The Economic “Recovery” in Consumer Loans Isn’t Real

Economics / US Economy Feb 02, 2011 - 02:36 AM GMTBy: Casey_Research

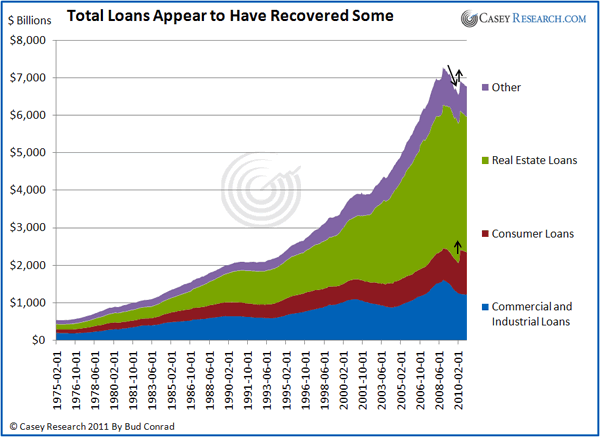

Bud Conrad, The Casey Report writes: The amount of loans being provided by our banking system is a good reflector of the strength of our economy. Below is a big-picture view that shows the total loans in the U.S. as the Fed reports in its H.8 each week. We can see that loans outstanding declined at a rapid rate at the beginning of the current great recession, but there seems to be a recovery in the little jump at the end of the chart, as highlighted by the two small black arrows. A little closer look shows that the Consumer Loans segment is the source of the optimism that we see in the total.

Bud Conrad, The Casey Report writes: The amount of loans being provided by our banking system is a good reflector of the strength of our economy. Below is a big-picture view that shows the total loans in the U.S. as the Fed reports in its H.8 each week. We can see that loans outstanding declined at a rapid rate at the beginning of the current great recession, but there seems to be a recovery in the little jump at the end of the chart, as highlighted by the two small black arrows. A little closer look shows that the Consumer Loans segment is the source of the optimism that we see in the total.

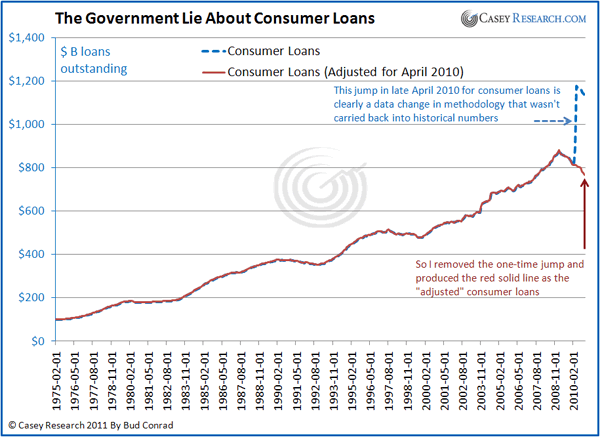

The Consumer Loans figure shows an impossible jump of $360 billion in a one-time change in April 2010, in the dashed blue line. Just graphically you can see that the jump is not consistent with history. The correct conclusion is that consumers didn't go on a $360 billion borrowing binge in one month. The change was from how the Fed reported the data. In other words, the "green shoot" of apparent loan growth in the first chart is bogus. It came from a fluke in the data that couldn't have happened, and so it didn't happen. We don't have evidence of recovery in loans but rather continuing their decline since the beginning of this recession in 2008.

To get a consistent view, I adjusted the data from April forward to remove the jump to produce the gradually continuing decline as shown in the solid red line. Without the one-time change in the data from the Fed, the loans at banks have continued to decline.

When combined into the big picture, the result is that the private sector is still deleveraging its outstanding balance of loans.

.png)

The rate of decline is still at the biggest level since World War II:

.png)

My interpretation is that the private economy is still in a downturn, because the Federal Reserve numbers when adjusted, as I provide here, are still showing we are in the worst decline on record. Not shown here is that government debt has been soaring, contributing to other positive economic numbers but leaving us with a debt burden for the future. I think the economy is weaker than the general consensus of economic reporters, because they haven't looked as closely at what is inside the numbers.

[To get a big-picture view of where the economy is headed, read our FREE Special Report “The Good, Bad, and Ugly: Outlook for the Economy” – authored by the editors of The Casey Report. 20 pages of deep economic insight you can’t afford to miss: Click here to read it now.]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.