Back to the Well?

Stock-Markets / Financial Markets 2011 Mar 11, 2011 - 03:45 AM GMTBy: Andy_Sutton

There is a rather popular cliché that those who don’t know their history are doomed to repeat it. I tend to like the variation, that the only thing we have learned from history is that we have learned nothing from it. Sounds like a clever oxymoron, but given the state of affairs in the world today, it is more than apropos. It would seem that once again, we are defying logic and trying to go back to 2005 when it was all roses, honey, easy mortgages, and big trade deficits. Have we really not learned a thing?

There is a rather popular cliché that those who don’t know their history are doomed to repeat it. I tend to like the variation, that the only thing we have learned from history is that we have learned nothing from it. Sounds like a clever oxymoron, but given the state of affairs in the world today, it is more than apropos. It would seem that once again, we are defying logic and trying to go back to 2005 when it was all roses, honey, easy mortgages, and big trade deficits. Have we really not learned a thing?

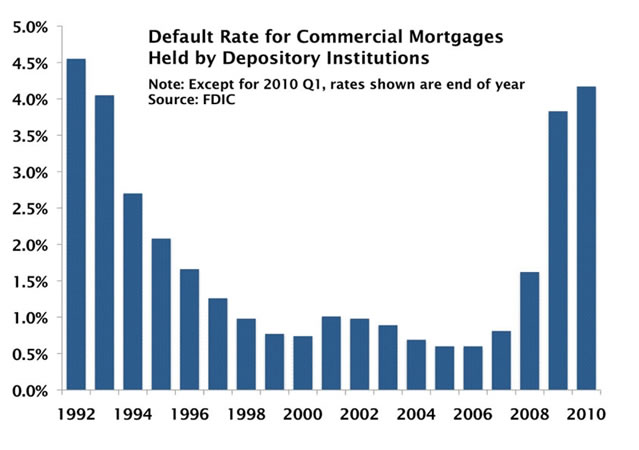

Buried among yesterday’s headlines about Libya, oil, and the assertion that higher oil and gas prices don’t hurt the economy was a little noticed headline about Bridger Commercial Funding and how they were planning on scuttling the ship, so to speak, regarding commercial lending. On the surface this looks like a no-brainer. Sure, the market is weak, securitization is down, etc. Not so fast. If you dig into the second paragraph of the article, you find out WHY they’re getting out of the business – increased competition from megabanks. It gets better. The big Wall Street banks have decided that they are going to provide their own fuel for securitization of commercial loans by originating them themselves instead of relying on downstream providers. According to the Bloomberg article, roughly 20 to 25 players are now seeking regulatory approval to originate loans in the commercial space. This is a 25% increase from a year ago.

Amazingly all this action is happening even as demand for commercial loans remains tepid. Normally one would expect the general lack of demand for loans to drive players from the market as it is in the case of Bridger, not INTO the market as is the case of the 20-25 presently un-named institutions mentioned. Banks are only expected to securitize around $6.5 billion in commercial loans this year compared to $11.5 billion all of last year. Incidentally, this segment of the market peaked in 2007 with over $234 billion securitized. So why is everyone scrambling to get back into a market that is not even 10% of the size it was at its peak? Clearly there is either something amiss in the thinking of these institutions or else logic is once again failing.

Pump and Dump II?

We can clearly draw the conclusion that these arrogant drains on society have learned absolutely nothing from the past few years or we can draw the conclusion that they learned quite well and are back for another try at the excess leads to bailout game, opting to try to get in at the bottom and hoping the pump and dump works again. At this point I’m going to put an interesting spin on this to provide some food for thought. Back in 2006 when I first started blogging, I noted that the residential real estate bubble was nothing more than a property grab by the banks. The American people willingly gave themselves over to this by going in way over their heads on pretty much everything and losing a record amount of real estate in the process.

The banks were dinged a bit in the form of credit card write-offs etc, but so what? They ran to Congress and told them the economy would collapse if they weren’t bailed out and Congress bought it hook, line, and sinker. Why not do it again? After all, America is apparently still hooked on shopping. Anywhere you look we continue to build more malls, shopping centers, and the like even while you can find empty commercial real estate almost anywhere you look. It is my opinion that at some point very soon, banks will own almost all of it. And we’ll have paid for it. All in the name of preserving the precious status quo because we were afraid of the day of reckoning.

Trade Deficits and ‘Prosperity’

Which brings us to the second point - the trade deficit. In reading the analysis of last month’s huge increase in the trade deficit to over $46 billion, the assertion was actually made that this is a good thing because the numbers indicate a healthy demand for imported goods. We still haven’t learned a thing. Of course, totally discounted in the report was the erosion of the dollar over the same period, which was notable. What also wasn’t noted was the effect of rapidly increasing energy prices on finished goods. Double that for increases in commodity prices in general. It is much the same as the situation with retail sales. Much emphasis is put on the headline numbers while little is done in the way of analyzing what the numbers actually mean or how they were derived.

Keynesian apologists love the big trade deficit because it indicates that the borrow- and-spend engine is getting revved up for another round. Maybe. Never do they look at the ability of the economy, particularly consumers, to support another round of excess. I wouldn’t go nearly as far as calling the consumer dead. The American consumer is like Sanka – good to the last drop, and will be around until it is absolutely impossible to remain. But we must wonder if consumer will be able to spend money at a rate that will cause another bubble to form with enough velocity and be of a large enough magnitude to keep the system afloat? More than likely, this endeavor will require additional rounds of QE by the Fed. Make no mistake about it – QE is now a permanent part of the discussion.

Similarly, Keynesian apologists also love the concomitant decline in the Dollar because it helps inflate things like asset prices (the ‘good’ inflation), thereby supporting the idea that somehow all of this is a good thing. They are breathing a sigh of relief because their precious status quo has seemingly returned. The fact that so many people are paying attention to the debt is something they find offensive and annoying. After all, debt hasn’t mattered before, why should we be worried about it now?

And so it would seem we are back to 2005 and it is déjà vu all over again. There are, however, some significant differences between now and then. In 2005, there was little awareness and discussion about America’s debt levels, which were already very significant. As recently as 2006, the US fiscal gap was around $65 trillion – already a massive number. Now, just four and a half years later, the gap is more than 3 times that – and growing rapidly. Many would argue it is already beyond help. States are coming to grips with their own insolvency, and austerity, while not specifically mentioned yet, is already on the table in most areas. Foreign creditors have backed away from buying additional US debt and have been diversifying for several years now. This gap in demand has been filled by the Fed, first covertly, and now, overtly in the form of quantitative easing. Direct monetization. The end game common to all fiat currencies has begun. Our world is clearly not the same one we left back in 2005.

Since 2005, we’ve had one global financial meltdown, an oil shock, the European mess, and are working on our second oil shock and a food shock simultaneously. While our thinking and desires for respite may be stuck in 2005, our world is well past that.

This month’s Centsible Investor, due out March 15th, will take a detailed look at the situation with global food stocks, the agricultural markets, and the fundamental drivers in these critical areas. We’ll also provide specifics about how to get exposure to these areas both in and out of your paper portfolio. For more information about the newsletter or to subscribe, click here. We’re currently running a special for a one-year subscription as well. Don’t miss it!

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.