Turkey and Iran Potential Conflicts Mean Crude Oil on Course to Hit $100 per barrel

Commodities / Crude Oil Oct 18, 2007 - 04:29 AM GMTBy: Gary_Dorsch

Tension in the Middle East has always been a favorite tactic for the “Axis of Oil” – Iran, Russia, and Venezuela, to keep the price of crude oil pegged at artificially high levels. Talk of war in the world's most unstable region can inflate a hefty “war premium” into each barrel of OPEC and Russian oil. In the Middle East, wars seem to break-out every few years, and lulls in the fighting are often just a timeout, in order to re-supply and prepare for the next round of combat.

Tension in the Middle East has always been a favorite tactic for the “Axis of Oil” – Iran, Russia, and Venezuela, to keep the price of crude oil pegged at artificially high levels. Talk of war in the world's most unstable region can inflate a hefty “war premium” into each barrel of OPEC and Russian oil. In the Middle East, wars seem to break-out every few years, and lulls in the fighting are often just a timeout, in order to re-supply and prepare for the next round of combat.

Earlier this week, crude oil jumped $5.50 to as high as $89 /barrel in New York, and is commanding a “war premium” of roughly $10 /barrel. The price of West Texas Sweet is $10 /bl higher since Sept 12th, when the OPEC cartel agreed to boost its daily oil output by 500,000 to help meet winter demand. But the token increase in OPEC output has done little to hold down surging premiums for Mid-East oil.

Instead, with the Americans looking for a way out of the Iraqi quagmire, Arab oil kingdoms worry that if the US falters and Iraq degenerates into a failed state, it could spread instability and terror through the region. The ingredients are there for civil war on three levels, Arabs against Kurds, Shi'ites against Sunnis and everyone against the US, all battling for control of Iraq's 220 billion barrels of oil.

An accurate reading of the global supply and demand picture is certainly a big help in predicting global oil prices. But if one wants to point the “finger of blame” at the biggest culprit behind the historic rise in crude oil prices, it's no other than Federal Reserve chief Ben “B-52” Bernanke, whose decision to bail-out Wall Street brokers and banks this past summer, by slashing short-term interest rates, set in motion another US dollar devaluation, and sent global oil prices and gold sharply higher.

The Fed is the guardian of the world's top reserve currency, and has a responsibility to defend the purchasing power of the greenback, and keep global inflation in check. But when push comes to shove, Mr Bernanke has always voted to speed up the printing presses, to inflate the US economy out of a tough bind. Today, the US M3 money supply is 14.7% higher than a year ago, it's fastest in history, and up from 8% when Bernanke got his hands on the printing presses in March 2006.

Bernanke's money printing binges are supported by his cohorts at the Fed. On October 9th, St Louis Fed chief William Poole said, “I do not see any implication for inflation, at least with the magnitude of the US$ depreciation that we've seen so far. I did not see any evidence of a raft of dollar price increases for foreign goods. For manufactured goods, I think the pass through is very, very small,” he said.

On Sept 287th, Federal Reserve Governor Frederic Mishkin was trying to brainwash his audience at a globalization conference held in Washington DC. “Inflation has come down in the old-fashioned way. Tighter monetary policy and a commitment to price stability by central banks throughout the world have led to lower inflation and an anchoring of inflation expectations,” Mishkin declared. On Sept 11th, Mishkin said, “Gold was not a particularly useful indicator of inflation."

When answering an audience question about inflation after a speech before the New York Economic Club on Oct 15th, “B-52” Ben did admit, “One cannot deny that when the dollar depreciates there is some inflationary impact.” However, to alleviate any fears that the Fed might combat inflation with higher interest rates, Bernanke added, that “expectations for slower growth may moderate price increases." Yet history might judge Mr Bernanke harshly, for guiding the US economy into the "Stagflation" trap.

Whenever the stock market has a bad day, reporters from the mainstream media try to find plausible explanation, for why the market turned south. This week, the surge in crude oil prices above $85 per barrel was widely blamed for the market's sudden tremors. Yet since the first quarter of 2003, the Dow Jones Industrials and crude oil have thrived together in peaceful harmony, both climbing in unison to all-time highs. So why blame the stock market's downturn on an “oil shock” this week?

At what point, would sharply higher oil prices begin to rattle the global stock market? (This topic will be covered in an audio broadcast on October 17th, for paid subscribers to Global Money Trends). And how would Ben “B-52” Bernanke, react in a “Twilight Zone” episode in which crude oil jumps to $100 per barrel? Nobody knows for sure, but on October 21, 2004, Mr Bernanke responded to such as question, “I would argue that the Fed's response to the inflationary effects of an increase in oil prices should depend to some extent on the economy's starting point.”

