Stocks Market Bearish Visions

Stock-Markets / Stocks Bear Market Nov 28, 2009 - 07:49 AM GMTBy: Adam_Brochert

There are, in my opinion, some extremely strong warning signals being sent out by the markets right now. Every time we delay the inevitable by artificially supporting and bailing out markets, we create the set up for the next round of volatility. Governments cannot change the primary trend of the economy, they can only destroy the currency and destroy confidence through their irrational and dangerous acts designed to protect the few and screw the majority.

There are, in my opinion, some extremely strong warning signals being sent out by the markets right now. Every time we delay the inevitable by artificially supporting and bailing out markets, we create the set up for the next round of volatility. Governments cannot change the primary trend of the economy, they can only destroy the currency and destroy confidence through their irrational and dangerous acts designed to protect the few and screw the majority.

I think the bear market is resuming right here and right now. I think the next leg down will take us to scary new lows in the Dow to Gold ratio and likely in nominal terms as well. There are several signals telegraphing this imminent move for those inclined to pay attention in my opinion. Some of these are repeats from previous posts, so excuse the redundancy. This is my attempt at a unified discussion of the risks in the equity markets right now.

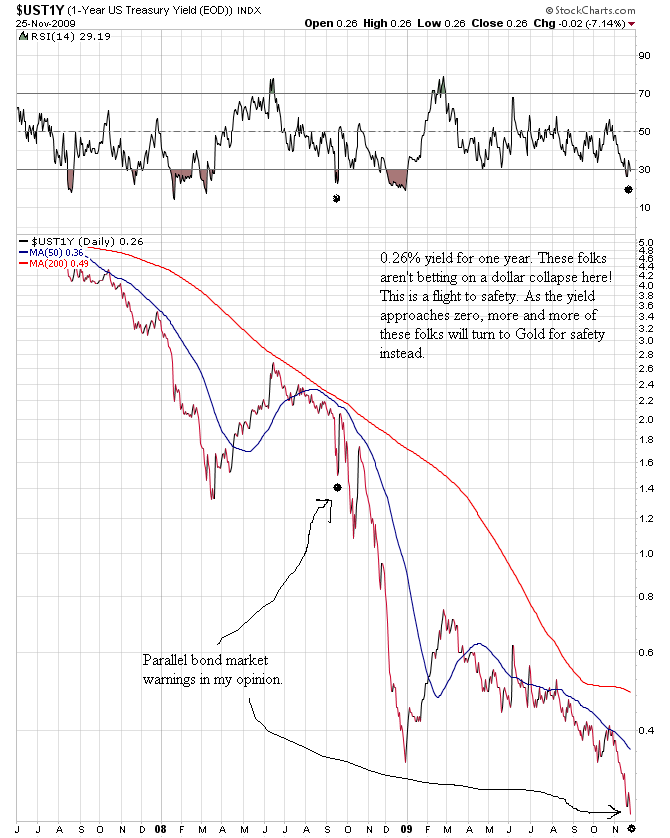

First, and very importantly, are the yields on U.S. government debt, particularly at the short end of the curve. The one year U.S. Treasury note exemplifies this scary trend well (below is a 30 month daily chart thru 11-25-09 close):

Even the 5 year U.S. Treasury bond broke down today (18 month daily chart thru 11-27-09 follows):

I have seen some stupid explanations for the moves in bonds. This is a classic flight to safety, so where's the fire? The big money that moves markets apparently sees what's coming next in the equity markets and they don't like it. Just like last year, the bond market is telegraphing the next wave down in stocks. Big money sells/distributes their equities to the public, escapes to the "safety" of government bonds, then magically the market starts to crumble on any bearish news and "buy the dips" doesn't seem to work any more.

Any other explanation for the move in short-term government bonds is designed to part you from your money. Inflation, deflation or both (I side with deflation when Gold is the measuring stick but have no idea exactly how the paper currency system implosion will play out), the stock bear market is NOT OVER.

