Massive Wealth Shift From West to Emerging Markets in Full Swing

Stock-Markets / Emerging Markets Aug 09, 2010 - 08:04 AM GMTBy: Martin_D_Weiss

Martin here with a quick update on foreign markets.

Martin here with a quick update on foreign markets.

One year ago, in our 2009 Global Forum, we forecast a massive shift of wealth — from the United States, bogged down with huge deficits and chronic, long-term unemployment … to emerging markets, enjoying the most rapid growth on the planet.

Now, that shift is in full swing …

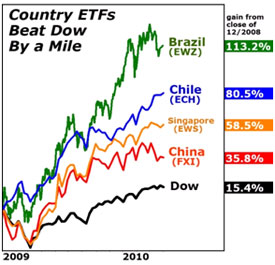

Since the beginning of 2009, despite the biggest government bailouts and stimulus of all time, the Dow Jones Industrial Average is up only 15.4 percent.

Since the beginning of 2009, despite the biggest government bailouts and stimulus of all time, the Dow Jones Industrial Average is up only 15.4 percent.

In contrast …

- FXI, our favorite exchange traded fund (ETF) focused on China’s blue chips, has gained 35.8 percent in the same period, beating the Dow by 2.3 to one …

- The ETF tied to Singapore’s market (EWS) has gained 58.5 percent, trumping the Dow by 3.8 to one …

- The ETF for Chile (ECH) has jumped 80.5 percent, or 5.2 times faster than the Dow, and …

- Our favorite Brazil ETF — EWZ — has surged by a whopping 113.2 percent, or 7.35 times better than the Dow!

In other words, for every $10,000 investors might have made in the Dow since the beginning of 2009, you could have made $73,500 simply buying and holding the Brazil ETF.

This is no fluke. We see a similar pattern of vast outperformance in virtually all time frames we review and nearly all emerging markets we sample.

Nor is this strictly a market phenomenon. As we’ve told you repeatedly in recent years, we see powerful forces driving a wider and wider wedge between …

- the mediocre performance of old and tired economies of the West and …

- the vibrant, rapidly growing economies of the East and South.

Specifically …

In the U.S., deficits have now emerged as a major drag on the economy.

A few months ago, the Congressional Budget Office estimated that the president’s budget would result in record-breaking, back-to-back deficits of $1.5 trillion in 2010 and $1.3 trillion in 2011.

But that was before the latest bad news on the economy, and certainly before Friday’s dismal jobs report. Not only was the labor market far weaker than Wall Street and Washington expected, but it also turned out that many prior jobs gains touted by the government were a mirage, wiped away by the single stroke of a statistician’s revisions.

John Williams, editor of Shadow Government Statistics, explains it this way:

“As suggested by the deterioration and revisions in today’s labor market report, the recently-hailed economic recovery has all but evaporated. … Market recognition of the re-intensified downturn is spreading, along with recognition of sharply negative implications for the federal budget deficit, for Treasury funding needs, [and] for banking system solvency. …

“July’s headline unemployment rate held at a seasonally-adjusted 9.5 percent, but not because of a stable employment environment. To the contrary, continued shrinkage of the labor force … reflects an increasing number of longer-term unemployed giving up looking for work and moving … into the discouraged worker category.”

Including discouraged workers who have given up looking for work for more than a year (excluded from the government’s official tally), Williams estimates that true unemployment in the United States now stands at 21.7 percent!

In contrast …

China’s economy grew by 9.1 percent, or nearly four times faster than the U.S; and this year is expected to grow 10.5 percent, or as much as five times faster.

Singapore’s economy expanded by an unprecedented 17.9 percent in the first half of the year, or nearly double China’s pace. Singapore’s prime minister is predicting “a slowdown” in the second half, helping to contain the yearly GDP growth to “only” 13 to 15 percent for the year. But that would still be about six or seven times faster than America’s GDP growth.

Meanwhile, Brazil and Chile now have the potential to catch up with the rapid growth in Asia. Indeed, in many respects, they are stronger than China and the two other BRIC countries — Russia and India.

Consider these facts:

- Unlike Russia and China, Brazil and Chile have true democratic elections and the rule of law.

- Unlike India’s, their exports are broadly diversified.

- Perhaps most important: Unlike the U.S., they have virtually no foreign debts.

Bottom line: Asian markets are greatly outperforming the U.S. … and key South American markets are poised to leap ahead of most of Asia’s.

Our response: Next week, I will be hosting a new Weiss Global Forum! I will bring together our experts on four continents, with specific instructions on how to protect yourself — and profit — from this massive wealth shift.

Coming tomorrow: Our announcement with all the details! Stand by.

Good luck and God bless!

Martin

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.