Investor Tool and Strategy for Coping with the Fed Led Cartels Market Manipulations

Stock-Markets / Exchange Traded Funds Aug 14, 2009 - 09:38 PM GMTBy: DeepCaster_LLC

(WARNING: Leveraged ETF's are EXTREME HIGH RISK)

“The only thing more certain than Death and Taxes is that when anyone from the Federal Reserve speaks or writes, it is with the specific purpose of misguiding the public,” - John Pugsley, Chairman, The Sovereign Society

“The only thing more certain than Death and Taxes is that when anyone from the Federal Reserve speaks or writes, it is with the specific purpose of misguiding the public,” - John Pugsley, Chairman, The Sovereign Society

Savvy Investors and Traders now have a relatively new Tool to help them combat the Fed-led Cartel’s* market manipulations (see below), and especially in the Markets typically targeted by The Cartel – Precious Metals and Strategic Commodities.

We refer to Exchange Traded Funds (ETFs) in General and particularly, to the 200% and 300% Leverage ETFs. But by themselves these ETF’s are only a tool. Thus we also offer a strategy for profiting and protecting from Cartel Interventions. But first consider the ETF tool.

We refer to Exchange Traded Funds (ETFs) in General and particularly, to the 200% and 300% Leverage ETFs. But by themselves these ETF’s are only a tool. Thus we also offer a strategy for profiting and protecting from Cartel Interventions. But first consider the ETF tool.

The 300% leverage ETF’s are Exciting Newcomers to the Exchange Traded Funds Territory in recent months.

These Funds seek leveraged investment results which are triple that, on a daily basis, of the underlying benchmark index, in the case of the ‘Long’ Funds, and triple the Inverse of the underlying benchmark index in the case of the ‘Short’ funds.

Clearly, a Major Positive of such Exchange Traded Funds is the substantial avoidance of the Time and Risk Premium decay inherent in Options. By substantially eliminating that Premium decay, one barrier to Profit is removed.

Clearly, also, a Major Negative is that the losses which result from an incorrect (see below) judgment about the direction of a particular Market Sector are magnified threefold or more with potentially catastrophic results.

Yet in our view these Triple Funds have their place, and not just for hedging, but for profit plays as well (cf. our experience below), but for sophisticated investors only.

A benefit in using these funds is that precise timing becomes somewhat less important, provided one gets the Direction of the next major move right.

Another major advantage -- particularly in today’s Markets in which ‘Buy and Hold’ rarely works anymore -- is that one can profit whether markets rise or decline. When we last checked there were about as many 300% leverage inverse (i.e. short) funds, as there are “long” funds.

Indeed, in considering these Funds it is essential to seriously digest the Disclaimer introducing the Prospectus of Direxion Funds (the major provider of these 3x Funds) as well as to read the Prospectus which states, in pertinent part:

“…each Fund offered in this Prospectus seeks daily leveraged investment results. The return of each Fund for periods longer than a single day, especially in periods of market volatility, may be completely uncorrelated to the return of the Fund’s benchmark for such longer period…”

The statement that these Funds seek “daily leveraged investments results” is especially important. In our experience, holding these ETF’s for longer than a day or two may well result in the performance not achieving a triple leverage of the benchmark performance. This is not necessarily a negative, but is a factor which should be taken into consideration when speculating with these Funds.

Indeed, if the benchmark index moves in the direction one does not expect; one can be worse off, much worse off, than one might naively expect.

This is due to the effects of compounding, also known as beta slippage. Consider a hypothetical ETF that promises twice the return of an index. Let’s say you buy a share of the ETF for $100 while the underlying index is at 10,000.

If the index goes up 10% the next day to 11,000, your ETF will go up 20%, to $120. If the index goes from 11,000 back down to 10,000 the next day, that’s a decline of 9.09%, which means that the EFT will go down twice this much, or 18.18%.

A decline of 18.18% from the $120 price of the ETF will leave it at $98.18. So even though the index ended up right back where it started, the ETF is down 1.82%! i.e. more than one might naively expect.

But, remember, this 1.82% loss happened because the investor “bet” wrong on direction.

The investor bet the Market would rise when, in fact it whipsawed.

