Fed's Hidden Agenda of Driving U.S. Into a Second Great Depression

Economics / Great Depression II Nov 21, 2010 - 06:46 AM GMTBy: Washingtons_Blog

Ben Bernanke has said that the Fed is trying to promote inflation, increase lending, reduce unemployment, and stimulate the economy.

However, the Fed has arguably - to some extent - been working against all of these goals.

Ben Bernanke has said that the Fed is trying to promote inflation, increase lending, reduce unemployment, and stimulate the economy.

However, the Fed has arguably - to some extent - been working against all of these goals.

For example, as I reported in March, the Fed has been paying the big banks high enough interest on the funds which they deposit at the Fed to discourage banks from making loans. Indeed, the Fed has explicitly stated that - in order to prevent inflation - it wants to ensure that the banks don't loan out money into the economy, but instead deposit it at the Fed:

For example, as I reported in March, the Fed has been paying the big banks high enough interest on the funds which they deposit at the Fed to discourage banks from making loans. Indeed, the Fed has explicitly stated that - in order to prevent inflation - it wants to ensure that the banks don't loan out money into the economy, but instead deposit it at the Fed:

Why is M1 crashing? [the M1 money multiplier basically measures how much the money supply increases for each $1 increase in the monetary base, and it gives an indication of the "velocity" of money, i.e. how quickly money is circulating through the system]

Because the banks continue to build up their excess reserves, instead of lending out money:

These excess reserves, of course, are deposited at the Fed:

Why are banks building up their excess reserves?

As the Fed notes:

The Federal Reserve Banks pay interest on required reserve balances--balances held at Reserve Banks to satisfy reserve requirements--and on excess balances--balances held in excess of required reserve balances and contractual clearing balances.

The New York Fed itself said in a July 2009 staff report that the excess reserves are almost entirely due to Fed policy:

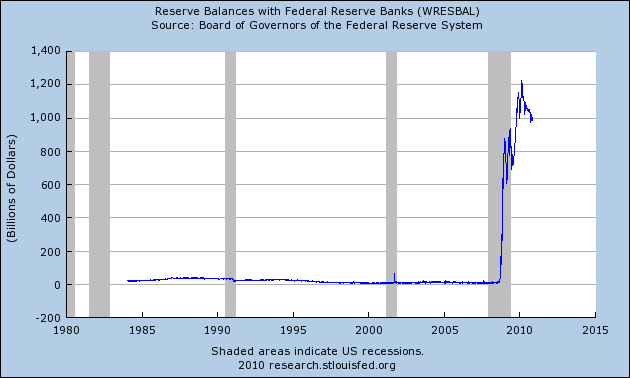

Since September 2008, the quantity of reserves in the U.S. banking system has grown dramatically, as shown in Figure 1.1 Prior to the onset of the financial crisis, required reserves were about $40 billion and excess reserves were roughly $1.5 billion. Excess reserves spiked to around $9 billion in August 2007, but then quickly returned to pre-crisis levels and remained there until the middle of September 2008. Following the collapse of Lehman Brothers, however, total reserves began to grow rapidly, climbing above $900 billion by January 2009. As the figure shows, almost all of the increase was in excess reserves. While required reserves rose from $44 billion to $60 billion over this period, this change was dwarfed by the large and unprecedented rise in excess reserves.

Why are banks holding so many excess reserves? What do the data in Figure 1 tell us about current economic conditions and about bank lending behavior? Some observers claim that the large increase in excess reserves implies that many of the policies introduced by the Federal Reserve in response to the financial crisis have been ineffective. Rather than promoting the flow of credit to firms and households, it is argued, the data shown in Figure 1 indicate that the money lent to banks and other intermediaries by the Federal Reserve since September 2008 is simply sitting idle in banks’ reserve accounts. Edlin and Jaffee (2009), for example, identify the high level of excess reserves as either the “problem” behind the continuing credit crunch or “if not the problem, one heckuva symptom” (p.2). Commentators have asked why banks are choosing to hold so many reserves instead of lending them out, and some claim that inducing banks to lend their excess reserves is crucial for resolving the credit crisis.