“If inflation has recently been on the low side of the desirable range, and the available evidence suggests that inflation expectations are likewise low and firmly anchored, then less urgency is required in responding to the inflation threat posed by higher oil prices. In this case, monetary policy need not tighten and could conceivably ease in the wake of an oil-price shock,” Bernanke said. So don't be surprised if “B-52” Ben argues that a weak US economy and doctored inflation statistics, justify a further easing in Fed policy, pouring more gasoline on the flames of inflation, in the event of a surge in crude oil prices to $100 per barrel.

Turkish Saber Rattling lifts Crude Oil

Earlier this week, Turkish PM Recep Erdogan asked his parliament to approve plans for an invasion into northern Iraq to attack Kurdish militants, defying a US demand for restraint. Turkey built up its military forces on Iraq's border, a move meant to pressure Baghdad to rein in the rebels of the Kurdistan Workers' Party, who are launching raids into southeast Turkey from hideouts in Iraq. Turkey must also deal with its own rebellious Kurdish minority, which makes up 20% of its population.

But Ankara also has its eyes on a bigger prize, the oil fields of Kirkuk that contain 40% of Iraq's proven oil reserves. Ankara still holds its claim to Kirkuk, which was taken from Turkey as a result of the 1923 Lausanne Treaty. Turkish nationalists still regard it as historically part of Turkey. Ankara also asserts guardianship over the Turkmen ethnic minority in northern Iraq.

Ankara fears that Baghdad will allow the Kurds to make Kirkuk part of their autonomous zone. For Ankara, this would be excessive Kurdish autonomy, its red line in Iraq, and it might resort to military intervention to prevent the emergence of an oil-rich Kurdish political entity on its southern border.

Erdogan said his country will not be deterred by the diplomatic consequences if it decides to stage a cross-border offensive against Kurdish rebels. “If such an option is chosen, whatever its price, it will be paid. There could be pros and cons of such a decision, but what is important is our country's interests.” With regards to whether or not a Turkish invasion of Iraq could destroy the relationship with the US Erdogan said, “Let it snap from wherever it gets thin.”

Republicans call for Military Strike against Iran,

A possible Turkish invasion into northern Iraq is only a small sideshow compared to the heated rhetoric that's building up on the Republican campaign trail. On October 16th, Republican candidates Rudy Giuliani and John McCain said they would use military force against Iran to prevent it from getting nuclear weapons. Giuliani said Iran is a state sponsor of terrorism that is seeking nuclear weapons, and needs to understand how the US would respond.

“Anybody who wants to be president of the United States would say a prayer at the beginning that you would never have to use American military power. But as president, you can't hesitate to do that, if it's in the best interest of the US. You have to stand up to dictators and tyrants and terrorists. Weakness invites attack. Strength keeps you safe,” Guilianni declared.

On Iran specifically, he said, “We've seen what Iran will do with ordinary weapons. If I'm president, I guarantee you we will never find out what they would do with nuclear weapons because they're not going to get them.” McCain agreed, “At the end of the day, we cannot allow the Iranians to acquire nuclear weapons.”

On July 4th, Republican presidential candidate Mitt Romney said he would use military force against Iran if attempts to isolate and pressure its current regime fail. “I'm not going to shrink away from Iranian President Ahmadinejad,” Romney said. “Ahmadinejad is a dangerous man and a threat to US interests.” On Oct 16th, Romney added, “It's time to take Ahmadinejad at his genocidal word.”

On June 12th, the UN atomic agency said Iran could have 8,000 centrifuges enriching uranium by December, a significant rise in nuclear capability likely to fuel fears that Tehran seeks nuclear weapons. “The concern is that they will have a sensitive number of centrifuges without having resolved the question marks surrounding the history of Iran's program. It becomes a greater proliferation concern,” IAEA chief Mohamed El-Baradei told political leaders in private conversations.

Then on October 15th, US Defense Secretary Robert Gates called Iran “an ambitious and fanatical theocracy. With a government of that nature, only a united front of nations will be able to exert enough pressure to make Iran abandon its nuclear aspirations. Our allies must work together on robust, far-reaching and strongly enforced economic sanctions. We must exert pressure in the diplomatic and political arenas as well,” he said. “And, as President Bush has said, with this regime we must also keep all options on the table,” he said, in a veiled reference to possible military action.