And remember also that if the Index does move in the direction the Investor expects, then returns can be better than he might naively expect, also due to compounding. Over time this can compensate for losses due to moves in the “wrong” direction.

As well, losses from the compounding problem (example above) may well be less than those one would have suffered had one suffered time and risk premium erosion inherent in holding options on the same index. Bottom line: while there is no free lunch, some lunches are better bargains than others. A speculation is a speculation and leveraged ETF’s are most definitely speculative vehicles.

Thus, our view is ‘So what if triple leverage results are not achieved if the triple leverage ETF is held for longer than a day or two?!’ We recently profitably concluded a speculative experiment of sorts in our Deepcaster High Potential Speculator Portfolio. About 6 months ago we recommended a triple leverage long equities fund. And just a few days ago we recommended it be liquidated for a 43% profit in just over six months, about an 80% return annualized!

So we repeat: “So what if it did not achieve 300% of the Index’s gain because it was held for more than a few days?! It did provide leverage for a juicy return in just a few months.”

Having recounted this we must emphasize that there are risks associated with these funds which are not explicitly addressed in the Direxion Disclaimer.

- We reiterate our observation that, even on a daily basis one may, at best, expect to achieve only approximate triple leverage, which is unsurprising to us.

But the key point is that to the extent that performance fails to achieve the “triple” leverage goal, those “failures” can be magnified if one of these ETF’s is held for multi-day periods as demonstrated above.

This experience does not necessarily argue against using these Funds, or against holding them for multi-day or even multi-week periods, but rather is an important factor to be considered.

2. As research regarding the Funds confirmed, some of the planned Triple Funds are not even operational yet, and others have been operational only a short time.

They thus lack a Track Record on which to base an informed judgment.

3. Some of the Funds, and especially those which have only recently become operational, are thinly traded. That suggests they could experience impaired liquidity and impaired performance.

4. Any investor or Trader who has an aversion to great volatility should not use these Funds. They are extremely volatile, with their price jumping up and down like a jackrabbit in a hailstorm. Indeed, the profitable triple leveraged long position we referred to above was substantially underwater for several days during the six months in which it was in the portfolio. One must have nerves of steel to hold such funds.

Nonetheless for sophisticated, adequately capitalized, speculators (the only persons who should use these funds) the Funds can be a profitable, albeit a highly Risky, Tool.

5. These Funds, as de facto ‘Market Basket’ Surrogates for Sectors, allow one to minimize the (recently greatly increased) risk in investing in any one particular company. Who knows which companies have massive exposure to Toxic Derivatives which can Rapidly result in dramatically reduced share values or even in their demise. Two years ago who would have thought the Derivatives Toxin would have caused Lehman Brothers to collapse?

A list of these 300% Leverage Long and Short Funds, as well as their symbols, is contained in Deepcaster’s June, 2009 Letter available in the ‘Latest Letter’ cache at www.deepcaster.com.

II. Background and Guidelines for The Profit Strategy.

The advent of 200% and 300% Funds with the aforementioned advantages (and risks!) puts sophisticated investors and traders in a better position to benefit from the following Strategy:

- Taking advantage of Proliferating Paper. Thus far, the Lion’s Share of the benefits of the Bailouts and Stimulus legislation and actions of the Federal Reserve and Treasury, has unfortunately gone directly or indirectly to the Mega Banks, much to the detriment of the regional and smaller bankers and to typical Tax-payers/Consumers/Investors.

But A Key Fact is Ordinary Investors/Taxpayers/Consumers are 70% of the U.S. GDP. Until that massive Sector is significantly helped, there can be no long term sustainable economic recovery or market rally. We need a “Bottom Up” Recovery Strategy, because the “Trickle Down” one is doomed to fail (see “The Financial Crisis Solution” (11/26/08) in the ‘Articles by Deepcaster’ cache at www.deepcaster.com.

