Stock Market Topping, Treasuries Recovering and Gold is on a Tear

Stock-Markets / Financial Markets 2011 Feb 26, 2011 - 04:53 AM GMT

Initial Claims Drop 22K To 391K, On Expectations Of 405K, Durable Goods Collapse - (ZeroHedge) Initial Claims, which were obviously revised higher from 410K to 413K, dropped well below expectations, printing at 391K, on expectations of 405K. With claims continuing to hug the 400K line, this means that unfortunately the economy is not creating nearly enough jobs: as a reminder per the CBO, the US needs to create over 100K jobs a month just to stay in line with population growth. Continuing claims dropped from an (upward) revised 3935K to 3790K, as more and more people hit the 6 month continuing benefits cliff. They also are hitting the end of their 99 week extension period: those on extended benefits dropped by -111,087.

Initial Claims Drop 22K To 391K, On Expectations Of 405K, Durable Goods Collapse - (ZeroHedge) Initial Claims, which were obviously revised higher from 410K to 413K, dropped well below expectations, printing at 391K, on expectations of 405K. With claims continuing to hug the 400K line, this means that unfortunately the economy is not creating nearly enough jobs: as a reminder per the CBO, the US needs to create over 100K jobs a month just to stay in line with population growth. Continuing claims dropped from an (upward) revised 3935K to 3790K, as more and more people hit the 6 month continuing benefits cliff. They also are hitting the end of their 99 week extension period: those on extended benefits dropped by -111,087.

And while the employment picture was better than expected, the capital goods data was a total disaster: January US Capital Goods orders non-defense ex. aircraft plunged by -6.9% M/M on expectation of just a -1.0% drop (Prev. 1.4% Rev. 4.3%). And just excluding Transportation, durable goods collapsed by 3.6% on expectations of a 0.5% increase.

Time for those downward GDP revisions.

Big Miss To Second Q4 GDP Read: Comes At 2.8% On Expectations Of 3.3%

(ZeroHedge) As we had been expecting, Q4 data once again continues to take downward revisions. Second revision of Q4 GDP prints at 2.8%, widely missing of 3.3%, compared to a 3.2% reading previously. US Personal Consumption came at 4.1% on expectation of 4.2% (Prev. 4.4%). Core PCE was 0.5%, on expectation of 0.4%. The attempt at getting the consumer to releverage, at least according to the BEA, is working: personal outlays increased from $10,736.3 to $10,883.2 resulting in a decline to savings of $55 billion. And still the economy refuses to either generate jobs to keep up with the rate of population growth, or to grow at the required rate of 4-5% nearly 2 years following the "end" of a recession.

Johnny-Come-Lately gets Snookered.

-- The Investment Company Institute has reported $5.181 billion of inflows to domestic equity funds last week. This brings the total inflows of money to domestic stock funds to a record $17.602 billion year-to-date, just in time for the reversal. The euphoria of a topping market is often what it takes for the average investor to throw caution to the wind.

Treasuries are Recovering.

-- Treasury 10-year notes headed for the biggest weekly gain in six months as unrest in Libya drove investors to the safety of U.S. government debt and raised concern that surging oil prices may stall the economy recovery. Yields on the benchmark securities fell for a third week, the longest stretch since October, after the Commerce Department reported slower-than-forecast fourth-quarter U.S. economic growth

Gold Is On a Tear, But Will It last?

-- Comex gold traded lower Friday on easing concerns about Saudi Arabia and lower crude oil prices.

The most actively traded contract, for April delivery, was recently down 0.8%, or $11.70, at $1,404.10 a troy ounce on the Comex division of the New York Mercantile Exchange.

Gold falling short of a new high is problematic for the bulls. It’s time to be on guard for a larger reversal.

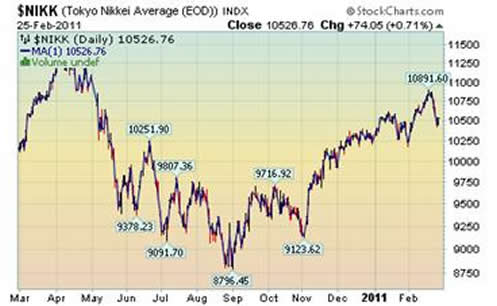

Concerns about Middle East, Oil brings Caution to Nikkei.

