No Stock Market Bottom in Sight, Bear Market Forces Gathering Strength

Stock-Markets / Stocks Bear Market Jun 02, 2010 - 03:28 AM GMTBy: Steve_Betts

"The National Government will regard it as it’s first and foremost duty to revive in the nation the spirit of unity and cooperation. It will preserve and defend those basic principles on which our nation has been built. It regards Christianity as the foundation of our national morality, and the family as the basis of national life."-- Adolph Hitler, My New World Order, Proclamation to the German Nation at Berlin, February 1, 1933

"The National Government will regard it as it’s first and foremost duty to revive in the nation the spirit of unity and cooperation. It will preserve and defend those basic principles on which our nation has been built. It regards Christianity as the foundation of our national morality, and the family as the basis of national life."-- Adolph Hitler, My New World Order, Proclamation to the German Nation at Berlin, February 1, 1933

When I read a quote like this it sounds a lot like Obama. People will of course get offended when I compare Obama to Hitler, but he didn’t become the Hitler we know today until 1938 or later. We tend to view some historic figure and assume they were always historic, but that is almost never the case. I predict that it will take the American public twenty years to realize just how bad, maybe even evil, Obama really is. Moving on the folks at Bloomberg and CNBC continue to ask self serving questions, or worse yet, questions that beg the answer. When a guest gives them an answer that catches then off guard, they’ll immediately change the subject or say they’re out of time.

The other day they had Marc Faber on Bloomberg and they asked him about the chances of a double dip recession. Mr. Faber answered that he doubted there was ever a recovery in the first place. That was the end of that discussion! In a separate interview they had a well known stock market bull and friend of Bloomberg in for an interview, and someone asked him about gold. He said it would go to US $3,000 within two years and that was a conservative target. The host almost fell out of his chair and was caught so off guard that he asked him to clarify, obviously thinking an error had been made. When the guest confirmed his answer and started to give his reasons, the host cut him off and went on to a different subject.

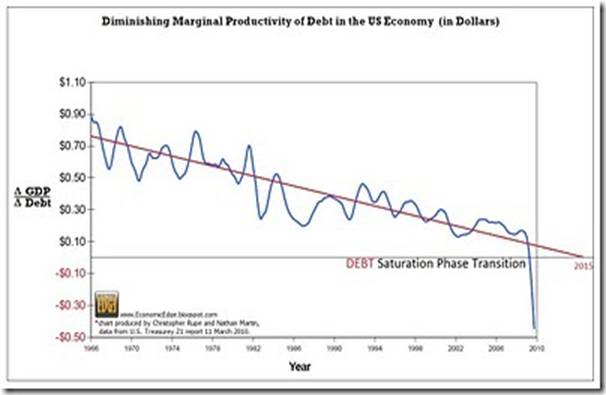

So much for the complaint department! Today I want to focus on the real problem, i.e., the staggering amount of debt around the world. Debt has always existed and in not inherently bad. Debt used for constructive purposes, for example to build a plant needed to produce a desired product

is a good thing because it adds value to the economy. You not only make money to service your debt but you create jobs and it spills over into other sectors of the economy. Unfortunately the type of debt created around the world either added nothing to the economy or it served to replicate production facilities that weren’t needed. Right now the world is awash in over production and that is forcing everyone to cut back. You buy fewer raw materials, lay off employees, cut back on production, slash prices and begin to reduce debt. Unfortunately incomes declines so fast that you can’t service existing debt, and that’s when the manure hits the fan.

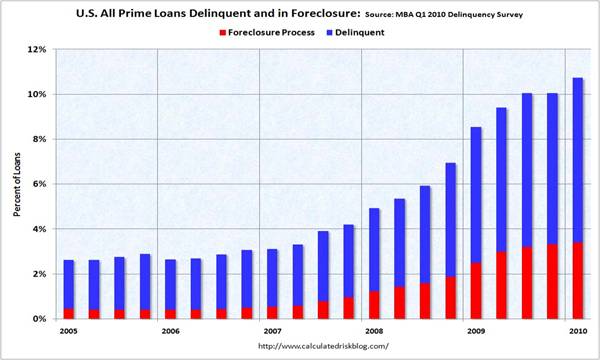

Once this type of downward spiral gains a foothold, it begins to feed on itself and becomes ingrained in the economy, much like a cancer, and consumes everything in its path. The Federal Reserve in particular and the world’s central banks in general, are supposedly trying to fight this downward spiral with an avalanche of fiat currency. This would have worked if they would have grabbed the bull by the horns in mid-2007 and acted in such a fashion, but that wasn’t the case. The Fed waited until March 2009 and the EU declined to act until last month. In short, the Fed and friends began to believe their own inflationary rhetoric and fell asleep at the switch, just like their predecessors did in 1930. History repeats itself! Then when they finally do get around to orchestrating a bailout, they pour trillions of dollars into a very small group of institutions that were for all purposes bankrupt. Now the Fed has come to the realization that these trillions went into a financial black hole for which no amount will suffice.

