Jeremy Grantham, Stock Markets Being Silly Again

Stock-Markets / Stocks Bear Market Nov 03, 2009 - 11:46 AM GMTBy: John_Mauldin

My long time readers are familiar with Jeremy Grantham of GMO as I quote him a lot. He is one of the more brilliant and talented value managers (and I should mention very successful on behalf of his clients). He writes a quarterly letter which I regard as a must read. I have excerpted parts of his recent letter, where the chief investment strategist really takes the current financial system follies to task. Typical of his great writing and thinking is the quote from this week's Outside the Box selection:

My long time readers are familiar with Jeremy Grantham of GMO as I quote him a lot. He is one of the more brilliant and talented value managers (and I should mention very successful on behalf of his clients). He writes a quarterly letter which I regard as a must read. I have excerpted parts of his recent letter, where the chief investment strategist really takes the current financial system follies to task. Typical of his great writing and thinking is the quote from this week's Outside the Box selection:

"I can imagine the company representatives on the Titanic II design committee repeatedly pointing out that the Titanic I tragedy was a black swan event: utterly unpredictable and completely, emphatically, not caused by any failures of the ship's construction, of the company's policy, or of the captain's competence. "No one could have seen this coming," would have been their constant refrain. Their response would have been to spend their time pushing for more and improved lifeboats. In itself this is a good idea, and that is the trap: by working to mitigate the pain of the next catastrophe, we allow ourselves to downplay the real causes of the disaster and thereby invite another one. And so it is today with our efforts to redesign the financial system in order to reduce the number and severity of future crises."

You can get the full letter at www.gmo.com (You will have to register).

Your glad to be back home at least for a week,

John Mauldin, Editor

Just Desserts and Markets Being Silly Again

by Jeremy Grantham

Just Desserts

I can't tell you how surprised, even embarrassed I was to get the Nobel Prize in chemistry. Yes, I had passed the dreaded chemistry A-level for 18-year-olds back in England in 1958. But did they realize it was my third attempt? And, yes, I will take this honor as encouragement to do some serious thinking on the topic. I will also invest the award to help save the planet. Perhaps that was really the Nobel Committee's sneaky motive, since there are regrettably no green awards yet. Still, all in all, it didn't seem deserved. And then it occurred to me. Isn't that the point these days: that rewards do not at all reflect our just desserts? Let's review some of the more obvious examples.

1. For Missing the Unmissable

Bernanke, the most passionate cheerleader of Greenspan's follies, is picked as his replacement, partly, it seems, for his belief that U.S. house prices would never decline and that at their peak in late 2005 they largely just reflected the unusual strength of the U.S. economy. As well as missing on his very own this 3-sigma (100-year) event in housing, he was completely clueless as to the potential disastrous interactions among lower house prices, new opaque financial instruments, heroically increased mortgages, lower lending standards, and internationally networked distribution. For these accumulated benefits to society, he was reappointed! So, yes, after the fashion of his mentor, he was lavish with help as the bubble burst. And how can we so quickly forget the very painful consequences of the previous lavishing after the 2000 bubble? Rewarding Bernanke is like reappointing the Titanic's captain for facilitating an orderly disembarkation of the sinking ship (let's pretend that happened) while ignoring the fact that he had charged recklessly through dark and dangerous waters.

2. The Other Teflon Men

Larry Summers, with a Financial Times bully pulpit, had done little bullying and blown no warning whistles of impending doom back in 2006 and 2007. And, famously, in earlier years as Treasury Secretary he had encouraged (I hope inadvertently) wild and reckless financial behavior by helping to beat back attempts to regulate some of the new and most dangerous instruments. Timothy Geithner, in turn, sat in the very engine room of the USS Disaster and helped steer her onto the rocks. And there are several others (discussed in the 4Q 2008 Letter). You know who you are. All promoted!

3. Misguided, Sometimes Idiotic Mortgage Borrowers

The more misguided or reckless the borrowers, the more determined the efforts to help them out, it appears, although it must be admitted these efforts had limited effect. In comparison, those who showed restraint and either underhoused themselves or rented received not even a hint of help. Quite the reverse: the money the more prudent potential buyers held back from housing received an artificially low rate. In effect, the prudent are subsidizing the very same banks that insisted on dancing off the cliff into Uncle Sam's arms or, rather, the arms of the taxpayers - many of whom rent.