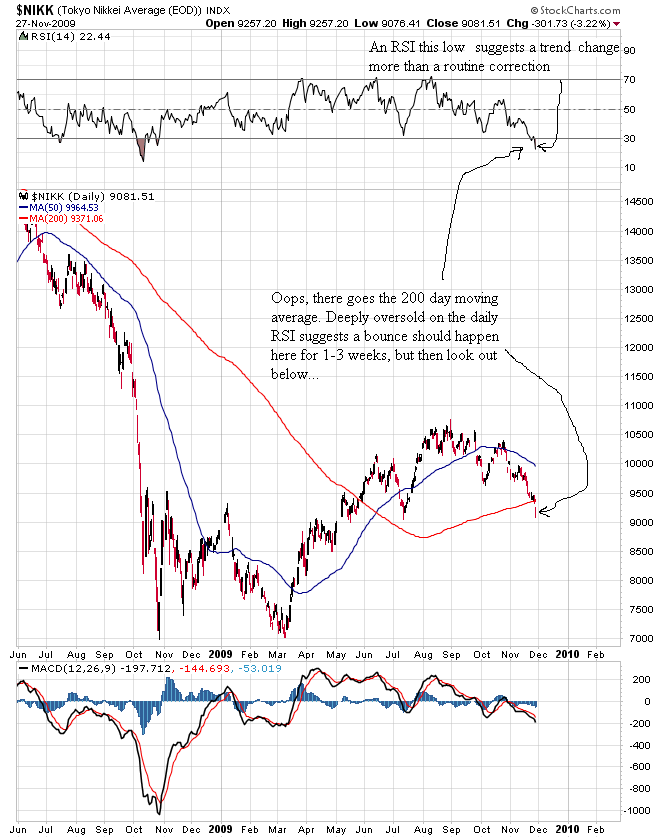

Next are the warning signs from Japan, Greece, and some of the non-confirming U.S. sectors and indices. First, Japan, the basket case of the world (following is an 18 month daily candlestick chart of the Nikkei average [$NIKK]):

Japan is in much worse shape than the U.S. when it comes to public debt. However, the Japanese private sector may be nearly finished deleveraging and this is a positive to keep in mind for down the road. Why? Because a currency crisis/devaluation due to the chronic Japanese government incompetence and persistent quantitative easing may occur once the Nikkei bottoms. This could spur a massive rise in the Nikkei as the private sector takes its saved paper currency units out of the banks and government bonds and gets back into "risk" assets. Such a scenario is not for now - we're talking at least a year from now, maybe several years...

Greece, a weak link in the Eurozone economy, is also breaking down in not-so-subtle fashion. Following is an 18 month daily candlestick chart of the Greek stock market ($ATG) thru 11-26-09:

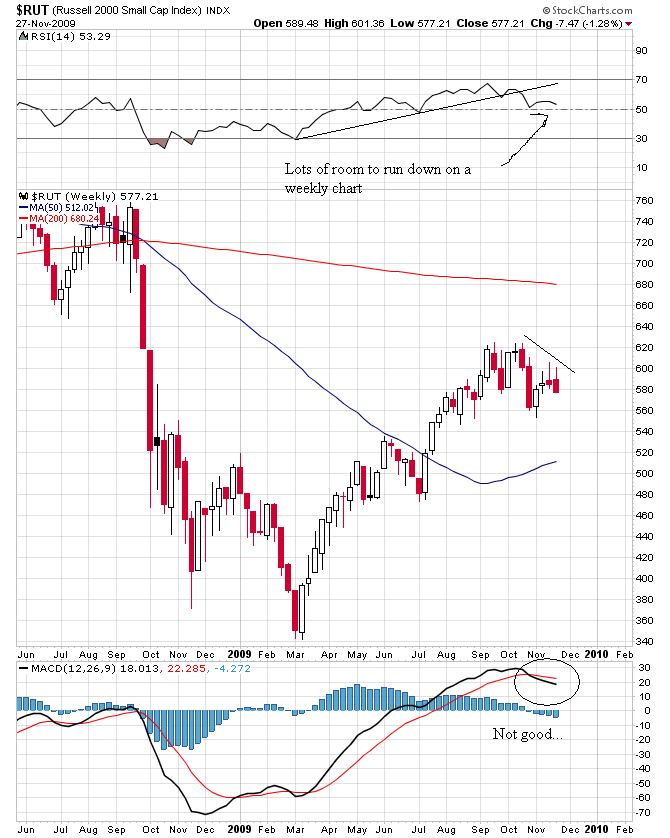

In the U.S., The Russell 2000 small cap index looks like it's starting to crack while everyone watches the S&P 500. Here's an 18 month weekly candlestick chart of this index ($RUT):

