EXTEND & PRETEND: A Matter of National Security

Politics / UK Economy Jun 18, 2010 - 07:14 AM GMTBy: Gordon_T_Long

There is something seriously wrong in America. We all sense it, but few in the mainstream media are willing to touch it or can effectively articulate it within the public’s sound-bite oriented attention span.

There is something seriously wrong in America. We all sense it, but few in the mainstream media are willing to touch it or can effectively articulate it within the public’s sound-bite oriented attention span.

It isn’t just about the remnants of the financial crisis; it isn’t the protracted jobs recession and slow recovery; it isn’t the trillions of dollars in deficit spending; it isn’t the degree of rampant financial malfeasants. It is something deeper which reaches into the soul of who we are as a people and society. It will soon be the central theme to your investment strategy and financial security.

On the surface it might appear we have lost our optimism about the future and our confidence that America is still the ‘beacon on the hill’ that countries around the world admire and look to for leadership. Though our children mouth the platitudes taught by older generations, they ring hollow in the hallways with video surveillance, motion sensors and metal detectors when recited by them. The high minded ideals seem misplaced in unemployment lines where they stand with freshly minted advanced degrees in hand, huge education debts and little hope other than the faint possibility of a non-paying internship position.

On the surface it might appear we have lost our optimism about the future and our confidence that America is still the ‘beacon on the hill’ that countries around the world admire and look to for leadership. Though our children mouth the platitudes taught by older generations, they ring hollow in the hallways with video surveillance, motion sensors and metal detectors when recited by them. The high minded ideals seem misplaced in unemployment lines where they stand with freshly minted advanced degrees in hand, huge education debts and little hope other than the faint possibility of a non-paying internship position.

It isn’t that the American people have changed. Our government has changed.

Before I specifically address what this means to your investment strategy and lay out a plan to protect your wealth, we need to delve into the unvarnished facts of what is happening to our quickly shifting cultural norms and our elected representative government.

The USA was a country that was based on a true moral compass and a belief system. Today, whether in Detroit, Cleveland or Los Angeles, we see decay and people who have lost their faith in America as the place where possibilities abound and everyone can have the American dream if he or she is willing to work for it. Today many in pursuit of that dream are working three jobs with no benefits and no longer getting by as they fall further into the grips of the lending shylocks. People, who perceive themselves as middle class, no longer have retirement plans like their parents, they are working longer hours to assist with their children’s horrendous college costs and are forced out of necessity to support their gown-up children long past ages which previous generations experienced.

Political slogans of “hope” and “change” touch cords with everyone but are hastily forgotten the moment the ballot is cast. Voters feel abandoned, betrayed and isolated from the political apparatus. Barrack Obama’s election evidenced both the desperation people have for anyone who is perceived to offer change and how quickly we are subsequently disappointed in their obvious empty political rhetoric. It seems it is all just great theater aimed at making us feel we actually have some choice in a carefully crafted choreography.

Unknowingly we are steadily marching towards a political crisis that will embody a currency crisis across the entire global fiat based money system. This crisis will force us as citizens to make choices about our personal freedoms that we would be startled to even contemplate today and ten years ago would have been viewed as heresy.

We are steadily marching towards a political crisis that will embody a currency crisis across the entire global fiat based money system.

