The Misery Index vs SP500 and Gold

Stock-Markets / Financial Markets 2011 Jun 23, 2011 - 06:47 AM GMTBy: Willem_Weytjens

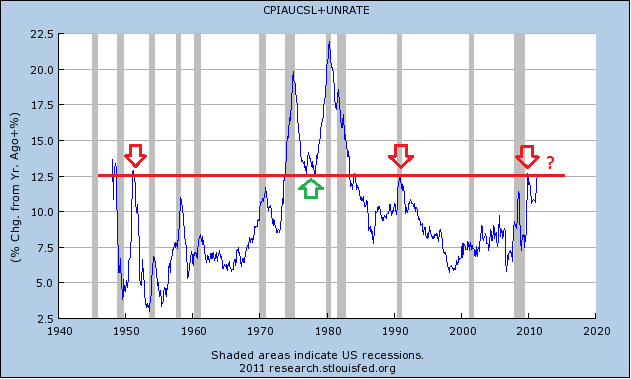

The Misery Index, the sum of the inflation rate and the unemployment rate reaches a multi-decade high. The index was created in 1976 by Jimmy Carter’s economists in an attack on Gerald Ford, but it backfired when it spiked under Carter.

The Misery Index, the sum of the inflation rate and the unemployment rate reaches a multi-decade high. The index was created in 1976 by Jimmy Carter’s economists in an attack on Gerald Ford, but it backfired when it spiked under Carter.

Chart from stlouisfed.org

From the chart above, we can see that the current level has acted as both support and resistance in the past. Will it act as resistance this time as well?

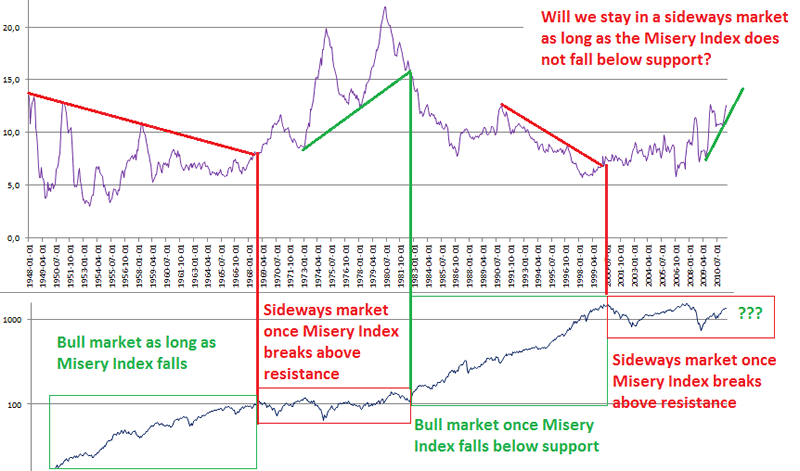

I did some research, downloaded the data in excel, I downloaded data of the SP500 at Yahoo Finance, created some charts using these data and I made some interesting observations.

First of all, for those of you who would like to have the excel sheet, please click HERE…

Now let’s look at the observations:

When the Misery index was falling, this meant higher stock prices. Once the multi-year resistance line was broken in 1968, the bull market ended, and a sideways market followed (for years) until the Misery index fell below its multi-year support line in 1982, the market bottomed and a huge bull market followed.

Then again in 2000, the Misery index broke above its multi-year resistance line, and stocks have been trading sideways ever since. Or sideways that is…

(I mean visually, on a log-scale chart).

So what can we conclude? The Misery index is still rising, and as long as the multi-year support line does not break, we should expect to remain in a sideways trend for years to come…

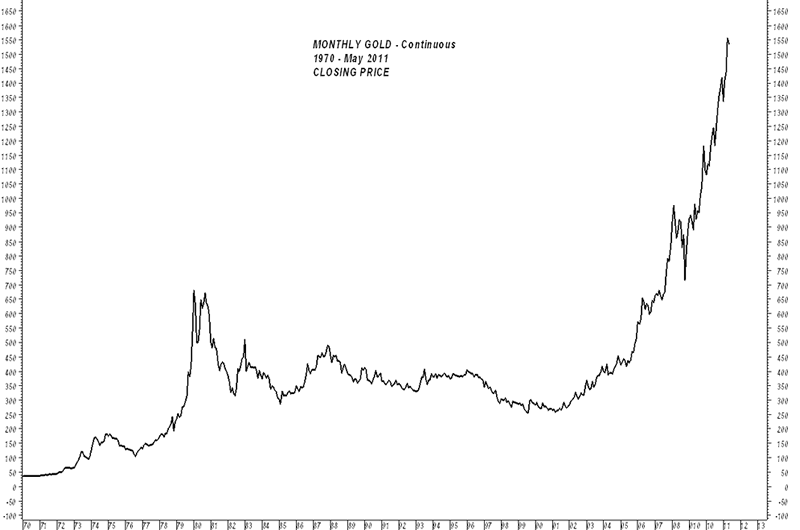

PS, it’s also good to know Gold started a bull market in the early ’70s that ended in 1980, and started a new bull market in the early ’2000s…

Chart from JSMineset.com

Willem Weytjens

www.profitimes.com

© 2011 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.