Emerging Markets' Growth and the Resources and Energy Boom

Commodities / Energy Resources Feb 05, 2010 - 12:51 AM GMT Specializing in emerging markets, natural resources and global infrastructure, U.S. Global Investors is positioned so perfectly for the times that CEO Frank Holmes might have written its business plan and tag line—"Resourceful Investing for a Developing World"—this morning. All of these arenas of expertise at U.S. Global Investors play powerful but somewhat unpredictable roles in the evolving 21st century worldwide economy. Led by China and India, the emerging markets have placed unprecedented (and growing) demand on natural resources.

Specializing in emerging markets, natural resources and global infrastructure, U.S. Global Investors is positioned so perfectly for the times that CEO Frank Holmes might have written its business plan and tag line—"Resourceful Investing for a Developing World"—this morning. All of these arenas of expertise at U.S. Global Investors play powerful but somewhat unpredictable roles in the evolving 21st century worldwide economy. Led by China and India, the emerging markets have placed unprecedented (and growing) demand on natural resources.

From gas and oil to copper and zinc, it takes vast quantities of those natural resources to build infrastructure to accommodate explosive growth in population, upward mobility, urbanization and industrialization. So as the other Holmes once said, "The game is afoot." Meanwhile, the developed world can hardly sit by and watch the action from afar. As Frank suggests in this exclusive Energy Report interview, the key to staying in the game—even as the rules are changing—may lie in adapting nimbly and rationally.

The Energy Report: President Obama recently came out with proposals to limit profit taking in the banking industry, impose salary caps and restrict banking investments. Then in his State of the Union address, he called for a freeze on spending for discretionary government programs. Any comments about that?

Frank Holmes: Wherever it is in the world, it's important to recognize the tremendous impact of governmental policies. Look at Hugo Chavez in Venezuela as opposed to Álvaro Uribe in Colombia. Chavez destroyed Venezuela's economy and judicial system to maintain his power. Bolivia is heading in the same direction, but Colombia and Panama are booming. Policies in those two countries are completely different from Venezuela's.

Basically, government policies break out to either monetary or fiscal. Of course, money supply is on the monetary side, along with real interest rates, while fiscal policies involve taxing and spending. We try to distill the G-7 versus what we call the E-7—the seven most populated emerging-market countries—and look at money supply. We see something very, very important when we create macro models to compare the E-7 to the G-7.

What we see with the E-7 countries is a very different set of policies for capitalism and job creation and social stability. In the G-7, in contrast, we see a sort of socialism being pushed. How it's being done is very significant, too, in part because one of the consequences of such policies is higher unemployment. What starts out as anti-money laundering expands to the point that it becomes anti-money.

Good government policies came to China after Deng Xiaoping came to power in 1978. He started a model based on the old saying that "it doesn't matter if a cat is black or white as long as it catches the mouse." People need a means of getting jobs and achieving prosperity. That's what drives China now. There was a lot of talk about a broker being shot by order of a Chinese court for stealing $19 million because of government concern over the gulf between rich and poor. That wasn't the reason. Chinese policies are designed to produce social stability. Stealing creates social instability. They need social stability and ways for people to realize economic independence.

The big wrestling in the world is to really appreciate urbanization and understand globalization, which—along with access to information—has changed the world dramatically.

TER: It seems that urbanizing is inevitable whether government policies are good or bad. As populations grow, a society cannot remain agrarian.

FH: Correct. There's no doubt that you get these tipping points in the population, but good government policies adapt to changes as they realize what's taking place. The planet had 1 billion people 200 years ago; 100 years later there were 2 billion people; 50 years after that, it was 3 billion people. The world's population has more than doubled since 1970, when gold became free-trading and there were 3 billion people. Now, 40 years later, we have more than 6 billion people. The number of people on earth becomes very significant and so government policies become very important. In China, India, Thailand, it's all about job creation.

Political parties talk about policies for managing this big sea change and about the urbanization and the information highways around the world changing things dramatically. The movie Slumdog Millionaire, which was filmed in India and won so many awards, starts off with kids living in a slum. At the end the slum is filled with huge high-rises and even though there's so much poverty in India, it's filled with hope too.