In this regard, consider that the Bailout Schemes and Stimulus/Spending Bills are all “funded” primarily through borrowing (by U.S. Taxpayers, from the private for-profit U.S. Federal Reserve); but it was excessive borrowing and the accompanying Toxic OTC Derivatives Creation which (and especially the employment of inadequately secured Credit Default Swaps, all encouraged by the private for-profit Fed whose policies) were the prime cause of our current crises in the first place. Yet this proliferating paper is already finding its way into the equities markets, serving as fuel for the spring and early summer Rally. Deepcaster forecasts which Sectors should be most helped by this capital infusion in his latest Letter and Alert at www.deepcaster.com.

2. Crises caused by the excessive borrowing and spending can not be cured by more borrowing and spending!

Yet, the U.S. Taxpayer is repeatedly asked to borrow, at interest, even more Trillions (which the private for-profit Fed prints for free out of thin air or with a few keystrokes) from the private for-profit Fed to fund bailouts of (mere congressmen and Taxpayers are not told which) private financial institutions. Several of these have gone on to award tens of millions in bonuses to their employees.

Perhaps the most important dangerous consequence of these Trillions in borrowing is the fact that this debt can never be repaid without destroying the U.S. Dollar in the long run, a consideration which must be addressed to achieve protection and profit. Consider the following Realities:

- The Debt Burden of the U.S. Government (and therefore the U.S. Taxpayer) burgeoned in 2008 and even more in 2009, and is still burgeoning if one counts the borrowing required to fund the government (Taxpayer) Bailouts, Guarantees, Loans and Authorizations. That Debt Burden was caused primarily by deleterious U.S. Fed policies, as we explain below and elsewhere;

In fact, the U.S. Government’s (Taxpayer’s) Debt Burden has grown far beyond its capacity ever to repay without a dramatic degradation in the purchasing power of the World’s Reserve Currency, the U.S. Dollar. That is because trillions more U.S. Dollars must be printed and borrowed by the U.S. Taxpayer from the private-for-profit U.S. Fed to meet ongoing obligations.

Of course, U.S. Taxpayers must pay “interest” to the private-for-profit U.S. Federal Reserve on those borrowings, thus further increasing the impossibly high debt burden.

Indeed, given that the present value of all the downstream-unfunded U.S. Government liabilities was (at the end of 2008) well in excess of $60 trillion, a further dramatic destruction of the purchasing power of the U.S. Dollar is “baked into the cake over the next very few years.” One of the several negative consequences of the ensuing crises will be the further impoverishment of those reliant on U.S. Dollar income - - mainly the U.S. Taxpayer/Consumer, and many investors around the world.

Thus one consequence of these Fed-facilitated credit and monetary excesses is that the economic and investment landscape has now been seriously damaged for many years to come.

- The Generator of 70% of U.S. GDP, the U.S. Taxpayer/Consumer/Debtor, is increasingly Financially Imperiled, as are small businesses Neither has been helped much by the Bailouts and Stimulus/Spending Bills.

In fact, no Lasting Remedy for the Financial and Economic Crises can be achieved unless small businesses and the typical U.S. Consumer/Taxpayer/Debtor is restored to at least some degree of economic health and is thus able to continue paying mortgage and other credit obligations. But no significant help has yet been provided to the typical Consumer/Taxpayer/Debtor or small business by the Obama Administration or The Fed and their situation is worsening daily.

Of course, as the ongoing Crises indicate, believing the claim that “The System has been saved” by the 2008 bailouts of Favored Financial Institutions is Delusional. In fact, the Bailouts have done no such thing, but have mainly served to “Save the Bacon” and/or line the pockets of the Reckless and Greedy Wealthy in certain Fed-Favored Financial Institutions.

Thus, given the continuing deteriorating health of the economy and the consumer, coupled with 20% (and increasing) Real U.S. Unemployment (see below), more defaults and a continuation of the ongoing economic and financial crises are sure to come.

Specifically, the aforementioned will continue to cause defaults in the vast ($592 Trillion see (www.bis.org) dark OTC Derivatives Markets and increasing weakness in the Economy and Equities Markets. (see below)

In sum, the deterioration of the Economy and Markets has only just begun and will likely take three to four years to bottom.

The aggregate effect is that we will be tortured by the threat of Systemic Collapse for years. Thus, the Assumption that the Strategy of investing-as-usual to “Buy and Hold” for the long-term, will generate profit will, in many cases, be an utterly false and profitless Fantasy.

