Japan's Nuclear Crisis Leads to 'Panic' - Nikkei Crashes, Gold Down 1%

Stock-Markets / Financial Markets 2011 Mar 15, 2011 - 06:45 AM GMTBy: GoldCore

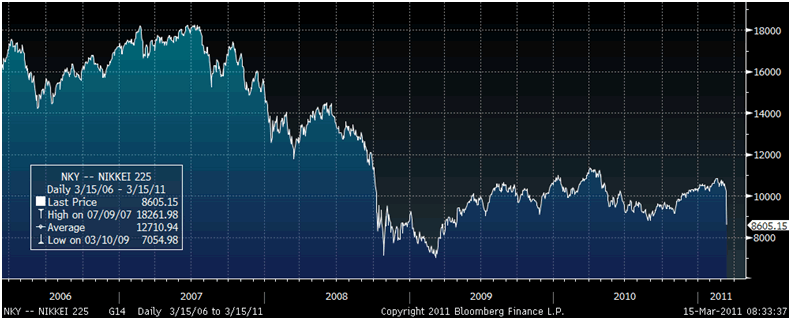

Japan's nuclear crisis has deepened and we deeply regret to say that there is now the real possibility of a nuclear catastrophe. Investor panic has set in with the Nikkei down over 16.5% in two days and the Topic index down by 17% - its worst two-day loss since the 1987 Wall Street stock market crash.

Japan's nuclear crisis has deepened and we deeply regret to say that there is now the real possibility of a nuclear catastrophe. Investor panic has set in with the Nikkei down over 16.5% in two days and the Topic index down by 17% - its worst two-day loss since the 1987 Wall Street stock market crash.

The cost to insure Japanese debt has surged to a record with credit-default swaps protecting Japanese government debt for five years soaring 27 basis points to a record of 125 basis points. One UBS trader said that the deteriorating nuclear crisis had led to "near panic across local credit-default swap markets."

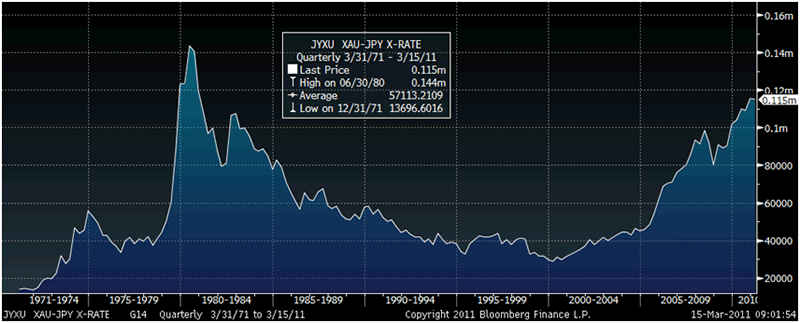

Gold in JPY – 40 Year (Quarterly)

While most equity indices and commodities have fallen, some sharply, gold has remained resilient and is down 1% in US dollar terms and is higher in Australian dollars which like other so called 'commodity' currencies has come under pressure in recent days. Gold remains marginally higher in all currencies since the tragedy began last Friday.

Gold's fall is likely due to speculators taking profits after recent gains or margin call selling to cover losses in equity and other markets. Should the sharp falls seen in Japanese shares spread to western stock markets, gold and silver could suffer further margin call liquidation and another short term sell off.

Any sell off will likely be shallow and short term as the crisis in Japan will lead to further diversification into gold and increased safe haven demand as investors grapple with the uncertainty and fragility of today's financial and economic world.

Gold will likely be supported by tensions in the Middle East which remain very high. Iran said this morning that Saudi Arabia's troops entering Bahrain is "meddling" and "unacceptable".

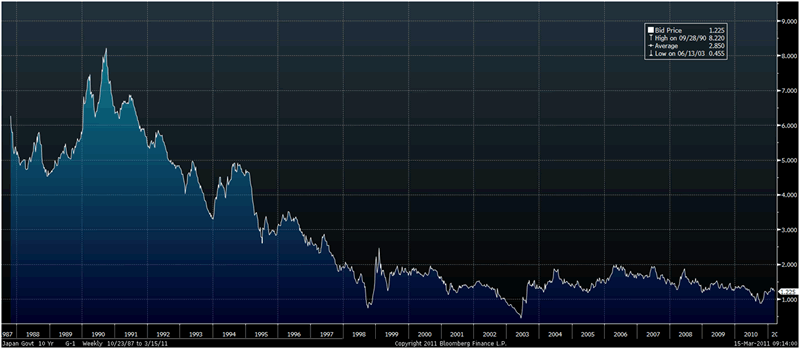

Japan Government 10 Year – 1987 to Today (Weekly)

The Japanese crisis could not have come at a worse time for the massively indebted Japanese economy which is struggling after more than 10 years of economic contraction. Like the US, near zero percent interest rates and significant stimulus programmes have failed to create economic growth.