Then on October 15th, US Defense Secretary Robert Gates called Iran “an ambitious and fanatical theocracy. With a government of that nature, only a united front of nations will be able to exert enough pressure to make Iran abandon its nuclear aspirations. Our allies must work together on robust, far-reaching and strongly enforced economic sanctions. We must exert pressure in the diplomatic and political arenas as well,” he said. “And, as President Bush has said, with this regime we must also keep all options on the table,” he said, in a veiled reference to possible military action.

Gates said Iran seems increasingly willing to act contrary to its own interests. “We should have no illusions about the nature of this regime or its leaders - about their designs for their nuclear program, their willingness to live up to their rhetoric, their intentions for Iraq, or their ambitions in the Gulf region.” Among the US objectives in the Middle East, Gates listed an “Iran that does not build nuclear weapons or holds Israel hostage with the threat of attack.

Gates will meet with Israel's new defense minister, Ehud Barak, in Washington on October 16th, to discuss the joint anti-missile Arrow-2 project, designed to intercept missiles that could deployed by Iran and Syria. Israel's satellite, the Ofek-7, flies over Iran, Iraq, and Syria once every 90 minutes.

Last month, Barak, Israel's most decorated soldier and legendary former commander of the Sayeret Matkal, directed an attack on a secret military compound near Dayr az-Zawr in northern Syria, inhabited by North Korean nuclear technicians. Today, the site lies in ruins after it was pounded by Israeli F15I's, reminiscent of the attack on Iraq's Osirak in 1980. The UK's Sunday Times said preparations for the attack began in May, when Meir Dagan, the head of Mossad, presented PM Olmert with evidence that Syria was seeking to buy a nuclear device from North Korea. Dagan feared such a device could later be mounted on North-Korean-made Scud-C missiles. Sergei Kirpichenko, the Russian ambassador to Syria, warned President Bashar al-Assad last month that Israel was planning an attack, but suggested the target was the Golan Heights.

Last month, Barak, Israel's most decorated soldier and legendary former commander of the Sayeret Matkal, directed an attack on a secret military compound near Dayr az-Zawr in northern Syria, inhabited by North Korean nuclear technicians. Today, the site lies in ruins after it was pounded by Israeli F15I's, reminiscent of the attack on Iraq's Osirak in 1980. The UK's Sunday Times said preparations for the attack began in May, when Meir Dagan, the head of Mossad, presented PM Olmert with evidence that Syria was seeking to buy a nuclear device from North Korea. Dagan feared such a device could later be mounted on North-Korean-made Scud-C missiles. Sergei Kirpichenko, the Russian ambassador to Syria, warned President Bashar al-Assad last month that Israel was planning an attack, but suggested the target was the Golan Heights.

Equally important, the Pantsyr-S1E missiles, purchased by Syria from Russia, failed to down the Israeli jets that penetrated northern Syrian airspace from the Mediterranean. The “absolute jamming immunity” which the Russian manufactures promised for the Pantsyr missiles were immobilized by the superior electronic capabilities of the Israeli jets. Such valuable information on Russian missile consignments to Syria or Iran is vital to any US calculation of whether to attack Iran over its nuclear program. Iran is especially concerned over the failure of the Russian-made radar systems, and is slated to purchase more radar equipment in a future deal worth $750 million, the American weekly Aviation Week reported on October 4th.

Battle for the Strait of Hormuz,

On June 12th, Admiral Ali Shamkhani, a former Iranian defense minister, told the US Defense News weekly, in the event of an American attack on Iran's nuclear installations, “Ballistic missiles would be fired in masses against targets in Persian Gulf states and Israel. The objective would be to overwhelm US missile defense systems with hundreds of missiles fired simultaneously at specific targets.” He said Iran anticipates that US forces will strike without warning against its military's command-and-control network, and will order ballistic and cruise-missile battery crews to launch the plan within an hour after a US attack begins. In retaliation, “Iran will open a freeway for 40,000 suicide bombers from Afghanistan all the way to Lebanon, to strike in almost every country in the Middle East.

Most importantly, is the potential shutdown of oil supplies through the Strait of Hormuz, a strategically important stretch of water between the Gulf of Oman and the Persian Gulf. On average around 17-million barrels of oil is shipped thru the Straits of Hormuz each day, roughly 20% of the world's daily oil production.