Sudan is poor, just like India, but there's no hope in Sudan—only fear. That same type of fear is here, in policies to deal with terrorists, and in Europe, where fear rather than hope drives policies. I think that's really key in looking at how governments deal with huge demographic change. It's not just the fact that the world population is moving toward 7 billion people. What is really important is the rise in the emerging-market middle class, whose needs are not the same as in middle-class America or Canada.

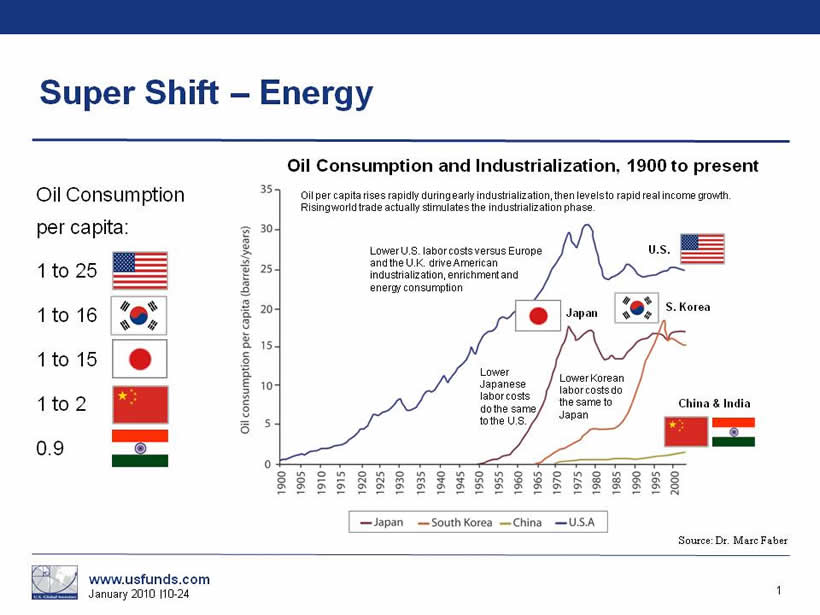

Look at China again. As many as 25% of Chinese—more people than the entire U.S. population—fall into the middle-class category or above now, with a doubling possible by 2020. While most dramatic in China, it is also underway in India and elsewhere. People in this emerging middle class just want a nice home with running water. When they turn on the switch, they want the light to come on. That means massive commodity consumption.

TER: But isn't the rise in the middle class an outcome of urbanization?

FH: It's a result of good government policy, too. As an investment person, I'm a big believer in what are called "complex adaptive systems." There are complex adaptive systems all around us—our body's brain and immune system, the ecosystem, ant colonies, the stock market and many others. In this sense, the immune system is very similar to the stock market and very similar to how bees swarm. It has a lot to do with the capacity to learn from a new experience and change in response to that experience.

A lot of people—or organizations or governments—can learn something, but they don't necessarily change their behavior. Remember when the Encyclopedia Britannica was sold in malls? Microsoft's Encarta came along and they were wiped out. The Britannica people knew what was happening, but failed to adapt fast enough. A classic example.

Unless you're dealing with a dictator, I believe that the majority of government policies, especially in democracies, begin with good intentions. But they have to adapt. In terms of investments, some of our biggest wins will come from policy change in Colombia versus Mexico, for example. Colombia has doubled its production. This all has to do with government policies.

TER: So as we look at countries such as India and China, with immense populations and growing middle classes, is it simply the nature of the middle class or are government policies promoting consumerism?

FH: I think it's a combination of three things— population density plus rational, intelligent government plus resources. Cities need proper infrastructure to function. Otherwise, you get slums. You get chaos. You're wiped out if an earthquake or a hurricane hits.

TER: But China still imports a lot of the resources required to build the infrastructure.

