The War Over the U.S. Dollar Versus Gold

Currencies / US Dollar Oct 26, 2009 - 09:12 AM GMTBy: Clif_Droke

A fierce war of words has erupted in recent weeks between the two major camps in monetary circles. The first camp – the gold bulls/dollar bears – have been loudly voicing their twin belief that the gold price is poised to skyrocket while the dollar price is perched for a collapse. The other side – the gold bears/dollar bulls – are making the counter claim the gold price is setting up for a crash.

A fierce war of words has erupted in recent weeks between the two major camps in monetary circles. The first camp – the gold bulls/dollar bears – have been loudly voicing their twin belief that the gold price is poised to skyrocket while the dollar price is perched for a collapse. The other side – the gold bears/dollar bulls – are making the counter claim the gold price is setting up for a crash.

Both sides have spared no expense in trying to convince the investing public of the merits of their respective arguments. In just the past couple of weeks I’ve received in the mail two elaborate promotional campaigns for financial advisory services. One of those packages contained on the outside envelope following warning: “ALERT: Dollar Crash Looms! Your Last Chance to Evacuate the Greenback Before the Stampede Begins.” The other package contained the following words on the envelope: “Shocking report reveals why GOLD is about to CRASH, not soar. Savvy traders are about to make a fortune SELLING gold to millions of panicking investors.”

Of these two promotionals, I received in the span of two weeks two copies of the mailing alerting of the dollar crash. I can only surmise that this particular mailing “pulled” very well for the publisher and probably for good reason: the public fears a dollar collapse much more than a gold crash. According to one sentiment poll mentioned on CNBC recently, nearly 98 percent of all respondents were bearish on the U.S. dollar. Assuming this figure is anywhere near accurate, this has to be an all-time record for bearish sentiment on the greenback.

Before we examine the claim of the “coming gold crash,” let’s examine the dollar crash scenario. Is it possible that the “powers that be” would allow the mighty greenback to cascade to new depths, eroding purchasing power for millions of Americans in the process? After all, no government has ever outlived its currency. Why would the federal government allow the dollar’s value to be sabotaged at the expense of its own survival? The possibility of an outright dollar implosion must therefore be seen as a slender one.

There is another train of thought espoused by some that a slow, steady decline of the dollar’s exchange value, rather than being a catastrophic event, is actually good for the U.S. David Jennett, editor of the Investment Letter, is an advocate of this theory. He writes, “Far from being a sign that things are heading for a disastrous crash, the weaker dollar is a sign that American manufacturers will once again be given a fair chance to prove to the world that they are a low cost, high quality producer.”

Echoing this sentiment, Adrian Van Eck writes in the October issue of his Money Forecast Letter, ““There is, I admit, a measure of national pride when the dollar is treated as the king of the business and financial world. There was a dollar rally during the [2008] crash, but now you can see the dollar is falling again. That allows U.S.-based producers to win orders around the globe based on quality and not a message of cheap prices.”

Even within the gold community there are some who don’t buy into the “dollar crash now!” scenario. In an interview I conducted recently with James Hesketh, President and CEO of Atna Resources, a Colorado-based gold production and exploration company, Hesketh said, “The gold price is pushing the limits to new highs on the back of a weakening U.S. dollar. At some point here the Treasury and the Federal Reserve will have to step in and support the dollar. They’re basically throwing the dollar under the bus, so to speak. Our continued deficits will continue to weaken the dollar. Effectively what they’re doing is devaluing the savings of every person in this country. And that is not something that cannot continue to go on indefinitely, so they will have to take moves to both tighten the belt and support the dollar. And that will stop the advance of gold when that happens.” He adds, however, that there “doesn’t appear at this point in time that there’s any political will to make those moves.” Hesketh foresees “if not a continued strengthening then a stabilization [of the gold price’ at these levels.”

