Gold Robust, Remains Near Record Highs in Most Currencies

Commodities / Gold and Silver 2010 May 05, 2010 - 06:17 AM GMTBy: GoldCore

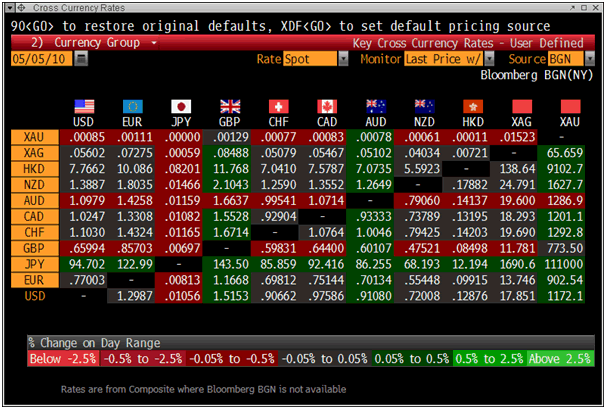

Gold has recovered from slight falls in Asia and is slightly higher in most currencies this morning - trading at USD 1,172 GBP 773 and EUR 903 per ounce this morning (see Cross Currency Table below). Gold is being supported by the significant risk to the stability of the European monetary union and the wider financial system and this is seeing investors internationally, and especially in Europe, diversify into gold.

Gold has recovered from slight falls in Asia and is slightly higher in most currencies this morning - trading at USD 1,172 GBP 773 and EUR 903 per ounce this morning (see Cross Currency Table below). Gold is being supported by the significant risk to the stability of the European monetary union and the wider financial system and this is seeing investors internationally, and especially in Europe, diversify into gold.

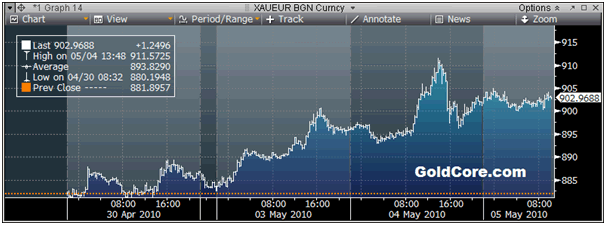

Gold in Euros - 5 Day (Tick)

Gold initially rallied yesterday as risk aversion increased. The metal touched a new high for the year of $1,191.90 an ounce, although it was back trading around $1,170 through the US and European sessions. Spot gold and US gold futures hit their highest since December 2009 yesterday, with the metal keeping its safe-haven appeal intact due to growing concerns on euro zone debt. Gold's increasing appeal as a currency resulted in it being one of the few commodities that benefitted from yesterday's risk aversion - oil, copper and other commodities fell sharply. Gold priced in sterling, Swiss francs and euros hit record highs and while gold was down by 1% in dollars, it rose in other currencies.

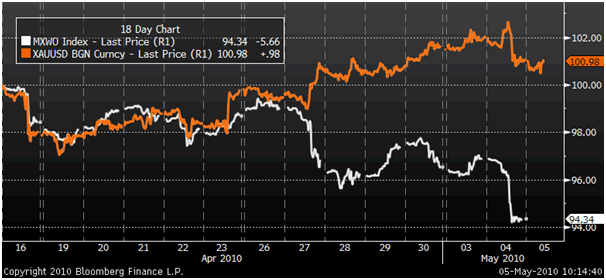

Gold and the MSCI - 20 Day (Tick) - Reweighted to 100

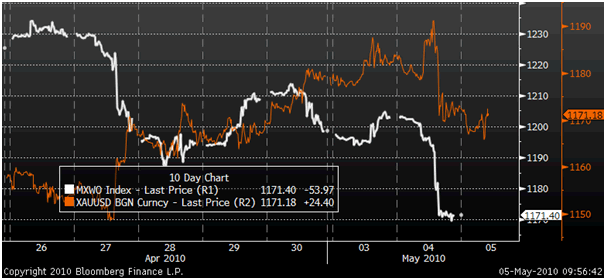

Gold's short term correlation with equities was seen yesterday with gold falling as equities fell (see Gold and MSCI Index charts above and below). However, gold fell by only 1% (in USD) while many equity indices were down by between 2% and 5%. It is worth remembering that gold has outperformed most equity indices in the last week, in the last month and year to date. While gold is correlated with equities it is only in the very short term. Gold can fall when equities fall sharply in turbulent market conditions however it generally falls by less than equities and then tends to recover quicker after sell offs. This has been the recurrent pattern in recent years.

Gold and the MSCI - 10 Day (Tick)

Silver

Silver fell some 4% yesterday but is flat so far today. The gold/silver ratio has risen back to nearly 66 meaning that silver remains good value vis-à-vis gold.

Platinum Group Metals

PGMs were under pressure yesterday with both platinum and particularly palladium falling. Platinum is trading at $1,670/oz marginally up and palladium is currently trading at $509/oz down another 1%. Rhodium is trading at $2,750/oz.

Cross Currency Rates at 1030 GMT - AUD, GBP and XAU Strongest Currencies and JPY Weakest

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.