4. Reckless Homebuilders

Having magnificently overbuilt for several years by any normal relationship to the population, we have decided to encourage even more homebuilding by giving new house buyers $8,000 each. This cash comes partly from the pockets of prudent renters once again. This gift is soon, perhaps, to be extended beyond first-time buyers (for whom everyone with a heart has a slight sympathy) to any buyers, which would be blatant vote-buying by Congress. So what else is new?

5. Over-spenders and Under-savers

To celebrate the overwhelming consensus among economists that U.S. individuals have been dangerously overconsuming for the last 15 years, we have decided to encourage consumption and penalize savers by maintaining the aforementioned artificially low rates, which beg everyone and sundry to borrow even more. The total debt to GDP ratio, which under our heroes Greenspan and Bernanke rose from 1.25x GDP to 3.25x (without even counting our Social Security and Medicare commitments), has continued to climb as growing government debt more than offsets falling consumer debt. Where, one wonders, does this end, and with how much grief?

6. Banks Too Big to Fail

Here we have adopted a particularly simple and comprehensible policy: make them bigger! Indeed, force them to be bigger. And whatever you do, don't have any serious Congressional conversation about breaking them up. (Leave that to a few journalists and commentators. Only pinkos read pink newspapers anyway!) This is not the first time that a cliché has triumphed. This one is: "You can't roll back the clock." (See this quarter's Special Topic: Lesson Not Learned: On Redesigning Our Current Financial System.)

7. Over-bonused Financial Types

Just look at Goldman's recent huge "profits," two-thirds of which went for bonuses. It is now estimated that this year's bonus pool will be plus or minus $23 billion, the largest ever. Less than a year ago, these same guys were on the edge of a run on the bank. They were saved only by "government" - the taxpayers' supposed agents - who decided to interfere with the formerly infallible workings of capitalism. Just as remarkably, it is now reported that remuneration for the entire banking industry may be approaching a new peak. "Well, we got rid of some of those pesky competitors, so now we can really make hay," you can almost hear Goldman and the others say. And as for the industry's concern about the widespread public dismay, even disgust, about excessive remuneration (and, I would add, plundering of the shareholders' rightful profits)? Fuhgeddaboudit! In the thin book of "lessons learned," this one, like most of our other examples, will not appear.

8. Overpaid Large Company CEOs

Even outside the financial system, there are many painfully obvious unjust desserts in the form of top management rewards. And most of the excessive rewards come out of the pockets of our clients and other stockholders, which is particularly galling. When I arrived in the States in 1964, the ratio of CEO pay to the average worker was variously reported to be between 20/1 and 40/1. This seemed perfectly respectable and had held for the previous 30 years. By 2006, this ratio had exploded to between 400/1 and 600/1, which can only be described as obscene. The results certainly don't suggest such high rewards: a) 10-year stock market returns are close to zero in real terms; and b) U.S. GDP growth has finally slipped below its 100-year trend of 3.5%. After deducting the effect of the rampant increase in the financial system, the growth in GDP ex-finance has fallen to 3.1% since 1982 and well below 3% since 2000, all measured to the end of 2007 to avoid the recent crisis. The corporate system, to be frank, seemed to run faster and more efficiently back in the 1960s before CEOs and financial types began to gobble up other people's lunches. I suppose I have done my share of gobbling. But, it still ain't right!

9. Holders of the Stocks of Ridiculously Overleveraged and Wounded Corporations

Yes, I admit this is part envy and part hindsight investment regret. But, really, our financial leaders so overstimulated the risk-taking environment that junky, weak, marginal companies and zombie banks produced a record outperformance (the best since 1933) of junk over the great blue chips. (Ouch!) In a world with less moral hazard, which would be a world of just, although painful desserts, scores of these should-be-dead companies would be. As it is, they live to compete against the companies that actually deserve to be survivors. Excessive bailouts are just not healthy for the long-term well-being of the economy.

10. The Well-managed U.S. Auto Industry

While firms in other industries fail and their workers look for new jobs, the auto industry is rewarded by direct subsidized loans, governmental arm-twisting of creditors forced to settle far below their legal rights, and direct subsidies for their products. All of this for their well-deserved ranking as the most short-sighted industry of the last 20 (40?) years, and one of the worst managed.