- The True State of the Economy is much worse than the Official Figures suggest.

As the Real Numbers mentioned below demonstrate, our ongoing economic and financial crisis is not merely a “normal” business cycle Recession, but a System-Threatening Crisis. Indeed, we have entered into a Depression. (see below)

It is thus another Naïve and False Assumption that the Official Figures accurately reflect the state of the Economy and Markets - - for example, that the current Recession is merely a normal “business cycle” phenomenon.

Making matters worse, Investors and citizens-at-large are misled by Official Statistics which have been gimmicked, as shadowstats.com demonstrates. All of the following Genuine Numbers are calculated by shadowstats.com, which calculates them according to traditional methods used in the 1980s, and early 1990s, before The Political Adjustments currently being utilized began.

Consider the following Real Numbers from shadowstats:

U.S. Consumer Price Inflation (CPI) actually averaged about 11% annualized for much of 2008, rather than the 5% to 6% figures, which have been reported as Official Statistics. Thus, the consumer must cope with diminished purchasing power and the threat or reality of job loss.

Though Official Figures show CPI dropping to 0% in early 2009, the July 2009 report reveals that Real CPI was still about 6% annualized.

U.S. Unemployment has (according to Official Numbers) been ranging 4% to 6% from 1995 to 2007, spiking “only” to about just under 7% in late 2008 and 9.4% in mid 2009. In fact, Real U.S. Unemployment in 2009 is now about 20.6% and is still increasing. Thus the consumer (70% of U.S. GDP, we reiterate) is increasingly unemployed, under-employed, and indebted.

Indeed, regarding the gimmicked Official Unemployment numbers released August 27, 2009

“Underlying economic series, shy of the related seasonal distortions in new claims for unemployment and the ISM manufacturing index, are consistent with a monthly July jobs loss in excess of 600,000, and a further increase in the unemployment rate…

The July 2009 seasonally-adjusted U.3 unemployment rate showed a statistically-insignificant decrease, to 9.36% 0.23% (95% confidence interval), from 9.51% in June. Unadjusted U.3 held at 9.7% in July. The broader June U.6 unemployment rate eased to an adjusted 16.3% (16.8% unadjusted), from 16.5% (16.8% unadjusted) in June.

During the Clinton Administration, "discouraged workers" — those who had given up looking for a job because there were no jobs to be had — were redefined so as to be counted only if they had been "discouraged" for less than a year. This time qualification defined away the long-term discouraged workers. Adding them back into the total unemployed, unemployment in line with common experience — as estimated by the SGS-Alternate Unemployment Measure — held at about 20.6% in July.”

John Williams’ Shadow Government Statistics, Flash Update, August 7, 2009

As well, the Delusion of Economic Growth claimed by Official Statistics is just that - - a Delusion. Real GDP growth has been negative since 2004. Indeed, in mid 2009 GDP “growth” is a negative 5.9% according to the August 1, 2009. (shadowstats.com) Thus the consumer is faced with a deteriorating economy, as well as diminishing job prospects and purchasing power.

As well, the 2008 U.S, Federal Deficit, rather than being about $1 trillion as reported officially, is over $5 trillion if one includes Social Security and Medicare. And, if downstream-unfunded U.S. obligations are included, the U.S. National Debt is nearly $70 trillion and rising!

In sum, Deepcaster agrees with Shadowstats conclusion that ‘the U.S. Economy is in a Multiple-Dip Depression.”

But knowing the Real Numbers is essential to profiting and protection.

Knowing these Real Numbers facilitated Deepcaster’s recommending “Opportunities in the Impending Perfect Storm” - - the title of his early September, 2008 (pre-Crash) Article warning of the impending Crash (available in the Articles Cache at www.deepcaster.com) and his making five short (and subsequently quite profitable) recommendations to subscribers at about that time.

6. Bailout/Stimulus Realities

In the meantime however, the paper infusion of hundreds of billions of Taxpayer Funds mainly into the Globalist Mega Banks (several of whom are likely shareholders of the private for-profit Federal Reserve) can provide substantial profit opportunities for Investors.

