Tiger Blood and Adonis DNA of the Bulls, Financial Markets Update, Crude Reality

Stock-Markets / Financial Markets 2011 Mar 08, 2011 - 03:34 AM GMTBy: Joseph_Russo

Like Charlie Sheen, the contingent of herding bulls who drove up the market more than 100% from its 2009 lows are just now beginning to deal with the crude reality of their infamous brand of hypomania.

Like Charlie Sheen, the contingent of herding bulls who drove up the market more than 100% from its 2009 lows are just now beginning to deal with the crude reality of their infamous brand of hypomania.

High on themselves, the band of financial sphere rock-stars-from-Mars led by the Fed, its primary dealers, Washington, transnational corporations and their embedded lobby groups are reeling with pink-cloud-syndrome much like Mr. Sheen has been, which is no laughing matter.

The big difference is that this band of rock-stars-from-Mars have done a much better job of convincing us they are in control, when in reality; they are no more stable than Charlie.

With 70% of the trade volume spawning from high frequency computer programs, the only thing missing is the meaningful participation by retail traders and investors. And participate they should. Why, because that’s where all the big money is.

MARKET UPDATE

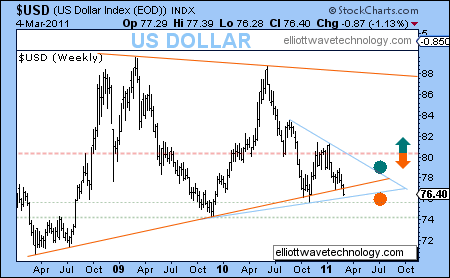

Of all financial markets, the US dollar is the one that most ordinary folks cannot seem to fully process. It is one of the most lethal and effective weapons that our band of hypo maniacs rely upon to nurture their denial of outright failure.

With global monopoly on the creation and management of the world’s reserve currency, our financial rock-stars are more like warlords on a mission to maintain full-spectrum influence over the entire world’s perception of wealth.

The reserve currency is at the epicenter of the global economy. Entrenched in a secular bear market from inception, the chart above illustrates the US dollar threatening to breakdown further amid three-years of sideways consolidation.

Claiming victory across the board (on every front) is contingent upon the effective and orderly management in maintaining a weak dollar. Under no circumstances should such operations be in the hands of such concentrated powers.

Sustained trade beneath 81 is an inevitable death sentence for the US dollar, while sustained trade above 83 is an eventual death sentence for equities.

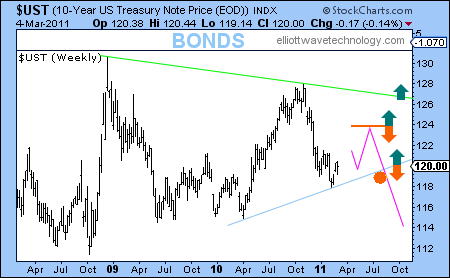

Perhaps even more so than the dollar, the Bond market is another heavily intervened upon arena that the gods of our financial universe rely upon in order to make the entire ponzi-scheme or “system as a whole” work.

You gotta hand it to these guys; they’ve had a really good run for the past 30-years. Even though the marginal utility of their grand operation is dead and buried, a generation of believers is wired to expect similar linear performance for the next 30-years. (Can’t wait for that wake-up call to rouse the masses)

After reaching a historic price high (low in yield) in December of 2008, the Bond market, which is the largest market in the world, is beginning to show some signs of stress. Getting crushed with the balance of the financial sphere in 2009, bonds came roaring back to life and were threatening to reach for another high as recently as October of 2010. That rally operation was shut down as Bonds took another leg down into their recent lows.

We warned that Bonds were set to rally weeks ago. If they can’t get these puppies back up and over the 124 handle, another substantial leg down is likely. They get em’ up and over 126, and we could have ourselves another mini rocket launch to the upside.

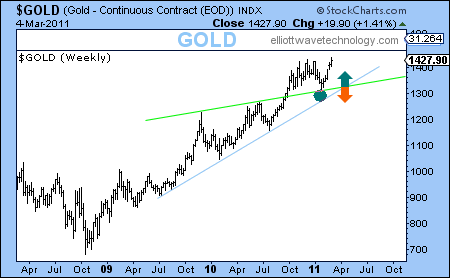

Just like Mr. Sheen, Gold is on a mission. It’s an operation actually, whereby the persistent rise in the Gold price reflects the ineptitude and risk of ruin being taken by our hypo manic rock-stars from Mars.

