Commodities and Market Internals Concerning For Stocks

Stock-Markets / Financial Markets 2011 Jun 27, 2011 - 08:35 AM GMTBy: Chris_Ciovacco

Our global economy still faces significant balance sheet problems (assets vs. liabilities) at numerous points in the economic food chain. Consumers are still hurting from the reverse wealth effect created by falling asset prices. Numerous countries, including Greece, Spain, Portugal, and the U.S., are burdened by mismatches between government spending and revenue. Falling asset prices make problems with balance sheets worse and are not good for revenues from ad valorem taxes.

Our global economy still faces significant balance sheet problems (assets vs. liabilities) at numerous points in the economic food chain. Consumers are still hurting from the reverse wealth effect created by falling asset prices. Numerous countries, including Greece, Spain, Portugal, and the U.S., are burdened by mismatches between government spending and revenue. Falling asset prices make problems with balance sheets worse and are not good for revenues from ad valorem taxes.

Global central bankers have been trying to stem the deflationary forces of excess capacity and tepid demand for big ticket items, such as housing. In theory, inflation, which includes rising asset prices, can help impaired balance sheets.

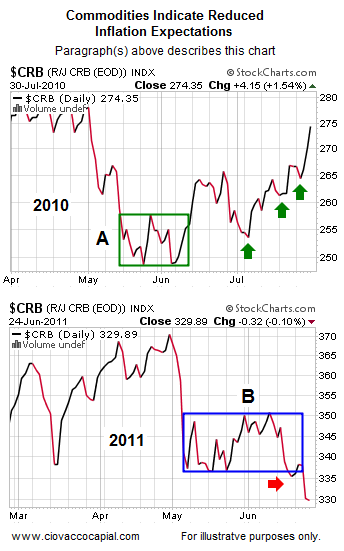

The commodity market is not giving market participants a lot of confidence that inflation is winning out over deflation at the present time. The charts below compare the performance of the CRB Index, a basket of commodities, during the 2010 summer lows and the current market. At point A in the chart below, commodities consolidated for a month before breaking out to the upside in early June 2010. The higher low that followed in early July 2010 (first green arrow) foreshadowed stabilization for the stock market.

The second chart below shows the recent performance of commodities, which is not foreshadowing inflationary outcomes at the present time. Deflationary outcomes or a reduction in inflation expectations are not positives for asset prices, including stocks and homes. Near point B below, notice how commodities consolidated for almost two months forming what is known as a base. The recent break below the base (see red arrow), means we should continue to err on the side of protecting capital until we see noticeable improvement in the markets.

On Friday, we further reduced our already relatively small exposure to commodities by selling broad-based positions, such as DBC. We will be watching DBC, copper (JJC), and silver (SLV) for signs of strength, which may come before we see strength in stocks. If the markets can stabilize, we would tend to use broad-based investments, like DBC and SPY (S&P 500), to reinvest a portion of our cash.

Turning directly to the stock market, we often look at “market internals” to gain a better understanding of possible inflection points for equity prices. Market internals include numerous indicators with most being centered around market breadth. Market breadth measures the number of stocks participating in the general market’s trend. Healthy markets have a high percentage of participation; weaker markets have what is known as “narrow breadth”.

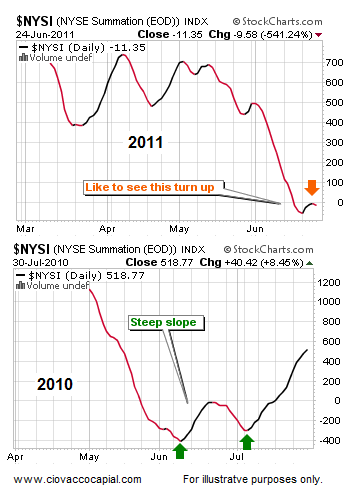

The Summation Index, shown below, is an intermediate-term measure of market breadth. Unfortunately, the Summation Index turned down again late last week, which is not what the bulls want to see. When the stock market started to show signs of finding a bottom during the flash-crash correction in 2010, market breadth made a sharp turn higher in early June 2010 (see steep slope). The positive turn in breadth was followed by a higher high, which was another sign of a possible bottom in stock prices.

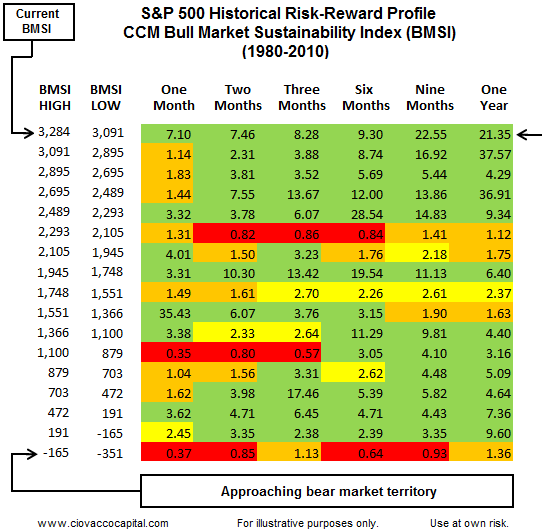

The CCM Bull Market Sustainability Index (BMSI) uses numerous breadth indicators, including the Summation Index. Some breath indicators are showing some signs of stabilization, but nothing to get too excited about yet. The BMSI closed Friday at 2,995, which has historically produced mixed outcomes for stocks over the following month, but excellent returns from a risk-reward perspective over the next twelve months.

While the markets are telling us to remain in a defensive posture, the CCM BMSI reminds us to keep an open mind about positive outcomes in the next twelve months. The current BMSI reading means little until we see improvement in the market and the market’s internals.

As we mentioned on June 22, investors who left the markets completely between May 2010 and August 2010 missed the QE2-induced rally off the summer lows. While things look negative for asset prices at the present time, the Fed will most likely step in again in the coming months.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.