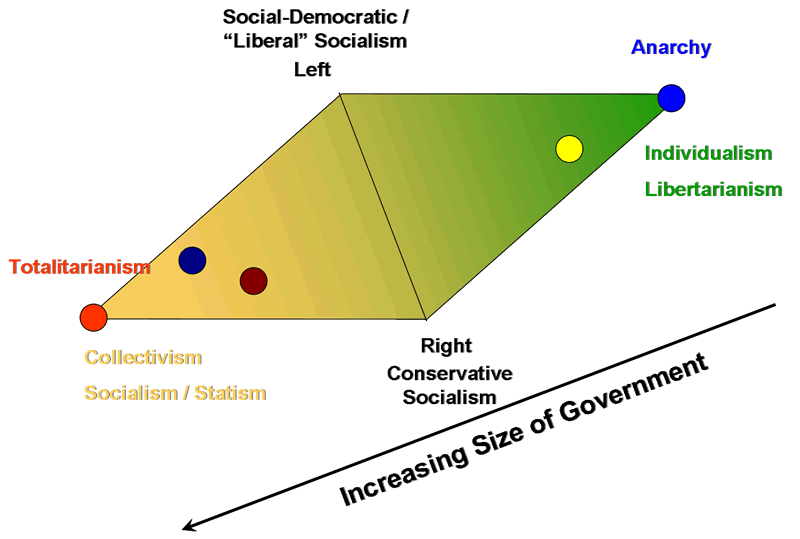

This article will bridge the Economic to Political Transition Shown Above

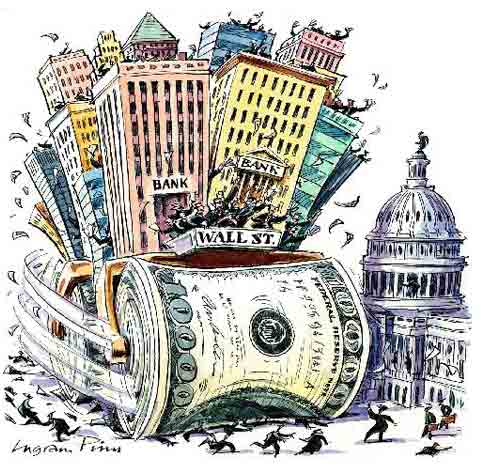

Our leaders have become propaganda machines promising change but delivering the lobbyists’ agenda which appears to make matters only worse. Every election, waves of our well intentioned fellow citizens go to Washington with high hopes of making a difference, but are quickly ground into submission by an unscrupulous culture of power, influence and compromise. The few who maintain their convictions are quickly neutralized and removed like an ugly infection by the party apparatus. So what is to be done?

First we need to recognize the real problem, not what the media spin machine purports the problems to be. We need to realize that we are in an era of trading personal freedom for what is economic freedom or touted as national security. Like slavery we are succumbing to a sacrifice of our liberty for the basic primeval needs of safety and survival. Few recognize the insidious cancer other than possible slave masters behind the curtain.

We are in an era of trading personal freedom for what is economic freedom or touted as national security

Many of you will no doubt think this harsh. Consider the personal freedoms we have surrendered in the last decade, for what we are sold with high pressure tactics, as increased personal security and labeled a matter of national security on our war on terror:

Many of you will no doubt think this harsh. Consider the personal freedoms we have surrendered in the last decade, for what we are sold with high pressure tactics, as increased personal security and labeled a matter of national security on our war on terror:

-

· Personal surveillance has become ubiquitous due to the fear of terrorism as represented by: surveillance cameras, metal detectors, security guards in every public and even private gathering place.

-

· Borders are tighter, money movement is tighter and government reporting requirements on movement has increased.

-

· Regulations, fees and taxes have exploded at all levels of government while basic public services are reduced.

-

· Personal Information under the Patriot Act has made available unlimited amounts of personal information to the government’s watchful eye. There is no longer any privacy from the government.

-

· A more than one $T annual military budget (including an off-budget sheet war) is spent to enforce police activities in over 130 countries yet we can’t implement a ‘half baked’ response to an oil spill on our own shores or assist our own citizens in the wake of a devastating hurricane. These are complete government failures to actually deliver the national security we have entrusted to them.

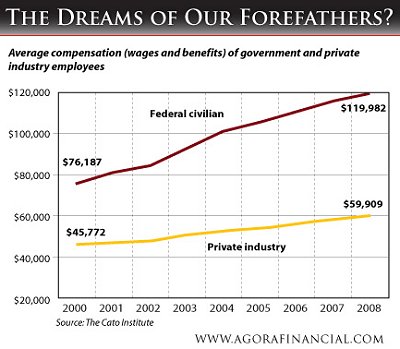

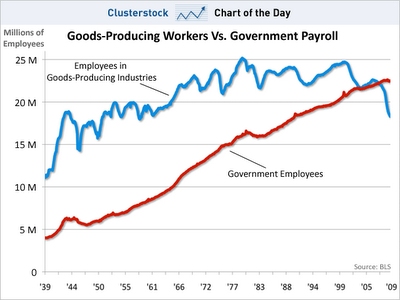

GOVERNMENT EXPANSION

This is not meant to be a political tirade or a commentary on the war on terror. I am not passing judgment on the need for any of the above. I am only stating the facts so we recognize the insidious change that is occurring around us.