The more things change, the more they stay the same. The same should apply to one’s physical apportionment of Gold regardless of the price. Hold - and on rare occasion rebalance 10% (at minimum) of your entire net worth in precious metals. Consider it a non-discretionary insurance premium to maintain residence in the evil world that we live in. Way back in 2005, we got longtime subscribers into Gold and Silver at $400 and $8.00 respectively.

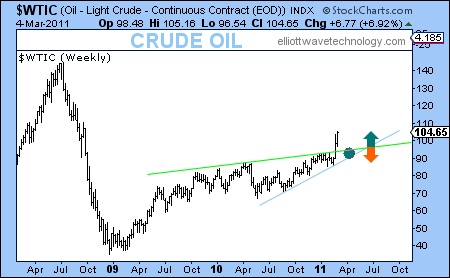

After a brief period of playing possum at the start of this year, Crude has awoken. And a rude awakening it has been. Playing catch-up with equity markets, $109 is within a stone’s throw, and $120 is doable by April.

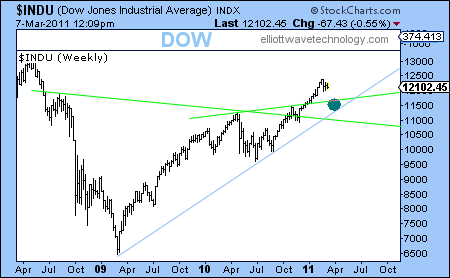

In contrast to the Crude Oil chart before it, the Dow chart is relatively close to tagging its former 2007 highs. Now that’s what a little Tiger blood and Adonis DNA will get you.

Led by our financial band of rock stars, the bullish contingent has scored so many first downs since the 2009 lows, that they can easily absorb a 10% - 20% decline then come roaring back with a renewed hunger for more bearish prey.

Currently, its 4th and 10, and you guessed it – the Bulls are going for another 1st down. Punt, you kiddin’ me - no way jackson. To get it, they must get another print high before decisively breaching recent lows.

If they fail, then we get another leg down in equities and give possession back to the broken-down shell shocked bears.

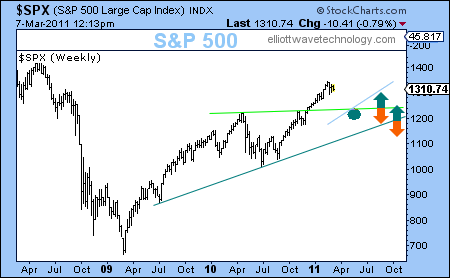

Though it can shine brighter than the Dow at times, remember that it did fail to make new highs back in 2007 when it double topped then collapsed against the highs achieved in 2000. Zero progress in over 10-years, now that’s my kinda benchmark.

Nonetheless, the S&P is THE benchmark by which most all financial performance is gauged. The chart above illustrates the S&P in similar standing as the Dow, and making a run for - dare we say it - a triple-top.

Back in the 80’s and 90’s the S&P was on a rocket ship to the moon. Thus far, the 00’s and 10’s have placed the S&P on a shoddy rollercoaster to nowhere.

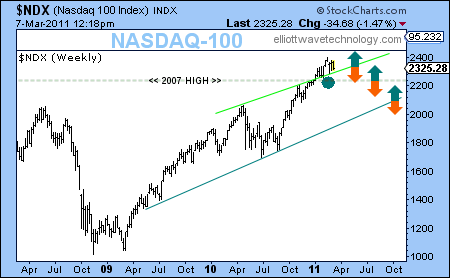

The “stock market for the next hundred years” often appears to lead the other majors, but when you take a few more steps back, this index has come nowhere remotely close to recovering from its zenith in 2000. Maybe that’s why so many think it’s undervalued.

That said, on a time relative basis, the Naz is certainly leading at the moment. In fact, it is amongst the first to eclipse its 2007 highs just north of 2200 (dashed horizontal line).

Should that old 2007 high (currently key support) hold as a new floor under this market, the upside range expansion is huge.