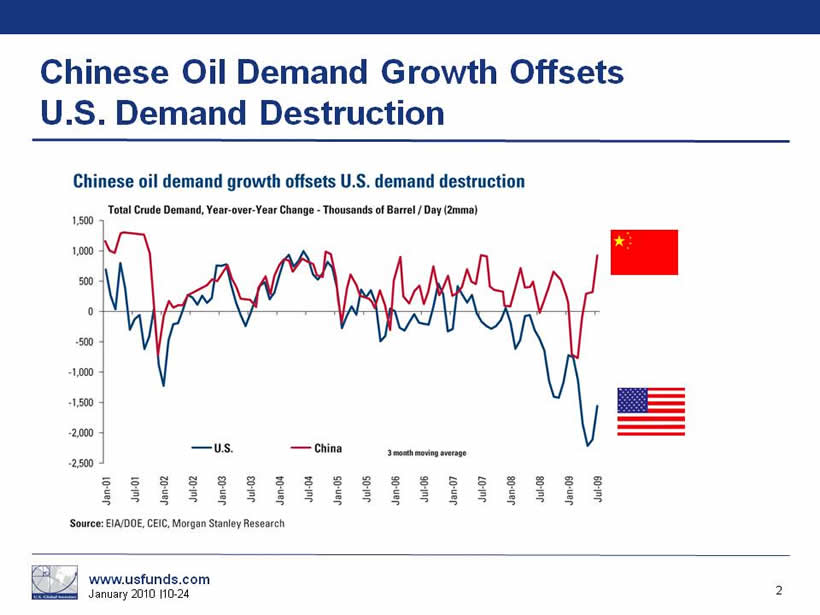

FH: China is a very pragmatic country with long-term thinking along the lines of, "Okay, we're going to need all this copper and steel and oil." So they go out and acquire. China emerged from being a net oil exporter in the early 1990s to the world's third-largest net importer of oil by 2006. Its natural gas usage has increased rapidly, as well, and China is looking to raise natural gas imports via pipeline and liquefied natural gas (LNG).

TER: Nouriel Roubini, the economist credited with having seen the economic meltdown coming, says a lot of people are talking about investing in China because they expect China to pull the world out of recession. He argues that China isn't the panacea that people think it is. He claims that the government needs to implement certain social programs that motivate people to stop saving and start spending. He's talking about unemployment insurance and other safeguards against lost income. From your viewpoint, looking at these policies, how much of the growth in China will come from consumerism evolving naturally or must the government intervene?

FH: It'll come and it won't be because Roubini wants to give it a European-style socialist perspective. It's going to come because the government does not give the free health care. China has basic health care and the technology to do all the x-rays and MRIs, but if people want anything special, they have to pay for it. China also offers basic education, but if people want the better schools, they have to pay.

The high savings rates in China are predominantly so people can take care of their families if something happens to them physically. At this stage, the government is not much worried about that; they're worried about job creation. They don't want a bunch of people on unemployment insurance and food stamps. They'd prefer to have them cleaning up dirt on the highways and debris on the streets. They recognize 800 million people still live in rural areas, so they have to manage urbanization and employment methodically and rationally. They can't force consumer spending. But they've found, for example, that when they gave farmers tax credits and made schooling easier, the farmers used their higher disposable incomes to acquire more products made in China.

TER: In your recent article, "The Case for Commodities in 2010 (and Beyond)," you say that an investment in natural resources is a vote of confidence in global economic growth. You also talk about how demand and growth of the middle class in emerging countries will fuel the commodity supercycle. Is the commodity supercycle dependent on the emerging countries' growth exclusively? Or does continued demand in developed countries dictate a big part of that?

FH: There's never a single factor; it's a summation of several factors. A big one is the last supercycle's pattern of infrastructure spending. It started in 1955 with Eisenhower building up America's interstate highway system—a job that had the U.S. consuming 55% of all the world's commodities at the time. Then Japan, Taiwan and Korea had significant buildouts. Then the Vietnam War put heavy demand on resources. So this supercycle that started out from deflation and ended with inflation lasted 25 years.

Then we went through a 20-year drought from 1980 until 2000. During this period there was significant underinvestment in schools for engineers and geologists. Kids were going to become electrical or technology engineers, not go into mining or into the resources. There was minimal investment in the technology of energy or in raw resources. Right now in America all the kids want to go into CSI or Law & Order. But 10 years from now they will be taking degrees in petroleum engineering and mining engineering. We'll see that shift when they start to see that they can make much more money that way.