Indeed, Japan is now the world's second most indebted country, with over $11 trillion in debt (US has $14 trillion), and a debt-to-GDP ratio of over 200%.

In January, Standard & Poor's cut Japan's sovereign debt rating, saying the government has no "coherent strategy" to deal with their mountain of debt. A bond crisis would see selling of Japanese bonds and an increase in interest rates - from the unsustainable historic lows of near 1% today. Any meaningful increase in interest rates would lead to Japan struggling to repay their debt and the real possibility of default.

The earthquake, tsunami and now nuclear tragedy in Japan may be a tipping point that leads to an international bond and currency crisis. This would see speculators and investors liquidating corporate and government paper assets in order to protect themselves from currency debasement and inflation.

Fiat currencies with negative real interest rates would also be shunned and significantly increased allocations to hard assets and particularly monetary assets such as gold would be seen.

Gold's finite currency status means that it will again be recognised as the ultimate safe haven asset and an essential part of every diversified portfolio.

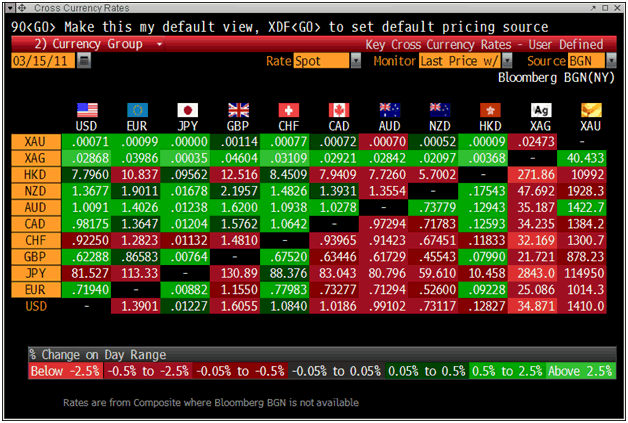

Gold

Gold is trading at $1,406.21/oz, €1,013.34/oz and £878.72/oz.

Silver

Silver is trading at $34.64/oz, €24.96/oz and £21.64/oz.

Platinum Group Metals

Platinum is trading at $1,712.25/oz, palladium at $716.00/oz and rhodium at $2,350/oz.

News

(Reuters) -- Gold down 1 pct as equities tumble on Japan quake

Gold slid more than 1 percent on Tuesday as declines in stock markets triggered by a growing nuclear crisis in Japan prompted speculators to sell bullion to cover losses, while holdings on the ETF fell to their lowest since May last year.

Silver fell around 3 percent. Platinum and palladium gave up early gains and dropped more than 1 percent after Japanese shares slumped for a second day on Tuesday as two fresh explosions rocked a stricken nuclear plant.

Gold lost $10.70 an ounce to $1,415.95 by 0636 GMT, after rising as much as 1 percent on Monday as Japan battled to prevent a nuclear catastrophe following last week's devastating quake and tsunami and on political unrest across the Arab world.

"It still looks like it's constructive. It's just consolidating. But if we get a large sell-off in equities, people will tend to sell gold," said Jonathan Barratt, managing director of Commodity Broking Services in Melbourne.

"But if it's a major concern, then people will eventually go to gold as the last resort."

Premiums for gold bars were steady at between $1.00 and $1.50 an ounce with spot London prices in Hong Kong and Singapore, with no signs of safe-haven buying related to last week's massive earthquake and tsunami in Japan and the subsequent nuclear crisis.

Japan faces a recovery and reconstruction bill of at least $180 billion -- 3 percent of its annual economic output -- or more than 50 percent higher than the total cost of 1995's earthquake in Kobe.

Japan warned that radioactive levels had become significantly higher around a quake-stricken nuclear power plant on Tuesday after explosions at two reactors, and the French embassy said a low level radioactive wind could reach Tokyo by the evening.

"The price shot up to above $1,430 but it could not break through that level. I think that's why the market is down. Also, ETF holdings seem to be going down again," said a dealer in Singapore.

"We can say people are selling gold to cover their margin call."

U.S. gold futures for April fell $8.6 to $1,416.3 an ounce.

In the Middle East, the United States urged Saudi Arabia on Monday to show restraint after it sent troops to neighbouring Bahrain in a move some analysts said showed the limits of Washington's influence in the region.

