Why is the U.S. Dollar Rising, Treasury Bond Market Failure 2010?

Interest-Rates / US Bonds Dec 29, 2009 - 02:35 AM GMTBy: G_Abraham

Now am not a trader nor do I rely on charts but those who do, tell me that dollar has broken a “falling wedge” and is all set to rally a great deal in the coming weeks. Most reaserch houses have put in dollar targets of anywhere between 78 and 83.

Now am not a trader nor do I rely on charts but those who do, tell me that dollar has broken a “falling wedge” and is all set to rally a great deal in the coming weeks. Most reaserch houses have put in dollar targets of anywhere between 78 and 83.

JP Morgan: 78

Morgan Stanley 82

CLSA 83

GS: They still cant believe dollar is rallying let alone leaving a target.

Regardless what the dollar index may finally rally to, it is quite clear that dollar has done an about turn in its multi month fall atleast for the near future.

And that brings us to the object of our discussion: Why is the dollar rising?

There are 3 reasons all of which I have heard over the last 3 weeks:

- Improving economic fundamentals:

Well well well. Am not sure how to say this. If you really think the economy has improved and it warrants the move of capital from high growth countries (China, Brazil and India) to a relatively low growth country with labor unemployment rate at 10% and banking failure touching 140 with deficit at an all time high of $1.5 trillion and a population that is increasingly dependent on federal aid, then am sorry to be rude, you need to do your financial education again and probably my suggestion, do not trade your own money. So when will I say economy has improved? For me economy will be on the mend when I see unemployment rate firmly below 8%. I need clear proof that jobs have been created in a sustainable period of 3 months. The fall in unemployement in Nov was aided by temp workers and not by permanent job creation.

Secondly, once the Unemployment picture stabilizes, I need to see FDIC bank default slowing down. Right now the problem list on FDIC site is 552 banks to fail. My own analysis is 1800 banks at unemployment rate of 9.8%.

Thirdly, I need to see a stable growth rate (Retail,auto, tech exports) when the QE ends.

Finally, I need the fiscal deficit well and truly below 6%. currently it is at a astounding 11%. Only UK is worse among the G7 economies.

If I see these few points clearly pointing to growth and stability, I will be the leader of the pack who will be bullish on the US recovery. Right now, US economy is under extended Quant Easing, and even then is not able to racket up a sustainable growth rate. Instead of an end to QE, they are talking of an extension of QE (read $400 bn blank cheque to Fannie Mae and Freddi Mac).

Now investors are not fools to have not seen these simple reasons and therefore I dont think it is investors who are bullish on the US economy who are driving up the dollar. Analyst and economist community by reason and history are nuts and in most cases are unaware of economic truths and therefore the folks who say “flow of capital back to US on back of recovery” should only be used as contrarian indicators in your analysis.

- Rate increase on improving economy:

This is a very credible argument if you really believe the economy has/will improve in the coming months. An improving economy will give rise to inflation and hence fed will need to raise rates. The problem is that neither the economy is improving nor are we going to see unmanageable “DEMAND SIDE” inflation concerns. Mind you, I said demand side inflation. There will be supply side inflation which will foster itself in food inflation in various parts of the world. Supply Side inflation shocks do not warrant a rate hike and needs a better management of resources to moderate.

- Rate increase from failing auctions:

In my view, this is the perfect explaination for the strength in dollar index. Attached the chart of dollar index ETF.

Dollar strength began in december, roughly the first time since March we saw FED auction indirect bids falling below 40% giving rise to an immediate pick up in 10 year yields. Then came the massive 30 year auction which also saw a moderate demand from indirect bidders (<40% as compared to an average of 45%) giving rise to an immediate uptick in yield. The uptick in yield is the market way of communicating to FED, we cannot subscribe to your low rate weakening dollar policy anymore. At the least we will need a higher yield in 10Y and 30 Year bonds. If FED runs out of options, it will need to meet the market yield curve by raising the fed rate by at least a token amount of 25 bps. Will the FED do it in an election n year? They have no choice but to do as they cannot risk a failing bond market at such a precarious moment in US history. The markets have got the whiff of this are now selling the bonds naked which is starting to distort the yield curve even more and ultimately leading to strength in dollar. Strengthening dollar is going to hurt US in more ways than one and FED will do everything to reverse it but this time around, FED talking and monetization alone may not be able to do it. They will need to show credible evidence of a working QE and its path to wind down. Right now it is an ever increasing program which ultimately had to fail.