This is not meant to be a political tirade or a commentary on the war on terror. I am not passing judgment on the need for any of the above. I am only stating the facts so we recognize the insidious change that is occurring around us.

My interest in politics in this discussion is limited to what it means to our investment strategy. I therefore have no political agenda in how I see things unfolding nor am I a conspiracy buff. I am a realist without a political agenda to sell. I simply want to survive and give to the next generation a better, safer and freer world than I was born into. Shorter term I want to accumulate and protect my wealth.

I need to spell this out so you understand that I am not trying to favor a Democrat, Republican or Libertarian agenda. To me they are all guilty of ‘political fiddling while Rome burns’. Soon politics as usual for Washington and them will be over as the blunt force of reality hits home in America.

Fuzzy words and happy face economics will soon be wasted on the public wanting real solutions to real problems, not idealistic philosophies on how to fix the problems in some far off land they watch on the evening news. The public wants ‘meat and potato’ solutions to problems of retirement, healthcare, education, taxation, housing etc. These demands expectantly escalate when standards of living fall and unrealistic expectations and senses of entitlement are crushed. This is part of the transitioning America is in the process of presently.

Demands expectantly escalate when standards of living fall and unrealistic expectations and senses of entitlement are crushed.

I want to give you a detailed framework with which to measure what is happening. Armed with this framework, I then want to show you what it means to your future financial strategy and planning.

COLLECTIVISM

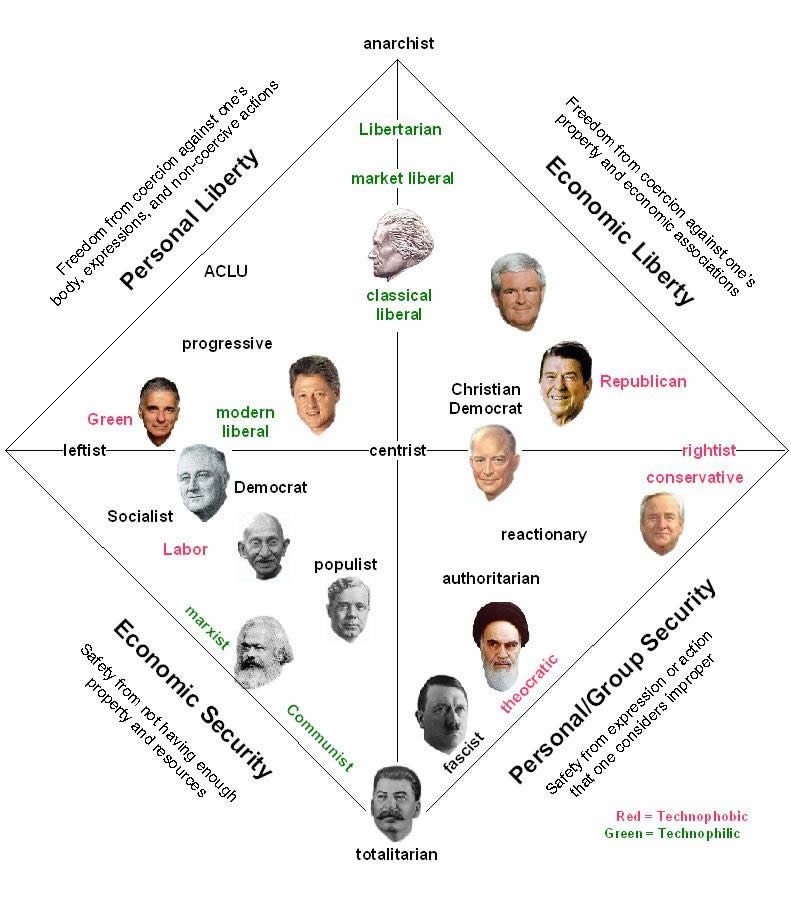

In The Road to Serfdom, F.A. Hayek showed how governments, supported by a collectivist mindset, always tend towards totalitarianism. Even the most libertarian government thus far created, the government of the United States, has slipped incrementally towards totalitarianism over the past two centuries. This is because it is an inherent trait of a government. (1)