The deployment of 1,000 Saudi troops, at the request of Bahrain's Sunni royal family, came two days after U.S. Defense Secretary Robert Gates visited the island kingdom and pressed its rulers to implement political reforms to defuse tensions with the Shi'ite Muslim majority.

Rising tensions in North Africa and the Middle East helped bullion strike record around $1,444 last week.

The yen surged on Tuesday after Japan's prime minister said radiation levels near a quake-hit nuclear plant had become high and the risk of further nuclear leakage was rising, prompting investors to dump risky assets.

The Bank of Japan (BOJ) said on Monday it would increase the size of its asset purchase to 10 trillion yen ($122 billion) from 5 trillion yen and analysts think it may take more steps if the economic outlook deteriorates further.

The BOJ is even more dovish than the U.S. Federal Reserve, which has been cautious about seeking to exit its stimulus policy as it wants to bring down unemployment.

U.S. Federal Reserve policymakers meet on Tuesday and investors will closely watch the Fed's assessment on unemployment and the economy in general.

(Bloomberg) -- Gold Drops as Commodities, Equities Tumble on Japanese Crisis

Gold dropped, snapping a two-day advance, as Japan's strongest quake and a worsening nuclear accident spurred concern that the global economic recovery may be hurt, prompting a selloff in commodities.

Immediate-delivery bullion fell as much as 1.3 percent to $1,408.07 an ounce before trading at $1,412.93 at 2:25 p.m. in Singapore. The April-delivery contract dropped 0.7 percent to $1,415.70. Oil plunged as much as 2.5 percent in New York as base metals and equities also declined.

"Gold and other precious metals are coming under pressure as commodities decline across the board," said Chae Un Soo, a Seoul-based trader at KEB Futures Co. "The decline in commodities also coincided with the need for gold to take a breather after a recent rally to a record."

A third blast occurred today at the Fukushima Dai-Ichi nuclear plant and Prime Minister Naoto Kan said the risk of further radiation leaks is rising. The March 11 temblor caused a death toll estimated at more than 10,000 and shut down factories.

Asian stocks tumbled 5.5 percent, led by the Topix index of Japan, which plummeted 14 percent on concern that the nation's economy will be crippled. The Dollar Index, a gauge of the currency's value, jumped as much as 0.4 percent. Gold usually moves inversely to the dollar.

Bullion climbed to an all-time high of $1,444.95 an ounce on March 7 after rallying 30 percent last year, the tenth straight annual gain, on the prospect of currency debasement and rising inflation.

Auto Plants

Demand for palladium and platinum has been hurt by shutdowns in Japan's auto plants, Hussein Allidina, head of commodity research at Morgan Stanley, wrote in a report. The metals are used to make pollution-control devices.

Toyota Motor Corp., the world's biggest carmaker, will suspend output at 12 Japanese factories today and tomorrow, spokeswoman Shiori Hashimoto said yesterday. Isuzu Motors Ltd., a Toyota affiliate, will halt production at its two Japanese plants until March 18, spokesman Koichi Ito said. Honda Motor Co. and Nissan Motor Co. also shut facilities in northern Japan.

"The greater feed-through for platinum and palladium spills from investor sentiment as a result of this disaster," Edel Tully, analyst with UBS AG in London, wrote in a note to clients. "A cautious tone already shrouds these metals and this could become more extreme in the current climate."

Palladium for immediate delivery dropped as much as 2.7 percent to $726 an ounce after losing 1.8 percent yesterday, while platinum decreased as much as 2.1 percent to $1,718.15 an ounce, extending a 1.5 percent decline. Cash silver fell as much as 3.6 percent to $34.62 an ounce before trading at $35.15 an ounce. The metal touched $36.7525 on March 7, the highest level since 1980.

(Financial Times) -- Saudis and US at odds over Bahrain policy

Some US officials say Washington and Riyadh have been at odds in the Middle East since the protests in the region began, but in recent days tensions have reached new heights, writes Daniel Dombey.

While Washington has been urging allies to carry out political reforms, Saudi Arabia has been giving the opposite advice, urging governments to stay firmly in control.

On Sunday, as Saudi Arabia was preparing to send troops to Bahrain, the White House issued a statement calling on the Bahraini government "to pursue a peaceful and meaningful dialogue with the opposition rather than resorting to use of force".

US officials say the Saudi and Bahraini governments have greatly overstated fears that the island state's Shia majority would move the country closer to Iran.

"The Saudis and the Americans are not on the same page about events in the region," says Simon Henderson at the Washington Institute for Near East Policy, a US-based think tank.

