Charles Nenner and Harry Dent Stock Bear Market 2012 Cycle

Stock-Markets / Stocks Bear Market May 26, 2011 - 10:21 AM GMTBy: readtheticker

Charles Nenner and Harry Dent Jr have both stood tall on their soap box and loudly proclaimed the Dow Jones is heading south to a new cycle low in 2012/13. We are going to watch this show closely, examining cycles in currencies, stocks, bonds and commodities to find supporting evidence as to the likelyhood of this scenario occurring. Our website will be live soon, so you can run your own cycles to construct your own conclusions.

Charles Nenner and Harry Dent Jr have both stood tall on their soap box and loudly proclaimed the Dow Jones is heading south to a new cycle low in 2012/13. We are going to watch this show closely, examining cycles in currencies, stocks, bonds and commodities to find supporting evidence as to the likelyhood of this scenario occurring. Our website will be live soon, so you can run your own cycles to construct your own conclusions.

A quick review of 2012/13 doomers.

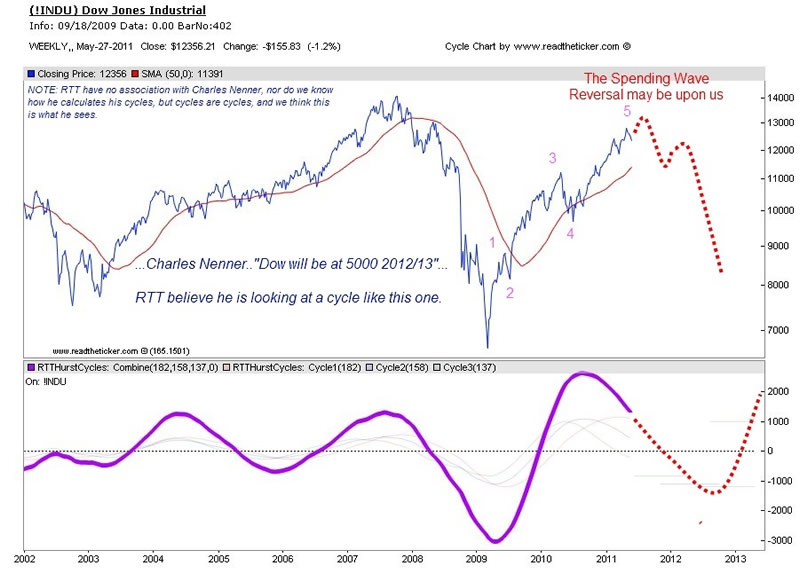

Charles Nenner on 15 July 2010 made his Dow 5000 call within two and half years (ie 2012/13). Since that date the Dow Jones has extended beyond his targeted market top call on the back of the Federal Reserve quantitative two (QE2), this however does not invalidate his bearish call for 2012/13. His overall reason for a move down in the Dow is based on further deflation.

We have stated in a previous post that we believe Charles Nenner sees this cycle within the Dow Jones.

Harry Dent Jr has the the same miserable forecast for the Dow Jones. Harry calls for Dow as low 3800 and uses the word 'depression', well that would be fun!. The main point is Harry is no slouch, no fool and he warrants your attention, Harry has been a bull when it counted, so if loved him on the way up, you better love him on the way down. Harry is an economist that aligns his forecast and planning with with the USA population growth rates. The demographic cycle that warrants your attention is the spending wave and its very high correlation to the inflation adjusted Dow Jones.

Listen to Harry Dent Jr forecast in his own words.

Looking at our own cycle work, we expect the SP500 to peak out in June 2011 just prior to the ending of QE2. We also have posted that we see that the bears are about to roar in the next few months. Interesting the cycles we see on the US Dollar fit very well with Harry's forecast for a rally.

Harry Dent Jr is not alone with his demographic analysis you can learn more at thegreatbustahead.com by Dan Arnold.

To Conclude: A US Dollar rally with legs will confirm Charles Nenner and Harry Dent Jr forecast. The US Dollar has had a solid high volume bounce out of the May 2011 low, we expect another test of the May low, if price fails to make new lows this would be a technical double bottom, and the expected bullish rally could lead to a new US Dollar bull market and a major sea change in world markets. Evidence of a double bottom pattern between May and June 2011 should be considered as a chance to BUY the US Dollar. Watching and waiting for Mr Market to show the way.

We will monitor the Charles Nenner and Harry Dent Jr show over the next year, expect part 2, 3, 4 etc. Of course once you are a member of our site you can do your own cycle investigations. If the above does happen we MUST profit from it, our wealth and retirement funds demand that we do.

Readtheticker

My website: www.readtheticker.com

My blog: http://www.readtheticker.com/Pages/Blog1.aspx

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2011 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.