-- Japanese stocks rose for the first time in four days as oil retreated and economic reports tempered concern about turmoil in the Middle East.

The Nikkei 225 Stock Average rose 0.7 percent to 10,526.76 at the close in Tokyo. The broader Topix index gained 0.8 percent to 941.93, with more than three stocks advancing for each that fell. Both gauges had the biggest gain since Feb. 14.

Middle East Tensions Make Chines Investors More Cautious.

-- Most China stocks fell today, adding to the benchmark index’s first weekly drop in more than a month, on concern higher oil prices caused by Middle East tensions will curb earnings growth. The Shanghai Composite Index lost 0.04 points, or less than 0.1 percent, to 2,878.57 at the 3 p.m. close. About 448 stocks fell, 420 rose and 62 were unchanged. The measure slumped 0.7 percent this week, the first decline in five weeks. The CSI 300 Index added 0.2 percent to 3,197.62 today.

The Dollar Rises Off its Lows.

-- The dollar remained higher against a basket of currencies of its major trade partners after data showed U.S. economic growth in the fourth quarter was slower than initially estimated.

Intercontinental Exchange Inc.’s Dollar Index, which tracks the greenback against six major counterparts, was up 1 percent at 8:40 a.m. in New York.

-- Wells Fargo is meeting today at noon with the Philadelphia homeowner who "foreclosed" on them, The Consumerist has exclusively learned. Patrick says he "received a call from upon high" late yesterday and that he now has an appointment, "with a very senior Wells Fargo person." It will be interesting to see how this plays out. But how did Patrick go from embattled and ignored homeowner to be seated across the negotiating table with leverage? I spoke with him to find out more about both how and why he did what he did.

Gasoline Prices go parabolic.

--The Energy Information Agency weekly report states, “The U.S. average retail price of regular gasoline marked its largest weekly increase of 2011, advancing a nickel to $3.19 per gallon, $0.53 per gallon higher than last year at this time. Prices on the West Coast gained a dime, the biggest increase in the country. Gasoline on the West Coast is also the most expensive in the country at $3.48 per gallon.”

Natural Gas Consumption Still Falling.

-- The U.S. Energy Information Administration reports, “Prevailing natural gas prices continued their decline during the week except for a brief respite around the Presidents Day holiday when a short cold snap passed. A falloff in natural gas consumption during the week, which exceeded a falloff in supply, was the primary catalyst causing the price decline to continue.”

U.S. Economy Overheating? We Should Be So Lucky: Caroline Baum

(Bloomberg) Wall Street lives in a world of extremes.

Today’s raging bull market may morph into tomorrow’s angry bear. Forecasts of inflation and deflation can be found on the same page. The Federal Reserve’s plans for an early exit from its emergency stimulus were derailed by the need to re-enter the treatment arena. And now, just when you thought fears of a double-dip recession had faded and the coast was clear, along comes a new hobgoblin: overheating.

(ZeroHedge) These days the Fed is blamed for everything: from liberating the world from oppressive regimes, to the resultant genocide that accompanies such a process, not to mention to reflating record bubbles that guarantee to wipe out another generaton's wealth as soon as this latest and greatest episode of central planning fails. Yet one thing the Fed can not be blamed for (yet) is the weather. And unfortunately for (Ben Bernanke), storm clouds are (literally) building up for the next five years. While some have blamed the recent surge in food prices on inclement weather, including floods here, droughts there, and massive conflagrations in Russia, the case is, as UBS points out, that weather over the next five years will likely be very unpredictable, and result in increasingly supply shocks and commodity price imbalances (at least for those commodities that are harvested; that the Fed's liquidity is at base reason for the surge in everything not nailed down, just look at the price action in items that do not need watering, or direct sunlight). Enter the Pacific Decadal Oscillator, and if UBS is right, things will continue to be ugly at least until 2016.

So is Everyone Printing Money?

(ZeroHedge) Japan has found out the perils of a long term zero interest rate policy means the banks have no incentive to assume credit risk and lend to each other or anyone else, so they trade their own book. The performance of the FTSE 100 and S&P500 suggest the true extent of the banks continuing to use cheap government money to trade bonds and equities. Japan knows what happens when the “extend and pretend” gravy train stops rolling.