The closing of the Straits for the passage of tankers will create a severe shortage that would send shock waves to the energy markets already beset by tight supplies and a limited spare capacity. It is anybody's guess as to how high the price of crude oil could go if Iranian threats were materialized. A surge above $100 per barrel could trigger a world economic recession of untold consequences.

Yet Tehran, with all of its threats and alleged ability to destroy anything that sails or floats in the Straits of Hormuz, might opt for a less risky retaliation, since the cessation of its crude oil exports and gasoline imports could bring down the Islamic regime. With unemployment rates as high as 20% any disruption in the levels of food and gasoline subsidies, from the drying up of oil revenues, could trigger a serious riot in the volatile Iranian street against the Mullahs in Tehran.

France hints at Military action against Iran,

One is not accustomed to hearing threats of war from the enlightened French government, but since Nicolas Sarkozy became the president of France and moved into the Elysee, France has changed course and is almost reflecting the same policies as the neo-cons of the United States. In his speech to the UN General Assembly on Sept 25th, Sarkozy said, “There will be no peace in the world if the international community falters in the face of nuclear arms proliferation.”

“If we allow Iran to acquire nuclear weapons, we would incur an unacceptable risk to stability in the region and in the world.” And in a broader warning against the dangers of appeasement, the new French leader said, “Weakness and renunciation do not lead to peace. They lead to war.” Sarkozy said that if the UN Security Council was unable to agree on further financial sanctions, the European Union should take its own measures to raise pressure on Iran.

In light of the Iranian nuclear crisis, French Foreign Minister Bernard Kouchner shocked the world on Sept 16th, “We have to prepare for the worst, and the worst, sir, is war,” he said in an interview on LCI television and RTL radio. Iran's state-run news agency IRNA angrily attacked the French government on Sept 18th, “The new occupants of the Elysee want to copy the White House,” it declared

Mr. Sarkozy went to Moscow on October 10th, urging tougher economic pressure on Tehran, but Russian kingpin Vladimir Putin quickly deflated the idea. “We don't have information showing that Iran is striving to produce nuclear weapons. That's why we're proceeding on the basis that Iran does not have such plans,” Putin said. The Kremlin is a member of the “Axis of Oil” and a staunch ally of Tehran, and is unlikely to agree to tougher economic sanctions on Iran.

In a visit to Tehran on October 16th, Putin declined to say when Russia will start delivering fuel to Iran's nuclear power plant in Bushehr. “At the moment Russia and Iran are discussing the issue of changing the contract. In general there is a common understanding of the problem. As soon as this is solved, supplies of nuclear fuel will start. Russia declares that it is committed to carrying out the contract,” Putin said

Oct 16th, Putin said Russia would not accept military action against Iran and he invited Iranian President Mahmoud Ahmadinejad to Moscow for talks. In comments aimed at the United States, Putin said, “We should not even think of using force in this region. We need to agree that using the territory of one Caspian Sea state in the event of aggression against another is impossible," he declared.

The Caspian nations of Iran, Azerbaijan, Kazakhstan, and Turkmenistan backed Putin's call, saying “under no circumstances will we allow the use of our territories by third countries to launch aggression or other military action against any of the member states.” According to the UK Telegraph's Sept 16th edition, Pentagon planners have developed a list of up to 2,000 bombing targets in Iran, anticipating that diplomatic efforts to slow Iran's nuclear weapons program are doomed to fail.

But the next day, US president Bush upped the ante, at a White House news conference, warning the world must do more to isolate the Islamic Republic. "We've got a leader in who has announced that he wants to destroy Israel," Bush said. "So I've told people that, if you're interested in avoiding World War III, it seems like you ought to be interested in preventing them from having the knowledge necessary to make a nuclear weapon. I'm looking forward to getting President Putin's read-out from the meeting, (in Iran). The thing I'm interested in is whether or not he continues to harbor the same concerns that I do. I look forward to having Vladimir Putin clarify his comments," Bush said

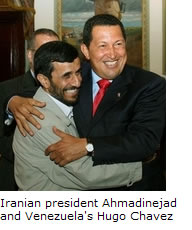

Senior American defense and intelligence officials told the Telegraph that Mr Bush's inner circle has decided not to leave office with Iran capable of developing a nuclear weapon. Yet should the Bush team decide to take military action against Iran's nuclear program, Venezuela's mercurial leader Hugo Chavez, has vowed to retaliate, by cutting-off two million bpd of oil exports to the US.