In the meantime, General Electric Company (NYSE:GE) has a huge new R&D center in Bangalore. I recently visited this center, which almost doubles GE's global research and development staff. GE went to India because U.S. colleges produce more sports trainers (75,000 of them a year) and lawyers than engineers—while India's producing 400,000 scientists and engineers.

TER: Wow.

FH: Financial Times recently reported that China is the leader now in filing for patents. If you go to grad school in America, you'll see it dominated by Indians and Chinese.

TER: Although technology seems to be getting more attention in North America nowadays, the resources industry here seems to be struggling more and more with environmental issues.

FH: That's right. The EPA, which was created in 1973, became a force around the world for clean air and clean water, which I'm a big believer in. But if you're not exploring and developing, and barriers to entry grow while the populations also continue to grow, where does that put you? In a situation where you have insufficient supply to meet the demands of a population that's doubled—and a growing middle class. Based on previous cycles of 20 years, I think we're halfway through the current increase in growth of the middle class, and I don't think the big inflation will hit for another five years.

TER: So five more years before inflation becomes problematic?

FH: Everyone keeps talking about big inflation. So why are real interest rates negative? Interest rates have been negative, not positive, in E-7 and G-7 countries 80% of the time since the year 2000. Governments are trying to ensure cheap cost of capital to create jobs and spur economic activity. After our recent credit crisis, year-over-year money supply (M-2) in the U.S. is up only 3%, and down dramatically from its peak. But the monetary base has increased massively. That's supposedly money that's gone to the banks for lending, but in fact they're not using it for loans because it's not showing up in the velocity of money supply.

At the end of the day, we're still wrestling with deflation. It's something we're going to live with. We'll get pockets of inflation, commodity by commodity. Zinc will rise and fall. Then copper will rise and correct, and so on. But we won't see the across-the-board inflation we had from 1975 to 1980 until probably 2015 to 2020.

Whenever America has a credit crunch, it usually lasts five years in any particular area. The credit crisis that started in '86, which bottomed in '91, devastated banks in Texas, Oklahoma and Louisiana. Two factors were in play there. Oil prices and gas prices, a big source of tax revenue, fell, and at the same time we had the S&L crisis. It took five years to resolve that.

Bear in mind, too, that natural resources are one of the few asset classes that benefit from inflation. If prices for fuel or other commodities rise, one way to hedge against the impact of those price increases is to invest in those commodities, or commodity-based equities, either through an actively managed natural resources fund or a passive vehicle such as an indexed fund or exchange-traded fund (ETF).

TER: Will that big inflation that's five or so years away be worldwide or isolated to specific countries or regions?

FH: Historically it's gone worldwide, and most countries are part of the economic engine. I think there's going to be food inflation. We'll see unions striking for higher income to deal with the food inflation. During the Christmas holidays I was in Sri Lanka. It's one of the best performing stock exchanges since its long civil war ended. The stock market took off. Why did I go there? Plantations. Food. The world will keep having babies and its middle class will keep growing. It makes me sort of bullish on commodities long term; we're going to get these spikes because we're not able to supply.

We're going to have to deal with this. More money has to be put in exploration and development. We were shocked to see the dimensions of cuts in exploration last year, talking to general mining and drilling companies. It was like a 90% cut overnight. It takes a lot longer to kick that resource back into production to meet the needs of urbanization and globalization in the age of the information world. But today's technologies allow these companies to just pull the plug on exploration and development as soon as the commodity price falls below its marginal cost of production.

TER: Do you expect some commodities to fare better than others? Near term and longer term?

FH: I don't know that. The complex adaptive system involves trying to adapt. Will the supply disruptions be sustainable? Will the amount of dollars that we spend for this $20 billion project be enough to secure supplies? Where are the commodities going to come from? There are real patterns here. We see a domino effect of related commodities. It's just a matter of recognizing the need and adapting to those changes.

In fact, that's what active money management is all about. What I think is a real bubble is all this money going to ETFs. It's not the best way to play one of these commodities. Either the Wall Street Journal or Bloomberg had an article saying that actively managed funds outperformed the ETFs. And it wasn't a little bit. It was pretty healthy.