This view has lead to proposals aimed at discouraging banks from holding excess reserves, such as placing a tax on excess reserves (Sumner, 2009) or setting a cap on the amount of excess reserves each bank is allowed to hold (Dasgupta, 2009). Mankiw (2009) discusses historical concerns about people hoarding money during times of financial stress and mentions proposals that were made to tax money holdings in order to encourage lending. He relates these historical episodes to the current situation by noting that “[w]ith banks now holding substantial excess reserves, [this historical] concern about cash hoarding suddenly seems very modern.”

[In fact, however,] the total level of reserves in the banking system is determined almost entirely by the actions of the central bank and is not affected by private banks’ lending decisions.

The liquidity facilities introduced by the Federal Reserve in response to the crisis have created a large quantity of reserves. While changes in bank lending behavior may lead to small changes in the level of required reserves, the vast majority of the newly-created reserves will end up being held as excess reserves almost no matter how banks react. In other words, the quantity of excess reserves depicted in Figure 1 reflects the size of the Federal Reserve’s policy initiatives, but says little or nothing about their effects on bank lending or on the economy more broadly.

This conclusion may seem strange, at first glance, to readers familiar with textbook presentations of the money multiplier.

Why Is The Fed Locking Up Excess Reserves?

As Fed Vice Chairman Donald Kohn said in a speech on April 18, 2009:

We are paying interest on excess reserves, which we can use to help provide a floor for the federal funds rate, as it does for other central banks, even if declines in lending or open market operations are not sufficient to bring reserves down to the desired level.

Kohn said in a speech on January 3, 2010:

Because we can now pay interest on excess reserves, we can raise short-term interest rates even with an extraordinarily large volume of reserves in the banking system. Increasing the rate we offer to banks on deposits at the Federal Reserve will put upward pressure on all short-term interest rates.

As the Minneapolis Fed's research consultant, V. V. Chari, wrote this month:

Currently, U.S. banks hold more than $1.1 trillion of reserves with the Federal Reserve System. To restrict excessive flow of reserves back into the economy, the Fed could increase the interest rate it pays on these reserves. Doing so would not only discourage banks from draining their reserve holdings, but would also exert upward pressure on broader market interest rates, since only rates higher than the overnight reserve rate would attract bank funds. In addition, paying interest on reserves is supported by economic theory as a means of reducing monetary inefficiencies, a concept referred to as “the Friedman rule.”

And the conclusion to the above-linked New York Fed article states:

We also discussed the importance of paying interest on reserves when the level of excess reserves is unusually high, as the Federal Reserve began to do in October 2008. Paying interest on reserves allows a central bank to maintain its influence over market interest rates independent of the quantity of reserves created by its liquidity facilities. The central bank can then let the size of these facilities be determined by conditions in the financial sector, while setting its target for the short-term interest rate based on macroeconomic conditions. This ability to separate monetary policy from the quantity of bank reserves is particularly important during the recovery from a financial crisis. If inflationary pressures begin to appear while the liquidity facilities are still in use, the central bank can use its interest-on-reserves policy to raise interest rates without necessarily removing all of the reserves created by the facilities.

As the NY Fed explains in more detail:

The central bank paid interest on reserves to prevent the increase in reserves from driving market interest rates below the level it deemed appropriate given macroeconomic conditions. In such a situation, the absence of a money-multiplier effect should be neither surprising nor troubling.

Is the large quantity of reserves inflationary?

Some observers have expressed concern that the large quantity of reserves will lead to an increase in the inflation rate unless the Federal Reserve acts to remove them quickly once the economy begins to recover. Meltzer (2009), for example, worries that “the enormous increase in bank reserves — caused by the Fed’s purchases of bonds and mortgages — will surely bring on severe inflation if allowed to remain.” Feldstein (2009) expresses similar concern that “when the economy begins to recover, these reserves can be converted into new loans and faster money growth” that will eventually prove inflationary. Under a traditional operational framework, where the central bank influences interest rates and the level of economic activity by changing the quantity of reserves, this concern would be well justified. Now that the Federal Reserve is paying interest on reserves, however, matters are different.