Chavez pushed two US oil giants, ConocoPhillips and ExxonMobil out of his country in June, as part of his socialist revolution, “This is the unity of the Persian Gulf and the Caribbean Sea,” he declared on a July 2nd visit to Tehran. Before heading to Iran, Chavez met Russian kingpin Vladimir Putin and called for a global revolution against Washington. He has also discussed possible purchases of submarines, surface to air missiles, and other weapons from Russia, arguing that these are needed to defend his oil-rich country against the United States. Last year, Russia sold 24 aircraft and 53 helicopters to Venezuela, worth $3 billion.

Chavez pushed two US oil giants, ConocoPhillips and ExxonMobil out of his country in June, as part of his socialist revolution, “This is the unity of the Persian Gulf and the Caribbean Sea,” he declared on a July 2nd visit to Tehran. Before heading to Iran, Chavez met Russian kingpin Vladimir Putin and called for a global revolution against Washington. He has also discussed possible purchases of submarines, surface to air missiles, and other weapons from Russia, arguing that these are needed to defend his oil-rich country against the United States. Last year, Russia sold 24 aircraft and 53 helicopters to Venezuela, worth $3 billion.

Tension in the Middle East boosts the Kremlin's Coffers

“A series of crises in oil supply is likely over the coming decades,” predicted Russian Industry and Energy Minister Victor Khristenko nearly two years ago, on October 24, 2005. “The first, related to the peak and decline of non-OPEC production, is practically upon us and underpins the currently high oil prices. The imminent inability of non-OPEC production to meet incremental demand and its decline after 2010 precipitates the second crisis as OPEC's diminishing spare capacity becomes less and less able to accommodate short-term fluctuations,” he said.

“The third crisis, due to OPEC's incremental supply being unable to meet incremental demand, follows in the first half of the next decade. This assumes that OPEC's reserves are as published. These crises will have global economic and geopolitical significance. The oil price will be high and volatile, and demand growth will have to be curtailed,” Mr Khristenko warned two years ago.

But alas, there are no central banks in the world that are willing to slow down their economies, to reduce the demand for crude oil. Just the opposite has transpired, with central banks in Australia, Brazil, China, the Euro zone, India, and the United States expanding their money supplies at double digit rates, and all aiming for maximum growth, through a game of competitive currency devaluations. The Bernanke Fed is the chief culprit behind the devaluation game.

Moscow is a big winner from tension in the Middle East, and a war between the US and Iran would only increase its clout on the world stage. Russia's foreign currency reserves have grown nearly 20-fold from four years ago to a record $415 billion, the third largest stash in the world, behind Japan and China. How Moscow decides to invest some of its stash in its new sovereign wealth fund, can have a big impact on global commodity and stock markets.

In keeping with world market trends, the Russian Finance Ministry lifted the tax of Russian oil exports by $26 to $250 per ton, which will bring even more money into the Kremlin's coffers. Russia's oil production has stagnated since growing 9% in 2004 and a record 11% in 2003, with growth of merely 2.7% last year, due to the higher tax burden, which is stifling investment in oil exploration and production.

Yesterday, the price of Russia's benchmark Urals crude oil rose to $81.25 per barrel, up from $25 per barrel just four years ago, helping to lift Russian exports to a record high of $31 billion in August. From January to August, Russia exported 160 million tons of oil, up 5% from a year ago. In cash terms, oil exports rose by 5.3% during the first eight months of this year to $69.7 billion. Exports to non-CIS countries amounted to 148 million tons worth $65.4 billion.

It's no wonder that Putin wants to stymie any UN initiative that can halt Iran's nuclear drive by non-military means. The current balance of tension and terror in the Middle East is bloating Kremlin's treasure chest. But if Mr Khristenko's outlook for peak oil after 2010 is correct, the Kremlin will see its clout and wealth multiply exponentially in the years ahead, with or without a war in the Middle East.

China deepens Ties with Tehran

Beijing is trying to strengthen its ties with Iran, its major supplier of crude oil and natural gas, required for its development and modernization. China imports 50% of its oil demand, and wants to reinforce its relations with Iran and reach the energy resources of the Caspian Sea to lessen its dependence on maritime oil imports from the Arab oil kingdoms of the Persian Gulf, securing an uninterrupted flow of oil.

Iranian crude oil-and gas reserves are largely untapped because of the threat of US sanctions on companies doing business with the Mullahs, leaving a large part of its petroleum fields unexplored. Since Tehran does not have adequate technology to increase its refined-oil production. China can assist Iran modernize its petroleum industry with technology, capital, engineering services and nuclear technology.