TER: Back to the commodities, what looks good these days?

FH: Right now, the hot commodities are platinum and palladium. You can probably make some money at the beginning owning the commodity itself, but some of those stocks are picking up. You're betting on car sales remaining healthy and strong.

TER: Isn't the growing middle class you were talking about an indicator that car sales will remain strong?

FH: They will grow. China has picked up the slack of America. But what happens when America turns and China remains robust? Holy jumping. Strap on your seatbelt.

TER: You showed an oil seasonality graph at the Vancouver Conference. Can you give our readers just a quick overview of the graph and how we should interpret it?

FH: Life's all about managing expectations and keeping an eye on the big picture. We look at the most populated countries and also the richest countries to see which have the strongest policies to create jobs. In the U.S., we overlay that with the U.S. presidential election cycle because the U.S. has the biggest GDP in the world. For more than 150 years, the pattern you see has a 70% accuracy of forecasting economic activity. We also look at the weather cycle. Every year has a seasonal cycle that affects supply and demand of commodities. We compare gold to copper to silver to platinum and to oil, and can see defined patterns.

As far as oil in particular is concerned, what's most interesting is that on a seasonal basis—it doesn't mean it happens every year—the oil price historically bottoms in January-February. It bottoms in the coldest part of the year, when it makes more sense for oil prices to be the highest. The price starts its climb until the shoulder months. In the summer it picks up steam. The crescendo is usually hurricane season, September-October. Then it goes through a correction.

If oil stocks are way down on our mathematical models over 60 trading days and also at a seasonal low, it's worthwhile buying some of the cheapest oil and gas stocks. If, all of a sudden, markets are down but you're at the seasonal high of the year, you figure you can even go lower in the next three months. That's why we overlay our models. In the end, we try to manage expectations by watching these patterns.

TER: Does that imply that you move in and out of stocks depending on seasonality?

FH: It's more for managing our cash levels. Money coming in; money coming out and making the cash part of a tactical strategy because of the inherent volatility of oil in particular. It's nothing for the rolling 12-month volatility for oil to be plus or minus 40% over 10 years. That's one standard deviation. Gold bullion is plus or minus 15%. Understanding inherent volatility within seasonal patterns helps you manage your cash as an active money manager.

When it comes to picking stocks, that's a different set of fundamentals. The most important thing we look at is management that respects and protects the value per share. There are three drivers for value per share: your producer's per-share growth in production, cash flow and reserves. It excludes the price of gold because while the price of gold's gone up dramatically, these companies' cash flow per share has not because they've issued so much paper.

TER: In terms of those three drivers—production, cash flow and reserves or rocks per share—could you name some companies whose ratios you find appealing?

FH: Yes. Here's a classic. The best performing stock in the Toronto Stock Exchange last year was Pacific Rubiales (TSX: PRE), which also had the highest production per share of growth. The stock was up 600%. So that's the key factor.

TER: Any other companies fit in this mode?

FH: Another one is Alange Energy Corp. (TSX-V:ALE). Great management. Luis Giusti is a proven manager who used to be CEO of Venezuela's national oil company and who is now an entrepreneur. Luis has done a phenomenal job building Alange. In six months, Alange is up to almost 5,000 barrels of daily oil production. Luis is very focused on that production per share and I think, with Alange's profile, they can double that production over the next 12 months.

TER: Did they go to a source that has been producing before?

FH: Yes, they have working interests in a dozen properties in Colombia, and they expanded production with technology. Based on the track record and the intellectual capital—management's knowledge of these fields and the technology—they feel quite comfortable that they can double production. Luis Giusti is a petroleum engineer from the University of Oklahoma. They're really smart people and I'll bet on those jockeys every day. And a government like Colombia, there's good policies. Just a couple of weeks ago, four of us sat down with President Uribe and looked at the policies and it's full-charge. He has policies to create jobs and wants social stability.

TER: That's what you were saying before. A lot of this stems from government policies and what they focus on. What a difference that can make between countries that are right next door to each other.

FH: So true.

TER: Any more companies you can tell us about?

