Socrates on Portugals Debt Crisis

Stock-Markets / Financial Markets 2011 Jan 12, 2011 - 02:57 PM GMTBy: PhilStockWorld

"Portugal will not request financial aid for the simple reason that it’s not necessary" – Socrates

"Portugal will not request financial aid for the simple reason that it’s not necessary" – Socrates

Of course, that was Jose Socrates, Portugal’s Prime Minister, not Σωκρτης the great Philospoher, who was more famous for saying "False words are not only evil in themselves, but they infect the soul with evil" as well as "True knowledge exists in knowing that you know nothing." More apropos for this morning is the more famous Scocrates’ more famous observation that "True wisdom comes to each of us when we realize how little we understand about life, ourselves, and the world around us."

The investors jacking up the markets at 6am this morning understand very little about the relevance of Portugal’s sale of $1.62Bn in bonds. While the auction was a "success" with longer bonds going off at 6.7% that’s WITH intervention by China and Japan on an auction amount that either one of them could have tipped the cab driver on the ride over from the airport and not missed it. This is like going to your rich uncle for a used car loan because the bank wants 12% and your uncle says "sure I will help you out but you will owe me big time and I will make my brother’s life miserable because I have to give his kid money and I’ll never let him forget it" and then he hands you a contract to pay him back at 11.5%.

The investors jacking up the markets at 6am this morning understand very little about the relevance of Portugal’s sale of $1.62Bn in bonds. While the auction was a "success" with longer bonds going off at 6.7% that’s WITH intervention by China and Japan on an auction amount that either one of them could have tipped the cab driver on the ride over from the airport and not missed it. This is like going to your rich uncle for a used car loan because the bank wants 12% and your uncle says "sure I will help you out but you will owe me big time and I will make my brother’s life miserable because I have to give his kid money and I’ll never let him forget it" and then he hands you a contract to pay him back at 11.5%.Actually, Portugal didn’t even get that much of a "family discount," The last bond auction of 2010 went off at 6.8% and the fear was that the rates would go over 7% but let’s not do cartwheels over 6.7%. Oh, sorry, too late, the markets are already doing cartwheels with a 0.5% gain in the futures and just look how excited the Hang Seng was after lunch, gaining 200 points in a virtual straight line and almost doubling the day’s optimistic opening. The Shanghai was just as exciting, falling from 2,828 down almost 1.5% to 2,788 but then flying back to 2,821 to book a 0.6% gain on the day and giving Mainland China’s Main Market this exciting profile:

So it’s no surprise Uncle China doesn’t want Portugal falling apart but Portugal doesn’t just need a car – They are also having trouble paying the rent and the phone bill and the cable and the food and they don’t have health insurance and their student loan payments are due. In short, Portugal needs $20Bn this year and that is only 2% of the rest of the EU’s $1Tn worth of bond rollovers. No problem says the punditocracy, who have been pointing out all week that China and Japan, our rich relatives from the East, have a combined $4 TRILLION in Forex reserves to throw around and what better way to spend their accumulated wealth than to pay the bills of their irresponsible distant relatives?

That is the "logic" of this relief rally so take it for what it’s worth. Of course China and Japan can afford to make a grand gesture by paying Portugal’s bills in January but what about India, the Niece who lives next door? The women on the right are gathered for a protest as food prices have shot up 18.32% in December. These are, by the way, educated, often English-speaking people – in case that helps you to care more – and their families are no longer able to pay their basic bills and the trajectory of food prices, along with everything else is, as I said yesterday – UP!

When 450M people are living on $2 a day in income, it doesn’t take much of a rise in the basics to literally take food off the table. Sadly, the people in India are being told the same thing US workers are: "Shut and take your pay cut or I’ll ship your job to China." Official unemployment rates are, like ours, 9.4% but it could have been worse if not for the fact that 6.4M children were removed from the work-force and put into schools. Both "Circus" and "Caring for Elephants" are no longer allowable child labor, bringing the total up to 18 occupations that may not be held by children.

In addition to speculators fueled into a buying frenzy using endless supplies of money supplied by Western Central Banks to run commodities to record highs, we now have actual emergencies like the flooding in Australia and drought in Russia that have helped send wheat futures up 47% this year. Actual wheat PRICES are up "only" 8% because, as I keep saying, PEOPLE CAN’T AFFORD TO EAT, but that won’t stop speculators from doing their best to collect on those contracts. Fortunately, making IPhones for 10 cents an hour is still OK for child labor so if those women would just stop rioting and start making some babies, we can look forward to keeping the production costs down on our IPhone 5s and 6s so we can watch American Idol while waiting at the drive-through for our Big Macs.