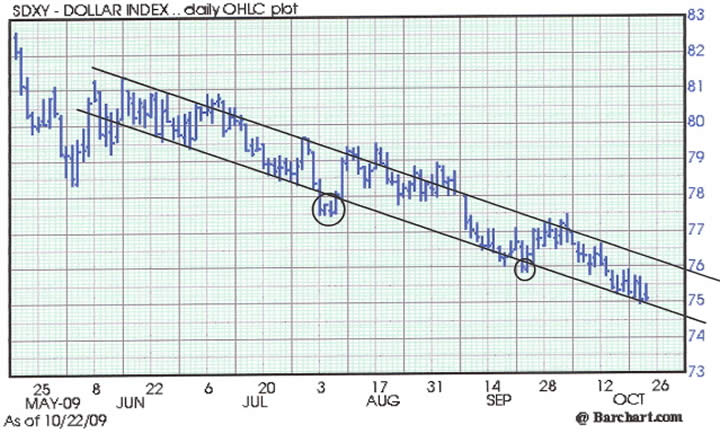

From a short-term technical standpoint we can see in the daily charts of both the dollar index and the gold futures price a potential juncture in the making. The dollar index is testing the lower boundary of a downtrend channel as shown below. The dollar is hugging the lower channel boundary and threatening to break under it. If this happens, though, it will create a “channel buster” which in turn will set up a potentially sharp rally. The previous two breaks below the lower channel boundary in August and September (circled) produced just such a snap-back, albeit a temporary one. A third “channel buster” below the downtrend channel would probably create an even bigger snap-back, especially given the overcrowded nature of the dollar bear related trades.

The gold price, on the other hand, is testing the extreme upper limit of an accelerating uptrend channel that has been in force since July. The attempt of the gold price to break out above the upper channel boundary is an upside “channel buster.” These patterns often result in an overextended price and tend to create at least a temporary exhaustion of the uptrend, rendering the price vulnerable to a correction. Gold hasn’t had a worthwhile correction in some time, so any further attempt at rallying above the trend channel upper boundary would provide the pretext for a correction.

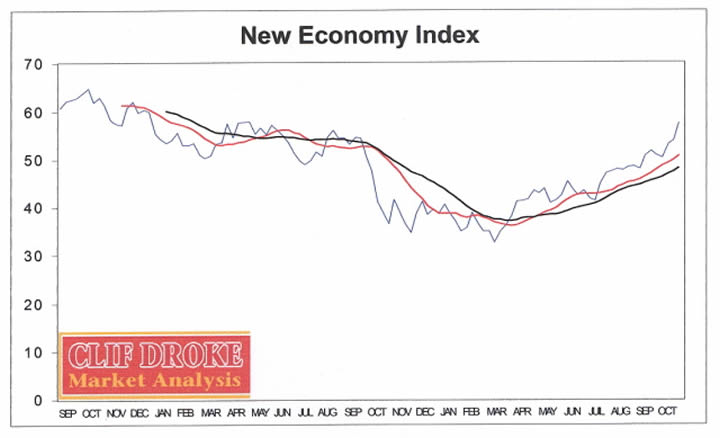

Turning aside from the dollar, another area in which there seems to be a consensus concerns the state of the economy. Apprehension over the state of the financial markets have clearly spilled over into the economic outlook. But are these fears founded? In an earlier commentary we looked at the New Economy Index (NEI), which provided some hope for a positive retail sales outlook for the all-important months of November and December. In spite of the internal weakness in some area of the market, the NEI actually strengthened this week as one of the components of this index, Amazon.com, exploded to a new recovery high. In doing so it pushed the weekly NEI reading to its highest level for the year. As previously discussed, the NEI directional trend tends to lead retail economic performance by 2-4 months. A stronger than expected retail sales for this holiday season is therefore anticipated. The most salient implication of this year’s stock market recovery is the potential for economic recovery, intermediate-term. Lest we forget the old bromide: the stock market leads economic performance by 6-9 months on average. I don’t expect this time to be the exception to this rule.

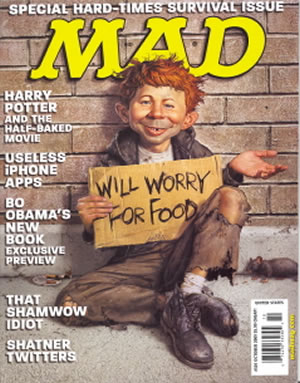

At a bookstore last week I saw someone I haven’t seen in years: Alfred E. Neuman! I couldn’t resist buying the latest issue of MAD magazine because of the cover. It shows Alfred clothed in rags and holding a cardboard sign that reads, “Will Worry For Food.”

This magazine cover perfectly encapsulates the widespread fear over the economy and is an indicator all on its own. As someone once said, when a financial or economic trend finds its way into the comics, the trend has just about played itself out.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.