When the economy begins to recover, firms will have more profitable opportunities to invest, increasing their demands for bank loans. Consequently, banks will be presented with more lending opportunities that are profitable at the current level of interest rates. As banks lend more, new deposits will be created and the general level of economic activity will increase. Left unchecked, this growth in lending and economic activity may generate inflationary pressures. Under a traditional operating framework, where no interest is paid on reserves, the central bank must remove nearly all of the excess reserves from the banking system in order to arrest this process. Only by removing these excess reserves can the central bank limit banks’ willingness to lend to firms and households and cause short-term interest rates to rise.

Paying interest on reserves breaks this link between the quantity of reserves and banks’ willingness to lend. By raising the interest rate paid on reserves, the central bank can increase market interest rates and slow the growth of bank lending and economic activity without changing the quantity of reserves. In other words, paying interest on reserves allows the central bank to follow a path for short-term interest rates that is independent of the level of reserves. By choosing this path appropriately, the central bank can guard against inflationary pressures even if financial conditions lead it to maintain a high level of excess reserves.

This logic applies equally well when financial conditions are normal. A central bank may choose to maintain a high level of reserve balances in normal times because doing so offers some important advantages, particularly regarding the operation of the payments system. For example, when banks hold more reserves they tend to rely less on daylight credit from the central bank for payments purposes. They also tend to send payments earlier in the day, on average, which reduces the likelihood of a significant operational disruption or of gridlock in the payments system. To capture these benefits, a central bank may choose to create a high level of reserves as a part of its normal operations, again using the interest rate it pays on reserves to influence market interest rates.

Because financial conditions are not "normal", it appears that preventing inflation seems to be the Fed's overriding purpose in creating conditions ensuring high levels of excess reserves.

***

As Barron's notes:

The multiplier's decline "corresponds so exactly to the expansion of the Fed's balance sheet," says Constance Hunter, economist at hedge-fund firm Galtere. "It hits at the core of the problem in a credit crisis. Until [the multiplier] expands, we can't get sustainable growth of credit, jobs, consumption, housing. When the multiplier starts to go back up toward 1.8, then we know the psychological logjam has begun to break."

***

It's not just the Fed. The NY Fed report notes:

Most central banks now pay interest on reserves.

Robert D. Auerbach - an economist with the U.S. House of Representatives Financial Services Committee for eleven years, assisting with oversight of the Federal Reserve, and subsequently Professor of Public Affairs at the Lyndon B. Johnson School of Public Affairs at the University of Texas at Austin - argues that the Fed should slowly reduce the interest paid on reserves so as to stimulate the economy.

Last week, Auerbach wrote:

The stimulative effects of QE2 may be small and the costs may be large. One of these costs will be the payment of billions of dollars by taxpayers to the banks which currently hold over 50 percent of the monetary base, over $1 trillion in reserves. The interest payments are an incentive for banks to hold reserves rather than make business loans. If market interest rates rise, the Federal Reserve may be required to increase these interest payments to prevent the huge amount of bank reserves from flooding the economy. They should follow a different policy that benefits taxpayers and increases the incentive of banks to make business loans as I have previously suggested.

In September, Auerbach explained:

Immediately after the recession took a dramatic dive in September 2008, the Bernanke Fed implemented a policy that continues to further damage the incentive for banks to lend to businesses. On October 6, 2008 the Fed's Board of Governors, chaired by Ben Bernanke, announced it would begin paying interest on the reserve balances of the nation's banks, major lenders to medium and small size businesses.

You don't need a Ph.D. economist to know that if you pay banks ¼ percent risk free interest to hold reserves that they can obtain at near zero interest, that would be an incentive to hold the reserves. The Fed pumped out huge amounts of money, with the base of the money supply more than doubling from August 2008 to August 2010, reaching $1.99 trillion. Guess who has over half of this money parked in cold storage? The banks have $1.085 trillion on reserves drawing interest, The Fed records show they were paid $2.18 billion interest on these reserves in 2009.

