, you have no say over it (they will force you to.) THEY OWN YOU AND YOUR BODY-- LOCK, STOCK and BARREL and slavery has RETURNED to AMERIKA.

The last 300 pages are available to NO ONE, but some of the highlights are NATIONAL ID cards, complete removal of FINANCIAL privacy, euthanasia, rationing, government micromanagement from a manual to guide the new little health czars as they careen through your lives. Saving money and being more productive is ridiculous; show me one other GOVERNMENT program where this is so. Medicare, Medicaid, social security, Fannie Mae and Freddie Mac, the US Postal Service, all insolvent, and now they want another program to manage; it will just be the next failure…. Consuming more then it produces.

There are over 9 million words in the tax code; the manual for your healthcare may be longer….. When the Congressional Budget Office announced the REAL tally of new and expected expenses over $1 trillion, The White House summoned this supposedly INDEPENDENT agency into a heated meeting, THE REPORT CHANGED THE NEXT DAY….. SO MUCH FOR HONEST GOVERNMENT…Chicago-style politics on plain display!

This is the total destruction of the present healthcare industry and a whole new one is being written and DIRECTED by PINHEADS, also known as Bureaurats, er… crats in Washington. They have NO KNOWLEDGE of the issues involved, other than their desire to NATIONALIZE and control approximately 20% of the US economy and all the opportunities it offers them to sell influence and collect rents, regardless of the welfare of the citizens. This IS NOT a solution to exploding healthcare cost, it is a recipe for more. WHAT a laugh or should I say cry. Think of your life in the hands of a bureaucrat, rather than in your own and your doctor’s. Not a pretty picture. The BIG uproar of the cost of this in the media and on Capitol Hill is just to DISTRACT you from the real details which are straight from a horror movie in which you are the next VICTIMS.

In closing: The greatest depression in history is BLOWING into the G7. Morally and fiscally-bankrupt public serpents, er… servants are INSURING it will be the worst in HISTORY. Implementing a plan that ATTACKS the most productive 5% of the economy and expecting they will continue to produce and invest in new businesses IS FALSE. Just ask California where the top 1% pay taxes at a rate which generates 50% of ALL State income. Taxes are now collapsing, as are these breadwinners who stay there quit producing, or vote with their feet. Now it is being done on a national level and you can expect the economy to collapse with them. It DOES NOT PAY TO PRODUCE and they WON’T, you can bet on it.

Just like dead cats, economies bounce if you throw them down hard enough; the G7 and world economies were thrown down harder than any time in history in this initial stage of the collapse, a weak bounce could have been expected and appears to be about OVER.

Only the most FOOLISH or uninformed entrepreneurs would venture into a new business with this storm on the horizon, because the only businesses that can survive are on the government dole, aka EARMARKS, which they paid for with CAMPAIGN contributions. And only a rising private sector and rising incomes will father the recovery. These GOVERNMENT policies are a dagger in the heart of any nascent recovery.

I know that expansion plans in my business and ALL my friends’ businesses are on INDEFINITE hold, as to make money from hard work, risk taking and building my business will be CONFISCATED for the GREATER good of those who have chosen not to do so. How nice! Why work hard with the goal to make a million dollars when government in one form or another is going to take 600,000 to 700,000 dollars of it? I won’t and no one else will either. Income in the G7 is collapsing and set to collapse FURTHER. Government is NOT the solution, it is the problem. The parasites in government are killing the private sectors on which they feed. ON PURPOSE!

For millennia, governments and kings have employed ALCHEMIST’S to turn lead into gold, trash into cash, and FAILED. Modern governments believe they have done so, creating money and capital from almost-worthless pieces of paper. This is an illusion; the worthless pieces of paper ARE NOT money, they are the illusion of it. Modern governments have failed as well, we see it every day as they try to control the markets which are careening wildly higher and lower in reaction to this FLOOD of funny money. These are opportunities learn to catch them!!!

