The Debt-Dollar Discipline: Part II - Conservation & Release

Currencies / US Dollar Dec 12, 2010 - 06:00 AM GMT Part I in this series introduced Michel Foucault's theory of disciplinary society, laid out in his book Discipline and Punish, and the application of this analysis to the "debt-dollar discipline" formally imposed on global society by the Bretton Woods Agreement of 1945 (establishing the dollar as the global reserve currency). It should come as no surprise that this global financial discipline is currently in the process of being revoked.

Part I in this series introduced Michel Foucault's theory of disciplinary society, laid out in his book Discipline and Punish, and the application of this analysis to the "debt-dollar discipline" formally imposed on global society by the Bretton Woods Agreement of 1945 (establishing the dollar as the global reserve currency). It should come as no surprise that this global financial discipline is currently in the process of being revoked.

This revocation is not carried out by the political or financial leaders of the world, but by the system itself. Part II will explore both the technical and practical aspects of disciplinary collapse, primarily in the context of complexity theory. Part III, to be released shortly, will conclude with some general thoughts on the potential forms of organization that could emerge from the ashes of debt-dollar discipline.

The Adaptive Cycle

Foucault did not say much about the future he envisioned for disciplinary society in his book, as it was geared towards promoting understanding rather than inspiring rebellion. He did, however, retain some hope that a better form of society could develop. [1]. Although he correctly identified the evolution of societal discipline with the evolution of economic structures, he was not in the business of predicting future economic developments.

Foucault's disciplinary system was a complex set of interacting networks, in which each central hub (households, schools, factories, prisons, etc.) served a necessary function. Although he described individuals moving from institution to institution in a somewhat linear path, he recognized that each institution was highly analogous to and reinforced the others. A system of such organization follows a natural evolutionary path. The debt-dollar discipline represents the tail end of this path, and the implications for disciplinary society at every level are extreme.

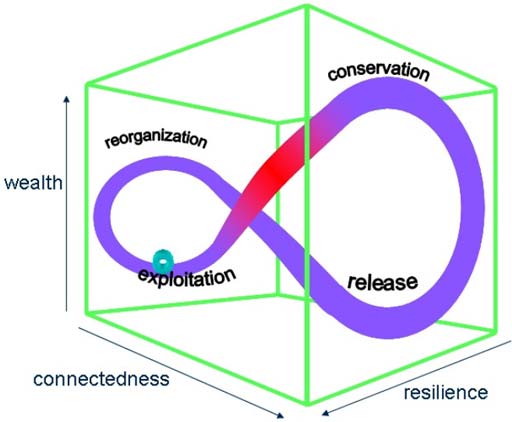

Most complex evolutionary systems, such as the global financial system, can be viewed in the framework of Buzz Holling's adaptive cycle, consisting of growth (exploitation), conservation, release and reorganization. An excellent primer on this topic and its relation to Robert Prechter's socionomics and Joseph Tainter's ideas on complex societies undergoing collapse can be found at The Automatic Earth [Fractal Adaptive Cycles in Natural and Human Systems].

The debt-dollar disciplinary system has been in a phase of extraordinary growth for the last few decades, exploiting markets and resources to increase inter-dependencies, systemic diversity and overall wealth. However, the high levels of growth and specialization also led the system into a phase of conservation, in which opportunities for novel exploitation diminished and systemic structures became rigid.

Increasing amounts of energy and resources were directed towards maintaining the existing system, rather than growth, and this maintenance was primarily achieved by core structures extracting large amounts of wealth from the periphery. The complex inter-dependencies, which previously functioned to generate wealth, became a major liability for the system, as it was less resilient to external or internal shocks. At this stage, Holling described the complex system as "an accident waiting to happen".

Financial Conservation

Foucault focused on the modern penal system, in part, to make it clear how the disciplinary society was able to maintain its power structures over time. It did not seek to eliminate undisciplined behavior, but simply manage such behavior on its own terms. In the wake of the industrial revolution and increasing wealth inequality, it was the property crimes committed by peasants that were most threatening to the staus quo structures. These "popular illegalities" were ultimately what drove seemingly "humanitarian" goals of "prison reform".