A number of people spoke about the disincentive for bank lending embedded in this policy including Chairman Bernanke.

***

Jim McTague, Washington Editor of Barrons, wrote in his February 2, 2009 column, "Where's the Stimulus:" "Increasing the supply of credit might help pump up spending, too. University of Texas Professor Robert Auerbach an economist who studied under the late Milton Friedman, thinks he has the makings of a malpractice suit against Federal Reserve Chairman Ben Bernanke, as the Fed is holding a record number of reserves: $901 billion in January as opposed to $44 billion in September, when the Fed began paying interest on money commercial banks parked at the central bank. The banks prefer the sure rate of return they get by sitting in cash, not making loans. Fed, stop paying, he says."

Shortly after this article appeared Fed Chairman Bernanke explained: "Because banks should be unwilling to lend reserves at a rate lower than they can receive from the Fed, the interest rate the Fed pays on bank reserves should help to set a floor on the overnight interest rate." (National Press Club, February 18, 2009) That was an admission that the Fed's payment of interest on reserves did impair bank lending. Bernanke's rationale for interest payments on reserves included preventing banks from lending at lower interest rates. That is illogical at a time when the Fed's target interest rate for federal funds, the small market for interbank loans, was zero to a quarter of one percent. The banks would be unlikely to lend at negative rates of interest -- paying people to take their money -- even without the Fed paying the banks to hold reserves.

The next month William T. Gavin, an excellent economist at the St. Louis Federal Reserve, wrote in its March\April 2009 publication: "first, for the individual bank, the risk-free rate of ¼ percent must be the bank's perception of its best investment opportunity."

The Bernanke Fed's policy was a repetition of what the Fed did in 1936 and 1937 which helped drive the country into a second depression. Why does Chairman Bernanke, who has studied the Great Depression of the 1930's and has surely read the classic 1963 account of improper actions by the Fed on bank reserves described by Milton Friedman and Anna Schwartz, repeat the mistaken policy?

As the economy pulled out of the deep recession in 1936 the Fed Board thought the U.S. banks had too much excess reserves, so they began to raise the reserves banks were required to hold. In three steps from August 1936 to May 1937 they doubled the reserve requirements for the large banks (13 percent to 26 percent of checkable deposits) and the country banks (7 percent to 14 percent of checkable deposits).

Friedman and Schwartz ask: "why seek to immobilize reserves at that time?" The economy went back into a deep depression. The Bernanke Fed's 2008 to 2010 policy also immobilizes the banking system's reserves reducing the banks' incentive to make loans.

This is a bad policy even if the banks approve. The correct policy now should be to slowly reduce the interest paid on bank reserves to zero and simultaneously maintain a moderate increase in the money supply by slowly raising the short term market interest rate targeted by the Fed. Keeping the short term target interest rate at zero causes many problems, not the least of which is allowing banks to borrow at a zero interest rate and sit on their reserves so they can receive billions in interest from the taxpayers via the Fed. Business loans from banks are vital to the nations' recovery.

The fact that the Fed is suppressing lending and inflation at a time when it says it is trying to encourage both shows that the Fed is saying one thing and doing something else entirely.

I have previously pointed out numerous other ways in which the Fed is working against its stated goals, such as:

Reinforcing cyclical trends (when one of the Fed's main justifications is providing a counter-cyclical balance);

Increasing unemployment (when the Fed is mandated by law to maximize employment); and

Encouraging financial companies to make even riskier gambles in the future (when it is supposed to stabilize the financial system).

Global Research Articles by Washington's Blog

© Copyright Washingtons Blog, Global Research, 2010

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Don Levit

23 Nov 10, 11:18 |

Interest rate on reserves

I am wondering how the interest is paid on these reserves? Is it done by issuing additional Treasury securities? Don Levit |