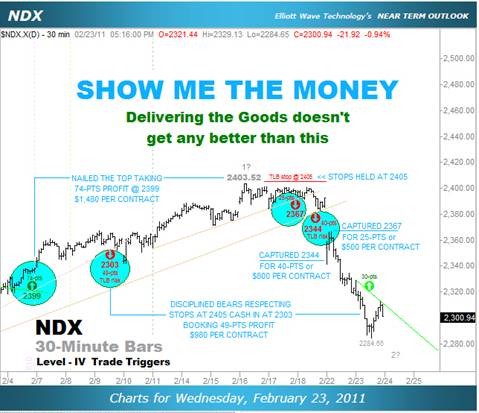

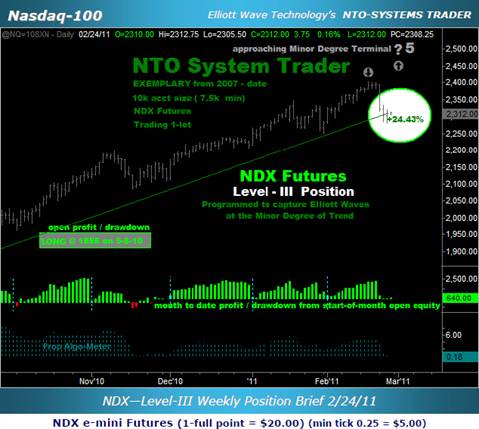

Speaking of the NDX, we’re gonna wrap up with an insider’s look at what type of market information is shared here at Elliott Wave Technology.

The first chart reveals what goes on in the short-term charting and forecasting side of the equation, while the second chart unveils the power of employing strategic trading and investment protocols over the medium term.

EWT in action > charting and forecasting:

Shortly after the start of February, we alerted Near Term Outlook readers to a bullish upside price target of 2399 for the NDX (circled lower left). A Charlie Sheen moment of clarity delivered us a price high of 2403.62 just after Valentine’s Day. To say the least, that was our pink-cloud moment of the month.

Along the way, for those of our members who were positioned bearishly, we pointed out 49-pts of future downside risk that could take the index down to 2303 (circled second from left), and we stated clearly that buy-stops to cover any short interest should be set way above the current market just north of the 2405 handle.

Around February 17, when the markets seemed invincible just north of 2400, we pointed out another small downside risk citing a move down to 2367 (circled third from left).

A couple of days later, we spotted another downside risk, citing 2344 as a short-term bearish target (circled fourth from left).

We must have some descendants with Tiger blood and Adonis DNA because riding the waves on a mercury surfboard in a super bitchin’ way; equipped with the focus of cross-rays into the universe, we nailed each and every one of these specific short-term calls for our Near Term Outlook subscribers.

We are certain that Mr. Sheen is not at all impressed with our powers, are you?

Many of our members simply to not have the time or inclination to ride the mercury surfboard in precisely that way. So for them, we employ a medium term KISS method of engagement, which requires no work at all – on their part. Sit back, relax, and let EWT do all the work – how good is that.

Just like pink-cloud syndrome, your trades and investments are no laughing matter. A growing number of traders and investors have entrusted us in providing them with exemplary guidance over the past five years, and we take that mission very seriously.

In order to succeed in meeting expectations, our mission is comprised of a series of distinct operations designed to focus on varied timeframes and objectives that meet the demands of a broad range of clients.

One such operation is called the NTO-Systems Trader. It employs tactical and proprietary strategies to swing-trade medium-term Elliott Waves at the minor degree of trend.

We refer to this operation as Level-III engagement. How is it performing? Take a peek. While many were bearishly waiting for primary wave-3 down to commence, we got NTO-Systems Traders on the long side of the NDX back in September of 2010, and have had them there ever since – until recently.

EWT in action > tactical trading and investment guidance:

Systems Trader Services might not be as glamorous or exciting as riding the mercury surf board across the financial sphere, but it sure does get the job done for those who want to keep it clean and simple. A 24% non-levered return in just seven months is totally killer dude.

10K invested in a non-levered ETF would have returned $2400 or about $340 per month in this one market alone. Returns earned on levered ETF’s or rolling futures contracts - fuhggetabout it, there in the stratosphere. Just in case you’re wondering, the biggest return of them all is the 1000% return on the cost of solid guidance - priceless.

summary:

When investing or trading remember that you are fighting a constant war, and there is no room for sensitivity. Elliott Wave Technology is on a quest to claim victory across the board in every timeframe. We correct course quickly when wrong, because we only have one gear, and that’s getting it right.

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2011 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.