11. The World's Most Over-vehicled Country

We chew up a dangerously large amount of Middle Eastern oil (and oil desperately squeezed from Canadian tar sands), which is ruinous for our globalpolitical well-being (and ability to avoid war) and also not so good for an overheating world. So the answer must be to subsidize more car purchases, and when the subsidies run out, you can have all the fun again. Good long-term thinking!

12. Stock Options

This, of course, is the crème de la crème of unjust desserts. Recent practices have basically been a legalized way to abscond with the stockholders' equity. So if the stock price crashes, perhaps with considerable help from management, that's all right - just rewrite the options at the new low prices. There has been no serious attempt to match stock option rewards (or total financial rewards for that matter) to the building of long-term franchise value. Instead, the motto is: grab it now and run! You can fill in your own favorite anecdotes here - there are so many of them!

13. Finally, Just in Case You've Forgotten, We Have My Old Nemesis, Greenspan

Alan Greenspan receives the title of Maestro in the U.S. and is knighted by the Queen for thoroughly demolishing the integrity of the U.S. financial system. He overtly ignored the great threat of bubbles in asset classes and, in fact, encouraged them. He Ayn Rand-ishly facilitated the progressive dismantling of governmental restrictions on financial behavior, he deliberately kept real interest rates at zero for years, etc., etc., etc. You have heard it before. Now, remarkably, in his very old age he has become imbued with the spirit of Hyman Minsky: "Unless somebody can find a way to change human nature, we will have more crises." Now he finally gets it. Too late! In his merely old age, he ignored or abhorred Minsky, and consistently behaved as though markets were efficient and the players were honest and sensible at all times. But for all of the egg on his face, the Maestro continues to consult with the rich and famous, considerably to his financial advantage. In the good old days, he would have been set in the village stocks, and not the kind you buy and sell. And I would have been right there, Alan, with very ripe tomatoes.

The Last Hurrah and Markets Being Silly Again

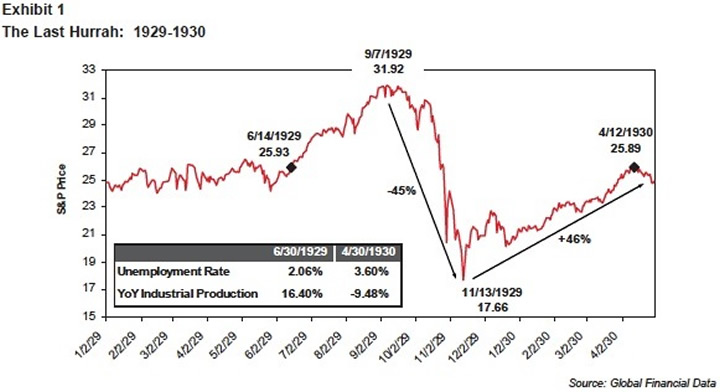

The idea behind my forecast six months ago was that regardless of the fundamentals, there would be a sharp rally.1 After a very large decline and a period of somewhat blind panic, it is simply the nature of the beast. Exhibit 1 shows my favorite example of a last hurrah after the first leg of the 1929 crash.

After the sharp decline in the fall of 1929, the S&P 500 rallied 46% from its low in November to the rally high of April 12, 1930. It then, of course, fell by over 80%. But on April 12 it was once again overpriced; it was down only 18% from its peak and was back to the level of June 1929. But what a difference there was in the outlook between June 1929 and April 1930! In June, the economic outlook was a candidate for the brightest in history with effectively no unemployment, 5% productivity, and over 16% year-over-year gain in industrial output. By April 1930, unemployment had doubled and industrial production had dropped from +16% to -9% in 5 months, which may be the world record in economic deterioration. Worse, in 1930 there was no extra liquidity flowing around and absolutely no moral hazard. "Liquidate the labor, liquidate the stocks, liquidate the farmers"2 was their version. Yet the market rose 46%.

How could it do this in the face of a world going to hell? My theory is that the market always displayed a belief in a type of primitive market efficiency decades before the academics took it up. It is a belief that if the market once sold much higher, it must mean something. And in the case of 1930, hadn't Irving Fisher, arguably the greatest American economist of the century, said that the 1929 highs were completely justified and that it was the decline that was hysterical pessimism? Hadn't E.L. Smith also explained in his Common Stocks as Long Term Investments (1924) - a startling precursor to Jeremy Siegel's dangerous book Stocks for the Long Run (1994) - that stocks would always beat bonds by divine right? And there is always someone of the "Dow 36,000" persuasion higher prices in previous peaks must surely have meant something, and not merely have been unjustified bubbly bursts of enthusiasm and momentum.

