Why Do U.S. Asset Managers Fear Government Gold Confiscation?

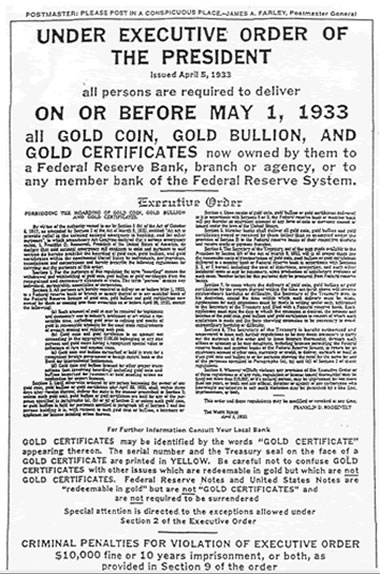

Commodities / Gold and Silver 2010 Jul 26, 2010 - 10:21 AM GMT Mr Levine of HSBC in a recent gold conference pointed out that some top U.S. Asset Managers were fearful of the possibility of government confiscation of gold. He explained, that on being told that the bank's U.S. vaults had sufficient space available for their gold he was told that they did not want their gold stored in the U.S.A. but preferably in Europe because they feared that at some stage the U.S. Administration might follow the path set by Franklin D. Roosevelt in 1933 and confiscate all U.S. gold holdings as part of the country's strategy in dealing with the nation's economic problems.

Mr Levine of HSBC in a recent gold conference pointed out that some top U.S. Asset Managers were fearful of the possibility of government confiscation of gold. He explained, that on being told that the bank's U.S. vaults had sufficient space available for their gold he was told that they did not want their gold stored in the U.S.A. but preferably in Europe because they feared that at some stage the U.S. Administration might follow the path set by Franklin D. Roosevelt in 1933 and confiscate all U.S. gold holdings as part of the country's strategy in dealing with the nation's economic problems.

Who are these Asset Managers?

Who are these Asset Managers?

For a start, they are highly qualified capable men who understand the ins and outs of investment management. Such knowledge usually encompasses monetary matters of the sort that would include gold. As such we would suggest their opinions have value.

Why did Roosevelt confiscate U.S. citizens Gold in 1933?

- The U.S. was fighting to come out of the Depression and U.S. banks were struggling in a not to dissimilar way that they are today.

- The Federal Reserve was fully aware that U.S. money supply was closely related to the gold they held. Money supply had to expand.

- Hitler had gained power in Germany. The potential for war now existed.

- The value of gold as a reserve asset that provided liquidity, when all else failed was fully understood.

- The ability to raise money supply by devaluing the Dollar in terms of gold, was an opportunity that had to be taken.

But where was Roosevelt going to get the gold needed to both enlarge the money supply sufficiently and to provide internationally acceptable money in the event of war? One of the recognized tactics of war always includes forging your enemy's money and undermining the home economy. Gold is difficult to forge.

So every advantage was there to confiscate gold and if needs be, to devalue the $ so instantly enlarge the money supply.

When National Interests supersede those of its Citizens

How true the saying, "A true patriot is one who commits you to his cause." And so it is with governments. Should we see ourselves as bound up with our government, or can we make our own decisions when we disagree with government. Each one must answer that question for himself. Many feel the answer has to be qualified by the situation that presents such demands. Many will support their government nearly all the way, but draw the line at their own personal wealth [on which tax has been paid] being confiscated, albeit for cash. It seems this is what these asset managers feel. Certainly the trust in and reliance on government has decayed since those days. Many feel that gold is beyond the pale of such demands.

In Roosevelt's day, it may have seemed reasonable to most to willingly accede to government demands for the confiscation of gold. Today, with the ability to hold gold anywhere in the world, such compliance may not be necessary [We will look at the validity of this concept in a later article on the subject - it may not be as clear as many would like it to be!] or will it? After all, the market price at the time was $20, so it seemed a fair price. That was so for two years, when President Roosevelt authorized the devaluation of the Dollar by 75% and raised the price of gold to $35 an ounce. Then many citizens had a sense of humor failure.

Where could the U.S. Government get more gold?

The most accessible gold was locally held gold, held by U.S. citizens. To help matters enormously, every U.S. citizen had to declare his assets on a yearly basis to the Taxman. So accurate records were held of how much was held, by whom and where it was held. The only way out was to hold rare gold coins, which fell outside the classification of simple gold.

It was a great start. The Depression spread far outside the States and the banking problems, like today, covered the developed world. Germany was rising fast and clearly headed for war. Europe and the U.K. were vulnerable in a war. Prudence demanded that a war chest be accumulated and held in the States.

It would be naïve to think that Europe and the U.K. were caught off-guard by the United States devaluation of the Dollar, which history leads us to believe. No other countries devalued with the U.S. Dollar. They all held their exchange rates to the Dollar at the rate of exchange that stood before the devaluation. This created a massive arbitrage opportunity. Buy gold in London at the equivalent of $20 and ounce and sell it to the U.S. at $35 an immediate 75% profit. It wasn't long before the U.S. was holding the bulk of the world's gold, over 26,000 tonnes of it.

What principles were established by this accumulation of gold?

- The first was that governments not only believe that it is a privilege for individuals to own gold, but that, that privilege can be removed at any time they want.

- The second is that governments will cooperate to the extent needed on accumulating gold, when they believe it necessary.

- The Third is that confiscation is a course of action that will be followed should one or more governments deem it necessary in their national interests.

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

![]()

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2009 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.