No, these boys are not celebrating the IPhone finally going to Verizon, they are also rioting for food in Algeria, which is not a terribly small country with 35M people who earn about $7,000 each for a GDP of $252Bn, only 25% below Apple, Inc’s market cap (and they only need 46,000 employees to make that so take that Algerians!). Google’s market cap is $196Bn and they spend $72M a year providing gourmet food for their 23,000 employees which works out, ironically (to Algerians) to be $7,500 per employee, or the ENTIRE per capita income of the average Algerian spent to feed each Googalian.

Not to worry of course – As Keynesians would argue that even a riot-broken window ads economic stimulus but that is called the "Broken Window Fallacy" and was well-refuted by Bastiat many years ago. Unfortunately, the whole Western World is currently operating under a broken window premise with bailouts, stimulus and wars substituting for actual economic activity that could contribute to lasting growth and jobs.

Of course Bastiat makes the mistake of looking at the economic problem from the point of view of SOCIETY which, it turns out, has little to do with Corporate Profits, where Keynes is right as the forced extraction of wealth from the lower classes – whether through breaking their windows or raising the price of food, fuel, clothing and shelter to the point where virtually everyone below the top 1% is essentially living on subsistence wages – is BRILLIANT! You don’t need to advertise the need for gasoline or heating oil, or bread or basic shelter – you simply build it as cheaply as possible, transport it to places where human beings would rather live than die and then come up with the highest possible price they can afford to pay and watch those profits roll in!

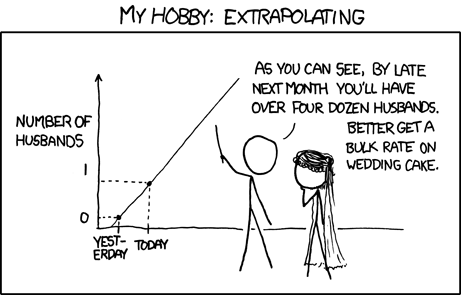

I wouldn’t be worried if screwing the poor was all we were doing to rebuild our economy. Historically, it’s been the norm for thousands of years so why not go with the classics? What’s different here is, as I pointed out above, speculators have extrapolated the current 8% rise in wheat prices as a trend that will lead to a 45% rise in wheat prices in the futures. People are already rioting over the 8% increase – where the Hell are they supposed to get the money for another 37%?

We’ll get a little insight today into the actual crop situation as the USDA releases its main report for the year. January’s World Agricultural Supply and Demand Estimates, or WASDE, is closely followed as it serves as a guideline for the year and divulges final numbers for the previous year. Corn futures are up 52% from last year’s report and soybeans are up 32%, with 20% of those gains coming in the past 90 days so expectations are high for speculators to say the least and God help the 5Bn people on this planet who earn less than $3,000 a year if they are right!

We also get oil inventories at 10:30 and that’s another case where you may see a draw in crude as we are being short-shipped over 10M barrels a week as speculators divert US-bound tankers into storage as well as fun games like shutting down the Houston Ship Channel last week because 15,000 gallons of beef fat spilled into the waterway. That delayed a day’s worth of oil deliveries and, as soon as that mess was cleared up, there was a spill in Alaska that shut down another 650,000 barrels a day’s worth of imports. Are we unlucky or what?

That little string of bad luck has sent oil prices flying up to $91.90 in pre-market trading but we’re still shorting the NYMEX as we believe there will be at least one big down spike as they prepare to roll the 250M barrels worth of oil demand contracts they pretend to want in February into 250M barrels worth of contracts they will pretend to want in March, April and May. All this extending and pretending is, of course, expensive as barely 5% of all the contracts written on the NYMEX are actually delivered but don’t worry about the speculators – they are able to pass all those fees down to you at the pump because $3 gas is really $126 per 42-gallon barrel so there’s lots of room left to screw you over!

This is why XLE was one of our "Secret Santa Inflation Hedges for 2011" but, unfortunately, as I mentioned yesterday, there was still a chance to grab them in the morning but now we’re up almost $2, testing $70 this morning so congrats to those who accepted my little Christmas gift when XLE was still $67 or even yesterday at $68 as $2 in a day isn’t bad…

That’s right, complain as I might, we know we can’t beat them so we just join ‘em. DBA (agriculture), XLF (financials) and XHB (homebuilders) were my other inflationary ideas in that post because it doesn’t matter if people can’t afford things as long as they NEED them and higher prices equal higher margins so it’s better to sell 9 of 10 loaves of bread that cost you $9 ($90) to make for $12 ($108) and let one family starve than to sell 10 loaves of bread for $10 ($100), which would feed everybody but make you 44% less profits.

I think Jesus said that…

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.