Emerging Markets Beating the Dow Six to One!

Stock-Markets / Emerging Markets Dec 28, 2009 - 11:32 AM GMTBy: Martin_D_Weiss

Martin here with a brief review of global markets for 2009 and some basic thoughts regarding the risks and opportunities in 2010.

Martin here with a brief review of global markets for 2009 and some basic thoughts regarding the risks and opportunities in 2010.

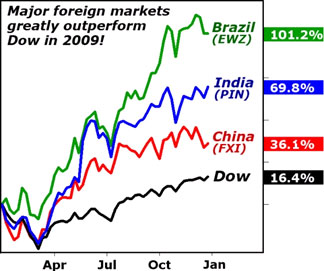

As we have been writing for many years, and as we highlighted in our Weiss Global Forum this past summer (click here for transcript), key emerging markets are — and should continue to be — greatly outperforming the Dow across the board.

Starting at the close of trading in 2008 and excluding the last few days of trading this year which are still to come …

Starting at the close of trading in 2008 and excluding the last few days of trading this year which are still to come …

- If you had invested $10,000 in the average Dow stocks, you’d now have a gain of $1,640 for the year. Meanwhile …

- If you had invested that same $10,000 in FXI, a leading ETF which tracks China’s blue chips, you would have made more than twice as much, with a gain of $3,613, and …

- With the ETF tracking Brazil’s leading stocks (EWZ), you could have put all of the above to shame — achieving a gain of $10,117, or over SIX times more than the Dow.

I hasten to add that no investment is risk free, and emerging market stocks can be especially volatile — the reason we have always approached them with caution.

But the fundamentals have clearly supported — and continue to support — this huge outperformance:

In the U.S., despite the biggest fiscal and monetary stimulus in our lifetime, the economic recovery remains one of the weakest in the world.

It’s bogged down in a morass of defaulting mortgages and bad credit cards.

It’s more dependent than ever on stimulus from a government that is already running the biggest budget deficits of all time.

And, as I detailed last week in “Three Government Reports Reveal New Looming Risk,” even this disappointing performance could be threatened by an interest-rate rise in 2010 for which few are prepared.

Chinahas just become the world’s second-largest economy, leaping ahead of Japan, which had held this distinction for nearly half a century.

For 2008, the Chinese government has just revised its official GDP growth figure from the already-high 9 percent estimated previously to a 9.6 percent. And for 2009, the government says the economy grew 8 percent — a number that’s also likely to be upwardly revised next year.

That will put China’s GDP at close to $4.75 trillion, compared to $4.6 trillion in Japan. And if you adjust these figures for the far higher cost of living in Japan, China’s economy is $3.5 trillion larger than Japan’s.

India is not far behind: Since 2003, it has chalked up an impressive growth, averaging 8.5 percent annually. This year, despite the global crisis, its growth is likely to come in at over 7 percent. And right now, it’s already gaining momentum for an expected 8 percent expansion in 2010.

Brazil, in my view, is the strongest BRIC country.

Brazil’s banking system boasts not only better stability than that of the other BRIC nations, but also of the U.S. and Western Europe. Its central bank is one of the few in the world that has strictly applied the higher capital standards recommended by the Bank of International Settlements — not only for high reserve requirements, but also for reduced risk taking.

Brazil has enjoyed a democratic multi-party system for 25 years, with two strong parties taking turns governing the country, and, remarkably, with the world’s most advanced computerized election system.

Most important, Brazil’s recent growth has been largely fueled by a dramatic expansion of the middle class and a reduction in the poverty rate. Tens of millions of citizens who were outside the economy — without a penny of savings or even a formal address — now have steady income, bank accounts, credit, cell phones, and most important, the ability to consume.

These are not structures or trends that change overnight. They promote sustainable growth. And they should give global investors the opportunity to again greatly outperform those who are confined to the U.S. markets.

Stand by for further instructions!

Good luck and God bless,

Martin

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.