The two countries were visibly at cross purposes over the protests in Egypt, with Saudi Arabia counselling former President Hosni Mubarak to stay even as the US called for a democratic transition. But Bahrain in particular has become something of a tug of war between Washington, which recommends more reforms, and Riyadh, which resists them.

(Bloomberg) -- U.S. Commodities: Sugar, Raw Materials Drop on Japan Concerns

Raw sugar fell to a two-week low, leading commodities lower, as conditions in Japan worsened following last week's earthquake and tsunami, threatening to hurt economic growth and demand for raw materials.

Prime Minister Naoto Kan said Japan faces its worst crisis since the end of World War II, and local media estimated the death toll from the March 11 temblor may top 10,000. The Bank of Japan today injected 15 trillion yen ($183 billion) into the financial system. The UBS Bloomberg Constant Maturity Commodity Index fell, extending the longest slump since August.

Most prices "are down because people are still assessing the impact of the quake," said Jeff Bauml, a senior vice president at R.J. O'Brien & Associates, a broker in New York.

In other markets, crude oil rebounded on speculation that unrest in the Middle East may escalate after Saudi Arabia sent its troops into Bahrain. Cotton tumbled. The UBS Bloomberg index declined 0.3 percent to 1,717.89, the sixth straight decline.

Raw sugar for May dropped 1.07 cents, or 3.7 percent, to 27.79 cents a pound on ICE Futures U.S. in New York. The sweetener posted the biggest drop among 26 commodities in the UBS Bloomberg index. Earlier, the price touched 27.41 cents, the lowest since Feb. 25.

Crude Oil

Oil futures for April delivery rose 3 cents to $101.19 a barrel on the New York Mercantile Exchange, ending a four- session slump. Earlier, the price touched $98.47, the lowest since March 1.

Saudi Arabia's cabinet said the kingdom has responded to a Bahraini request for "support." Prices were lower most of the day on speculation that energy demand in Japan, the third- largest economy, may decline after an 8.9-magnitude earthquake devastated parts of the northeast.

"The situation in Bahrain appears to be escalating and people start to wonder that it could become a bigger issue," said Carl Larry, the president of Oil Outlooks & Opinions LLC in Houston.

Saudi troops entered the neighboring country as part of a regional force from the Gulf Cooperation Council, the first outside intervention since a wave of popular uprisings swept through parts of the region.

Cotton

Cotton tumbled the most allowed by the ICE exchange on signs that demand may ease in China, the world's biggest buyer, after prices approached a record high.

The China National Cotton Information Center said imports dropped 53 percent in February to 184,200 metric tons from January, down 17 percent from a year earlier. On March 11, the price jumped as much as 3.5 percent to $2.0798 a pound. The fiber climbed to an all-time high of $2.197 on March 7.

"This sell-off is largely on a reduction to demand expectations at these high prices," said Erica Rannestad, a commodity analyst at CPM Group in New York. "A lot of manufacturers are expected to purchase less cotton and use less in end-products."

Cotton for May delivery fell by the exchange limit of 7 cents, or 3.4 percent, to $1.9794 on ICE. The price dropped 3.6 percent last week. The fiber has more than doubled in the past year as demand outstripped global supplies.

Commodities settled as follows:

Precious metals:

April gold up $3.10 to $1,424.90 an ounce

May silver down 9.5 cents to $35.84 an ounce

April platinum down $29.40 to $1,752.30 an ounce

June palladium down $17.30 to $748.20 an ounce

Livestock:

June live cattle down 0.3 cent to $1.1665 a pound

August feeder cattle down 0.775 cent to $1.3685 a pound

June lean hogs down 1.95 cents to 97.55 cents a pound

Grains:

May soybeans up 5.5 cents to $13.40 a bushel

May corn up 1.75 cents to $6.66 a bushel

May wheat up 2 cents to $7.2075 a bushel

May rice up 36.5 cents to $13.375 per 100 pounds

May oats down 6.5 cents to $3.44 a bushel

Food and Fiber:

May coffee down 1.1 cents to $2.733 a pound

May cocoa down $23 to $3,389 a metric ton

May cotton down 7 cents to $1.9794 a pound

May sugar down 1.07 cents to 27.79 cents a pound

May orange juice up 1 cent to $1.6895 a pound

Energy:

April crude oil up 3 cents to $101.19 a barrel

April natural gas up 2.5 cents to $3.914 per million British thermal units

April heating oil up 3.48 cents to $3.0638 a gallon

April gasoline down 2.74 cents to $2.9603 a gallon

Others:

May copper down 2.1 cents to $4.1865 a pound

May lumber down $3.30 to $307.80 per 1,000 board feet.