Considering the overall situation, the trillions of U.S. Dollars in total commitments and guarantees provided by the U.S. and United Kingdom are equivalent to 90% of their GDPs. This staggering number primary reflects the magnitude of the paper provided mainly to the mega financial institutions. The trillions provided by U.S. and United Kingdom Central Banks has been widely reported.

But the fact that these Trillions have benefited primarily the Mega Financial Institutions, to the detriment of the smaller banks, Investors and Consumers who are paying for it all has been less well reported. Professor Morici’s recent article entitled “Taxing Granny to Pay Goldman Sachs” says it all.

But this Monetary and Credit Expansion Deluge does provide the Profit Opportunity we describe below. First, though we address another “Elephant in the Room.” Reality essential to understand in order to implement a successful Profit and Protection Strategy. -- OTC Dark Derivatives.

7. OTC Dark Derivatives

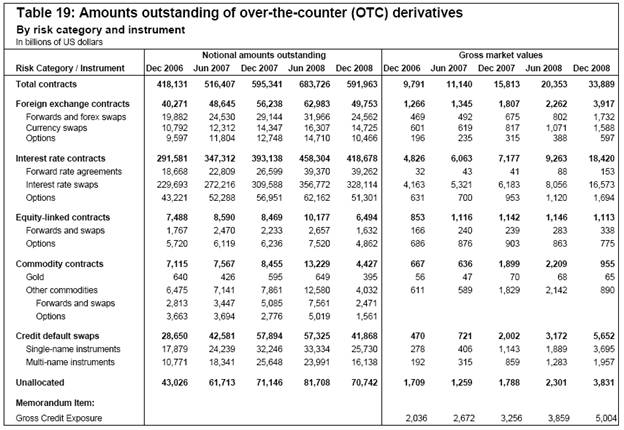

As Deepcaster has pointed out on several occasions, the explosion of over-the-counter (i.e. not exchange traded and therefore “dark”) derivatives, now total $592 Trillion, according to the last publicized accounting by the Bank for International Settlements (The Central Bankers Bank). This dwarfs the nearly $60 trillion in current notional value of Exchange Traded (i.e. publicly traded) derivatives. Taken together there are nearly three-quarters of a quadrillion in Derivatives outstanding. Note also that this “Dark” Market is ten Times larger than the public Market!

That is over ten times the amount of the entire Annual Global Product. Yet OTC Derivatives are not publicly traded. Therefore, if a substantial number of parties to those derivatives default as they began to do in 2008, we have increasing Systematic Risk.

Yet as Deepcaster pointed out in his January, 2009 Letter available at www.deepcaster.com, these derivatives and infusion of money and credit provide two significant opportunities for profit, provided one can reduce the inherent risks:

a. A chunk of the massive infusion of tremendous amount of paper into the market via the stimulus and Bailouts is available to purchase equities (witness the ongoing Bear Market Rally) and other goods (albeit not without risk). Investors can make substantial profits if their timing and Sector choices are right, and provided they take profits when they have them. This is essential given the hyperinflationary effect of the vast expansion of Money and Credit.

b. The ever-increasing notional value ($592 trillion plus as of December, 2008) of Dark Derivatives (coupled with two other interventional vehicles noted below) has for several years allowed massive ongoing Overt and Covert Market Interventions in Most Major Markets by the Fed-led Cartel* of key Central Bankers and favored financial institutions and allies. These Interventions leave “Tracks” which allows the generation of “Interventionals”. Analyzing these Interventionals’ “Tracks” is essential to successful investing and trading in today’s markets, notwithstanding a traditional reliance (still justified, except when The Interventionals override them) on fundamentals and technicals.

![]()

*We encourage those who doubt the scope and power of Overt and Covert Interventions by a Fed-led Cartel of Key Central Bankers and Favored Financial Institutions to read Deepcaster’s December, 2008 Letter containing a summary overview of Intervention entitled “A Strategy for Profiting from the Cartel’s Dark Interventions & Evolving Techniques” and Deepcaster’s July, 2009 Letter entitled "A Strategy For Profiting From The Cartel’s Dark Interventions & Evolving Techniques - II" in the “Latest Letter” Cache at www.deepcaster.com. Also consider the substantial evidence collected by the Gold AntiTrust Action Committee at www.gata.org for information on precious metals price manipulation. Virtually all of the evidence for Intervention has been gleaned from publicly available records. Deepcaster’s profitable recommendations displayed at www.deepcaster.com have been facilitated by attention to these “Interventionals.”

