Corporate Insiders Selling Stocks , Extremely Bearish

Stock-Markets / Stocks Bear Market Aug 20, 2009 - 12:51 AM GMTBy: Bob_Bronson

We are in very good company with our bearish outlook for the stock market. Insiders at companies in the aggregate are still unloading their companies’ stock at the most rapid clip at least since October 2007, when the stock market peaked and the current, as-yet unfinished, second downleg of the Supercycle Bear Market started. (endnote 1)

Insiders are those corporate officers, directors, major shareholders and others have an inside track on the future earnings outlook for their companies, as well on the relative attractiveness of the price of their companies’ stocks. Insiders’ buying and selling activity is a particularly useful market indicator over the short term (weeks) to intermediate term (months), especially when used in conjunction with other market timing indicators.

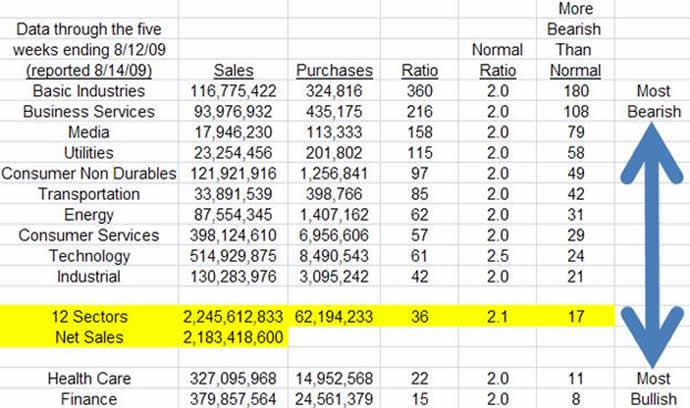

Insiders normally sell about twice as many shares as they buy, since they receive shares of stock from their employers as part of their total compensation package and need to sell in order to get at the money. However, in the five weeks ending August 12 and reported today, August 14, by the WSJ’s Market Data Center, insiders sold a whopping $2.2 billion and purchased only $62.2 million in their companies for a huge sell-to-buy ratio of 36:1, or 17 times normal (table below).

Selling to buying in technology stocks was a huge 61:1, or 24 times normal. And remember that technology stocks lead the market, so the insider selling in that sector is an extraordinarily bearish indicator for the direction of the stock market.

This latest report, which includes insider activity when the S&P 500 index made its 1018 intraday high last Friday, in itself is another major sell signal for the stock market. Taken together with the sell signals from insiders’ extremely high levels of net selling during the previous four weeks, the reconfirmation is an additional, extremely bearish signal.

Endnotes:

#1 A Supercycle Bear Market is the biggest sequence of bear markets during a Supercycle bear market period. For example, during the previous Supercycle bear market period from 1965-82, the Supercycle bear market lasted for the six years from the high point in December 1968 to the low point in December 1974. The latest one started on October 7, 1997, when money market fund returns started to sustainably outperform stocks, and exactly when we issued our call for it. Current Stock Market Rally Within Supercycle Stocks Bear Market

A Bronson Asset Allocation Cycles (BAAC) Supercycle Bear Market period is a 12- to 20-year period of underperformance during which bear markets, anticipating economic recessions, as well as the recessions themselves typically are at least twice as frequent and twice as severe in magnitude and duration as during Supercycle Bull Market Periods. Such a period begins when the return on money market funds sustainably exceeds the total return on equities, especially when downside-volatility-risk is taken into account. Further details are found in our research paper, “Bronson Asset Allocation Cycles,” available on request.

By Bob Bronson Bronson Capital Markets Research bob@bronsons.com

Copyright © 2009 Bob Bronson. All Rights Reserved Bob Bronson 's 40-year career in the financial services industry has spanned investment research, portfolio management, financial planning, due diligence, syndication, and consulting. At age 23, he and his partner founded an investment research firm for institutional clients and were among the first to use mainframe computers for investment research, especially in the areas of alpha-beta analysis and risk-adjusted relative strength stock selection. Since 1967, he has served as an investment strategist and consultant to various investment advisory firms and is the principal of Bronson Capital Markets Research. If you wish to read more, read his BIO

A note to visitors ~ We do not have a website, but we maintain a private e-mail list. I'm also often asked why we provide research and forecast information for free. Since we are not looking for new business from the internet, I periodically post some of our research and forecasts in exchange for feedback from others. And since we don't publish in academic or industry trade journals, such internet discussion gives us as much peer review as we want and can conveniently assimilate at this time.

Also, the few archiving discussion boards in which I have the time to participate give us new ideas and allow us to establish and maintain intellectual property copyrights for our proprietary research, and to establish a verifiable forecasting record. At the same time, we are able to publicly document our forecasts and help others who otherwise don't have access to our work.

To be added to our private e-mail list, we only ask that you periodically provide feedback: questions, comments and/or constructive criticism to keep our research work and forecasts as error-free, readily comprehensible and topically relevant as possible. If you would like to be added, please explain, at least briefly, what you do, since our e-mailing list is categorized by the backgrounds of the recipients.

Robert E. Bronson, III Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.