Cash for clunkers is the latest bailout for the auto sector (pulling forward next year’s purchases to today); looks like its bombs away as SOON AS IT’S OVER. Don’t use your computer to get the coupon, though. To do so you have to accept a disclosure which says if you proceed, your computer becomes the “Property of the Government” and subject to search and seizure. During an episode of Glen Beck, they did proceed and an auto program promptly began downloading ALL THE FILES. When looking at the public option for healthcare, it is the same. Your body and finances become? What else? The property of government! With the rebates for home purchases, you also have the government as shareholder!

When the inevitable COLLAPSE occurs, they will use that as the EXCUSE to seize everything they have not already seized in one manner or another. The first lesson in Econ 101 is TANSTAAFL “there ain’t no such thing as a free lunch,” and it is about to be learned on a scale which will boggle the mind. The printing press WILL BE rolled out to an extent larger than can be imagined. But soon, those IOU’s will be reduced to their intrinsic value and the collapse in living standards will ACCELERATE.

Bernanke MUST stop any audits of the Fed as it would allow the WORLD to discover actually HOW MANY dollars are in existence. Off-balance-sheet vehicles are great until they are DISCOVERED, then all hell breaks loose. As for the people who store wealth in dollars, what would they do if they found out that there were 10, 20 or 30 TRILLION dollars more in circulation than what is now BELIEVED to be in existence? As a store of value it would be DESTROYED. This is entirely possible, or should I say PROBABLE. The US claims to have a debt-to-GDP ratio near 80%; informed investors know the liabilities are 70 to 90 trillion dollars, or almost 600%.

Look no further than the recent GDP numbers and the benchmark REVISIONS to see government corruption and PUBLIC RELATIONS in action. Here is a recent excerpt from a report by John Williams of www.shadowstats.com

Five of the last six quarters now are reported in real quarterly contraction. The revised official real GDP quarterly growth rates (and prior estimates of growth) are: 1q08 was down 0.7% (previously up 0.9%); 2q08 was up 1.5% (previously up 2.8%); 3q08 was down 2.7% (previously down 0.5%); 4q08 was down 5.4% (previously down 6.3%); 1q09 was down 6.4% (previously down 5.5%); 2q09 was down 1.0% in its "advance" estimate.

As noted in the SGS Newsletter No. 51, July 2009 marked the 19th month of economic contraction, the longest downturn (based on NBER timing) since the first downleg of the Great Depression. The new string of quarterly GDP contractions, as well as annual declines of 3.3% and 3.9%, respectively, in first- and second-quarters 2009, are the worst showings in the history of the quarterly GDP series, which goes back to 1947/1948.

Rest assured that the fall in GDP was much worse than -1%; we will only know when the bean counters do the next BENCHMARK REVISIONS. Can GDP bounce from here? Sure, anything is possible as long as it comes from such a low new baseline, showing a countercyclical bounce, and you can lie about the numbers from which they are calculated, as they have done so now for YEARS…

Last but not least is the recent revelation of legalized front-running by high-frequency traders with the express knowledge of the regulators and the exchanges. They saw approximately $23 billion of profits in the last year alone, transferred directly from investor’s pockets into their own. To see an explanation for the criminality involved, see this Bloomberg report: http://www.youtube.com/watch?v=V4cRYI2x60Q&eurl=http%3A%2F%2Fwww%2Egoldismoney%2Einfo%2Fforums%2Fshowthread%2Ephp%3Ft%3D394720&feature=player_embedded .

Corruption is running out of control as the elites try to revive the un-revivable. Printing money out of thin air is nearing its demise, of that you can be certain. The moves up and down in the market and the rapidity (up and down moves which used to take years now unfold in weeks and months) as markets and investors are blown about as NEW surprises cause investors to change course. Buy and Hold is dead, absolute-return investing (making money in up and down markets) as volatility expands is not, and volatility is opportunity. Learn how to catch it.

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2009 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

ed

08 Aug 09, 22:49 |

good!

this is a kick ass article |