The degree of socialism in the United States increased substantially after the establishment of the Federal Reserve System (1913) and the measures taken during the Great Depression (1929-46) which it created. Ever since the early 1900's the United States has had a two-party system dominated by ‘socialists’. The Republican Party has always advocated conservative socialism. The Democratic Party, which in the 19th century favored libertarianism, advocates social-democratic socialism. So long as people are divided by Left and Right, Democratic andRepublican, the US is prone to being influenced by factions who transcend party politics and from behind the scenes could possible exert strong control over the United States. They could do this by maintaining power over public opinion and hence over the course of government. Steadily, the United States has been traveling down the road to totalitarianism, and many people have not noticed, possibly because they are only looking at the position on the Left-Right paradigm.

Upon further analysis, it is clear that Left, Right, and Centre, are all forms of socialism.(1) In particular, we may call them “social-democratic socialism” (the Left) and “conservative socialism” (the Right). They are both socialism because they both share the principle that the government should “run” and “mould” society, by using legal force and intervention to transfer property and personal wealth as part of the political scientists’ process of ‘redistribution of wealth’.

The differences are only in the particular ways the government should run society – the methods it should use, and who, exactly, should be the recipients of government wealth transfers and who should pay. In particular:

-

Social democrats tend to prefer heavy taxation, large wealth transfers to the poor, and nationalized industries, and oppose price controls, regulations and behavioral controls.

-

-

Conservatives tend to prefer lower taxation, a smaller welfare state, regulated (cartelized) industries, price controls, product controls and behavioral controls.

The modern Republican Party is Center-Right on the Left-Right paradigm. As with the Democratic Party, this obscures the huge range of views Republicans hold on how powerful and how much control the State should be allowed. Their 2008 presidential nominee John McCain, like Barack Obama, strongly favored socialism, though with a Right-wing flavors. Barack Obama (blue circle) and John McCain (red circle) are positioned in the accompanying graphic. Thus, the two main candidates at the 2008 Presidential election represented a false choice - really no choice at all. One candidate, Ron Paul (yellow circle), stood in stark contrast to the candidates favored by the mainstream media and political establishment. As would be expected he was neutralized by the mainstream media outlets as a zealot with an unsound political view of America.

WHAT IT MEANS TO YOUR FINANCIAL STRATEGY & PLANNING

It is almost indisputable that as future events unfold, the US government will become larger, more controlling and more interventionist. It will exert more power over ever increasing levels of our personal decision making. This will include our investment choices, which will be increasingly represented and framed as what is in the best interest of the state and national security. They will increasingly be policed by taxation, regulatory reporting and predatory restrictions on available options that were previously available.

The following graphic from the Sultans of Swap and Extend & Pretend series of articles is an exploded view of the short term transitional process we are presently within. I have labeled the transition into three states: A, B and C.

UNFOLDING EVENTS: Sign Posts and Tell-Tales

You must be alert and carefully watch for these tell-tale signals in the not too distant future.

LEGISLATIVE REGULATION

NEW PUBLIC POLICY INITIATIVES TARGET POLITICAL EXCUSES

Must hold government Debt Instruments (Bonds, Bills, Notes) Banks ‘LIQUIDITY’

Must hold government Debt Instruments (Bonds, Bills, Notes) Pensions ‘SAFETY’

Restrictions on IRA, 401K (Investments & Withdrawal)

Caps on Private Interest Rates – Ceilings Lenders ‘USURY’

Capital and Exchange Controls Investors ‘SPECULATION’ [Escape]

HOW TO PROTECT YOURSELF

In EXTEND & PRETEND: A Guide to the Road Ahead I stated:

“Hard assets such as physical gold and silver have traditionally been the ideal vehicle for an environment of high inflation coupled with a currency crisis. I fully expect governments will strip these assets from holders either directly or through predatory taxation, fees or other trading limitations. They will be classified somewhere in the four categories discussed above. Alternatively, if it is not done in this fashion it will be controlled through intervention similar to national currencies in the forex arena. I personally suspect it is already being controlled in some fashion based on the March 25th whistleblower testimony by Andrew Maguire. It is a matter of national security in a beggar-thy-neighbor environment since gold and silver are the only real money in a fiat based system. Protect yourself accordingly.”

