New Inflation Beater Bond from Leeds BS and Loans Getting More Expensive

Personal_Finance / UK Banking Jul 19, 2007 - 02:42 PM GMTBy: MoneyFacts

Lisa Taylor, analyst at Moneyfacts.co.uk – the money search engine comments:

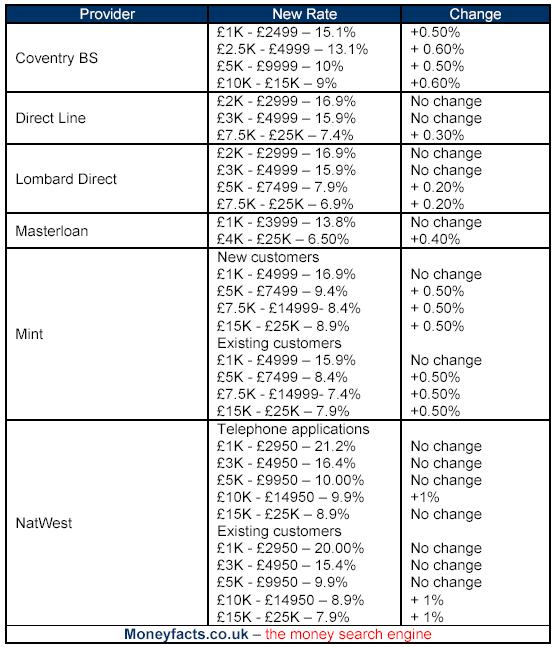

Loan rates getting more expensive

“Although not directly linked to base rate, a trend has emerged that loan rates are being tweaked quite quickly following base rate rises. However, the size of the rate rises do not always correlate with the increase in base rate, take the examples below, where the loan increases are anything up to one per cent for certain loan amounts. So with that said there must also be other factors contributing towards these rises. Perhaps it’s a combined effect of rising costs and bad debt provisions.”

“Despite the rises we have seen over the last 12 months, there are still some very competitive deals to be found, especially if you are looking for loans of £5K or above."

“However smaller loans are becoming far more expensive, with rates of 20% now commonplace - almost 3.5 times the level of base rate. If you’re looking to borrow under £5K, then it’s worth looking at other forms of credit. For short term borrowing a 0% credit card deals should be first choice, but for those looking to spread their debt repayments over a longer term, low standard rate cards with purchase rates under 10%, are a competitive alternative. Marks and Spencer money are still offering a balance transfer for life rate of 4.9% APR on their &more credit card with no balance transfer fee, which looks extremely good value in the current market.”

New inflation beater bond from Leeds

“With fixed rate bonds hitting new highs on an almost daily basis, the new Inflation Beater Bond from Leeds takes this to a new level, both in terms of rate and innovative product design.”

“Until the bond opens on 1st September any saver will receive a return equal to base rate. Then the rate reverts to RPI plus 3%, so assuming inflation remains at a similar level to today, savers could initially bag themselves an impressive 7.4% before tax.

“But, whilst the margin above RPI is fixed there is some uncertainty, as the interest rate you’ll receive for the whole of year one is based on RPI as at May 08 plus 3% and for year two is based on RPI as of May 09 plus 3%. Whilst inflation has fallen slightly, CPI is still above the MPCs target figure of 2%, so if market analysts are correct it’s more likely that your rate will fall, rather than rise.

“The bond requires a minimum of £1K deposit and additional contributions can be made while the issue remains open.

“While the headline rates looks attractive, you must remember you are taking a gamble on the unknown rate you will receive. If you are looking for a fixed rate of return for the two-year period, then perhaps the current Moneyfacts.co.uk best buy from Halifax at 6.63% gross may prove more attractive.”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.