Today there has been so much more varied encouragement for a rally than existed in 1930. The higher prices preceding this crash (that were far above both trend and fair value) had lasted for many years; from 1996 through 2001 and from 2003 through mid-2008. This time, we also saw history's greatest stimulus program, desperate bailouts, and clear promises of years of low rates. As mentioned six months ago, in the third year of the Presidential Cycle, a tiny fraction of the current level of moral hazard and easy money has done its typically great job of driving equity markets and speculation higher. In total, therefore, it should be no surprise to historians that this rally has handsomely beaten 46%, and would probably have done so whether the actual economic recovery was deemed a pleasant surprise or not. Looking at previous "last hurrahs," it should also have been expected that any rally this time would be tilted toward risk-taking and, the more stimulus and moral hazard, the bigger the tilt. I must say, though, that I never expected such an extreme tilt to risk-taking: it's practically a cliff! Never mess with the Fed, I guess. Although, looking at the record, these dramatic short-term resuscitations do seem to breed severe problems down the road. So, probably, we will continue to live in exciting times, which is not all bad in our business.

Lesson Not Learned: On Redesigning Our Current Financial System

I can imagine the company representatives on the Titanic II design committee repeatedly pointing out that the Titanic I tragedy was a black swan event: utterly unpredictable and completely, emphatically, not caused by any failures of the ship's construction, of the company's policy, or of the captain's competence. "No one could have seen this coming," would have been their constant refrain. Their response would have been to spend their time pushing for more and improved lifeboats. In itself this is a good idea, and that is the trap: by working to mitigate the pain of the next catastrophe, we allow ourselves to downplay the real causes of the disaster and thereby invite another one. And so it is today with our efforts to redesign the financial system in order to reduce the number and severity of future crises.

After a crisis, if you don't want to waste time on palliatives, you must begin with an open and frank admission of failure. The Titanic, for example, was just too big and therefore too complicated for the affordable technology of its day. Given White Star Line's unwillingness to spend, she was under-designed. The ship also suffered from agency problems: the passengers bore the risk of unnecessary speed and overconfidence in "too big to sink!" while the captain stood to be rewarded for breaking the speed record. No captain is ever rewarded for merely delivering his passengers alive. Greenspan, nearly 100 years later in his short-lived "irrational exuberance" phase, did not enjoy being metaphysically slapped by the Senate Subcommittee for threatening the then speedy progress of the economy. What is needed in this typical type of agency problem is for the agent on those rare occasions when it really matters, whether a ship's captain or a Fed boss, to stop boot licking and say, "No, this is wrong. It is just too risky. I won't go along."

We have a once-in-a-lifetime opportunity to effect genuine change given that the general public is disgusted with the financial system and none too pleased with Congress. I have no idea why the current administration, which came in on a promise of change, for heaven's sake, is so determined to protect the status quo of the financial system at the expense of already weary taxpayers who are promised only somewhat better lifeboats.

It is obvious to most that there was a more or less complete failure of our private financial system and its public overseers. The regulatory leaders in particular were all far too captured and cozy in their dealings with reckless and greedy financial enterprises. Congress also failed in its role. For example, it did not rise to the occasion to limit the recklessness of Fannie and Freddie. Nor did it encourage the regulation of new financial instruments. Quite the reverse, as exemplified by the sorry tale of CFTC Chairman Brooksley Born's fight to regulate credit default swaps.

But, at least now, Congress seems to realize the problem: the current financial system is too large and complicated for the ordinary people attempting to control it. Even Barney Frank, were he on his death bed, might admit this; and most members of Congress know that they hardly understand the financial system at all. Many of the banks individually are both too big and so complicated that none of their own bosses clearly understand their own complexity and risk taking. The recent boom and the ensuing crisis are a wonderfully scientific experiment with definitive results that we are all trying to ignore. And, except for bankers, who have Congress in an iron grip, we all want and need a profound change. We all want smaller, simpler banks that are not too big to fail. And we can and should arrange it!

