Stocks Bear Market Fractal Encouragement

Stock-Markets / Stocks Bear Market Aug 23, 2009 - 12:37 PM GMTBy: Adam_Brochert

It's gotten mighty lonely in the bear camp and the bulls have certainly had their way with the bears since the March 2009 lows. It has been a rally for the ages and the subsequent pending drop will also have this distinction. In looking through a long-term chart of the Dow Jones Industrial Average, I found an encouraging fractal pattern for the current bear market rally. Markets don't repeat precisely, but they do rhyme.

It's gotten mighty lonely in the bear camp and the bulls have certainly had their way with the bears since the March 2009 lows. It has been a rally for the ages and the subsequent pending drop will also have this distinction. In looking through a long-term chart of the Dow Jones Industrial Average, I found an encouraging fractal pattern for the current bear market rally. Markets don't repeat precisely, but they do rhyme.

The number of people calling for a new bull market, saying the recovery is upon us and saying that the stock market "sees" a future recovery and is discounting it is funny to me. Funny in a sad way, because I know what comes next and how upset many retail investors are going to be in a few short months. I have taken my licks and learned a lot about trading bear market rallies over the past few months, to be sure. Mr. Market never fails to humble.

But to say that this bear market is over is ridiculous in my opinion. Granted, when trading short term it really doesn't matter whether we are in a bull or bear market, it matters if you get the short-term trend right and trade it effectively. But there is a longer-term investment horizon that is of great concern to me as well, which is why I made the decision to buy physical Gold and sit this one out with a large portion of my savings.

Until the Dow to Gold ratio is back to 2 or less, general stocks are a TERRIBLE longer term investment. Though this ratio has come a long way since its peak in the 40s around the turn of the century, it has a long ways to go with the current ratio sitting around 10. In other words, if one ignores the intermediate-term swings, those who hold physical Gold will be able to buy 5-20 times the number of stocks (using the Dow as a proxy) in a few short years relative to today, using the rational assumption that the Dow to Gold ratio will bottom between 0.5 and 2.

I choose Gold over fiat currencies because it is stable and predictable, unlike the actions of governments and the apparatchiks who run them. Those who think Gold is no longer money will change their minds over the next decade, when Gold is used to re-liquefy the system and restore the confidence lost due to over-subscribed and over-issued hollow paper promises. It's Gold versus paper and Gold will win during this business cycle (paper won the 1980-2000 cycle and Gold will win in the 2000-(?)2015(?) cycle).

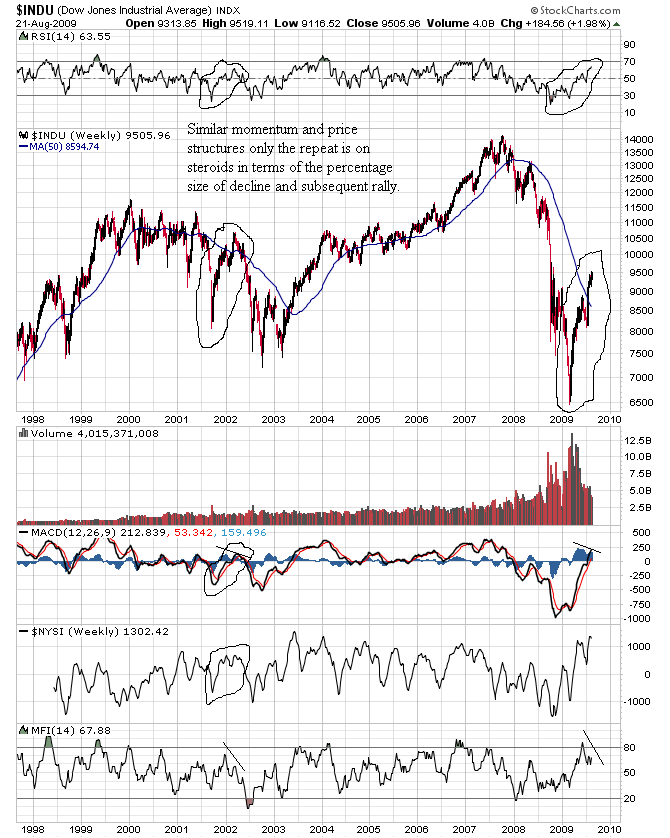

Anyhoo, back to the fractal pattern in the Dow. We need only turn to the last cyclical bear market from the early 2000s to get a similar appearance of a bear market rally. Here it is in context, using a 12 year weekly log scale chart:

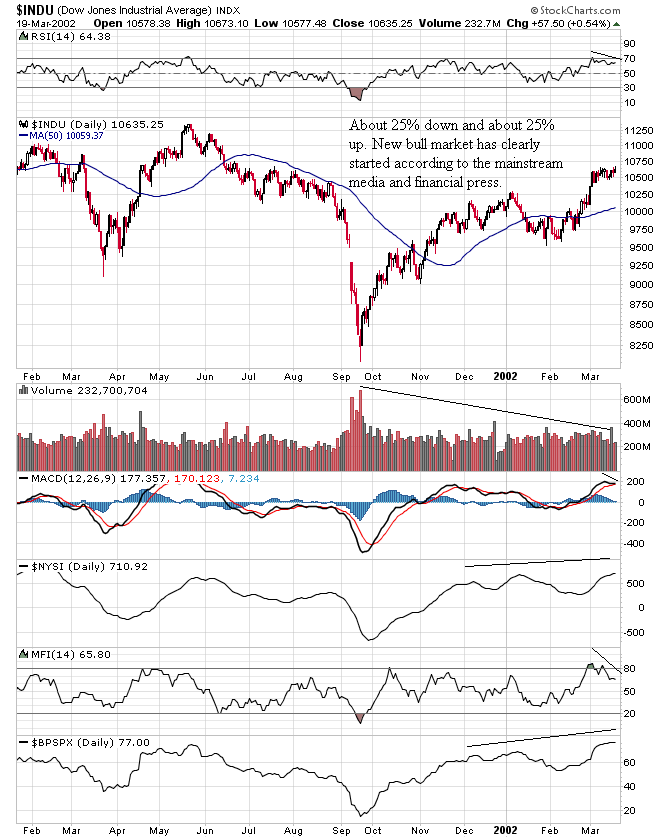

As a close-up, here's the daily chart of the action in the Dow during the 2001-2002 time up to the day of the high for this bear market rally:

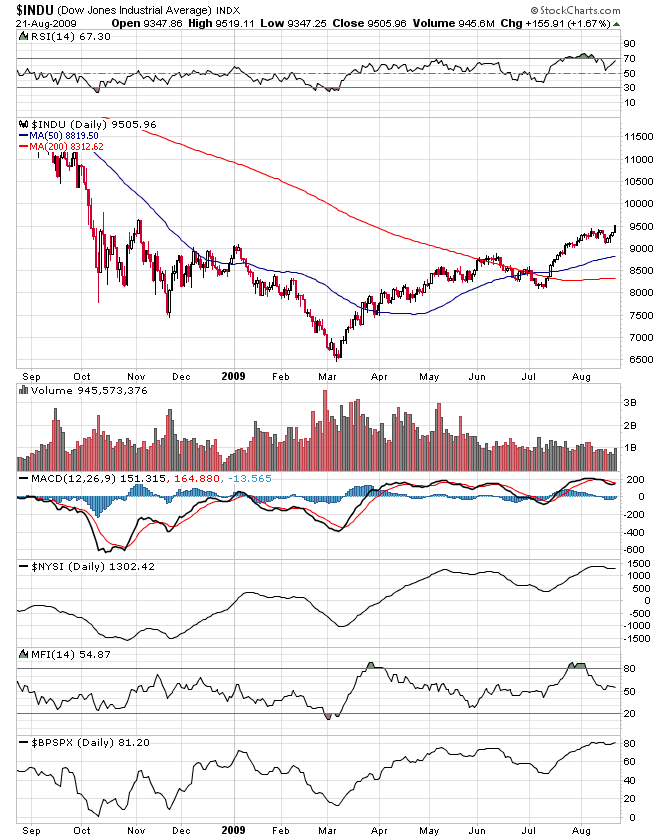

And here's a current 1 year daily chart of the Dow Jones Industrial Average:

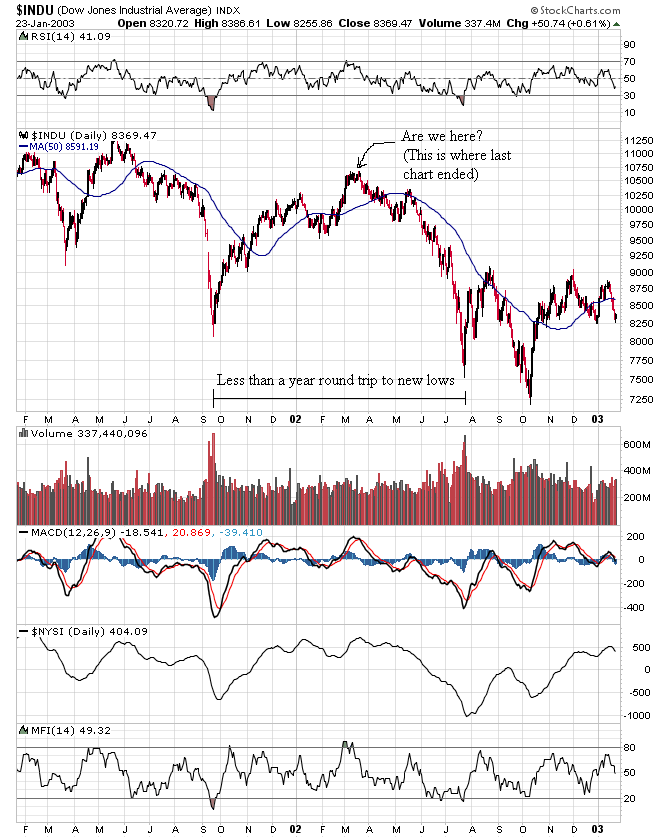

And, of course, the obligatory chart of what came next back in 2002 on a daily chart:

I, for one, don't intend to lose the forest through the trees here. Just as bear market rallies are fast and furious, so are the subsequent declines. You don't start new bull markets with trailing 12 month PE ratios over 120 during the middle of a housing market crash and banking system collapse (and no, neither one of these trends is close to being over). Even general stock puts and shorts initiated at the June highs with an eye towards the long term will look good 6 months from now.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be relia

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.