(Bloomberg) -- Topix Drops as Japan's Default Risk Jumps; Commodities Decline

Japanese stocks dropped, sending the Topix index to its worst two-day plunge since 1987, and default risk jumped as Prime Minister Naoto Kan said the danger of further leaks from a nuclear power plant damaged by the nation's biggest earthquake was increasing. Commodities fell.

The MSCI Asia Pacific Index slumped 5.2 percent at 4 p.m. in Tokyo. The Topix sank 9.5 percent and the cost of protecting Japan's sovereign debt surged to a record. Treasuries gained, sending yields to their lowest level this year. The Australian dollar weakened 1.2 percent. The S&P GSCI spot index of 24 commodities slid 1.3 percent. Oil lost 1.9 percent in New York. Futures on the Euro Stoxx 50 Index decreased 2.1 percent and those on the Standard & Poor's 500 Index declined 2 percent.

The Bank of Japan added 8 trillion yen ($98 billion) into money markets today, adding to yesterday's record cash injection, to secure the nation's financial stability following the March 11 temblor -- updated to a magnitude of 9, from 8.9, by the U.S. Geological Survey -- and subsequent tsunami. Tokyo Electric Power Co.'s Fukushima Dai-Ichi nuclear plant was today rocked by two more explosions and a fire.

(Financial Times) - Saudi soldiers enter Bahrain

More than 1,000 Saudi troops rushed to the rescue of Bahrain's royal family on Monday as neighbouring Gulf states backed the Sunni rulers' attempts to confront a popular uprising by a mainly Shia opposition.

As the Saudi troops crossed into Manama, the capital of Bahrain, the United Arab Emirates said it had also sent 500 police officers to help quell unrest in the tiny kingdom of less than 600,000 people. The Manama regime appealed on Sunday for help from its partners in the Gulf Co-operation Council, the regional grouping.

The cross-border intervention in the strategically important state, home to the US Fifth Fleet, dramatically raises the stakes in Bahrain's political standoff, which has pitted the Shia majority against the Sunni al-Khalifa royal family.

It came after Bahrain's riot police were over-run by tens of thousands of Shia protesters who by the end of Sunday had occupied much of the capital's central business district bringing the city to a halt.

Protesters said they would not be deterred by Saudi Arabia's military intervention, and remained determined to press ahead with demonstrations. The main opposition parties warned that the intervention was a "blatant occupation" and "undeclared war" by armed troops.

People familiar with the matter say the Saudi force was primarily to be used for policing, but Mr Fairouz said at least two dozen Saudi tanks had also crossed the causeway into Bahrain.

"It will deepen the crisis," said Jawad Fairouz, a senior member of al-Wefaq, the largest Shia opposition party. "The conclusion to this could be very dramatic . . . I think they are playing their last card."

The Saudi intervention creates a dilemma for the US, which has been urging Arab states to negotiate with protesters but does not want the region to spin out of control. The White House said it was aware that other countries from the GCC were considering sending troops. But it urged the Gulf states to "show restraint and respect the rights of the people of Bahrain, and to act in a way that supports dialogue instead of undermining it".

The Pentagon confirmed that neither defence secretary Robert Gates nor chief of staff Adm Mike Mullen had been informed of the Saudi move on their recent trips to Bahrain.

The defence department said it was monitoring the deployment of Saudi and GCC forces closely.

"We have communicated to all parties our concerns regarding actions that could be provocative or inflame sectarian tensions and we continue to call on all parties to prioritize a peaceful, negotiated outcome in support of the Crown Prince's National Dialogue," said spoekesman Col Dave Lapan.

"We expect GCC states to support the reform initiatives proposed by the government."

Observers said that regional Arab involvement could provoke Shia-dominated Iran to try to assist the protesters.

In Tehran, the spokesman for parliament's foreign policy committee, Kazem Jalali, said the involvement of "foreign forces" in Bahrain to help crack down on protesters was "a kind of crime". Reports from Riyadh suggested that the Saudi troops moving into Bahrain were part of the Peninsula Shield Force, an arm of the GCC first set up as an anti-Iranian bulwark after the Islamic revolution of 1979.

Even under the GCC umbrella, however, the intervention was likely to make "a difficult situation even more difficult", said Abdulkhaleq Abdalla, professor of political science at the United Arab Emirates University. The Bahraini government said the Peninsula Shield forces had arrived to "help protect the safety of citizens, residents and critical infrastructure".

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.