Step 1 should be to ban or spin off that part of the trading of the bank's own money that has become an aggressive hedge fund. Proprietary trading by banks has become by degrees over recent years an egregious conflict of interest with their clients. Most if not all banks that prop trade now gather information from their institutional clients and exploit it. In complete contrast, 30 years ago, Goldman Sachs, for example, would never, ever have traded against its clients. How quaint that scrupulousness now seems. Indeed, from, say, 1935 to 1980, any banker who suggested such behavior would have been fired as both unprincipled and a threat to the partners' money. I, for one, saw Goldman in my early days as a surprisingly ethical firm, at worst "long-term greedy." (This steady loss of the old partnership ethic is typically underplayed in descriptions of Goldman.) Today, Goldman represents a potential hedge fund trade as being attractive precisely because they themselves have already chosen to do it. These days, all - or almost all - large banks do proprietary trading that is pure hedge fund in nature. Indeed the largest bank, Citi (owned by us taxpayers), is gearing up to substantially increase its aggressive prop trading as I write. ("No, no, we're not!")

Some insiders have argued that we should not worry about prop trading because they claim it did not play an important part in the recent crisis. I think this is completely wrong for it misses the very big picture. Prop trading can easily introduce an aggressive hedge-fund type mentality into the very hearts of what ideally should be conservative, prudent - even boring - banks. This hedge fund mentality became a dominant organizing principle, particularly with respect to compensation practices. It encouraged personal aspirations over corporate goals and invited bonus-directed behavior at the clients' expense and ultimately, as we have seen, at the taxpayers' expense to rid itself of this problem. All Congress has to overcome is the lobbying power and campaign contributions of the finance industry itself, which I admit is no small feat. In a bank with a hedge fund heart, you can't reasonably expect ethical or non-greedy behavior, and you haven't seen it.

Of course, commercial and investment banks need to invest their own capital. They probably should have the right to do genuine hedging against investments that flow naturally from their banking business. As for the rest, they could easily be required either to limit the leverage used on prop desk trading or to be restricted to investing in government paper and, at the very least, play by the same rules as other hedge funds. What they certainly should insurance, as is now the case.

In the early 1930s, following the famous Pecora hearings, the conflict of interest between the management of other people's money as fiduciary and the business of dealing and underwriting in securities was considered so inimical to the public interest that Congress almost compelled separation of proprietary trading and client trading. Close, but no cigar. Instead, Glass-Steagall made the probably less useful step of separating commercial and investment banking. Unfortunately, they left intact the obvious conflict between the banks' managing their own money and simultaneously that of their clients. We now have a unique opportunity to revisit this matter.

(As we ponder the problem of prop trading, let us consider Goldman's stunning $3 billion second quarter profit. It appeared to be almost all hedge fund trading. Be aware also that this $3 billion is net of about $6 billion reserved for future bonuses. Goldman's CEO had, in fact, the interesting job of deciding how much of this $9 billion profit would be arbitrarily awarded to shareholders. [In this case, one-third. Could be worse!] This means that they extracted every penny of $9 billion from a fragile financial system. "Good for them," you may say, and they indeed are very smart. But surely they should not have been insured against failure by us taxpayers! Remember, they are now also a commercial bank yet very, very little of their $9 billion came from making loans. Three months later their bonus pool for the year is estimated to be a new record at $29 billion. And the whole banking industry is back to a new record for remuneration. How resilient! How remarkable! How basically undesirable for our economy!)

In Step 2, the Justice Department, together with Congressional and other advisors, should be invited to develop a special set of rules for the banking industry that recognizes the moral hazard of "too big to fail." If really too big to fail, banks should be divided by Justice into manageable, smaller pieces that can indeed be allowed to fail. With these two steps and possibly with an intelligent son of Glass-Steagall, the deed would be done! Regulators would have a fighting chance of being able to regulate, unlike their recent woeful past. If an angel appeared, waved his wings and, lo, it was so, almost every single Congressman would sigh with relief.