Equities should continue to rise while government stimulus money can find no other home. This is why politicians are irked at bankers bonuses, because they wouldn’t be making fat profits without cheap government money raised at the expense of the tax payers. All tangible assets, commodities (metals, energy, agricultural) and rare artifacts are likely continue rising until growth is undermined. The threat of rampant inflation and civil unrest will eventually cause the US, UK, Eurozone, Japan and China to rethink stimulus packages.

We are in bubble caused by politicians across the world trying spend their way out of debt. It hasn’t worked before and it won’t work this time either.

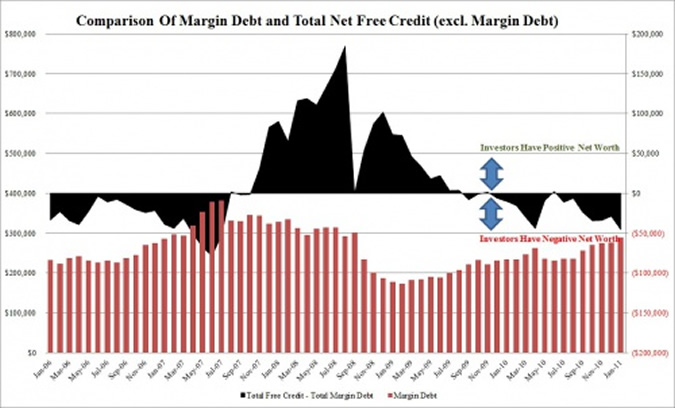

(ZeroHedge) The NYSE has released its January margin debt data. Not surprisingly, total margin debt hit a peak of $290 billion, the highest since September 2008, but the one category that shows just how much purchasing is occurring on margin is total Free Credit less Total Margin Debt drops to the lowest since the all time credit bubble peak in July of 2007! At ($45.9 billion) this number is just below the ($52.8) billion last seen just before the August 2007 quant wipe out which blew up Goldman's quant desk, and arguably was the catalyst for the beginning of the end. In other words, as we have shown, everyone is now purchasing on margin and the level of investor net worth is the lowest in over 3 years. Which means that should the market decline from this week persist and the Fed be unable to stop it, the margin calls will start coming in fast and furious, and unwinds in otherwise stable products like gold and silver are increasingly possible as hedge funds proceed to outright liquidations.

The Next Borrow Short-lend Long Guaranteed to Blow Up Bank Lending Scheme

(Mish) Borrow-short lend-long strategies have caused more pain and grief than nearly any play in the book. They are virtually guaranteed to blow up given enough time if the duration mismatch and leverage is too great.

For those who do not know what I am describing, a couple examples below will help explain. The first example is a look at "cost of funds" and guaranteed profits that banks can make. It is not a borrow-short lend-long strategy but will morph into such a scheme as I vary the parameters.

Citigroup CDs

Inquiring minds investigating Citigroup's cost of funds note that Citigroup 5 year CDs yield a mere 1.5%. For this example, Citigroup's cost of funds is 1.5%, the rate it pays depositors.

Citigroup has the gall to brag about "guarantees in life" when the "guarantee" in question is a complete ripoff. It's a ripoff because 5-year US treasuries currently yield 2.35%.

Guaranteed Free Money

Anyone buying 5-year CDs from Citigroup, Bank of America, Northern Trust, or JPMorgan Chase is giving those banks a shot at guaranteed free money.

All those banks have to do is take that money and invest in 5-year US treasuries to have a guaranteed profit. Here are the reasons for that statement.

- There is no duration mismatch. The banks secure funding for 5 years and invest that money for 5 years.

- The US government is not going to default no matter what nonsense you may hear elsewhere.

Purists may point out the play is not entirely risk-free because people can pay a penalty, cash out the CD, then take the money elsewhere. However, from a practical standpoint, fools dumb enough to accept 1.5% or lower are probably not bright enough to pay a penalty and take the money elsewhere even if rates dramatically shoot up.

(There’s more to this article at Mish’s website.)

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.