Let me expand on that further but I would suggest you also consider the following gold / silver discussion as a model for all of your present investment choices.

GOLD & SILVER

-

I would fully expect to see a ‘black market’ in gold IF the government goes the route of confiscation. This would therefore favor smaller denominated physical assets such as coins and possibly smaller bars. I am skeptical that the government will choose this route since there is too much precedence for black markets appearing.

-

Predatory taxation is the highest probability as the government choice since it already has the mechanisms in place to police such an approach. Therefore offshore holding such as “Gold Money” where the physical gold is easily moved and converted seems appropriate. Unfortunately this is as regulations presently stand. The G20 countries are all in this together and they are very much now focused on ‘tax haven’ countries that would harbor these and other taxable holdings. Government will make it illegal not to report these holdings and when you move them you will have a great deal of difficulties, plus possible felony issues.

-

-

China is advising its citizens to own gold. In India, owning gold is a way of life. Therefore it is highly unlikely that all countries will act in a predatory fashion towards gold. The problem here is they still may make it illegal or difficult for foreigners to actually hold gold in their countries as an appeasement to other nations. You may be all right until they are forced to make concessions to external pressures.

I could go on with other gold / silver holding options but I find they can all be made extremely difficult if governments choose to target them.

The answer to me is therefore ‘PLANNED VIGILANCE’ under the auspices of a clearly predetermined ‘DECISION TREE’. Let me explain what I mean by this terminology.

Don’t try and outguess what the government is going to do. Since the government has only so many options, you can put together a ‘decision tree’ of alternatives in advance. Knowing this you can watch government activities closely for signals and shifts. Legislative and regulatory actions are usually well telegraphed. Large professional fund managers have known this and executed such strategies for years. It is now a strategic imperative for all investors.

If you have proportioned your gold investments in advance based on the probabilities on your decision tree ( i.e. so much in coins because the probability of a confiscation is say 15%) then you would shift your ALLOCATION as events unfold. The trick will be to stick to your strategy and not to be lulled by the spin that will accompany government actions. You can fully expect it to be camouflaged or misrepresented but not hidden.

The trick will be to stick to your strategy and not to be lulled by the spin that will accompany government actions

So how does this strategy actually protect you over the long term? The fact is government legislation and regulation is often ripe with loopholes. Either intentional or mistaken it is the world where accountants, tax advisors and lawyers live. You can be assured that new options for your decision tree will emerge if you are vigilant and know this is integral to your long term investment strategy. Welcome to the 21st century of investment management.

THIS APPROACH CAN BE FOLLOWED THROUGHOUT YOU PORTFOLIO AS GOVERNMENT CONTROL IS INCREASED AND THE WORLD OF PROFESSIONAL CAPITAL AND REGULATORY ARBITRAGE ACCELERATES

Upcoming in the Extend & Pretend series will be the Decision Tree for Gold (Decision Tree sign-up) along with a Tipping Points overlay map (Overlay Map sign-up) to track critical unfolding developments.

SOURCES:

(1) Truth and Liberty Web Site - Politics

For further background read: EXTEND & PRETEND - Manufacturing a Minsky Melt-Up.

Sign Up for the next release in the EXTEND & PRETEND series: Commentary

The previous EXTEND & PRETEND article: EXTEND & PRETEND: A Guide to the Road Ahead

Gordon T Long gtlong@comcast.net Web: Tipping Points

Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2010 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

K Smith

30 Jun 10, 03:12 |

analysis

This is the most cogent, coherent, and succinct analysis I have seen of what we all face. Keep up the good work. |