The Three Financial Market Trends That Will Define 2011

Stock-Markets / Financial Markets 2011 Dec 22, 2010 - 01:50 PM GMTBy: Chris_Kitze

It’s that time of the year when analysts and economics make financial predictions for the year ahead. And it is time for me to throw in my two cents’ worth as well. I believe that four financial trends will shape and define 2011. Here they are:

It’s that time of the year when analysts and economics make financial predictions for the year ahead. And it is time for me to throw in my two cents’ worth as well. I believe that four financial trends will shape and define 2011. Here they are:

Gold will rise in price again in 2011. Gold stocks will be amongst the best stock sectors for investors in 2011.

As I sit down to write PROFIT CONFIDENTIAL this morning, the price of gold bullion is up 27% for 2010. Many of the gold stocks recommended in our various financial newsletters were up over 100% this year. I believe that trend will continue in 2011, because of the two other financial trends below that will establish themselves.

The U.S. dollar’s long-term downward trend will recommence in 2011.

After getting near a record low against other world currencies in early November, the U.S. dollar has been rallying. In my opinion, the greenback has been going up for the simple fact that the euro has been going down in value, as country after country in Europe gets its bond ratings downgraded. The hard fact is that euro countries own very little in U.S. Treasuries when compared to other countries. In October of 2010, the five biggest owners of U.S. Treasuries were: China, Japan, the United Kingdom, Brazil, and Hong Kong. No euro country even made the top-10 list!

Because of bond trader focus on European countries (I think the bond traders are making a fortune shorting the bonds of troubled euro countries), the trend for a stronger U.S. dollar may continue in the first or even second quarter of 2011. But medium- to long-term, the greenback will go down, as it simply succumbs to too much debt backing the currency.

Interest rates will rise in 2011. Utility stocks and U.S. Treasuries will not be good investment for investors next year.

Long-term interest rates in the U.S. started to rise in October. Specifically, the yield on the bellwether 10-year U.S. Treasury has risen 38% since the first week of October 2010 to today. I believe this trend will continue as: (1) foreign investors demand greater returns for buying bonds of a country that is drowning in debt; and (2) all this monetary liquidity that has been pumped into the system to save us from the Great Depression II will result in inflation.

When 2011 ends, another $1.2 trillion to $1.5 trillion will be added to the national debt. The U.S. is taking in between $100 billion and $125 billion less a month than it spends. Now that the Bush tax cuts have been stayed, we know the only big revenue source can be people/companies paying more tax because they are making more money. Incomes will not jump in 2011; the economy is still very fragile. There has been no meaningful reduction in our annual deficit, no austerity measures introduced like in European countries.

We all know that the prices of bonds and utility stocks decline as interest rates rise. I won’t own any of either in 2011.

Michael’s Personal Notes:

Gold just can’t get a break. The metal’s been rising for eight or nine consecutive years now and it gets no respect.

My broker tells me not to buy anymore gold, because it is in a bubble. Bloomberg ran a story on Monday with the headline, “Soros Gold Bubble at $1,384 as Miners Push Buttons.” Other major news sources have been writing negative “bubble” articles on gold’s bull-run.

The more negative news I read about gold, the more I love it. As long as there are doom-and-gloom people out there shooting their mouths off about gold being a bubble, gold bullion will rise more in price and my gold related investments will rise more in price.

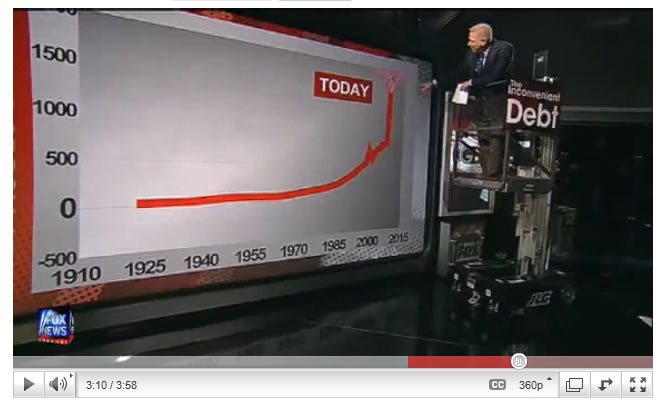

Watch this video to get just one reason why gold bullion will rise in price:

What the Market Stands; Where it’s Headed:

You’ve got to love this market. Slowly, but surely, it just keeps rising, which is great for us stock market investors. With very little coverage in the major business newspaper or on the popular financial Internet sites, the Dow Jones Industrial Average has moved up to the same level it was at in August of 2008.

As I have written for the majority of 2010, the bear market rally in stocks that started on March 9, 2009, is alive and well.

The Dow Jones Industrials opens this morning up 10.6% for 2010.

What He Said:

“The conversation at parties is no longer about the stock market; it’s about real estate. ‘Our home has gone up this much’ or ‘Our country home has doubled in price.’ Looking around today, it would be very difficult to find people who believe that one day it could be out of vogue to own real estate, because properties would be such a bad investment. Those investors who believe a dark day will never come for the property market are just fooling themselves.” Michael Lombardi in PROFIT CONFIDENTIAL, June 6, 2005. Michael started warning about the crisis coming in the U.S. real estate market right at the peak of the boom, now widely believed to be 2005.

read more on: www.profitconfidential.com/...

By Chris Kitze

A long career in digital media led to Before It's News, the People Powered News site that is quickly becoming a leading source for alternative news. We've got a great team of very bright and hardworking people with an incredible market opportunity that's been handed to us by a corrupt media and government. We're here to help you get your news out, that's why this site exists.

© 2010 Copyright Chris Kitze - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.