Beijing sees Tehran as a geopolitical ally to combat US influence in the Middle East, and wants to avoid United Nations sanctions against Iran. China buys 15% of its oil demand from Iran, and pays for its imports in Euros. Chinese crude oil imports hits a record high of 14.8 million tons in July, and in the first half of this year rose 11.2% from the same year-ago period to 81.54 million tons.

China's biggest oil producer, PetroChina, PTR.N, 0857.hk, would like to develop Iran's oil and natural gas fields. PTR.N's market value has soared to $460 billion, the second highest in the world, behind Exxon Mobil's $518 billion value. PetroChina is expected to announce big oil and natural gas discoveries in the northern Liaohe and Dagang areas, PTR.N Chairman Jiang Jiemin said on October 15th. The offshore finds will add to reserves from the Jidong Nanpu field, China's largest oil find in 50-years.

OPEC can't Stop Oil Spike

OPEC says there is no fundamental justification for a price run-up that has lifted oil from below $70 in mid-August. “OPEC cannot do much now,” said Libya's hawkish oil chief Shokri Ghanem on October 16th. “OPEC did all that it can. It is not because of a lack of crude oil. There is all the uncertainty in Iraq and the Gulf area,” he said. Indonesia's oil chief Maizar Rahman added, “The market fundamentals are in balance. There is too much speculative money coming into the market.”

“OPEC is carefully watching developments in the oil market and has observed with concern the recent escalation in oil prices. The rising oil prices which we are currently witnessing are, however, largely being driven by market speculators. Persistent refinery bottlenecks and seasonal maintenance work, ongoing geopolitical problems in the Middle East and fluctuations in the US dollar, also continue to play a role in pushing oil prices higher. Additional political tensions, seen during recent days, are also pressurizing oil prices upwards,” the cartel said on October 16th.

OPEC is reluctant to boost oil output beyond the scheduled 500,000 bpd increase in November, realizing that the Federal Reserve and other central banks are simply printing large amounts of monopoly money to pay for higher crude oil imports. To compensate for the fiat currency devaluations, OPEC seeks a higher oil price, and is expected to keep a tight rein on oil supply.

At some point, it would become necessary for the Bernanke Fed to reverse course, and start slowing down the money printing machine, if it wants to prevent an out-break of hyper-inflation. Yet one has to wonder if Mr Bernanke has the political license to tighten the money supply, when US Treasury chief Henry Paulson wants to keep the US stock market artificially high to offset weaker US home prices.

Since Mr Bernanke took the helm at the Federal Reserve, the Dow Jones Industrials have soared by roughly 32% to an all-time high near 14,000. But gold prices have also climbed by 64% to a 28-year high of $765 /oz, which in turn, has knocked the DJI to Gold ratio from 23 oz's to 18.2 oz's of gold today. In hard money terms, the DJI's spectacular rally is nothing more than a monetary illusion. One would have been much better off, owning an ounce of gold, rather than a DJI share.

Which asset class would be a better choice to own, if crude oil climbs to $100 per barrel in the weeks or months ahead? The answer of course, is elementary.

The Global Money Trends newsletter is happy to announce a special bonus for new and existing subscribers, - “Audio Broadcasts”, posted on Monday and Wednesday evenings, during Asian trading hours, to the Log-In section of our website, with our latest analysis of gold, crude oil, base metals, foreign currencies, interest rates and the top stock markets from around the world.

To make life easier, Global Money Trends also presents a model portfolio of our top-20 picks in the global stock markets, to take advantage of historic price movements in the global commodity markets and foreign currencies. That's in addition to our regular newsletter, published on Friday, for 44 weekly editions.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

This article is just the Tip of the Iceberg, of what’s available in the Global Money Trends newsletter! Here's what you will receive with a subscription, Insightful analysis and predictions for the (1) top dozen stock markets around the world, Exchange Traded Funds, and US home-builder indexes (2) Commodities such as crude oil, copper, gold, silver, the DJ Commodity Index, and gold mining and oil company indexes (3) Foreign currencies such as, the Australian dollar, British pound, Euro, Japanese yen, and Canadian dollar (4) Libor interest rates, global bond markets and central bank monetary policies, (5) Central banker "Jawboning" and Intervention techniques that move markets.

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

A subscription to Global Money Trends is offered at only $150 US dollars per year for “44 weekly issues”, including access to all back issues. Click on the following hyperlink, to order now, http://www.sirchartsalot.com/newsletters.php Call toll free from USA to order, Sunday thru Thursday, 2 am to 4 pm EST, at 866-576-7872.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2007 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.