The separation of commercial banking from investment banking is not as vital as the removal of prop desk complicated enterprises both smaller and simpler, which characteristics I for one believe are probably essential if we are to avoid further disasters. So what is the problem? The argument against all major changes, without at least some of which we will soon surely be back in another crisis, is always the same. "Oh, you can't roll back the clock." But, even repeated twice before every breakfast, it is not persuasive. Why exactly can't you roll back the clock? We did it once before and, although it was very imperfect and probably missed the central point of conflict of interest, it still produced an improved system that was successful enough for 50 years. In general, countries with simpler and less aggressive banks have had much less pain in the recent crisis while we were pawning the Crown Jewels - sorry, the Federal Jewels - to bail out aggressive bankers who were out of their depth in the new complexities.

Step by step, even as the complexity grew, our regulatory leaders enabled systemic risk to grow. They continued to push the boundaries for banks by allowing more leverage, new instruments, and less control. The details are familiar. All this was done in the name of untrammeled, unfettered capitalism, and almost all of it was a bad idea.

"Oh!" say the bankers, "If we become smaller and simpler and more regulated, the world will end and all serious banking will go to London, Switzerland, Bali Hai, or wherever." Well, good for those other places. If that means they will have knee-buckling, economy cracking, taxpayer-impoverishing meltdowns every 15 years and we will be left looking like a boring back water, that sounds fine to me. Remember, just like our investment management branch of the financial system, banking creates nothing of itself. It merely facilitates the functioning of the real world.

Yes, of course every country needs a basic financial system to function effectively with letters of credit, deposits, and check writing facilities, etc. But as you move beyond that it is worth remembering that every valued job created by financial complexity is paid for by the rest of the real economy, and talent is displaced from real production, as symbolized by all of the nuclear physicists on prop trading desks. Viewed from the perspective of the long-term well-being of the whole economy, the drastic expansion of the U.S. financial system as a percentage of total GDP in the last 20 years has been a drain on the health and cost structure of the balance of the real economy. To illustrate this point, in 1965 the financial sector of the economy took up 3% of the GDP pie. The 1960s were probably the high water mark (or one of them) of America's capitalism. They clearly had adequate financial tools. Innovation could obviously have occurred continuously in all aspects of finance, without necessarily moving its share of the economy materially over 3%. Yet by 2007 the share had risen to 7.5% of GDP!

The financial world was reaching into the GDP pie and taking an unnecessary extra 4%. Every year! This extra rent is enough to lower the savings and investment potential of the rest of the economy. And it shows. As mentioned earlier, the growth rate of the GDP had been 3.5% a year for a hundred years. It had proven to be remarkably robust. Even the Great Depression bounced off it, and soon GDP growth was back on the original trend as if the Depression had never occurred. But after 1965, the growth of the non-financial slice, formerly 3.4%, slowed to 3.2%. After 1982 it dropped to 3.1% and after 2000 fell to well under 3%, all measured to the end of 2007, before the recent troubles. These are big declines. It is as if a runner has a growing and already heavy blood sucker on him that is, not surprisingly, slowing him down. In the short term, I realize that job creation in the financial industry looked like a growth driver, as did the surge in financial profits (which we now realize were ludicrously overstated). But in the long term, like a sugar high, this stimulus was temporary and unhealthy.

The financial system was growing because it could. The more complex and confusing new financial instruments became the more "help" ordinary citizens needed from the experts. The agents' interests were totally unaligned with the principle/clients' interests. This makes a mockery of "rational expectations" and the Efficient Market Hypothesis, which assumes (totally unproven, as usual) equivalent and perfect knowledge on both sides of all transactions. At the extreme, this great advantage in knowledge and information held by the financial agents has the agents receiving all the rewards, according to the recent work3 by my former partner, Paul Woolley, and his colleagues at the Woolley Centre for the Study of Capital Market Dysfunctionality. (With a great name like that their job is half done before they start.)

The second problem, right on the heels of the too-big-and complicated issue, is that of inadequate public oversight. Even with existing institutions, we would have avoided most of the recent pain, borne by taxpayers, if we had had better public leadership. Yes, the public bodies had flaws, but the individuals running the shop had far bigger flaws. Greenspan, with arguably the most important job in the world, simply did not believe in interfering with capitalism at all. His regulatory colleagues such as Bernanke and Geithner fell into line without any challenges. And Congress, strongly influenced by the financial industry, or merely misguided, or often both, facilitated the approach that capitalism in general and banking in particular would do just fine if left entirely alone. It was a very expensive error. Does anyone think we would have run off the cliff with even one change - Volcker at the Fed? I, for one, am confident that we would have done far less badly.

