10 Forecasts for 2011 – Gold, Dollar, Stocks, Politics

Stock-Markets / Financial Markets 2011 Jan 12, 2011 - 01:49 AM GMTBy: Jason_Hamlin

What’s in store for the economy and world at large in 2011? First let’s admit that short-term predictions are a crapshoot. Still, I have been able to nail about 80% of mine over the past few years and I find the process valuable in determining my overall investment strategy for the year.

What’s in store for the economy and world at large in 2011? First let’s admit that short-term predictions are a crapshoot. Still, I have been able to nail about 80% of mine over the past few years and I find the process valuable in determining my overall investment strategy for the year.

My first prediction is that my forecasting abilities will worsen each year, as today’s markets are driven less by fundamentals and increasingly more by the whims of elite bureaucrats deciding how many Trillions of taxpayer dollars to toss to their bankster friends. I’m not sure if we’ve ever had truly free markets, but I am certain it is not the case in modern-day America. But, let’s give it a go anyway…

My first prediction is that my forecasting abilities will worsen each year, as today’s markets are driven less by fundamentals and increasingly more by the whims of elite bureaucrats deciding how many Trillions of taxpayer dollars to toss to their bankster friends. I’m not sure if we’ve ever had truly free markets, but I am certain it is not the case in modern-day America. But, let’s give it a go anyway…

#1 Gold will climb to a minimum of $1,800 and silver to $45. Mining stocks will perform much better than in 2010 and return to offering leverage of at least 2X the advance in the underlying metal. Juniors will continue outperforming the major producers by a wide margin. Corrections will become less severe both in magnitude and duration due the winding down of the manipulation scheme by JPMorgan, HSBC and other banks. The potential for CFTC position limits and sudden willingness of long-term investors to stare down the shorts and clench their gold all the tighter during sudden take downs will also help to moderate declines.

#2 The dollar index will enjoy some strong rallies throughout the year on Euro weakness, but will end the year down 10% or more against the stronger currencies. It might not be the year the dollar dies quite yet, but the weakness in the Federal Reserve’s fiat currency will become more and more evident around the globe.

#2 The dollar index will enjoy some strong rallies throughout the year on Euro weakness, but will end the year down 10% or more against the stronger currencies. It might not be the year the dollar dies quite yet, but the weakness in the Federal Reserve’s fiat currency will become more and more evident around the globe.

#3 The FED will be forced to step up its stimulus in order the keep the economy afloat. Look for QE 3 during 2011. Similarly, Bernanke will increase the monetization of U.S. debt in order to keep rates low and fund growing government deficits. U.S. citizens will become increasingly aware of the FED with growing negative sentiment thanks to Congressman Ron Paul’s new position as head of the Fed Oversight Panel.

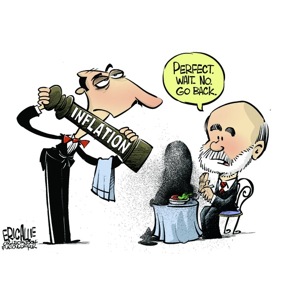

#4 Deflation will give way to inflation this year, with sharp price increases across most key commodities. The official inflation rate will climb back above 5%, with true inflation easily above 10% (SGS Alternative).

#5 The stock market will grind higher throughout the year, driven by government stimulus / quantitative easing. There will be higher levels of volatility and greater swings than seen in 2010. Absent a significant crisis, the S&P 500 could end the year up 5-10%. That said, investors are still scarred from the 2009 crash and will be quick to dump stocks if a panic ensues.

#6 Food prices will continue higher during 2011, making another all-time record. This will be driven by both inflation and severe weather volatility. Investing in agriculture stocks such as potash/fertilizer producers will prove even more profitable this year than in 2010.

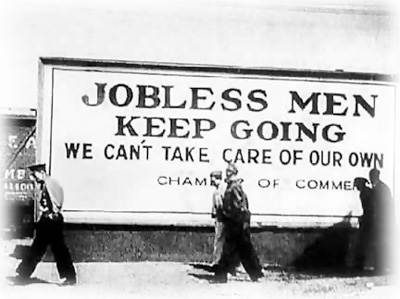

#7 Official unemployment will hover below 10%. However, more and more job seekers will become discouraged and stop looking for jobs, pushing the true unemployment rate (Shadow Stats Alternative) above the 23% mark.

#8 Real Estate prices will continue to slide, dropping another 5-10% in 2011. This decline would be much worse if it weren’t for inflationary pressures. Contrary to what many experts have said, the bottom is still not in sight. It will take another government stimulus in order to keep prices from dropping to new lows. Real estate prices will drop significantly when priced in gold and silver terms. At some point in the next 3-5 years, 1,000 ounces of silver will be able to purchase a median-priced home.

#9 There will be more austerity programs announced worldwide and serious discussions of cutting Social Security and other benefits in the United States. This will lead to greater voter outrage, more protests and more violence, unfortunately.

#10 The Internet will become a battleground focus over issues such as Net Neutrality, Wikileaks and cyber warfare. The more information citizens are able to glean from independent media rather than corporate media, the more aware and more outraged they will become. The government will step up its efforts to keep a lid on the true state of world’s corrupt political and economic systems.

Parting Shot… While I hope that I am wrong, I predict that we will see a financial or currency crisis in the next two years. It will be much more devastating than the financial crash of 2008/2009, as the world loses faith in the U.S. dollar and the government’s ability to ever pay off its debt. How far reaching this disaster will be and how long the world will remain in chaos is hard to predict, but I do view the coming crisis as an opportunity to flush out an old, broken and completely corrupt system. If we are motivated, wise and prepared, we will be able to usher in a new and better political and economic system. Every crisis is indeed an opportunity.

To learn how I am preparing for the coming crisis, view my portfolio and receive the contrarian newsletter, sign up for the Gold Stock Bull Premium Membership. You can also click here for a video introduction to my service. I wish you health, wealth, peace and prosperity in the new year.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $35/month by clicking here.

Copyright © 2011 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.