Long Term Bonds, Inflation and Deflation

Interest-Rates / US Bonds Sep 24, 2010 - 06:03 AM GMTBy: Tony_Caldaro

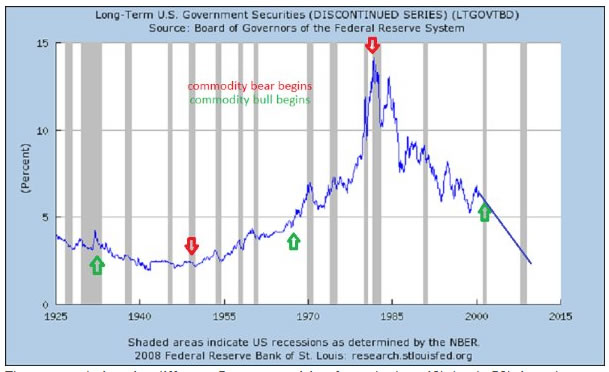

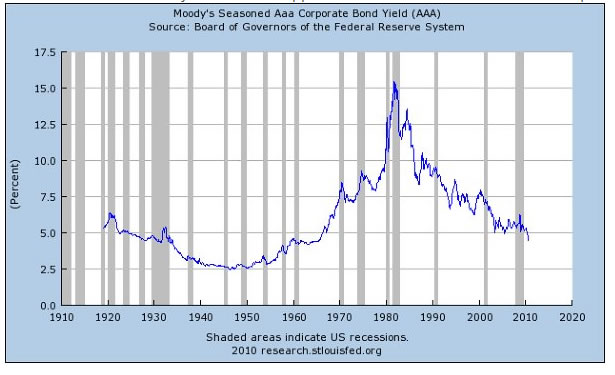

Been thinking about Bonds, inflation, deflation, etc recently. Everyone seems to have a different opinion these days. Checking around all I could find on long term Gov't Bond rates was at the St. Louis FED. Could not find anything elsewhere. After reviewing the charts of Long Term Gov'ts since 1925, Moody's AAA since 1919, and Moody's BAA since 1919 ... I found a pattern.

Been thinking about Bonds, inflation, deflation, etc recently. Everyone seems to have a different opinion these days. Checking around all I could find on long term Gov't Bond rates was at the St. Louis FED. Could not find anything elsewhere. After reviewing the charts of Long Term Gov'ts since 1925, Moody's AAA since 1919, and Moody's BAA since 1919 ... I found a pattern.

In the 1920's when credit was flowing rates were declining. Then heading into the depression rates spiked momentarily after FDR increased the money supply dramatically when calling all the gold and raising the price from $20.67 to $35.00. Then during the main part of the depression rates continued to decline until the late 1940's. After that they started edging up into the 1950's until taking off in the 1970‘s and topping around 1980 or so.

Again credit started flowing as rates gradually declined, and they continue to decline. During the last deflationary cycle rates declined throughout the 1930's to 1940's. During this deflationary cycle rates are also declining as deflationary pressures persist. But here is the pattern.

The chart below notes the commodity bull market cycles, with 'green' arrows when they start and 'red' arrows when they end. Notice rates were declining heading into the depression. When FDR increased the money supply the commodity bull market began in 1933. That bull market continued until 1946, putting some inflationary pressure on the economy, and rates continued to decline. Rates did not start ticking up until after the commodity bull market was over in 1946.

The next cycle is quite different. Rates were rising from the late 40's/early 50's into the next commodity bull market, which kicked off in 1967. Look at the results of that bull market without deflationary pressures to offset it. Rates peaked right after the commodity bull market ended in 1980. Two commodity bull markets, two different results.

Now we jump ahead to the present. Rates have been declining since around 1980. Then continued to decline into the 1990's. This is similar to the decline in the 1920's. Deflationary pressures began around the turn of the century with the dotcom bust. The bull market in commodities kicks off in 2001. As commodities continued to rise rates, (except for a momentary spike), continued to fall. This is similar to the 1930's. Again the commodity bull market is offsetting the deflationary pressures in the economy.

When we look at 1929-1933 we see a total deflationary collapse. The stock market lost 90% of it value and unemployment soared to 25%. Commodities at that time were in a bear market too. It wasn't until FDR called all the gold and dramatically increased the money supply in 1933, which kicked off the commodity bull market, that things started to stabilize. Rather than going through a similar deflationary episode this time around Greenspan left rates low for a long time and kept liquidity flowing. This averted the first wave of the collapse, but it created new bubbles in real estate and the financial instruments. When those bubbles burst in the second wave of deflation, Bernanke started the printing press and dramatically increased the money supply. What followed was a myriad of alphabet soup programs, $875 bln from the gov't, etc., etc. etc. The FED/Gov't flooded the system with money. For the past two years the FED has been buying Gov't agency bonds to keep mortgage rates low, and Gov't bonds to support the expanding debt. Recently they announced they are buying further out the yield curve, which is exactly what the FED did in the 1940's to keep rates low.

What was old, is now new again.

Conclusion.

Long term rates, including AAA corporate’s, should continue to decline or hold steady until the commodity bull market ends in 2014.

Around that time deflationary pressures will probably have lost its effect on the economy.

Rates will start moving higher after the FED is comfortable that this has occurred. This is likely to occur during the next stock bull market cycle after 2014.

Rates will then start to normalize again in the area of 5% until the next commodity bull market kicks in. Then hyperinflation.

When a commodity bull market occurs during a deflationary period the net effect is low inflation.

When a commodity bull market occurs during normal times the net effect in high inflation.

Interesting world. When Gold tops in 2014 most will think inflation is dead and rates can now stay low for a long time. Then over the next several years the exact opposite will occur. One has to love historic quantitative data.

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2010 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.