![]()

Thus it is appropriate to review the profit Potential inherent in monitoring the interventionals and in the massive infusion of paper into the economy.

- Overt and Covert Market Intervention and Data Manipulation by a Fed-led Cartel* of key Central Bankers and their Allies and Factota serve to hide key negative market, financial and economic realities from investors around the world much to their detriment.

The Fed-led Cartel’s Covert Interventions work to periodically take down Precious Metals prices, control the levels of Equities Markets and manipulate the price of Crude Oil and other Strategic Assets. The Cartel apparently employs at least three vehicles to conduct their Covert Market Interventions.

a. A substantial portion of the About $592 trillion in Dark OTC Derivatives positions (as of December, 2008 as reported by the BIS (www.bis.org Path: Statistics>Derivatives>Table 19)

b. The Repurchase Agreement (REPO and POMO) Pool

c.The TLSF Pool

For details on each of these three Vehicles and on this Interventional Regime in general, see Deepcaster’s December, 2008 Letter and July, 2008 Letter referred above at www.deepcaster.com.

Three (of several) key negative consequences of this Overt and Covert Interventional Regime are that:

a. It prevents genuine market forces from operating

b. It makes the financial and economic systems reliant on, and, simultaneously, vulnerable to the Cartel’s Market Intervention Regime and on gimmicked, and quite inaccurate, Official Statistics.

c. It presents a false picture of Economic and Financial Realities and prevents the Market from purging unsuccessful businesses, lightening debt burdens, and generally making wise business, financial, and political decisions, thus postponing any possible recovery for years.

However if one regularly tracks The Interventionals, as Deepcaster does, it provides one an edge in investment and Trading decisions. See Deepcaster’s Front Page (www.deepcaster.com) for details.

III. The Strategy – Guidelines for Identifying Opportunities for Profit and Protection

- Get the Real Data. As many Investors suspect, Crucial Official Government and Agency Economic and Financial Data are of questionable validity. The Data set forth above from shadowstats.com is a good starting point.

Educate yourself about the realities of the marketplace using Alternative Data Sources such as Deepcaster, Gold Anti-Trust Committee (www.gata.org), and shadowstats.com. Gathering and staying attuned to authentic information regarding the marketplace can save one much financial grief as well as positioning one for profit.

- Take Account of both Overt and Covert Cartel Intervention. Many of these same investors who suspect Official Statistics also rightly suspect that the private-for-profit U.S. Federal Reserve and/or Central Banks overtly and covertly manipulates Major Markets. But they might not be aware that covert Market Interventions and Data Manipulation are likely far more pervasive than generally believed, as detailed in Deepcaster’s articles mentioned above.

As well, such investors may not have thought systematically about how one copes with and profits from such Intervention and Data Manipulation.

Consider one example of Cartel Intervention: the Traditional and Legitimate Safe Haven from inflation, deflation, and risk, is Gold. Yet, Gold has, during the recent periods of extreme financial market turmoil, been taken down in price from its highs of over $1000/oz down to around the mid-$700 level (e.g. 2008) when it should have skyrocketed.

In early March, 2008 Gold was over $1000/oz. when the Bear Stearns Crisis revealed the fragility of the Financial System. Gold should surely have skyrocketed then. Instead, it was brutally taken down. Were its price not manipulated, Deepcaster’s view is that its price would be over $3,000.00 per ounce today.

Deepcaster and others, including the Gold AntiTrust Action Committee, have offered considerable evidence that the Cartel* of Central Bankers and Favored Financial Institutions are the culprits behind these dramatic and devastating Takedowns. See Deepcaster’s Alert of 12/25/07 “A Strategy for Profiting from Cartel Intervention in Gold, Silver, Crude Oil and Other Tangible Assets Markets” in the Alerts Cache at www.deepcaster.com.