San Juan Basin Royalty Trust (NYSE:SJT)

FH: Another one is an American company, . We like it as a proxy on natural gas because when gas prices are down, the dividend's down and when gas prices are up, the dividend is up. It pays a dividend every month. And even with low gas prices, the yield is higher than a money market fund.

And the government policy has come out to recognize that natural gas is much more important for the CO2 emissions and the Copenhagen Treaty and things like that, that they recognize that they should go spend money on infrastructure for gas lines across the country. We have lots of gas, lots of it to develop. It's also compliant with the green movement. So I think a shift in government policy would bring changes in gas prices. I don't think they'd going to explode on the upside, but I do think you get better economics and more people converting to gas. So San Juan Basin has that nice yield.

TER: Are they getting those yields because they're able to increase production?

FH: It's a combination of production and gas prices. Right now the production per share is not going to be expanding, but it's a great way to speculate on the price of gas. And you get paid every month. To anyone who hates pay higher prices at the gas pump, if that price is going up, most likely natural gas is going up too—so that's your hedge.

TER: What do you see happening with natural gas prices?

FH: The big issue now is that they're getting much more production. When it costs $6 million for a well that lasted 15 years, it's now 30 years. That's really positive for the longevity of these wells. It's now going to come to the fact that this is a country with lots of gas. It's going to take the smart government policymakers to separate gas from coal and oil and come up with a mandate and start building out more gas lines so that gas can get to more people—as they did interstate highways. And make more things run on gas rather than electricity. That will be an important part, and it will happen. It's just a matter of time. It's just such a profound fact that they just can't deny. If the price of oil runs to $100 a barrel, watch all the heads turn. That's what it takes.

TER: Any parting comments?

FH: To end on a bright note, the secular bull market for commodities and natural resources stocks remains intact. Depending on the extent of economic recovery in developed nations, it could even intensify this year. Either way—although we have more conflict in the world than anybody needs, I think it's just great that peace and prosperity are driving the cycle in these emerging countries.

Frank Holmes is CEO and chief investment officer at U.S. Global Investors Inc., a registered investment adviser with approximately $2.7 billion in assets under management. Its 13 no-load mutual funds, which offer a variety of investment options, have won more than two dozen Lipper Fund Awards and certificates over the last 10 years. The company's World Precious Minerals Fund was the top-performing gold fund in the U.S. in 2009 – it was the second time in four years that the fund has achieved this distinction. Frank has been CEO since purchasing a controlling interest in the company in 1989. He co-authored The Goldwatcher: Demystifying Gold Investing, which was published in 2008. A regular contributor to a number of investor-education websites and speaker at investment conferences around the world, he maintains an investment blog called Frank Talk, writes articles for investment-focused publications and appears as a commentator on business channels such as CNBC, Bloomberg Television, Fox Business Channel and CNN's Your Money. Frank, who has been profiled in Barron's, Fortune, the Financial Times and other publications, was named Mining Fund Manager of the Year by The Mining Journal, a London-based publication for the global natural resources industry, in 2006. Last year, the World Affairs Council's chapter in San Antonio, Texas—where U.S. Global Investors is based—named him 2009 International Citizen of the Year. In addition to achievements as an investor in international markets, the award recognized Frank's involvement with the William J. Clinton Foundation to provide sustainable development in emerging nations and with the International Crisis Group to avoid and resolve armed conflicts around the world.

DISCLOSURE:

1) Karen Roche, of The Energy Report, conducted this interview. She personally and/or her family own none of the companies mentioned in this interview.

2) None of the companies mentioned in the interview are sponsors of The Energy Report.

3) Keith Schaefer—I personally and/or my family own the following companies mentioned in this interview: West, Petrominerales, Bankers, Painted Pony. I personally and/or my family am paid by none of the companies mentioned in this interview.

The ENERGY Report is Copyright © 2010 by Streetwise Inc. All rights are reserved. Streetwise Inc. hereby grants an unrestricted license to use or disseminate this copyrighted material only in whole (and always including this disclaimer), but never in part. The ENERGY Report does not render investment advice and does not endorse or recommend the business, products, services or securities of any company mentioned in this report. From time to time, Streetwise Inc. directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.