By identifying, labeling, detaining and controlling lower class "delinquents" in a confined space, the state could also control the general socioeconomic conflicts that were increasingly common within industrial capitalist society. The lower segments of this society, who were absolutely necessary for the state's economic functioning, were coerced to self-discipline and fear the potential that they, too, may become a part of the largely invisible, yet detested "delinquent class". To maintain a high level of discipline, then, societal elements of popular dissent must be carefully managed, which presents an inherent conundrum for a financial system under debt-dollar discipline.

This system, unlike its strictly industrial predecessor, is endogenously prone to over-extension in the short-term. The large economic rents extracted by speculative financiers lead to severe debt deflations, which then leave significant segments of the underlying population in economic despair, including the industrial capitalists. The rapid growth enabled by financial discipline sparks a crisis of legitimacy, in which previously self-disciplined financial consumers begin to question the wisdom of their shackles. For the most part, this questioning is simply a result of there being no other option, as financial expectations and promises have evaporated as quickly as they were formed.

Before the global financial crisis of 2008, debt-dollar discipline was maintained by re-directing credit growth whenever a debt-induced recession occurred. Essentially, financial consumers would be disciplined (by the system and themselves) to leverage their stagnant real wealth into various different assets for temporary returns. There are currently no asset classes or greater fools left to pick up credit growth where it left off, save for government leaders around the world, who will stop at no lengths to preserve the debt-dollar discipline keeping them in power.

However, these governments are currently or will soon face sovereign debt crises, as a function of their own enslavement to the financial disciplinary system. They, too, must borrow money from private banks and pay interest on that debt, which becomes increasingly difficult as economic growth stagnates and tax revenues plummet. The "delinquent class" has now become too massive and visible for the existing power structures to effectively control, but that does not prevent the disciplinarians from trying.

Many of their attempts to reinstate debt-dollar discipline are failing because of the financial system's rigid structures themselves. As a function of conservation, these structures have become extremely inflexible and a liability for those seeking to maintain the status quo. The U.S. Federal Reserve has created trillions of debt-dollars through discounted loans and quantitative easing, in the alleged hopes that this "liquidity" will find its way to financial consumers and inflate the prices of assets and goods.

Their attempts are futile because economic actors worldwide had previously been disciplined to take on dollar-denominated debt, and as those massive liabilities come due, the demand for dollars will spike along with their value. It may seem counter-intuitive that a collapse in debt-dollar discipline will cause dollars to increase in value, but the disciplinary system has actually relied on a suppressed dollar to carry out its purpose. Without inflated asset prices relative to the dollar, debts cannot be repaid and financiers go broke.

Other attempts involve governments incurring fiscal deficits to provide subsidies, backstops and general support for the financiers. The U.S. policies of TARP, ARRA and Fannie/Freddie housing intervention are great examples of such attempts. It is hoped that financial discipline can be restored by propping up the institutions most responsible for implementing and reinforcing it. Once again, the reason this plan will not succeed is due to the financial system's original disciplinary purpose.

It had evolved to establish a global class of financial consumers who will continuously take on debt and repay most of those debts, in the form of debt-dollars or hard assets. The system has now limited its own ability to extract future wealth, as financial consumers have very limited capacity to repay existing debts, let alone incur new obligations. Much of the collateral secured by existing debts, or that could potentially be secured by future debt, has lost significant value, cannot be reached or is already encumbered.

These fiscal deficits will eventually lead the U.S., the purveyor of debt-dollar discipline, into a sovereign debt crisis. Attempts to decrease the national debt have been rendered useless by the financial disciplinary system, as it requires private or public credit growth for economic health. Without the underlying private growth, cuts in public spending will most likely make deficits worse and debt servicing costs greater (the current Euro zone crisis is an ongoing example of this dynamic).

President Obama's laughable plan to double U.S. exports in five years will not even come close to fruition, because debt-dollar discipline has come at the expense of the country's manufacturing sector, and the ability to suppress the dollar's value as explained earlier. The complex disciplinary system has also rendered the political apparatus inflexible, which is why many Democrats, claiming to be against tax cuts for the rich, and Republicans, claiming to be against public deficits, have both agreed to extend Bush's tax cuts (which will cost taxpayers $5T over ten years [2]). It is truly a predicament, an inherent contradiction of the system itself, and can only be resolved by a wholesale simplification of the structures within global disciplinary society.