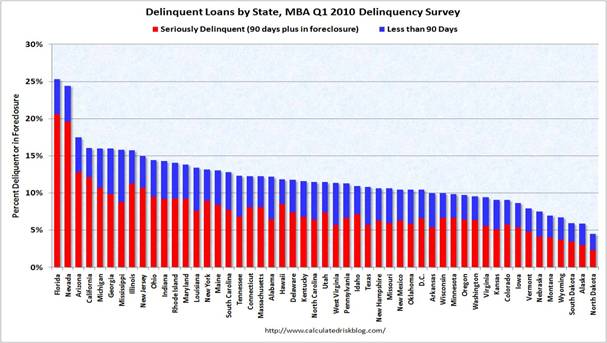

So the Fed and friends bailed out something that shouldn’t have been saved in the first place, while ignoring the productive private sector altogether. This miscalculation will only serve to exacerbate the deflationary cycle that has gripped both the US as well as the rest of the world. Debt is everywhere: residential and commercial real estate, credit card debt, lines of credit and of course on every level of the municipal, state and federal government. Tax revenues are in serious decline and that will strain government resources even more. Then we have the banks with unknown exposure to tens, if not hundreds of trillions of dollars worth of derivatives. The proper response should be to write off all bad debts, but that would affect some very powerful interests. So instead all governments are printing excessive amounts of fiat currency that you and I will never see, and they are sending us the bill.

Now I am going to tell you a little secret. All of these institutions they are trying to save are going to fail anyway. You’re not going to save the housing industry or commercial real estate sector from a second, even more disastrous wave down, any more than you’ll save the municipal and state governments from default as revenues disappear and they can no longer deposit into employee pension funds.

Right now California is paying with IOU’s while Illinois has simply stopped paying altogether. Harrisburg, Pa. is going to file for bankruptcy and a number of California municipalities are going to follow their lead. But that is just the tip of the iceberg. The banking sector is going to be extremely hard hit.

Right now the FDIC has their eyes on more than 700 “troubled” banks, with assets of more than US $350 billion that are a potential problem. On Friday they took over five more banks bringing the total top 79 for the year and the FDIC is already US $25 billion in the red. In April and May the pace of bank takeovers increased considerably and I look for it to pass 250 before the current year come to a merciful end. As far as Europe is concerned they are estimating that the banking sector will lose another US $250 billion over the coming year, on top of the US $300 lost over the last year. I believe their projections are grossly over optimistic.

The real problems will begin when the big boys, with their sovereign debt, begin to stumble and fall. Greece will be the first as it will soon be forced to abandon the Euro and then default on its debt. This will add another US $300 billion in losses to banks around the world. Then you’ll see Spain, Portugal, Ireland, and Italy all follow Greece’s lead. In the US you’ll see California, Michigan, Illinois and New York all default on their debt. Technically I suppose the US can’t default since it owns a printing press, but it will destroy the US dollar in the process. Right now we have a tremendous battle going on in the FX market as the EU tries to defend support in the Euro at 1.215. Last night and early this morning the Euro was getting hit very hard as the July futures contract traded as low as 1.211. Then as New York opened we saw significant intervention driving the June dollar down from its high of 87.58 to a low of 86.22. Once they took their foot off of the gas, they dollar began to rally and is now positive at 86.70.

As I’ve mentioned before there is significant resistance at 87.55 and today was the third test of that level. I have no way of knowing whether or not the greenback is making a top here, although I suspect not quite yet, but if it is, it should not be construed as good news for the Euro. The Euro is doomed in my opinion and a top in the dollar will simply signal the beginning of a mad race to the bottom. Neither the dollar nor the Euro will survive in its present form, and a top in the greenback will simply signal that all US paper assets will be heading in the same direction, i.e. lower. Stocks, bonds, and the dollar will all begin to experience sharp declines together as the second wave of deflationary pressure sucks all the air out of the market. This is the main reason why gold will continue to move higher throughout the summer when just about everyone sold in May and went away! Gold smells the coming debacle and is stubbornly refusing to turn down and today is trading well above the 1,219.20 resistance that has been so critical. Gold is going higher over the coming weeks, but I’ll have more on this tomorrow.

Finally, I would like to close out this discussion with a quick look at the Dow. A number of clients sent me the following chart and asked me to comment on it. What’s more I know that Richard Russell has hypothesized about the possibilities of the Dow putting in a head-and-shoulders top here. Below you can see that I have highlighted what could be the left shoulder, head, and neckline and I have inserted a question mark where the right shoulder might begin:

I will go right out on a limb here and say that I don’t think we’ll see a head-and-shoulders top, and if we do, the right shoulder will be extremely weak. My reasoning is that we’ve already seen two lower highs and two lower lows since the top was put in, and I don’t think that would be the case with a head-and-shoulders top. If the Dow can exceed and make two consecutive closes above the 200-dma, only then would I stop to consider such a formation. Yes, I know the Dow is being supported at 10,000 in order to keep up appearances, but it will fail. The bear market forces are gaining more strength every day and once it breaks decisively below 10,000, the flood gates will open.

[Please note that the new website at www.stockmarketbarometer.net will become operational this week. Also, note that you can contact us at our new e-mails, info@stockmarketbarometer.net (general inquiries regarding services), team@stockmarketbarometer.net (administrative issues) or analyst@stockmarketbarometer.net (any market related observations).]

By Steve BettsE-mail: analyst@stockmarketbarometer.net

Web site: www.stockmarketbarometer.net

The Stock Market Barometer: Properly Applied Information Is Power

Through the utilization of our service you'll begin to grasp that the market is a forward looking instrument. You'll cease to be a prisoner of the past and you'll stop looking to the financial news networks for answers that aren't there. The end result is an improvement in your trading account. Subscribers will enjoy forward looking Daily Reports that are not fixated on yesterday's news, complete with daily, weekly, and monthly charts. In addition, you'll have a password that allows access to historical information that is updated daily. Read a sample of our work, subscribe, and your service will begin the very next day

© 2010 Copyright The Stock Market Barometer- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.