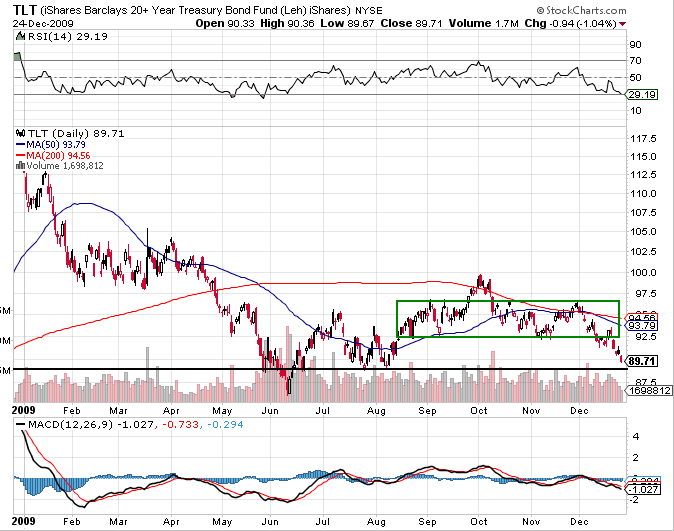

Yields on long-term bonds have rallied quite substantially in recent weeks, and this trend has major implications for the economy moving forward. A breakdown below June lows would be a very bearish signal, especially with Option ARM resets coming in 2010.

Morgan Stanley had this to say:

From Bloomberg

Yields on benchmark 10-year notes will climb about 40 percent to 5.5 percent, the biggest annual increase since 1999, according to David Greenlaw, chief fixed-income economist at Morgan Stanley in New York. The surge will push interest rates on 30-year fixed mortgages to 7.5 percent to 8 percent, almost the highest in a decade, Greenlaw said.

Investors are demanding higher returns on government debt, boosting rates this month by the most since January, on concern President Barack Obama’s attempt to revive economic growth with record spending will keep the deficit at $1 trillion. Rising borrowing costs risk jeopardizing a recovery from a plunge in the residential mortgage market that led to the worst global recession in six decades.

The Treasury will sell a record $2.55 trillion of notes and bonds in 2010, an increase of about $700 billion, or 38 percent, from this year, Morgan Stanley estimates. Caron says total dollar-denominated debt issuance will rise by $2.2 trillion in the next 12 months as corporate and municipal debt sales climb.

The question then is how will this effect the US economy. The primary concern in a rising yield environment will be its effect on housing prices. If tax credits and direct MBS purchases couldn’t lift housing out of the abyss, imagine what mortgage rates at 50% above current levels will do to housing. The Option ARMageddon that is already set to drag housing down in 2010 will pick up even more steam as resets occur at much higher rates. Keeping this in mind, do you really think the Fed will raise interest rates in 2010 as so many people expect?

Bloomberg quotes:

“There’s no free lunch, and when you take these kinds of aggressive policy actions to prevent a depression, you have to clean up after yourself,” Greenlaw said. “Foreign central banks are just not going to be able to finance these kinds of budget deficits for very long.”

Monetary officials in China, Japan and other countries helped Geithner lower U.S. borrowing costs by 15 percent in the government’s 2009 fiscal year. Indirect bidders, a group of investors that includes foreign central banks, purchased 45 percent of the $1.917 trillion in U.S. notes and bonds sold this year through Nov. 25, compared with 29 percent a year ago, according to Fed auction data compiled by Bloomberg News.

The decline in interest expense was the biggest decrease since before 1989 and came even as the nation’s debt increased by $1.38 trillion this year to $7.17 trillion in November, the data show.

Even the slightest increase in the yield curve is an exploding increase in debt service costs to the federal budget which am afraid they have not even factored in. Fed’s program of quantitative easing. Unfortunately, the party is about to come to an end because when about 40% of Treasury purchases are carried out directly by the Federal Reserve, you have a recipe for disaster. We can easily see interest payments on our debt rise 100-200% in 2010, which should put a lid on any economic recovery.

Now my arguments could be wrong and purely an year end balancing as US companies bring home their winnings thus leading to a demand for dollars. But then that should not in any distort the 30 yield curve. Also it could be that central banks around the world have taken December off and hence not participating in auctions. But then most of these central bankers are buzy bidding the gold at IMF.

If you are an investor, the best thing to do is to keep a close watch on the 10Y, 30Y yield cuves for 2 weeks into January. If they snap back into their 2009 ranges, we are fine. If NOT, it is BIG BIG trouble and the first sure steps to Bond meltdown. If the meltdown happens, I dont think there will be any place to hide as it will totally destroy all assets including Gold, Silver, equities, commodities. Everything!!! There will be repricing of risk and asset prices. The value of Money as we know it will change!!!!

If December 2009 was an indication of what is to come, then spring 2010 onwards will be the most fearful and scary times in our life times. Unfortuately if you are planning to make money off it, you will be surprised at how for the first time almost all assets can go down together, I rather suggest think of surviving your capital.

2010 Will not be about RETURN ON CAPITAL but rather of RETURN OF CAPITAL.

Godly Abraham

http://investingcontrarian.com/

Formerly a hedge fund analyst for India's largest fund house and currently a Private Equity fund analyst with a swiss firm, Godly Abraham is an active writer at INVESTING CONTRARIAN which is a daily online publishing house, covering investing ideas and economic analysis on wide ranging topics but mainly specialized to covering US,UK, EU and BRIC countries and their political ramifications.

© 2009 Copyright Godly Abraham - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.