Comprehensive Release

For reasons stated above and others, the financial disciplinary system has entered a phase of irreversible release. The sub-prime housing crisis in the U.S. was the triggering event for this global release, in which the complex power structures supporting debt-dollar discipline will be rapidly and chaotically dismantled. Without pervasive access to affordable credit, the vast networks of discipline around the world cannot be coherently maintained (i.e. international trade heavily dependent on "letters of credit"). This credit had become the lubricant enabling Foucault's disciplinary machine to operate smoothly, and without it, the machine will grind to a screeching halt.

In Part I of this series, the financial disciplinary system was referred to as a parasite, which attaches itself to all other disciplinary institutions of society and feeds off of their established functions. In turn, the disciplines legitimizing these institutions become hopelessly intertwined with the debt-dollar discipline, as the latter has come to define the relative "success" of a society. Systems of education, healthcare, industrial production (including agribusiness) and law enforcement have become mal-adapted to prolonged periods of economic deleveraging and contraction. These foundational systems will be unable to perform their disciplinary functions when they lack sufficient resources, price their customers out and are perceived as being irretrievably damaged.

For example, 41 percent of American adults reported that they "had medical debt or trouble paying medical bills" in 2007 [3], and debt owed by American students graduating from a public college has increased more than 100% over the last decade. [4]. It was reported that the Illinois State Police was planning on laying off more than 460 troopers and closing five regional headquarters by Fall 2010 [5], which is an ongoing trend in many U.S. and European localities.

The U.S. passed a $26 billion spending bill in August 2010 to prevent about 160,000 teacher layoffs [6], but teachers continue to lose their jobs and the ones saved will surely disappear as soon as the money runs out [7]. Disciplinary institutions are classically "caught between a rock and a hard place", leaving them with almost no options to preserve their current functions. Perhaps the institution most visibly affected by disciplinary collapse has been the political apparatus of the U.S., which has lost much of its legitimacy in recent years.

The emergence of the "Tea Party" movement in America is an obvious example of the government's disciplinary policies being popularly rebuked. However, this movement has arguably been co-opted by the mainstream power structures (Republican Party) and, in the spirit of Foucauldian punishment, many elements of the movement are labeled as "extremist" or "racist" by politicians and the corporate media. Whether there is any truth to those claims is irrelevant, as long as they serve to marginalize the rebellious ideas lurking within. Nevertheless, the disciplinarians are having a difficult time containing the popularity of the subversive concepts represented by the Tea Party movement.

Another recent, existential threat to disciplinary society is the WikiLeaks organization, co-founded by Julian Assange. For many years, the various disciplines (especially debt-dollar discipline) have greatly benefited from advances in electronic communications technology, and have evolved right alongside them. Now, this technology increasingly serves as a means of communicating outside the panoptic gaze of disciplinary society.

WikiLeaks has released numerous electronic documents given to it by informants within the heart of the system, exposing some inconvenient truths about those directing foreign and domestic policies. [8]. These documents are especially threatening to disciplinarians because they are "raw dumps" of data and communications, at least before they are "vetted" and deceptively reported on by the mainstream corporate media. The leaks provide the disciplined public a rare glimpse into the "dark side" of the modern "democratic" state and its complex power structures.

Governments and many parts of the corporate media have obviously responded by attempting to marginalize the effects of such leaks, primarily by labeling Assange a "child molester", cyber-attacking the WikiLeaks website, restricting its access to funding and threatening criminal prosecution. Perhaps more importantly, they have attempted to frame the narrative surrounding WikiLeaks as one involving unpatriotic acts of disclosure, which may actually harm the lives of American citizens. If the truth becomes known, then we will be more susceptible to external threats and less secure.

This is a recurring narrative that has been heavily used by the disciplinarians to marginalize political threats (i.e. Daniel Ellsburg - released Pentagon Papers during Vietnam War) and reinforce discipline (i.e. Patriot Act), especially since the attacks on 9/11. However, the momentum of release, fueled by a break down in financial discipline, is currently overwhelming their suppressive efforts. International hacker groups have recently launched web attacks against PayPal, MasterCard and Visa in response to these companies cutting their payment services to WikiLeaks. [9], [10]. The WikiLeaks organization itself has released an "insurance file" into cyberspace containing many more revealing documents, which can be decrypted and exposed should it be deemed necessary, and rest assured it will be soon enough.

