Will Aussie Dollar Overtake U.S. Dollar?

Currencies / US Dollar Dec 10, 2010 - 02:39 AM GMTBy: Bari_Baig

Green back was not strong nor weak it was neutral at best with mild bias towards the red territory a perfect example of undergoing consolidation. However, the U.S Dollar really was materially weak against the Aussie Dollar as the data out from Canberra of employment beat not just the streets estimates but also beat previous induction of “full time” workers. The employment rose by 54,600 for the month of November for full time workers. Australia has the highest interest rates of all the developed nations and keeping in view such high employability the already tight monetary policy would certainly have to be tightened even further.

The data is such that regardless of the fact that employment numbers might be adjusted lower for the month of December nonetheless central bank or Reserve Bank of Australia cannot turn a blind eye towards it. It wasn’t too long ago when RBA Governor hinted towards softening of the policy as they inferred [they] had been hawkish previously but as we take employment numbers very seriously and believe them to be amongst the best indicators of the economy then Aussie economy is surely heating up and had we been at the helms of RBA we’d surely be looking towards tightening of the policy not softening.

That is purely our opinion therefore we’d not expect committee members to give a vote of raising interest rates in the coming meeting or the meeting there after. We hold nothing against the central bankers but we also do find them somewhat slow to react. But we do believe by the turn of the year as was previously thought that RBA might not go for another interest rate hike until April, they might just now start with tightening at the start of New Year.

One of the reasons which we had anticipated for Obama and Co. [Democrats] defeat as far back as early may was lack of job creation. When people can’t find jobs, the tall claims of the politicians do not make much sense as even the diehard voters switch as was evident with U.S midterm Congressional elections however, on the contrary Aussie politicians can safely say they now hold the [bragging] rights as Australian companies are each month employing more and more people.

So, further tightening is only going to make the Aussie Dollar that much stronger. The big question then, do we foresee Aussie trading par with U.S Dollar? Surely we can, it might not happen tomorrow, or next week or month after but in next several months Aussie Dollar can outperform the green back and par is just the first step.

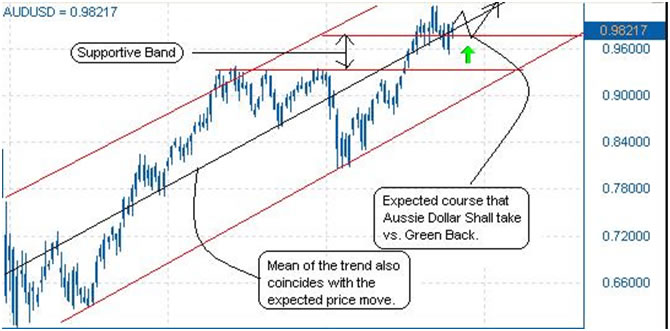

The chart above shows AUD vs. USD trending from October of 2008 and clearly we can see that the trend is from lower left to upper right corner of the chart. From the looks of it we can see three fully formed waves which then leaves two waves fourth [downward leg] and fifth [upward leg]. If Aussie Dollar is currently transitioning from third to fourth then the supportive band would help limit the downside and the fifth leg pushes past par for good. As the top of third leg was already above par therefore once the fifth leg is completes we can be sure of AUD vs. USD trading over 1.15 and once the downward cycle begins thereon par would only be strengthened.

By Bari Baig

http://www.marketprojection.net

© 2010 Copyright Bari Baig - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.