But there is a Profitable Refuge from Market Intervention and Data Manipulation. That Profitable Refuge lies in the Strategy described in the aforementioned Alert, certain characteristics of which we outline here:

- Recognize that the “Buy and Hold” strategy rarely succeeds anymore. The Eminence Grise of Newsletter writers, Harry Schultz perhaps put it the best when he stated that “buy and hold no longer works anymore, even with Gold.” Recent Market Developments should suffice to demonstrate this principle!

- Track the Covert Interventionals as well as the Technicals and Fundamentals and Overt Interventionals. Tracking the Footprints, as it were, of the Covert Interventionals (e.g. the Repo and TSLF Pools) daily can often, but not always, give one excellent clues about The Cartel’s next likely Interventional Move - - such clues are essential to preserving wealth and making profits. Deepcaster’s tracking of The Interventionals, for example, allowed him to recommend five short positions going into September, 2008, (i.e. before the Market Crash) all of which he has subsequently recommended be profitably liquidated.

- Perhaps most important, be prepared to go both long and short Major Market Sectors - - long near the bottoms of Interim Takedowns and short near Sector Tops. The Interventionals are essential to helping identify these tops and bottoms. In Deepcaster’s view, it will be increasingly difficult to achieve a net profit for one’s portfolio if one is unwilling and/or unable to “go short” as well as “long”.

The Blossoming of the 200% 300% (and other) leveraged ‘short’ and ‘long’ ETF’s described above provide a superb opportunity to go short and long with ease, but not, as we explain above, without risk.

- Be aware of the overall Geopolitical Landscape in order to gain an adequate understanding of how that Landscape might affect the present and future direction of the Markets. It is essential that one understand the motivations of the major players in the market and the resources at their disposal.

For example, a Major Motivation of the U.S. Federal Reserve and other key Central Banks is the protection and enhancement of the legitimacy of their Treasury Securities and Fiat Currencies as Measures and Stores of Value. Therefore, one can understand that one of their Major Goals will be to attempt de-legitimize Gold, Silver and the Strategic Commodities, including especially Crude Oil, as Stores and Measures of Value. With this in mind, the periodic takedowns of Gold and Silver and, since July, 2008, of Crude Oil, become understandable. Moreover, such an insight applied daily to the market can result in a tremendous edge in understanding market performance, present and future.

Moreover, regarding the assets at The Cartel’s disposal, if one tracks the Repurchase Agreement and TSLF Pools regularly, as Deepcaster does, and is aware of the other Interventional tools that The Cartel has at its disposal, then one gains a considerable edge.

Conclusion:

The Rampant Monetary Inflation reflected in M3 and in the various bailouts and loans is measured in the trillions of Dollars. And this tremendously increased monetary base is available to temporarily inflate the paper value of the Equities and other Markets, when money managers first think the markets have a chance for a sustained (for a few months only) Rally, and, when The Cartel Interventional Regime “agrees” with them.

Thus, given that the financial system and key heavyweight investors are awash with printed and borrowed money, after a brief correction, certain Key Sectors should again explode upward until the long-term negative Economic and Financial Fundamentals drag them down again. Of course, this will not happen in one fell swoop, it will happen in Spurts, the forecast timing of which we set forth in our Latest Letter and Alerts available at www.deepcaster.com.

Caveat and Conclusion: Until demonstrated otherwise, a continuation of the recent rally is nonetheless a ‘Bear Market Rally’. Such Bear Market Rallies are treacherous and often rapidly reverse themselves, turning gains into losses. Thus, it is especially important to monitor the Interventionals, as well as the Fundamentals and Technicals, very closely!

"Note: Deepcaster provides a list of 'Frontier' ETFs, and identifies one with especially great potential, in his latest Alert, posted in the 'Alerts Cache' at www.deepcaster.com."

Source: Bank for International Settlements

www.bis.org, Path: Statistics > Derivatives > Table 19

Best regards,

By DEEPCASTER LLC

www.deepcaster.com

DEEPCASTER FORTRESS ASSETS LETTER

DEEPCASTER HIGH POTENTIAL SPECULATOR

Wealth Preservation Wealth Enhancement

© 2009 Copyright DeepCaster LLC - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

DEEPCASTER LLC Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.