A claim circulating in the blogosphere that deserves a quick mention is that WikiLeaks is actually a covert psychological operation by the U.S. government to further reinforce discipline, primarily with regards to the "war on terror". [11]. It is claimed that much of the leaked information does not really criticize the overall justifications and motives of U.S. foreign policy (or economic policy), and rather focuses more on the corruption and deceit of other "hostile" countries. For example, the leaked diplomatic cables simply present slightly embarrassing, but well-known facts about U.S. policies, while providing the disciplinarians even more justifications to engage in military operations against Iran (diplomats alleging it has nuclear weapons).

I tend to disagree with this viewpoint and see much of the WikiLeaks activity as being more than "slightly embarrassing" to U.S. power structures (especially given their responses), but instead of sidetracking into that debate, I will simply quote an excellent article written by Andrew Gavin Marshall on the Global Research website:

"If Wikileaks is a psy-op, it is either the stupidest or most intelligent psychological operation ever undertaken. But one thing is for sure: systems and structures of power are in the process of being exposed to a much wider audience than ever before. The question for the alternative media and critical researchers, alike, is what will they do with this information and this opportunity?" [12]

The financial structures of power are also under attack by some of the financial consumers themselves, who have decided not to buy into the fabled narratives espoused by their politicians and pundits. Europe had an obviously unofficial "bank run holiday" on December 7th, in which large numbers of people withdrew their deposits. This episode arguably led to a temporary crash in the ATM systems of the Bank of Ireland, the country's largest financial institution. [13].

Max Keiser and Mike Krieger also recently launched an operation to decapitalize J.P. Morgan by encouraging consumers around the world to buy an ounce of physical silver, forcing the institution to cover massive losses on its silver short positions. November saw record sales of silver American Eagle coins from the U.S. Mint, and this surge could very well have been influenced by the operation. [14]. The immediate success or failure of these "attacks" is largely irrelevant at this point, because it is literally the thought that counts.

The U.S. disciplinary order has also lost legitimacy in the eyes of many other nations, who previously were coerced to support the system. It was mentioned above that the value of the dollar will most likely increase in the short-term, precluding the disciplinarian's attempts at restarting credit inflation, but this process is by no means a vote of confidence in the dollar as a long-term store of wealth. It is a necessary function of global deleveraging, as the dollar still provides the best means of eliminating debts and transforming paper wealth into hard assets, but this window of opportunity is rapidly narrowing. Many countries have made clear that they are no longer willing or able to submit to debt-dollar hegemony in the near future.

The Federal Reserve's latest round of quantitative easing was ubiquitously rebuked by officials in Europe, Asia and Latin America. Brazil's finance minister has blatantly stated that "it does no good at all to just throw [debt] dollars from a helicopter". [15]. These states are simply attempting to maintain their own disciplinary mechanisms by separating out from the overarching debt-dollar discipline. They sense that structures preserving the latter are naturally collapsing, and a pre-emptive break provides their best chance to maintain a degree of national or regional order.

Russia and China recently announced that they would stop using the dollar to settle bilateral transactions, and instead use the yuan and ruble. [16]. Germany consistently expresses its disdain for the IMF and ECB's euro zone bailout facilities, which ultimately serve to prop up financial institutions operating in Europe. [17]. Numerous countries have also been engaged in ongoing discussions with the IMF about establishing a new reserve currency, and though this is unlikely to occur, it is symbolic of the debt-dollar discipline's demise.

Foucault perceived the disciplinary society exerting its power primarily by fixing "docile bodies" within time and space. [18]. These bodies would spend much of their lives in a highly regimented and confined existence, disciplining themselves to become "normally" functioning members of society. Debt-dollar discipline has not strictly operated through such physical requirements, but rather a pervasive psychosocial drive of consumers to extract ever-greater amounts of wealth from their environment.

As the complex structures supporting this financial discipline deteriorate, consumers will have to confront a profound new reality, one that they previously thought to be outside the realm of possibility. They must not only confront the fact that they have been deceptively enslaved, but simultaneously impoverished as well. Part III of this series will discuss the general ways in which financial power structures and disciplined consumers may react to the new realities faced by global society, introducing the insightful thoughts of Gilles Deleuze on what he ominously termed the "control society".

Ashvin Pandurangi, third year law student at George Mason University

Website: "Simple Planet" - peakcomplexity.blogspot.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2010 Copyright Ashvin Pandurangi to - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.