Behind this weakness in the recent cast of characters is a systemic (suddenly the trendiest word in the English language) weakness in our method of job selection. How can Greenspan, with his long-established record of failure as a professional economist, have resurfaced as the Fed boss? With no record of success in any important job, he gets one of the world's two most important jobs! Now we have to decide how much more decision-making power to give to the Fed - an institution with a 25-year proven record of failure. How can we separate the logical neatness of institutional design from our recent proven inability to pick effective, principled leaders with strong backbones?

It is a conundrum: too many regulatory agencies and you have too many opportunities for financial interests to shop around for regulatory bargains and to find and exploit the ambiguous seams between them. Too few agencies and we run the risk of my worst nightmare: waking up and finding Alan Greenspan with twice the authority!

At the least we must recognize the improbability of acquiring great leaders and that our financial system must be simple and robust enough to withstand the worst efforts from time to time of poor or even bad leadership. A simpler, more manageable financial system is much more than a luxury. Without it we shall surely fail again. And it looks as if we are bound and determined to bend once again to the will (and the money) of the financial lobby, which is encouraged by the unexpected conservatism of the current administration's "Teflon" men. They seem terrified to make any substantial changes. And the one person with the character to make tough changes - Paul Volker - is window dressing, exactly as I suggested in January. A sad, wasted opportunity!

Summary

- Yes, this was a profound failure of our financial system.

- The public leadership was inadequate, especially in dealing with unexpected events that often, like the housing bubble breaking, should have been expected.

- Of course, we should make a more determined effort to do a more effective job of leadership selection. But excellence in leadership will often be elusive.

- Equally obvious, we could make a hundred improvements to the lifeboats. Most would be modest beneficial improvements, but in the long run they would be almost completely irrelevant and, worse, they might kid us into thinking we were doing something useful!

- But all of the above points fail to recognize the main problem: the system has become too big and complicated for even much-improved leaders to handle. Why should we be confident that we will find such improved leaders? For, even in an administration directed to "change," Obama and his advisors fell back on the same cast of characters who allowed, even facilitated, the development of the current crisis. Reappointing Bernanke! What a wasted opportunity to get a "son of Volker" type. (Or should that be "grandson of Volker?")

- The size of the financial system continues to grow and shows every sign of being out of control. As it grows, it becomes a bigger drain on the rest of the economy and slows it down.

- The only long-term hope of avoiding major recurrent crises is to make our financial system simpler, the units small enough that they can be allowed to fail, and, above all, to remove the intrinsically conflicted and dangerously risk-seeking hedge fund heart from the banking system. The rest is window dressing and wishful thinking.

- The concept of rational expectations - the belief in the natural efficiency of capitalism - is wrong, and is the root cause of our problems. Hyman Minsky, on the other hand, was right; he argued that the natural outcome of ordinary people interacting is to make occasional financial crises "well nigh inevitable." Crises are desperately hard to avoid. We must give ourselves a chance by making the job of dealing with them much, much easier.

- All in all we are likely to have learned little, or rather to act, through lack of character, as if we have learned nothing. In doing so we are probably condemning ourselves to another serious financial crisis in the not too- distant future.

PS: As quite often happens, since I write painfully slowly (even without extra tick-borne delays), a professional slipped in with a great column that gets to the heart of this matter. Please read John Kay in the Financial Times of July 9. It is short and persuasive. "Our banks are beyond the control of mere mortals" - now, that's what I call a title!

Footnotes: 1 Erratum: Last quarter I cast mild aspersions on Finanz und Wirtschaft by suggesting that I had not precisely said that the S&P would scoot rapidly up to 1100; I remembered it more as between 1000 to 1100. Never mess with a Swiss journalist: this one duly pointed out that his tape of April 1 confirmed his accuracy. Either way, here we are, more or less (at 1098 on October 19). 2 Andrew Mellon, Secretary of the Treasury, 1931. 3 Biais, Bruno; Rochet, Jean-Charles; and Woolley, Paul. Rents, Learning and Risk in the Financial Sector and other Innovative Industries. September, 2009. Working Paper Series 2009, The Paul Woolley Centre for the Study of Capital Market Dysfunctionality. http://www.lse.ac.uk/collections/paulWoolleyCentre/news/RentsLearningAndRisk.htm

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.