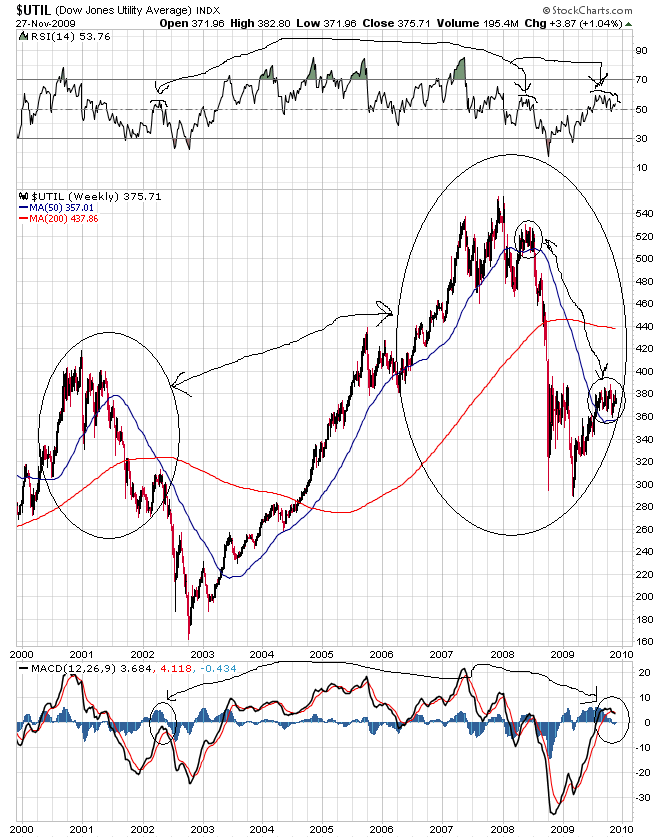

I also get an eerie sense of deja vu when I look at a long-term weekly chart of the Dow Jones Utility Average (10 year linear scale weekly candlestick chart thru 11-27-09 follows):

Other sectors that have not made recent new highs along with the Dow Jones Industrial Average include banks, financial services, insurance, commercial real estate, and the homebuilders. In other words, the FIRE (i.e. acronym for finance, insurance, and real estate) economy that defines the essence of the entire U.S. economy is not making new highs with the Dow right now. A narrowing of breadth in the market often occurs under the surface before a major top and I don't think this time is an exception.

Sentiment is back at an irrationally bullish extreme at a time when economic fundamentals have deteriorated further despite what you hear on CNBC (e.g., unemployment, banking system and federal/state/local government insolvency, real estate collapse, etc.). Courtesy of Market Harmonics, here's a chart of the Investors Intelligence percentage bears:

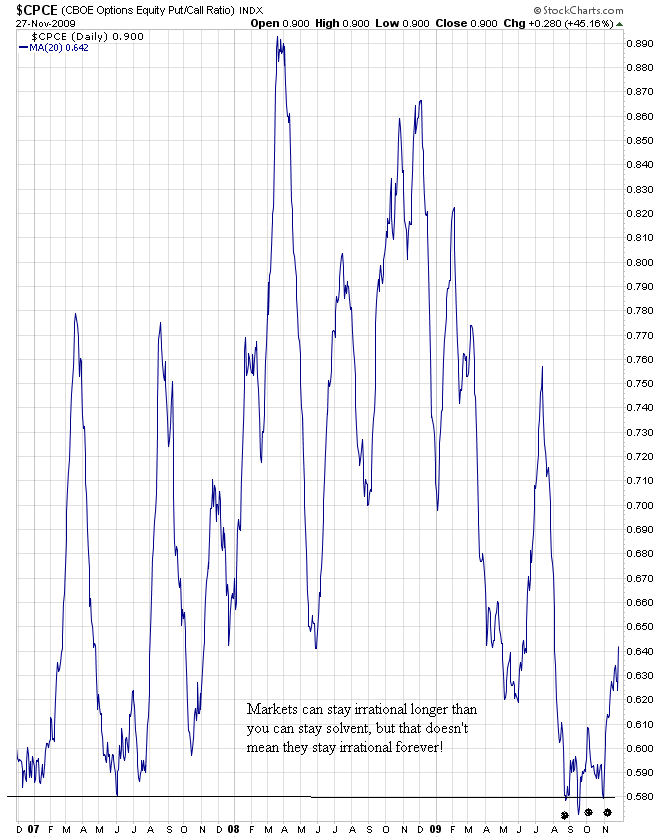

It may seem like everyone is bearish if you spend too much time on the internet reading kooky blogs like this one, but it ain't so. This is also evident when reviewing the equity put to call ratio ($CPCE). Following is a chart of the 20 day moving average (used to smooth out the noise in a daily plot) of the $CPCE over the past 3 years (remember that the lower this number, the lower the ratio of bearish bets [puts] to bullish bets [calls]):

The "dumb money" crowd (of which I sometimes am a card-carrying member despite my best intentions) has a very short memory. People think helicopter Ben can just guarantee everything and the stock market will keep rising as the dollar keeps falling. The dollar may keep falling, but that doesn't mean the stock market won't have another bear leg down! "Dollar down, stocks up" works until it doesn't. If you're a hard core inflationist and subscribe to this horribly misguided oversimplification of the relationship between currency fluctuations and risk assets, explain why stocks didn't go up all through the 1970s. The 1973-1975 bear market was the worst of the last 40 years until the 2007-2009 bear came along! You'll also have to explain why all the money/debt printing, bailouts and government guarantees didn't prevent the Great Panic of 2008 (does anyone remember the massive government interventions related to Bear Stearns, Fannie Mae, etc. that "saved" the market from collapse before it ended up collapsing anyway?).

And, finally, that brings us to Gold. Gold won't collapse. It had a vicious correction of 30% in the 2008 fall panic and then it was back up to $1000 a few months later during February. A quick sell-off is possible, of course, but Gold will weather this storm VERY WELL. How can I be so sure? Simple. Central banks are now net buyers in the Gold market at over $1000/ounce. When the hedgies puke, India, China, Russia and others will step up and keep a bid under the market. Central bank buying of Gold is a multi-year buying strategy, not a "make a quick buck by trading" strategy. The writing is now on the wall for the current global currency system and people know that Gold can be relied upon as a currency regardless of what happens to the Dollar, Yen, Yuan, Euro or any other paper debt ticket.

For those projecting shocking drops in the Gold price and a complete deflationary wipeout (a la the 1930s scenario), I would counter that this is highly unlikely for one reason: people don't trust the Dollar any more (as much as Americans would like to believe they do). The Dollar can rise some relative to other counterfeited fiat paper tickets, sure, but Gold will re-emerge as the premier global currency, not the Dollar. The Dollar has had its day in the sun and that time is past. A heavily indebted nation rarely experiences a shocking rise in their currency's value when the poop hits the fan (ask Iceland). I am not saying we can't have another "short squeeze" in the Dollar for a few months - we can and we very well may. But if cash is king during deflation and you're a deflationist, look to real money (i.e. Gold), not the IOUs of an out of control debtor.

In the 1930s, we were on the Gold standard while others left it (e.g., England, Switzerland). We were also a creditor nation rather than a reckless debtor nation. When other countries defaulted on their debts and Gold obligations/standards, money poured into the United States to hold our "good as Gold" Dollar and/or exchange their paper tickets for our Dollar so that they could then redeem those Dollars for Gold! When we defaulted on our Gold obligation in 1971, we sewed the seeds of our currency's destruction. Gold is the asset class at major new highs - not stocks, not commodities, not the Dollar, not real estate, not corporate bonds. You can look at this and call Gold a bubble, or you can recognize massive relative strength and a major secular shift when you see it. The secular Gold bull is just now starting to reach critical mass in my opinion, and I believe it will keep right on going regardless of what the stock market does until the Dow to Gold ratio reaches 2 (and it may well go below 1 this cycle).

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.