The Gerontocracy, Workers are the Economic Slaves of Pensioners

Politics / Demographics Feb 18, 2011 - 11:06 AM GMTBy: MISES

Jan Iwanik writes: I suspect that funded retirement plans like American 401(k)s British private pensions, or Polish open pension plans (OFE) cannot survive in a centralized democracy. The only alternatives are unfunded schemes such as American social security, British state pensions, or the Polish Social Insurance Institution (ZUS).

Jan Iwanik writes: I suspect that funded retirement plans like American 401(k)s British private pensions, or Polish open pension plans (OFE) cannot survive in a centralized democracy. The only alternatives are unfunded schemes such as American social security, British state pensions, or the Polish Social Insurance Institution (ZUS).

But such systems naturally lead to a conflict of interest between age groups, out of which the older generations emerge victorious. As a result, an internal gerontocracy is formed within the democratic system. This new and more oppressive system may prove to be more sustainable than the democracy itself.

Funded Systems Must Decline in the Long Run

In Aristotle's Politics, Book V, he describes the cause of downfall of the democracies he had known:

In democracies the most potent cause of revolution is the unprincipled character of popular leaders. Sometimes they bring malicious prosecutions against the owners of possessions one by one, and so cause them to join forces: for common fear makes the bitterest of foes to cooperate. At other times they openly egg on the multiple against them.

Just as in ancient Greece, in a centralized welfare state the redistribution of wealth remains the driving force of politics. Hence, all savings are always at risk from the political system. Retirement savings are no exception. Changes such as the recent reductions to the funded schemes in Eastern Europe[1] or the new taxation of private pensions in the UK[2] show how nationalizations of these resources may proceed.

"Living half of one's life as a slave and half as the master is not the same as being free."

The democratic pressure on the redistribution of savings has transformed ancient democracies into oligarchies and tyrannies, and therefore it is probably powerful enough to bring about the end of modern funded-retirement systems — and prevent their revival afterward. Their permanent transformation into politically controlled, unfunded schemes will conclude the Schumpeterian process of socialization, bureaucratization, and monopolization of the retirement-savings market.

Unfunded Retirement Systems Lead to a Conflict of Interest between Age Groups

In unfunded systems, the conflict of interests between age groups is easy to see: people of working age are forced to pass a portion of their income to retired people. This taxation means less income for most workers and unemployment for some.

The fact that young people will retire in the future guarantees that this conflict of interests will be perpetuated from one generation into another.

An unfunded system benefits the pensioners. Since they were once contributing to the system and became dependent on it, they will naturally oppose any reductions of the transgenerational transfers. Since they are well aware of their group interest, they are bound to be effective in exerting political pressure.

The second group reinforcing unfunded systems is people close to retirement age. Despite still having to contribute to it, they back the system in hopes of soon becoming its beneficiaries. The closer they are to retirement, the closer their political interest aligns with the pensioners'.

The victims of this system are the young people. However, they mostly remain oblivious to the issue. They are less politically effective and their priorities are less focused. Young people also often accept the cultural norms passed on by their elders, which become the ethical rationalization of the transgenerational transfers.

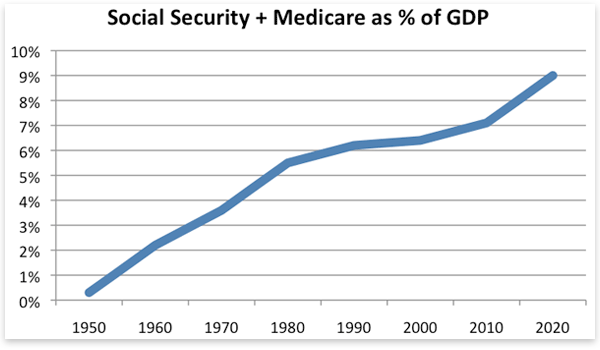

This way older people emerge victorious out of the conflict between generations. This is how the democratic gerontocracy is made. In the United States, the increase in federal funding for programs supporting the elderly (see the chart[3] ) is a result of this process.

Those who question the right of older people to appropriate the fruits of the labor of others have difficulty gaining any influence in the political process. Simply expressing an opinion that in an unfunded system pensioners are a parasitic group is inadvisable if one values one's public reputation.

The Gerontocracy Will Not Go Bankrupt

Some say that unfunded systems are bound to go bankrupt and future pensioners will be left with no means of survival. This would supposedly come to pass because unfunded systems accumulate no savings and all contributions are being spent immediately.

Yet spending does not necessarily mean that the benefits will dry up at some point. As long as there are still some productive people in the economy, they can be taxed and funds can be transferred to the older generations. The scale of this transfer is virtually unlimited — tax rates may go up to 80, 90, or 100 percent. Even in a world without borders, the young will have nowhere to escape from increasing burdens, because similar changes are happening in most Western countries.

Changes in demographics only mean that the numbers of voting pensioners will go up. This means the unfunded systems will strengthen rather than decline. Even if the result of this process is a poorer society (which is most likely) the pensioners may remain relatively well off.

Gerontocracy: The Oldest Political System

Accumulation of capital, knowledge, and political connections takes decades. As a result, political power tends to rest in the hands of older people. The average age of the USSR's general secretaries was 62 years, for European monarchs it is 70, for voting Roman Catholic cardinals 73, and for US senators 62.

In the long run, changes in national retirement systems will probably reinforce democratic gerontocracies around the world. People of working age will continue being economic slaves of the pensioners. But living half of one's life as a slave and half as the master is not the same as being free.

Notes

[1] World Bank, "Pensions in Crisis: Europe and Central Asia Regional Policy Note." Jan Iwanik, "Europe's Pension Seizures."

[2] Liam Halligan "Brown's raid on pensions costs Britain £100 billion," The Telegraph, Oct. 15, 2006.

[3] Congressional Budget Office, "A 125-Year Picture of the Federal Government's Share of the Economy, 1950 to 2075."

Jan Iwanik is a property and casualty actuary with experience in the American and European insurance markets, currently practicing in London. He has a PhD in mathematics from the Wroclaw University of Technology. Recently Jan has also been supporting the work of the Polish Instytut Misesa. Send him mail. See Jan Iwanik's article archives..© 2011 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.