U.S. Treasury Bond Market’s Perception of Economic Recovery Path is Strongly Bullish, But Mind the Hurdles

Interest-Rates / US Bonds Dec 09, 2010 - 03:09 AM GMTBy: Asha_Bangalore

The 10-year Treasury note yield has climbed from a recent low of 2.41% (October 6-8, 2010) to 3.27% as of this writing. The 86 bps increase in yield in a short span reflects the market's assessment of likely improvements in economic conditions during the months ahead and the impact of a projected increase in supply of Treasury debt as a result of the compromise tax deal President Obama announced yesterday.

The 10-year Treasury note yield has climbed from a recent low of 2.41% (October 6-8, 2010) to 3.27% as of this writing. The 86 bps increase in yield in a short span reflects the market's assessment of likely improvements in economic conditions during the months ahead and the impact of a projected increase in supply of Treasury debt as a result of the compromise tax deal President Obama announced yesterday.

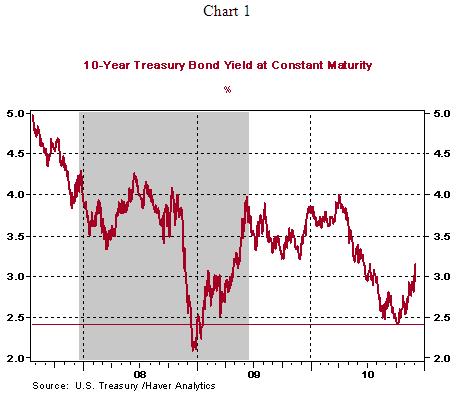

The bullish outlook the Treasury market is embracing is partly overdone given the significant weakness in hiring and the headwinds from the housing market that are worrisome sectors the Fed is watching closely. Back-to-back robust monthly gains in payrolls and a sustained increase in home sales will be necessary to validate the current market perception of future economic conditions. Between March and October of 2010, the 10-year Treasury note yield declined from 4.0% to 2.41% (see Chart 1), only to reverse it in a brief period.

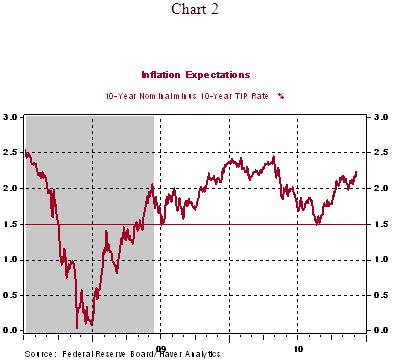

Consistent with this movement, inflation expectations have also advanced 74 bps since the recent low of 149 bps on August 24, 2010 (see Chart 2).

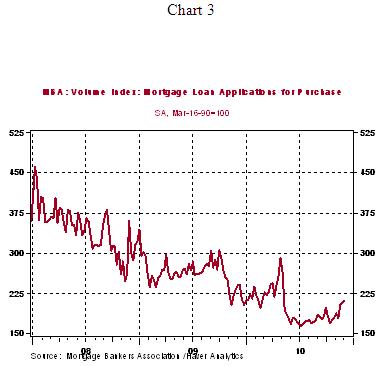

Speaking about the housing market, the Mortgage Purchase Index of the Mortgage Bankers Association rose slightly to 210.9 for the week ended December 3 from 207.2 in the prior week. This index has risen for three consecutive weeks, implying a likely gain in home sales during November.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.